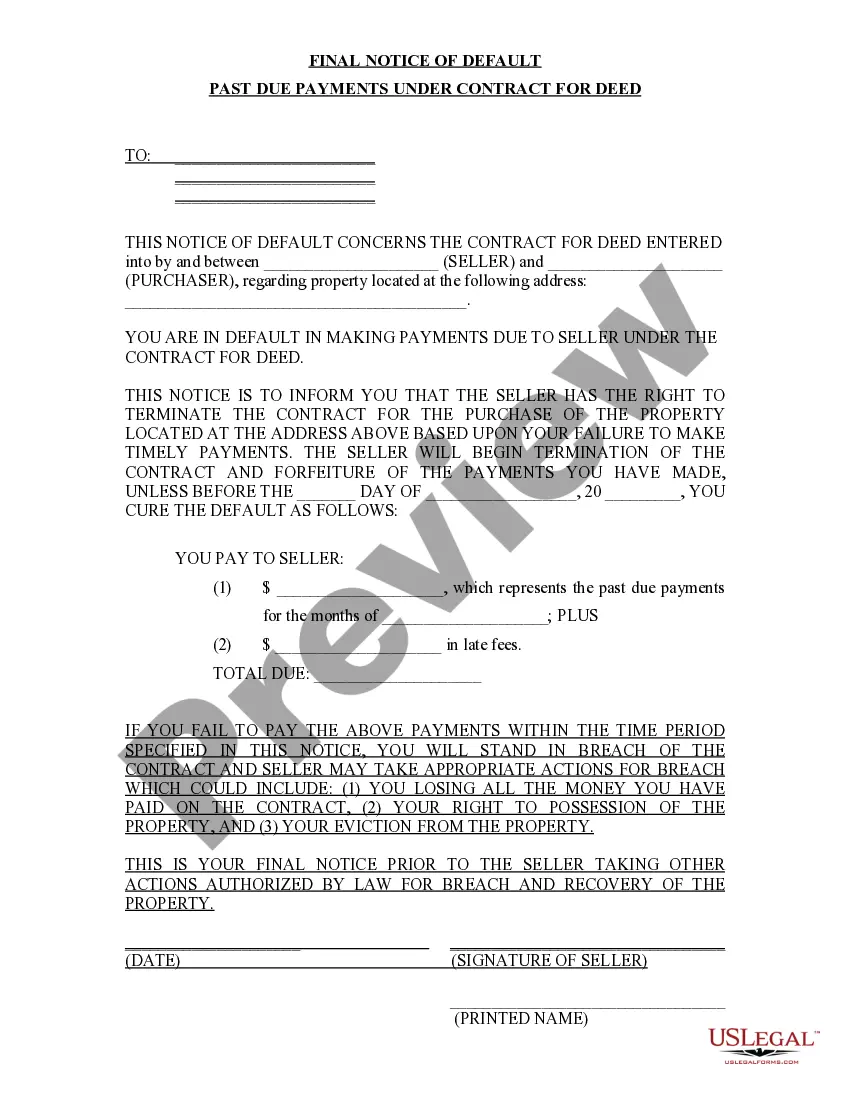

Syracuse New York Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

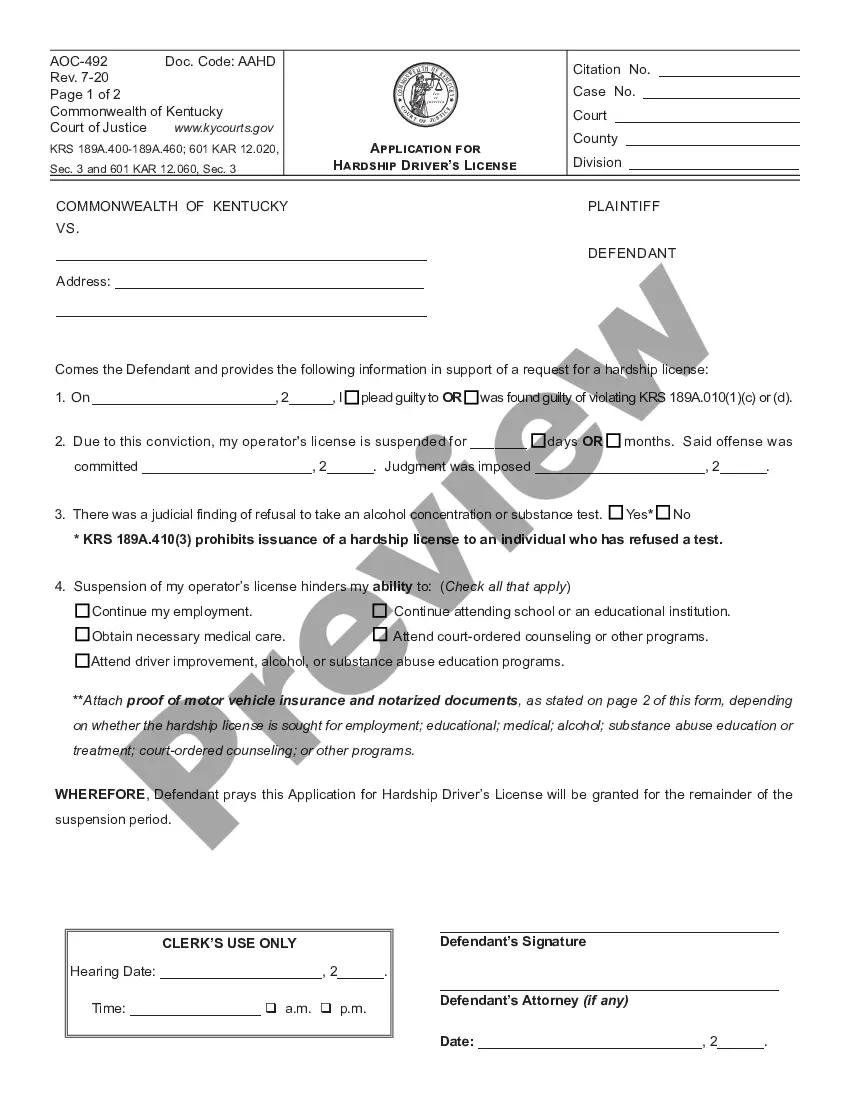

How to fill out New York Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Regardless of social or career standing, completing legal-related paperwork is an unfortunate requirement in the current professional landscape.

Often, it’s nearly impossible for an individual lacking legal expertise to create such documents from the ground up, primarily due to the complex language and legal subtleties they entail.

This is where US Legal Forms comes to the rescue.

Ensure the form you have selected is tailored to your locality, as the regulations of one state or county do not apply to another.

Review the document and read a concise overview (if available) of situations the form can be utilized for.

- Our platform provides an extensive collection with over 85,000 ready-to-use state-specific forms applicable for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to enhance their efficiency using our DIY papers.

- Whether you need the Syracuse New York Final Notice of Default for Past Due Payments related to Contract for Deed or another document suitable for your state or county, US Legal Forms has everything readily available.

- Here’s how to swiftly obtain the Syracuse New York Final Notice of Default for Past Due Payments concerning Contract for Deed using our trustworthy platform.

- If you are an existing customer, you may continue to Log In to your account to download the necessary form.

- If you are new to our platform, please ensure that you follow these steps before downloading the Syracuse New York Final Notice of Default for Past Due Payments related to Contract for Deed.

Form popularity

FAQ

The New York Foreclosure Prevention Act was designed to aid borrowers by offering more tools and options to avoid foreclosure. This legislation often emphasizes negotiation and mediation before the foreclosure process begins. If you’ve received a Syracuse New York Final Notice of Default for Past Due Payments related to a Contract for Deed, exploring the provisions of this act could provide beneficial alternatives.

The process can take anywhere from several months to over a year, depending on the complexity of the case and whether the borrower contests the foreclosure. Judicial procedures can be time-consuming, and any delays may extend the process. If you are dealing with a Syracuse New York Final Notice of Default for Past Due Payments associated with a Contract for Deed, being proactive can influence these timelines.

A bank can potentially begin foreclosure proceedings within a few months after missed payments, but the complete process is often much longer. New York law also mandates a judicial process, which can prolong the timeline depending on various factors. It’s important for anyone facing a Syracuse New York Final Notice of Default for Past Due Payments in connection with a Contract for Deed to act promptly to protect their interests.

Recent changes to New York's foreclosure laws emphasize borrower protections and aim to reduce unnecessary delays. These laws often require lenders to provide more assistance to borrowers facing financial hardships. If you have received a Syracuse New York Final Notice of Default for Past Due Payments related to a Contract for Deed, staying informed about these laws can be essential.

The foreclosure timeline in New York can vary but generally takes several months to over a year. Factors impacting this duration include court schedules and the possibility of borrower appeals. For recipients of a Syracuse New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, understanding this timeline can help in planning the response.

Foreclosure in New York state follows a judicial process, requiring lenders to file a lawsuit to initiate proceedings. Importantly, borrowers have the right to respond and may submit defenses. Understanding these rules is vital, particularly if you receive a Syracuse New York Final Notice of Default for Past Due Payments relating to a Contract for Deed.

In New York, a lender typically initiates the foreclosure process after the borrower misses three payments. However, the timeline can vary based on the lender’s policies and the specific terms of the contract. For those dealing with a Syracuse New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, the situation may escalate quickly if immediate action is not taken.

A request for notice of default is a formal appeal made by a lender to notify a borrower of their overdue payments. In Syracuse New York, this request is critical in the context of contracts for deed, as it sets the stage for legal proceedings if necessary. This notice prompts borrowers to take action to address their default status before further consequences unfold. Engaging with platforms like US Legal Forms can equip you with the necessary information and documentation to respond effectively.

Receiving a default notice is a serious matter, as it indicates that your payments are overdue. In the context of Syracuse New York's regulations regarding contracts for deed, this notice serves as a formal alert to the borrower about the need to rectify their payment situation. It's essential to take this notice seriously and seek assistance to understand your options and next steps, as failing to respond may lead to foreclosure. Utilizing legal services like US Legal Forms can simplify navigating this complex situation.

When a property goes into default, it means that the borrower has failed to make the required payments, which can lead to significant consequences. In Syracuse New York, a default on a contract for deed can result in the lender taking legal action to reclaim the property. This process involves a series of notifications and deadlines that the borrower must be aware of to avoid losing their home. Proactively addressing the default with the help of legal professionals can often provide alternative solutions.