Queens New York Quitclaim Deed from Corporation to LLC

Description

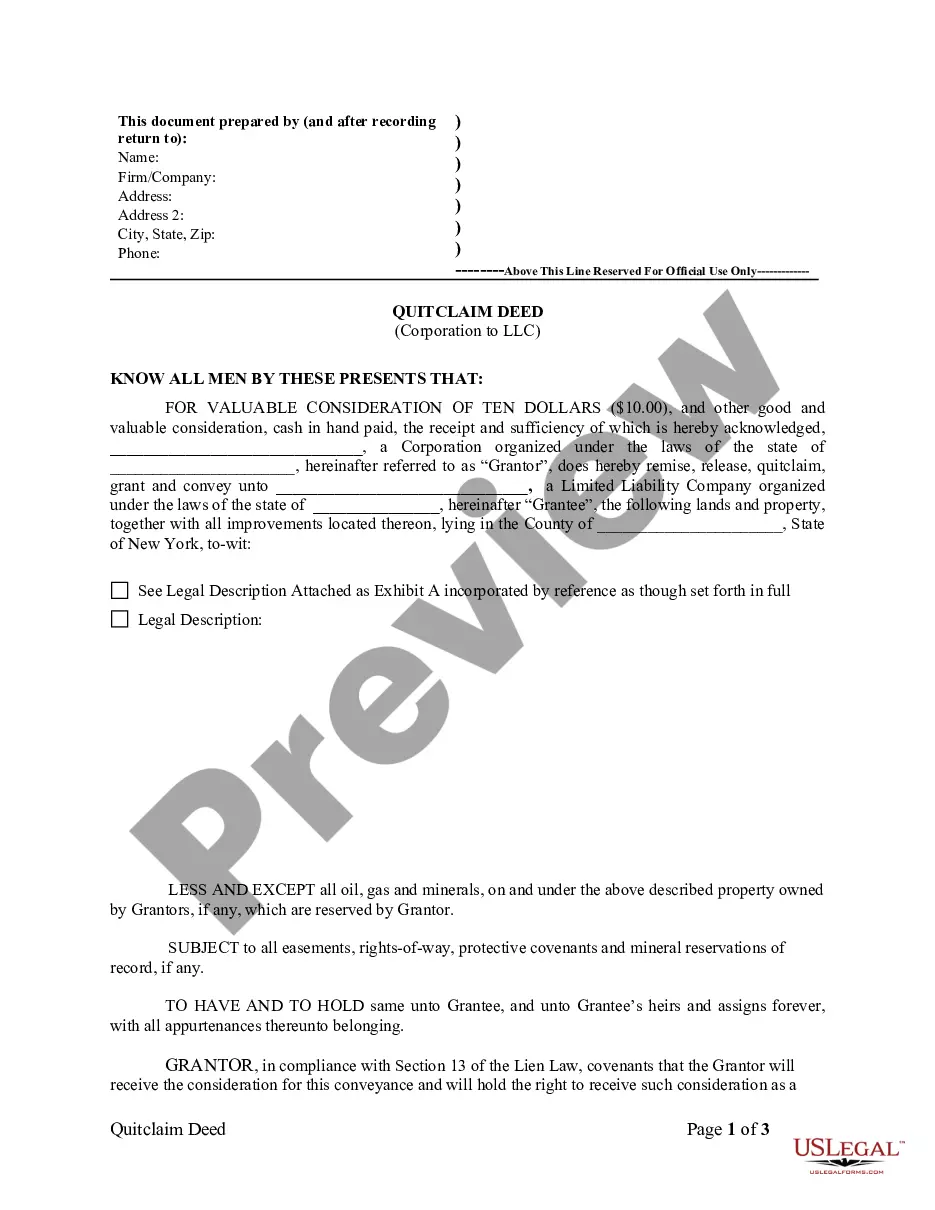

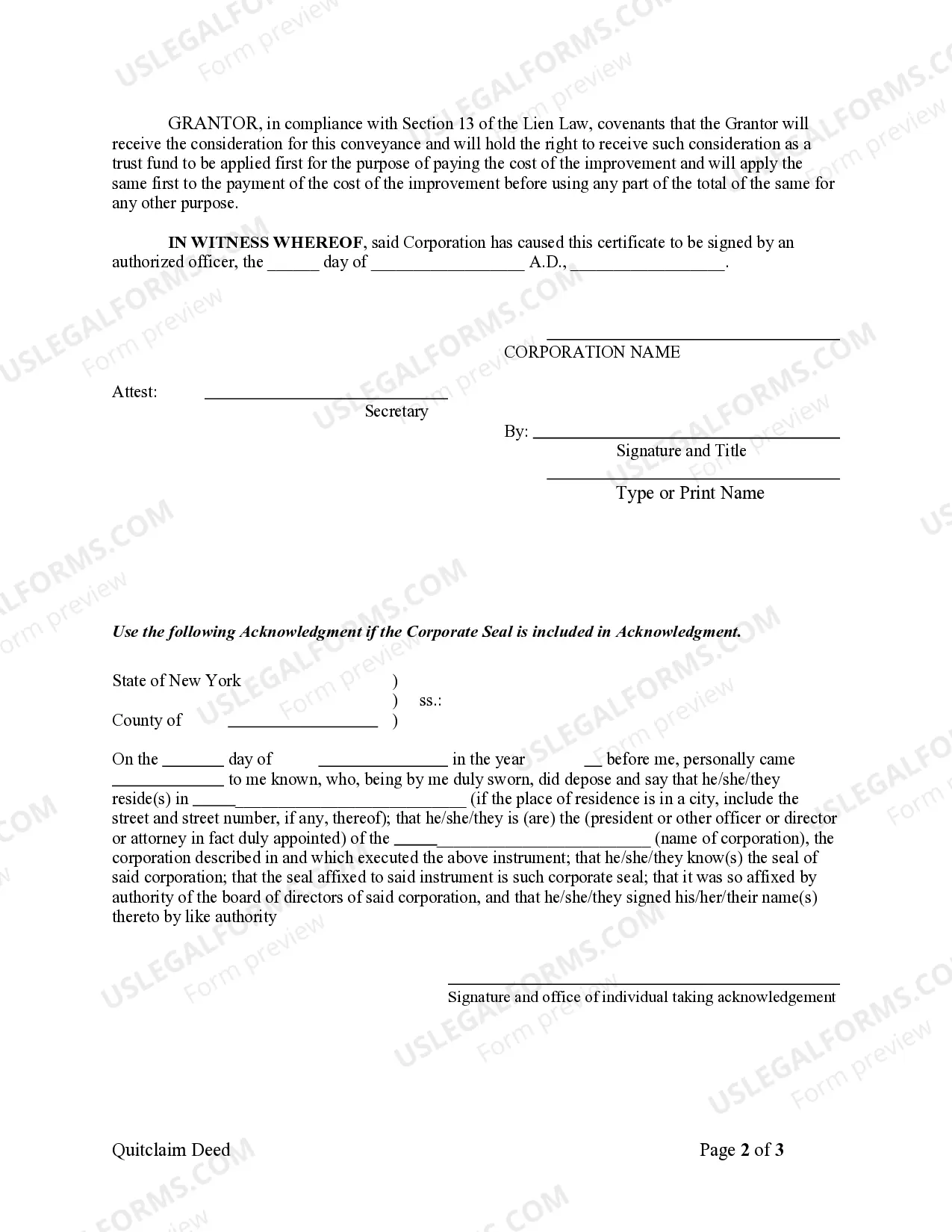

How to fill out New York Quitclaim Deed From Corporation To LLC?

If you have previously utilized our service, Log In to your profile and download the Queens New York Quitclaim Deed from Corporation to LLC onto your device by pressing the Download button. Ensure your subscription remains active. If it isn’t, renew it according to your billing plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have everlasting access to all documents you have purchased: you can find them in your profile within the My documents section whenever you need to retrieve them again. Utilize the US Legal Forms service to swiftly find and download any template for your personal or business requirements!

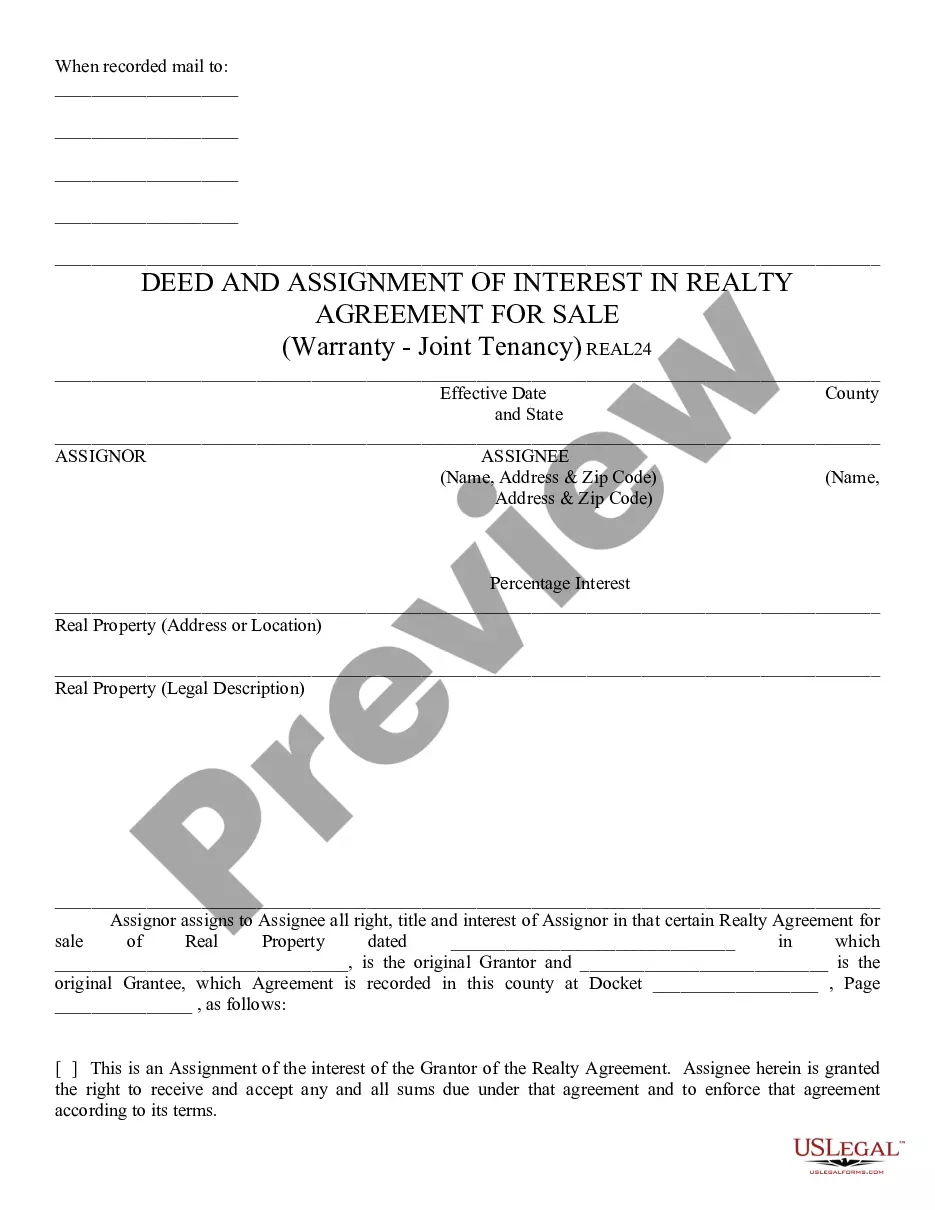

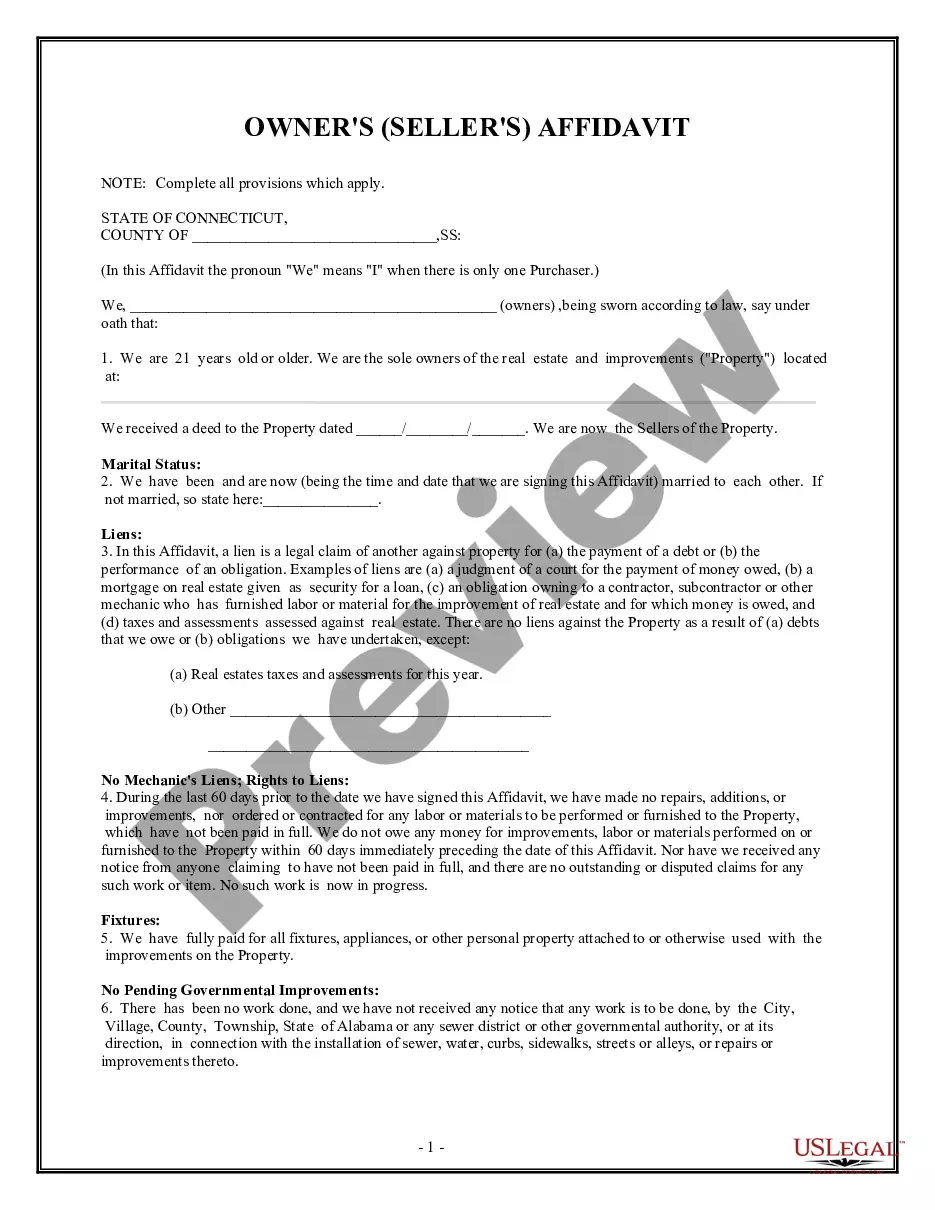

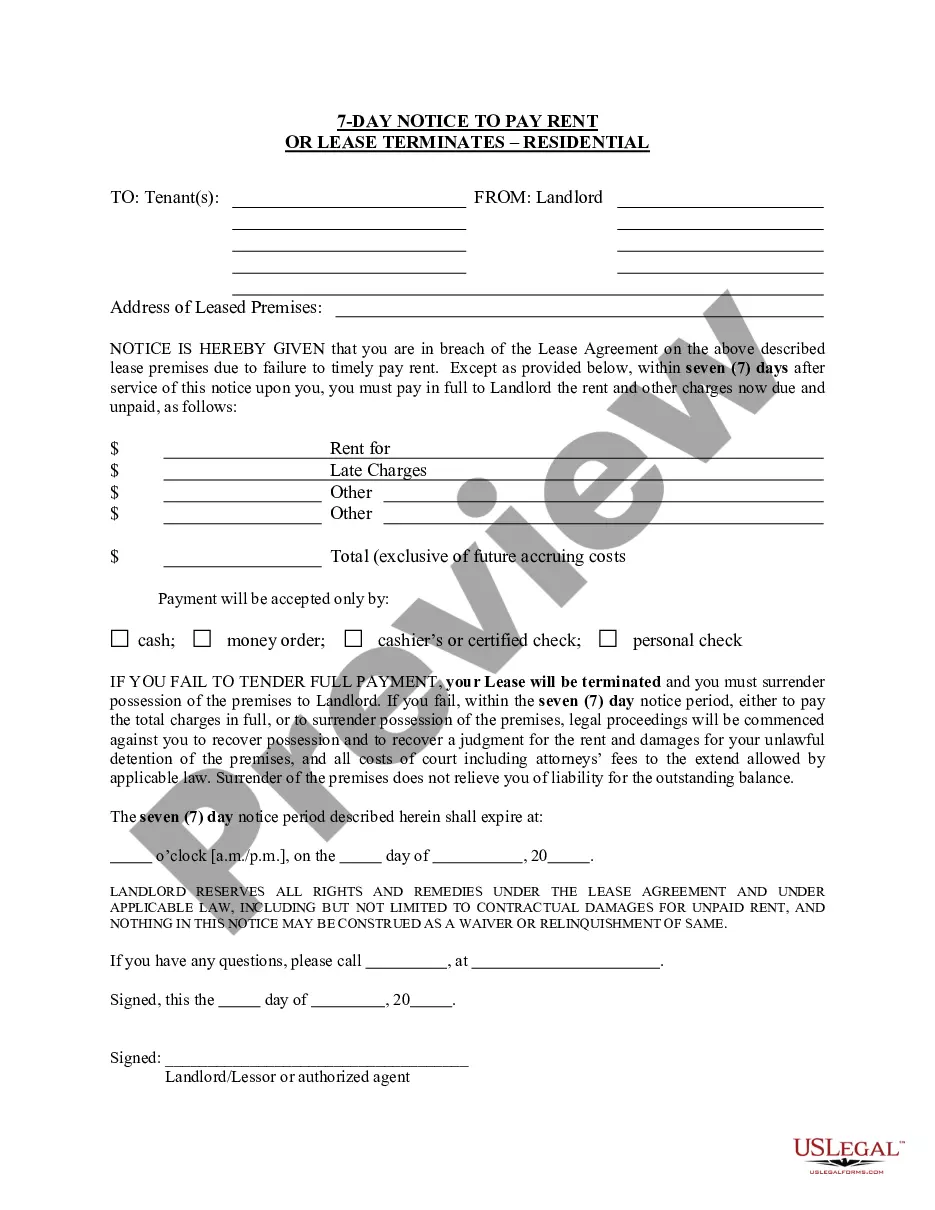

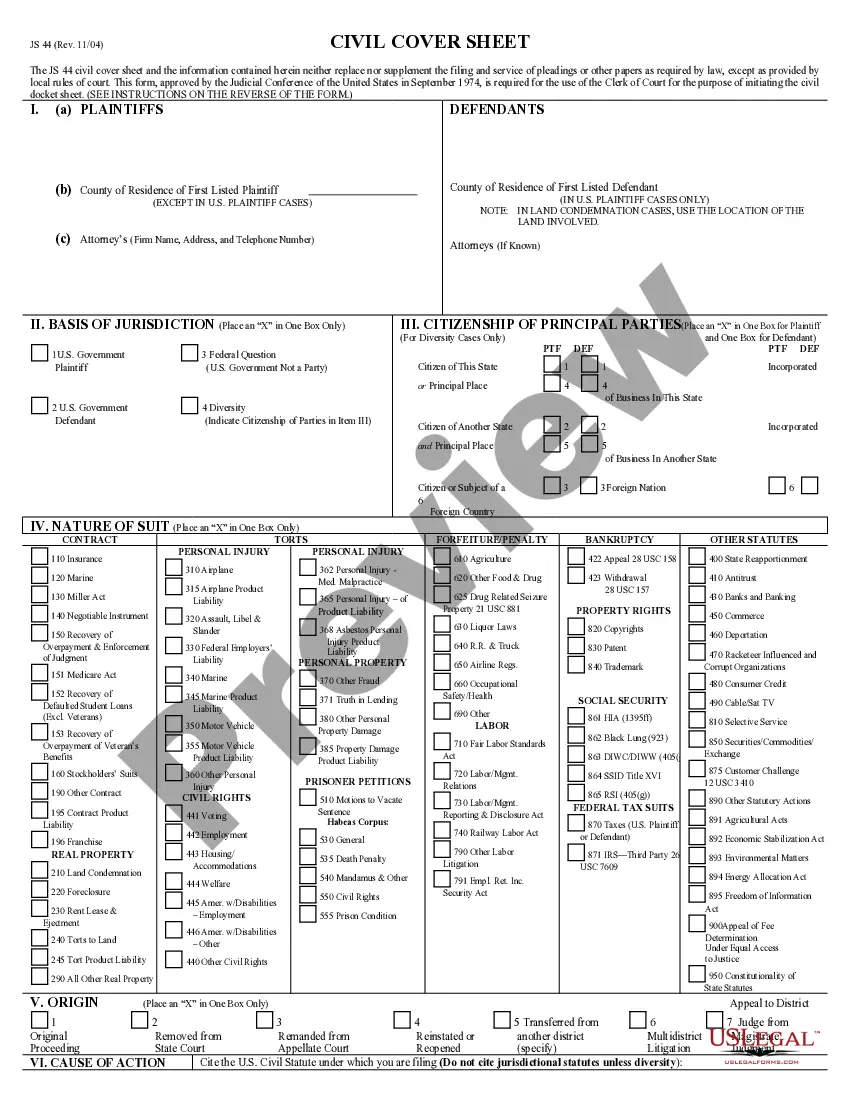

- Ensure you’ve found an appropriate document. Review the description and use the Preview feature, if accessible, to determine if it satisfies your requirements. If it does not, use the Search tab above to locate the right one.

- Purchase the template. Click on the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Queens New York Quitclaim Deed from Corporation to LLC. Select the file format for your document and save it to your device.

- Complete your form. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

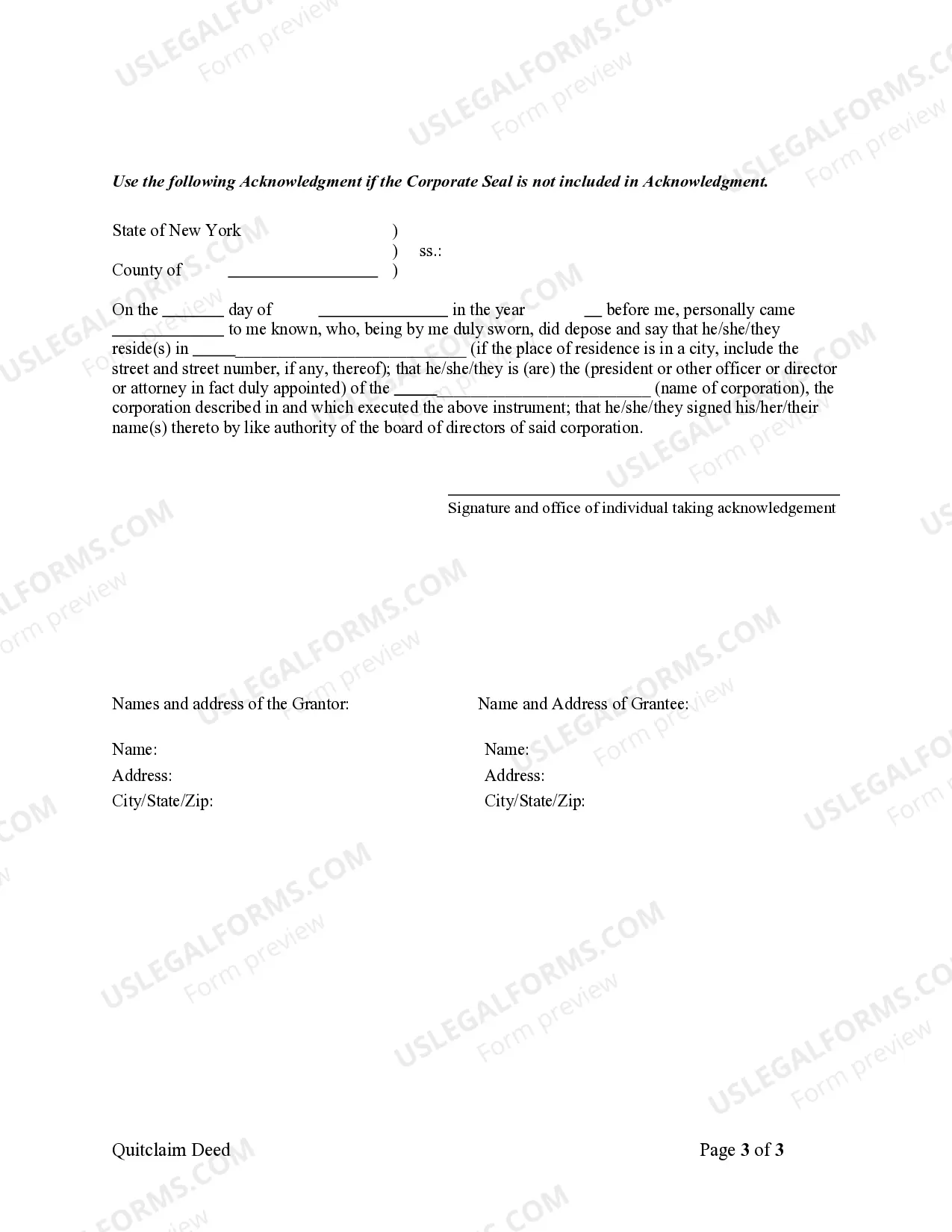

To quitclaim property to an LLC, start by drafting a quitclaim deed that specifies your intent to transfer ownership to the LLC. After signing the document with a notary, you must record it with the county clerk’s office. This action is essential to finalize the transfer effectively, aligning with the practices of a Queens New York Quitclaim Deed from Corporation to LLC.

To file a quitclaim deed in New York, begin by completing the appropriate deed form that lists the grantor and grantee. Next, ensure it is properly signed and notarized. Finally, you need to submit the deed to the county clerk's office where the property is located, fulfilling the process for a Queens New York Quitclaim Deed from Corporation to LLC.

Transferring property to an LLC involves executing a quitclaim deed that names the LLC as the new owner. After preparing the deed, ensure to record it with the local county clerk. This legally updates the ownership records and may provide tax advantages, particularly relevant under the Queens New York Quitclaim Deed from Corporation to LLC.

To transfer property from your personal name to an LLC, you should initiate a quitclaim deed. This process involves drafting the deed in compliance with New York state laws. Make sure to include the LLC as the grantee and sign the deed in the presence of a notary. Additionally, recording the quitclaim deed with the county clerk solidifies the transfer under the keyword: Queens New York Quitclaim Deed from Corporation to LLC.

To do a quitclaim deed in New York State, start by filling out a quitclaim deed form with all required property and owner information. Next, sign the form in front of a notary. Then, file the executed deed with the local county clerk's office to make the transfer official. If you're transferring from a corporation to an LLC, consider using resources like US Legal Forms to guide you through the tailored process for a Queens New York Quitclaim Deed from Corporation to LLC.

To file a quitclaim deed in New York, you need to submit the completed and notarized deed to the county clerk's office where the property is located. Before filing, ensure that you have filled out the necessary tax forms to avoid any delays. Once filed, the deed becomes part of the public record, finalizing the transfer in a Queens New York Quitclaim Deed from Corporation to LLC.

Yes, you can complete a quitclaim deed yourself, but it's important to understand the process thoroughly to avoid mistakes. Using a reputable platform like US Legal Forms can simplify the creation of the deed and help ensure that it complies with New York regulations. By following the correct steps, you can successfully execute a Queens New York Quitclaim Deed from Corporation to LLC without hiring an attorney.

To quitclaim your property to an LLC, you first need to prepare a quitclaim deed form, which outlines the property details and the parties involved. Once the form is ready, sign it in front of a notary public. After notarization, you must file the deed with the local county clerk's office in Queens, New York. This process ensures a smooth transfer of ownership in the Queens New York Quitclaim Deed from Corporation to LLC.

To obtain a quitclaim deed in New York, you should first gather the necessary information, including details about the property and the parties involved. Next, you can create the quitclaim deed using a reputable online service, like US Legal Forms, which offers ready-to-use templates. Once completed, you must sign the deed in front of a notary and then file it with the county clerk's office. This process is essential when transferring ownership under a Queens New York Quitclaim Deed from Corporation to LLC.

Yes, an LLC can be included on a deed as a property owner. This is common in real estate transactions, including a Queens New York Quitclaim Deed from Corporation to LLC. By properly documenting the LLC's involvement, you can ensure that ownership is correctly transferred.