Suffolk New York Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out New York Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you are in search of a legitimate form template, it’s challenging to discover a superior location than the US Legal Forms website – likely one of the largest collections on the web.

Here you can locate an extensive variety of form samples for business and personal uses categorized by types and states, or keywords.

With the enhanced search feature, finding the latest Suffolk New York Final Notice of Default for Outstanding Payments related to Contract for Deed is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the format and save it to your device.

- Additionally, the validity of each and every document is assured by a team of experienced attorneys who continuously examine the templates on our site and revise them in accordance with the most current state and county laws.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Suffolk New York Final Notice of Default for Outstanding Payments related to Contract for Deed is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

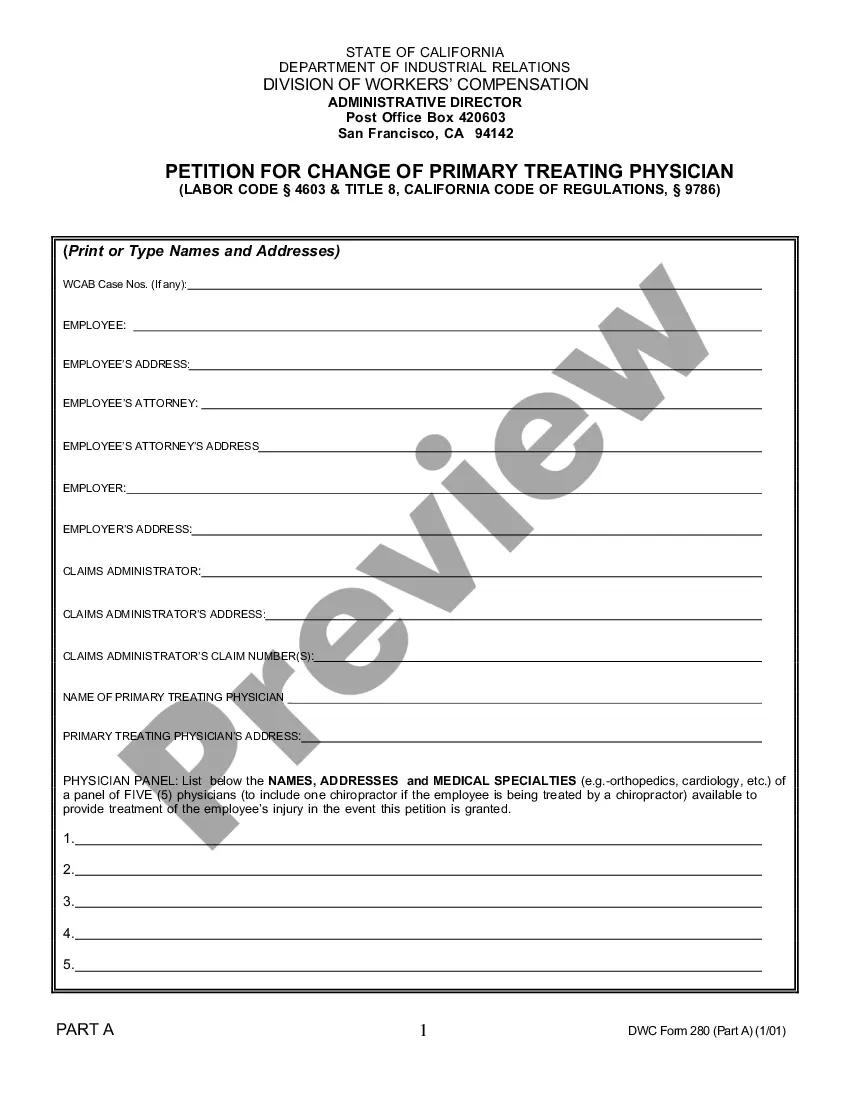

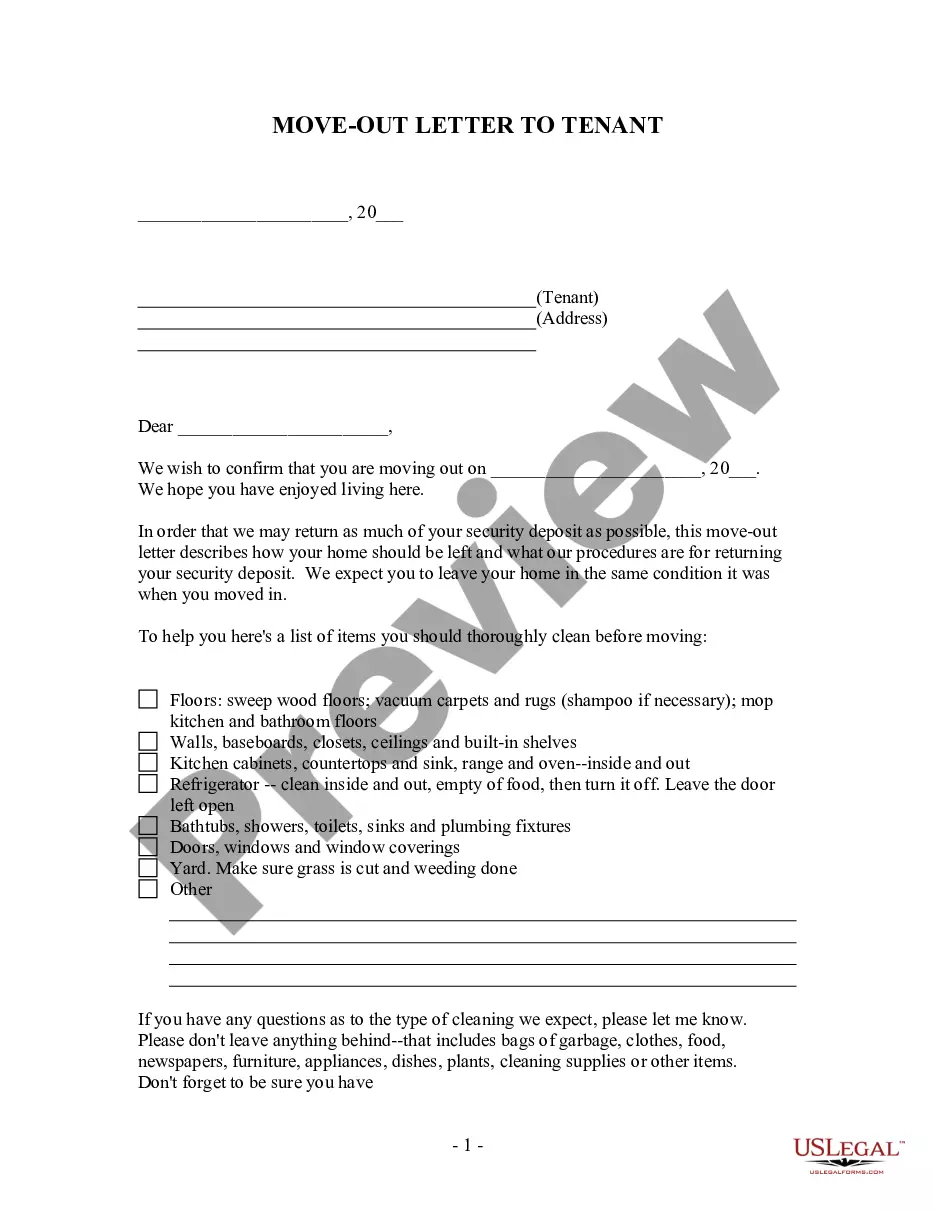

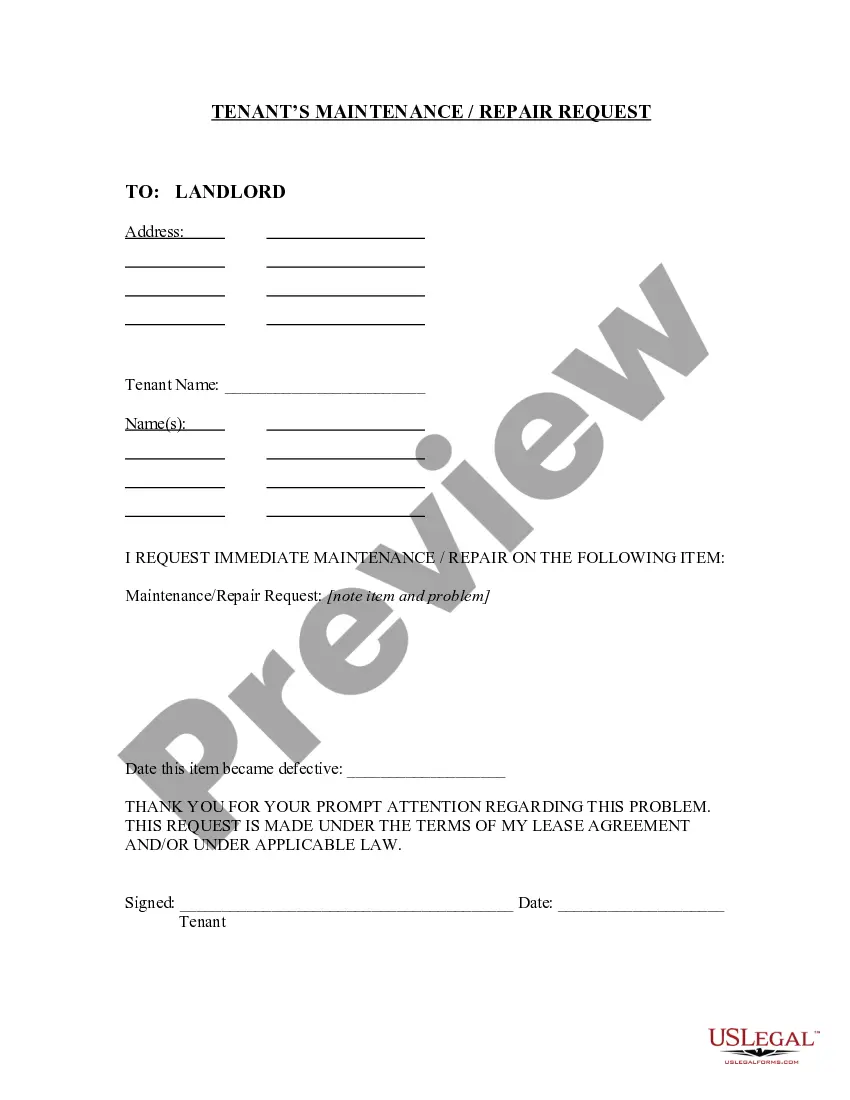

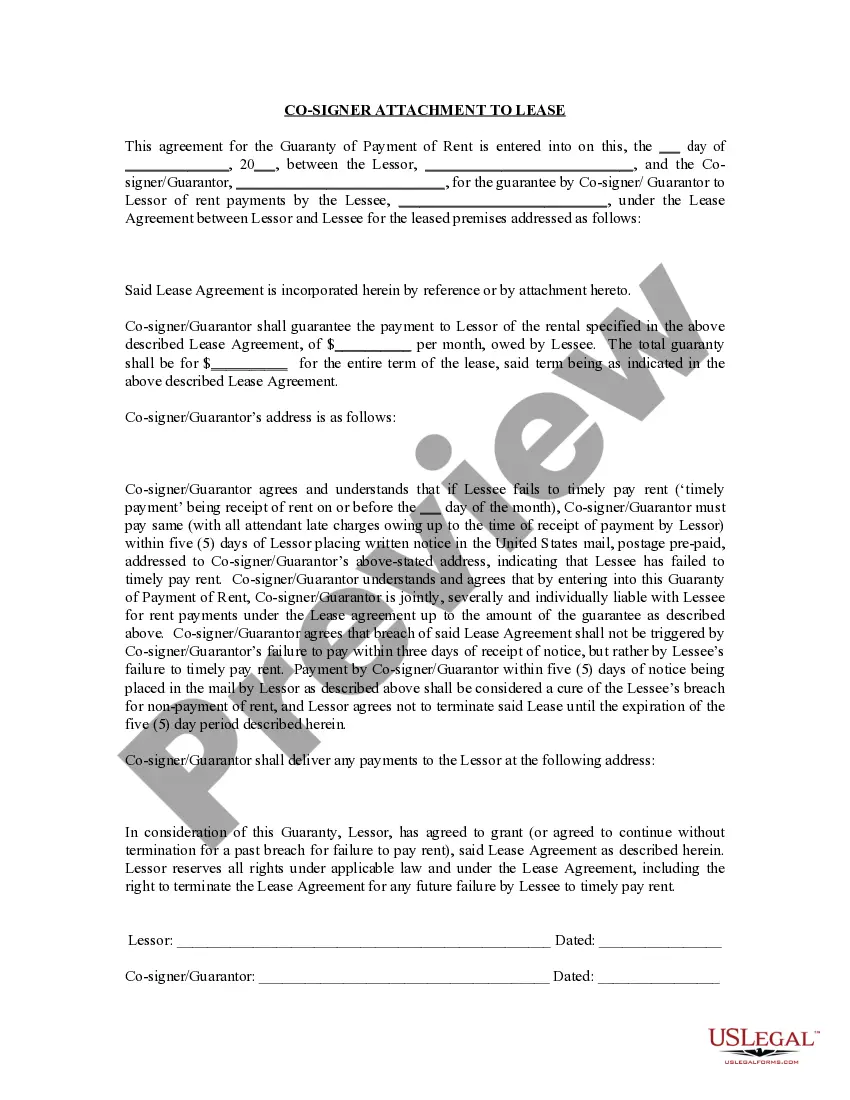

- Ensure you have identified the form you require. Review its description and utilize the Preview feature to view its contents. If it does not meet your requirements, use the Search option at the top of the page to find the correct document.

- Confirm your choice. Click the Buy now button. Then, select your preferred pricing plan and provide credentials to register for an account.

Form popularity

FAQ

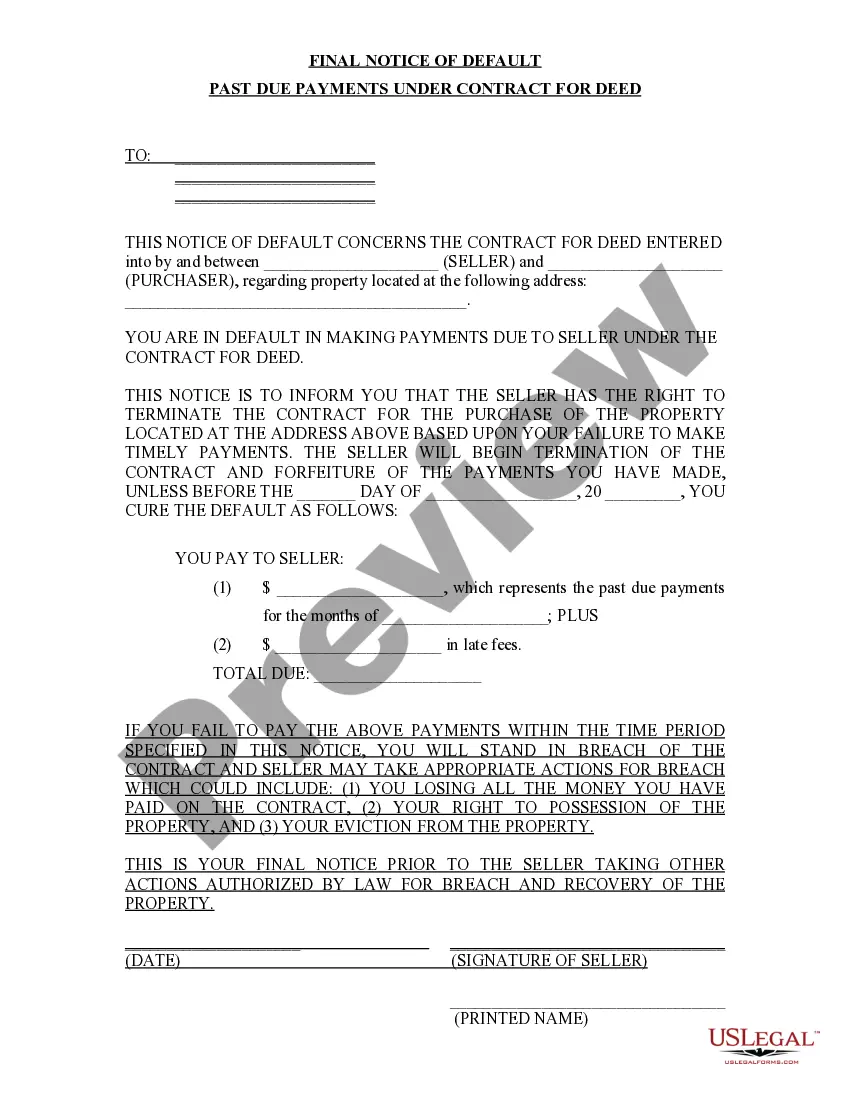

To write a notice of default letter, start by clearly stating the recipient's name and address, along with your own contact details. Include specific information regarding the property and the nature of the default, referencing the Suffolk New York Final Notice of Default for Past Due Payments in connection with the Contract for Deed. Be sure to specify the actions required to rectify the default and the consequences should the issues remain unaddressed. You can find templates and guidance on uslegalforms to assist you in crafting an effective letter.

When a contract for deed is in default, the seller must first issue a Suffolk New York Final Notice of Default for Past Due Payments, notifying the buyer of the default. The notice typically must provide a specific timeframe for the buyer to remedy the situation. If the buyer fails to comply, the seller may initiate eviction proceedings to regain possession and equitable title. Consulting with an attorney or using resources from uslegalforms can help ensure you follow the correct legal procedures.

You can find notice of default properties in Suffolk, New York, by checking public records at your local county clerk's office. Many online databases also offer searchable listings of properties that have received a Final Notice of Default for Past Due Payments in connection with a Contract for Deed. Additionally, real estate websites may feature specific listings for distressed properties. Consider using platforms like uslegalforms to simplify your search process.

The primary purpose of a notice of default is to formally alert the borrower that they are behind on their payments. In the context of the Suffolk New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, this notice initiates possible legal actions or conversations about payment solutions. It serves as both a warning and an opportunity for the borrower to address the situation before further actions are taken. Recognizing the significance of this notice can help borrowers take timely action.

The foreclosure process in New York begins when a lender files a notice of default due to unpaid debts. Following the Suffolk New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, the lender may initiate a lawsuit to pursue foreclosure. After this, the court will schedule a hearing, and if the lender prevails, a foreclosure sale can occur. Understanding this process is essential for both buyers and sellers engaged in real estate transactions.

A notice of default on a contract for deed is a written statement indicating that the buyer has not fulfilled their payment obligations. This notice is crucial for initiating subsequent actions, such as a foreclosure or a remedy. In cases involving Suffolk New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, this document serves as an essential first step in addressing any outstanding debts. It not only informs the buyer but also helps the seller establish their legal rights.

The eviction process in Suffolk County, NY, can vary, but it typically takes around 2 to 3 months from start to finish. Once you issue a Suffolk New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, the tenant has a limited number of days to respond or settle the debt. If they do not comply, you can file for eviction in court. Be prepared for possible delays due to court scheduling and local regulations.

A letter of default on a contract serves as a formal notification that one party has failed to meet their obligations under the agreement. In the context of Suffolk New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, this letter indicates that a payment has not been made. It is essential for parties involved to address this issue promptly to avoid further legal consequences. This letter can act as a wake-up call to find a solution before things escalate.

The maximum amount you can claim in small claims court varies by jurisdiction but is generally $5,000 for individuals in Suffolk County. Make sure your claim fits within this limit to have a smoother process. If your situation involves a Suffolk New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, ensuring your claim's alignment with the court's requirements is essential.

In New York, you can sue for up to $10,000 in small claims court if you are a business, and up to $5,000 if you are an individual. This distinction is important as it affects who can file and the limits applicable. If you need to address a financial issue around the Suffolk New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, this limit will guide your decision on how to proceed.