Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt

Description

How to fill out New York Articles Of Incorporation Certificate - Nonprofit Corporation - Tax Exempt?

We consistently aim to minimize or avert legal harm when addressing intricate legal or financial issues.

To achieve this, we seek out attorney services that are typically quite costly.

However, not all legal issues are equally intricate.

Many of them can be managed independently.

Take advantage of US Legal Forms whenever you need to retrieve and download the Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt or any other document swiftly and securely. Just Log In to your account and click the Get button next to it. If you happen to lose the form, you can always re-download it from the My documents tab. The process remains easy even if you are new to the site! You can create your account in a matter of minutes.

- US Legal Forms is an online repository of up-to-date DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our repository empowers you to handle your issues autonomously without resorting to an attorney's help.

- We provide access to legal document templates that are not always readily available to the public.

- Our templates are tailored to specific states and areas, greatly simplifying the search process.

Form popularity

FAQ

To form a not-for-profit corporation in New York, you must first select a unique name that adheres to state regulations. Next, you should draft and file your Articles of Incorporation, specifically designed for a nonprofit, along with the necessary fees. Additionally, ensure that your organization complies with federal guidelines to secure tax-exempt status. For assistance, consider using resources like US Legal Forms to streamline the process of obtaining your Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt.

Nonprofits can be exempt from sales tax in New York, provided they have the correct documentation and tax-exempt status. Having a Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt is vital as it confirms your nonprofit's eligibility. This exemption can help your organization allocate more resources towards your charitable goals rather than tax expenses.

Yes, nonprofits in New York can be exempt from local taxes if they have been granted tax-exempt status. This is usually contingent upon holding a Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt. Local tax exemptions can be beneficial in minimizing operational costs, making it easier for nonprofits to fulfill their missions.

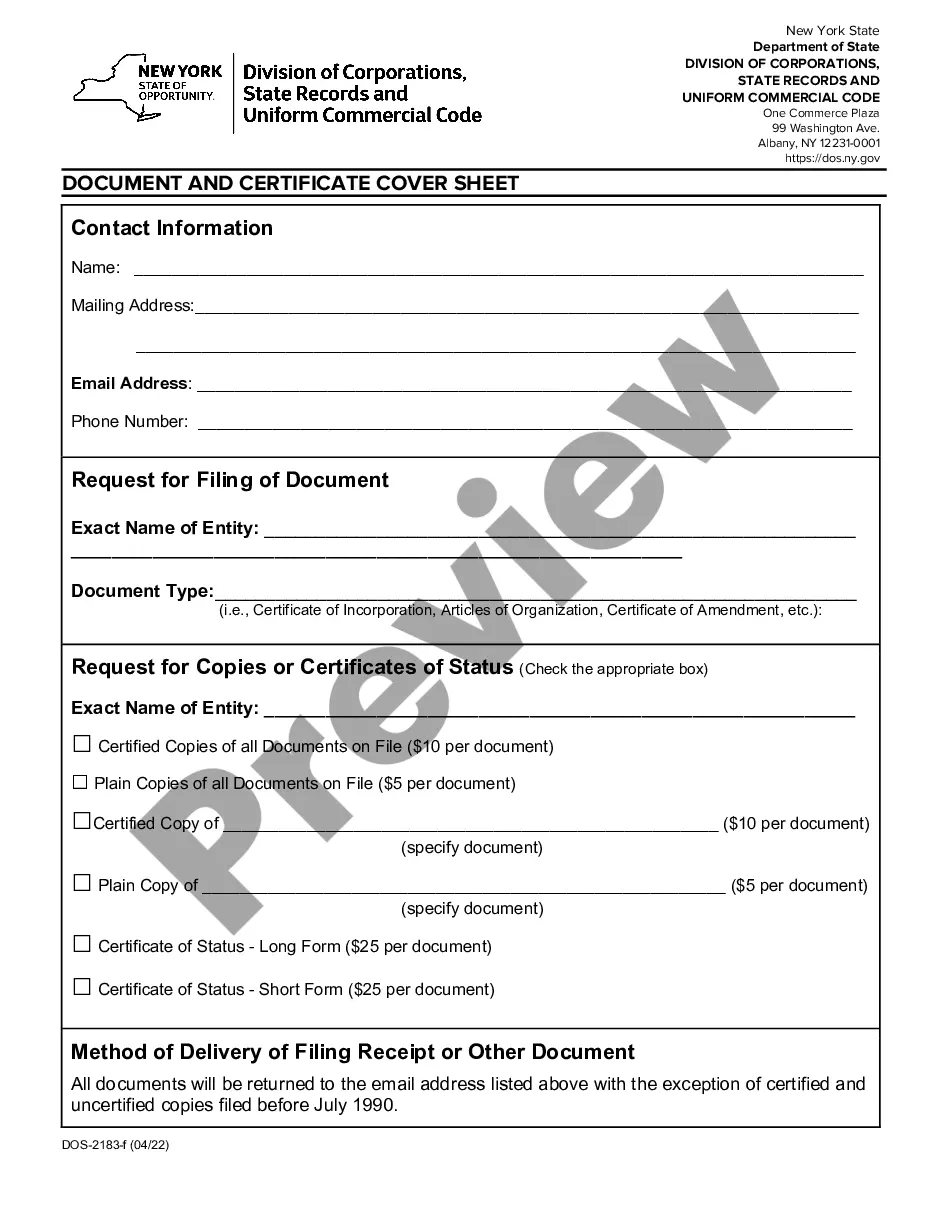

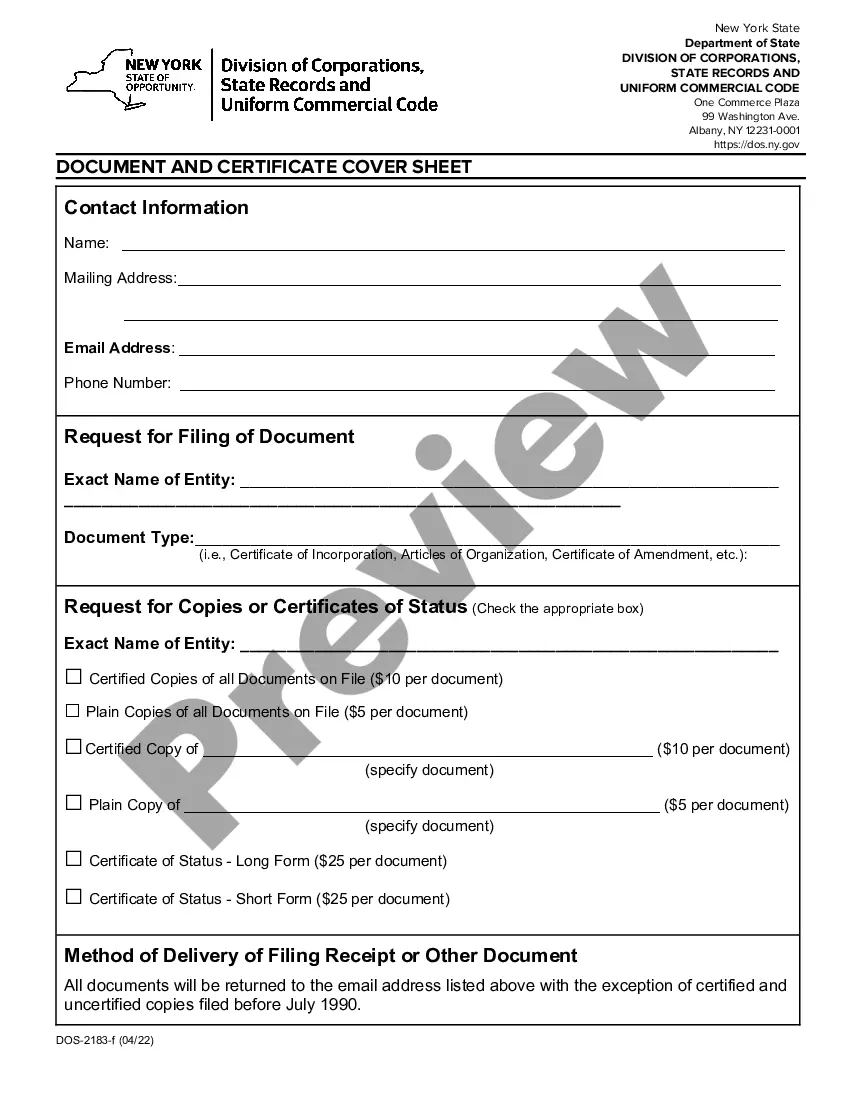

To obtain a copy of your certificate of incorporation in New York, visit the Department of State's website or contact their office directly. You will need to provide your organization's name and possibly other identifying information. If you have the Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt, this process may be streamlined for you.

In New York, organizations that meet certain criteria are exempt from sales tax. This generally includes nonprofit corporations that have been granted tax-exempt status through the proper channels, including those holding a Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt. Each organization should verify its specific exemptions to ensure compliance.

To avoid New York sales tax, specifically when dealing with nonprofit organizations, you must understand your tax-exempt status. Ensure you obtain a Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt, which qualifies your nonprofit for sales tax exemption. You can present this certificate to your vendors to avoid being charged sales tax on eligible purchases.

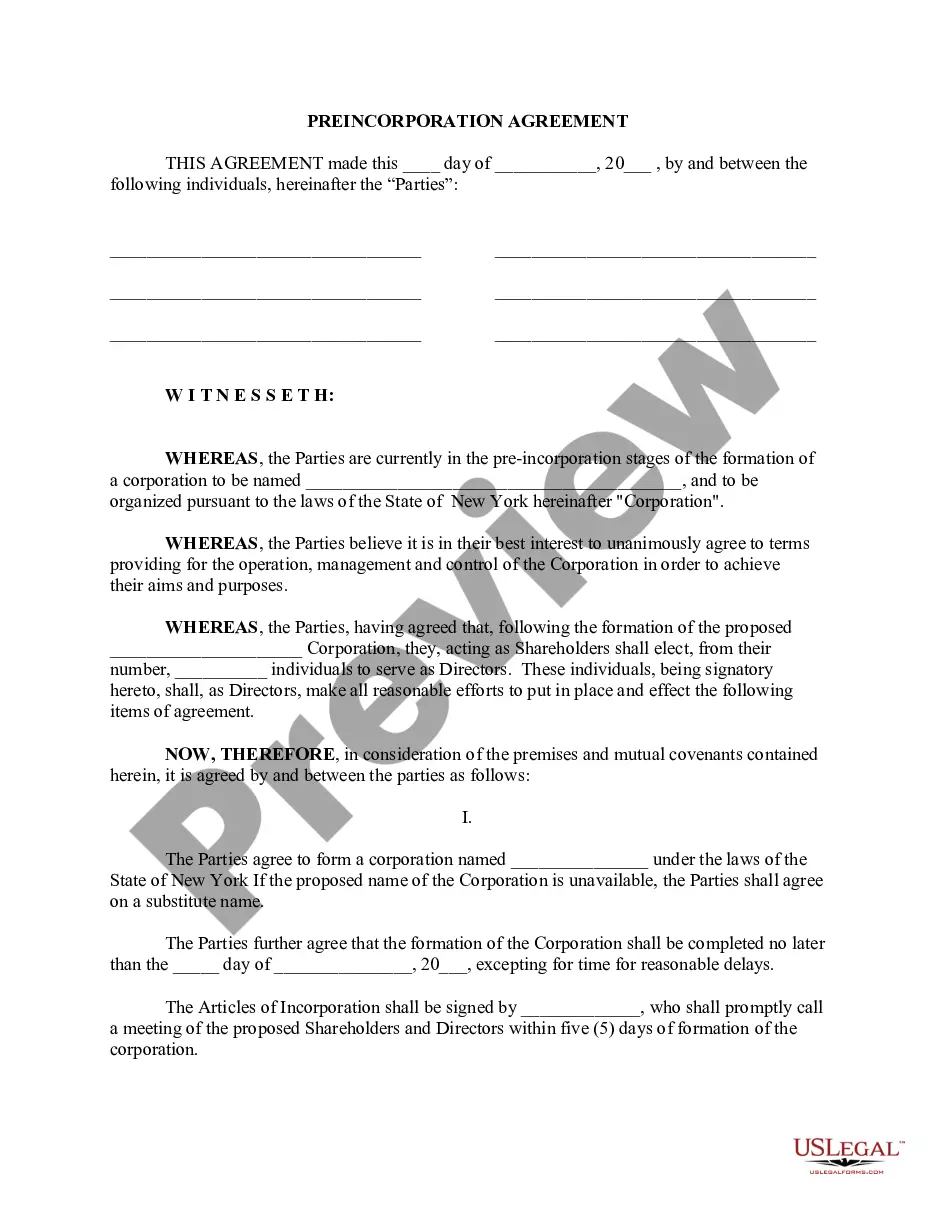

To file for a 501(c)(3) in New York, you must first complete the Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt. This involves gathering necessary information about your organization, including its purpose, structure, and proposed activities. After filing the Articles of Incorporation with the New York Department of State, you will need to apply for federal tax-exempt status by submitting Form 1023 to the IRS. Using a platform like USLegalForms can simplify this process by providing guided templates and resources specifically for nonprofit incorporation and tax exemption.

forprofit corporation in New York is generally formed to pursue charitable, educational, or other activities that provide benefits to the public. This type of corporation operates similarly to a business corporation but differs in its profit distribution and tax implications. To establish your notforprofit corporation, you must file your Rochester New York Articles of Incorporation Certificate. Using US Legal Forms can provide you with the necessary templates and guidance to navigate the incorporation process efficiently.

The time it takes to receive 501(c)(3) status in New York can vary widely, typically ranging from 6 months to over a year. After incorporating with a Rochester New York Articles of Incorporation Certificate, your application for 501(c)(3) status goes through review by the IRS. Factors such as the completeness of your application and the IRS’s current workload impact the timeline. To minimize delays, consider using resources like US Legal Forms to ensure your application is thorough and accurate.

To incorporate a nonprofit organization in the US, begin by preparing your Rochester New York Articles of Incorporation Certificate, which serves as your official documents for state recognition. You'll need to decide on a name, create a mission statement, and meet the specific state requirements regarding board members and bylaws. Filing the articles is generally done at the state's business filings office. Platforms such as US Legal Forms provide templates and guidance to ease this process.