Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

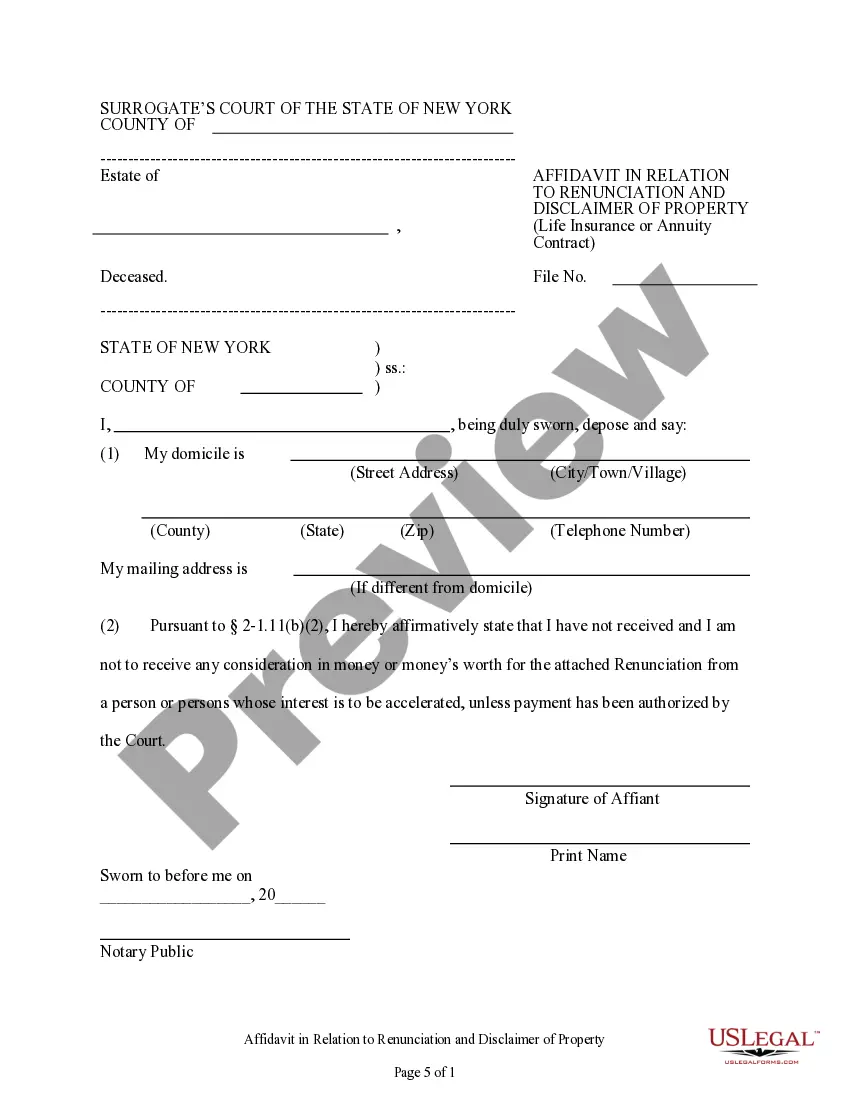

How to fill out New York Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you have previously utilized our service, Log In to your account and retrieve the Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have perpetual access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to conveniently locate and save any template for your personal or professional requirements!

- Ensure you’ve found the suitable document. Review the description and use the Preview option, if available, to verify if it aligns with your requirements. If it doesn't suit you, use the Search tab above to discover the suitable one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and finalize a payment. Enter your credit card information or opt for PayPal to finish the transaction.

- Obtain your Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. Choose the file format for your document and save it onto your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

If you refuse your inheritance in New York, it typically passes to the next beneficiary as specified by the decedent's will or state law. This process can be influenced by the Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. Thus, refusing an inheritance does not mean it simply disappears; it transfers to another party as per the intended estate plan.

To disclaim an inheritance in New York, you must submit a written disclaimer to the executor or administrator of the estate. This disclaimer should meet specific legal requirements and state your intent to renounce your inheritance. Utilizing the Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can help simplify this process and ensure you comply with all necessary regulations.

In New York, beneficiaries do not need to file an inheritance tax waiver form. However, it's crucial to ensure compliance with state regulations on estate and inheritance taxes. The Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract may impact your tax obligations, so it’s wise to consult with a professional to navigate these matters.

In New York, specific assets are exempt from probate. These include assets held in a living trust, certain jointly owned property, and accounts with designated beneficiaries. When you consider the Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, these assets bypass the lengthy probate process, offering a quicker resolution for your estate.

Yes, beneficiaries are entitled to receive a copy of the will in New York. This allows them to understand their rights and the distribution of assets as described in the will. If beneficiaries are considering renouncing their share, they can explore options like the Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, which can help clarify their position within the estate.

New York inheritance laws dictate how assets are distributed after someone's death, whether they left a will or not. If a valid will exists, it directs the distribution of property according to the deceased’s wishes. In cases where no will is present, intestacy laws come into play, which may affect how life insurance or annuity benefits are handled, potentially involving Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract for beneficiaries looking to change the flow of assets.

In New York state, beneficiaries have clear rights, including the right to receive the assets as outlined in the will or trust. They can also request information about the estate and its administration. If a beneficiary wishes to renounce their interest, they may utilize the Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract to formally decline their share and redirect it to other heirs or beneficiaries.

A beneficiary holds significant powers when it comes to the assets they receive. They can accept or reject the inheritance under New York law, which includes the option of Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. This rejection can streamline the transfer of property to the next eligible heir, providing flexible options in estate planning.

The exclusion amount for New York in 2024 is expected to align closely with 2023's threshold, hovering around $6.58 million. For individuals considering a Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, understanding this amount is vital for effective estate planning. Be proactive and consult with professionals to confirm the exact figures as they become available. Staying informed allows for strategic planning and meaningful decisions regarding your estate.

The estate tax exemption in New York for 2025 is projected to maintain the current exclusion amount, although it is always subject to legislative changes. This means that individuals should stay vigilant about updates, especially if you're involved with a Yonkers New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. An estate planning professional can assist you in navigating these regulations effectively. Preparation is key to ensuring minimal tax implications for beneficiaries.