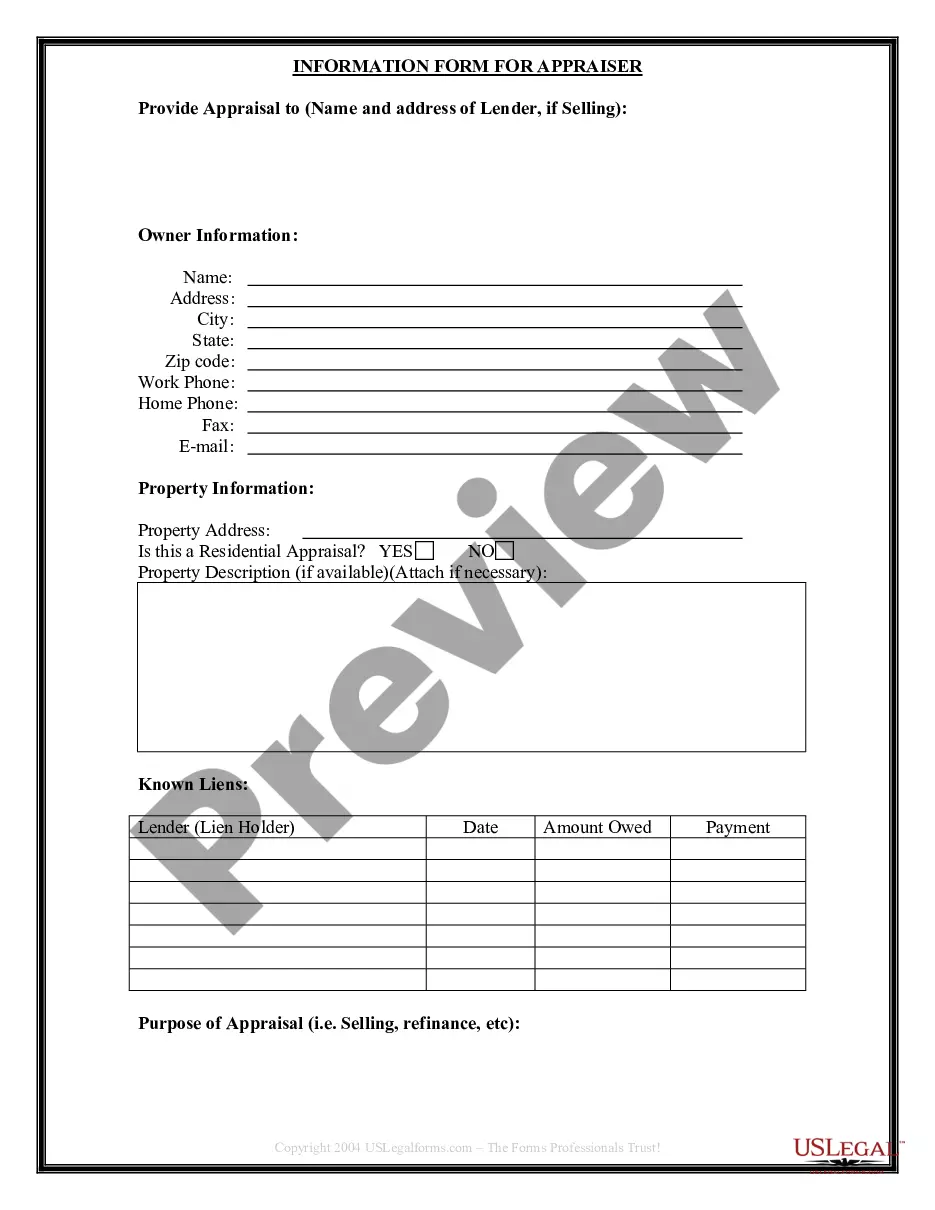

Suffolk New York Seller's Information for Appraiser provided to Buyer

Description

How to fill out New York Seller's Information For Appraiser Provided To Buyer?

Acquiring validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents for both personal and business needs as well as any real-world scenarios.

All the papers are accurately categorized by usage area and jurisdictional regions, so finding the Suffolk New York Seller's Information for Appraiser given to Buyer becomes as simple as ABC.

Maintaining documentation organized and adhering to legal standards holds significant value. Take advantage of the US Legal Forms database to consistently access crucial document templates for any needs right at your fingertips!

- Examine the Preview mode and document description. Ensure you’ve selected the correct one that fulfills your needs and fully aligns with your local legal stipulations.

- Search for an alternative template, if necessary. If you notice any discrepancies, use the Search tab above to find the correct one. If it fits your requirements, proceed to the following step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you desire. You will need to register for an account to access the library’s features.

- Complete your purchase. Provide your credit card information or use your PayPal account to pay for the subscription.

- Download the Suffolk New York Seller's Information for Appraiser provided to Buyer. Store the template on your device to continue with its completion and access it in the My documents section of your account whenever you need it again.

Form popularity

FAQ

Who Pays the Real Estate Transfer Tax? In New York, the seller of the property is typically the individual responsible for paying the real estate transfer tax. However, if the seller doesn't pay or is exempt from the tax, the buyer must pay.

General property defect disclosure Structural information such as roof condition as well as whether there is any fire, smoke, insect or water damage to the home. Information on the home's age and ownership history. Information on mechanical systems and services like drainage, water source and utilities.

If a property is transferred from one spouse to another during a divorce, no disclosure is required. Similarly, if the property is being transferred along close family lines (even without a divorce), then no disclosure is required. 4. Dwelling.

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.

The transfer tax is a tax imposed on the seller (or ?grantor?) during the conveyance of real property so it is typically their responsibility to pay. If the seller finds a way to not pay the tax (or just disappears), the responsibility to pay falls on the buyer. One way or another, the tax is going to get paid.

The tax rate is an incremental rate between . 25% and 2.9% based on the purchase price.

New York law requires you to disclose known home defects to the buyer. Under today's law, you?as a New York home seller?could be found liable to a buyer for having failed to disclose certain property conditions, or defects, in the course of the sale.

The NYC Real Property Transfer Tax is a seller closing cost of 1.4% to 2.075% which applies to the sale of real property valued above $25,000 in New York City.

This disclosure will help you to make informed choices about your relationship with the real estate broker and its sales agents. Throughout the transaction you may receive more than one disclosure form. The law may require each agent assisting in the transaction to present you with this disclosure form.

This is a statement of certain conditions and information concerning the property known to the seller. This Disclosure Statement is not a warranty of any kind by the seller or by any agent representing the seller in this transaction.