Nassau New York Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out New York Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Regardless of one’s social or professional standing, completing law-related documentation is an unfortunate requirement in contemporary society.

Often, it’s nearly impossible for individuals without a legal background to produce such documents from the beginning, primarily due to the complex language and legal subtleties they encompass.

This is where US Legal Forms proves to be beneficial.

Make sure that the form you have selected is tailored to your area since regulations from one state or county do not apply to another.

Review the form and examine a brief summary (if provided) of the situations in which the document can be utilized.

- Our service offers an extensive array of over 85,000 ready-to-use state-specific forms suitable for nearly any legal scenario.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to enhance their efficiency by utilizing our DIY forms.

- Whether you are in need of the Nassau New York Final Notice of Default for Past Due Payments related to Contract for Deed or another document valid in your region, US Legal Forms makes everything readily available.

- Here’s how to quickly obtain the Nassau New York Final Notice of Default for Past Due Payments concerning Contract for Deed using our dependable service.

- If you are an existing subscriber, you can simply Log In to your account to access the required form.

- However, if you are new to our library, please ensure to follow these steps before downloading the Nassau New York Final Notice of Default for Past Due Payments related to Contract for Deed.

Form popularity

FAQ

Finding properties with a notice of default involves checking local real estate databases or county records. You can search through online platforms and public databases that provide details on properties undergoing the Nassau New York Final Notice of Default for Past Due Payments in connection with Contract for Deed. Using tools like U.S. Legal Forms can simplify this process, offering access to necessary documents and records.

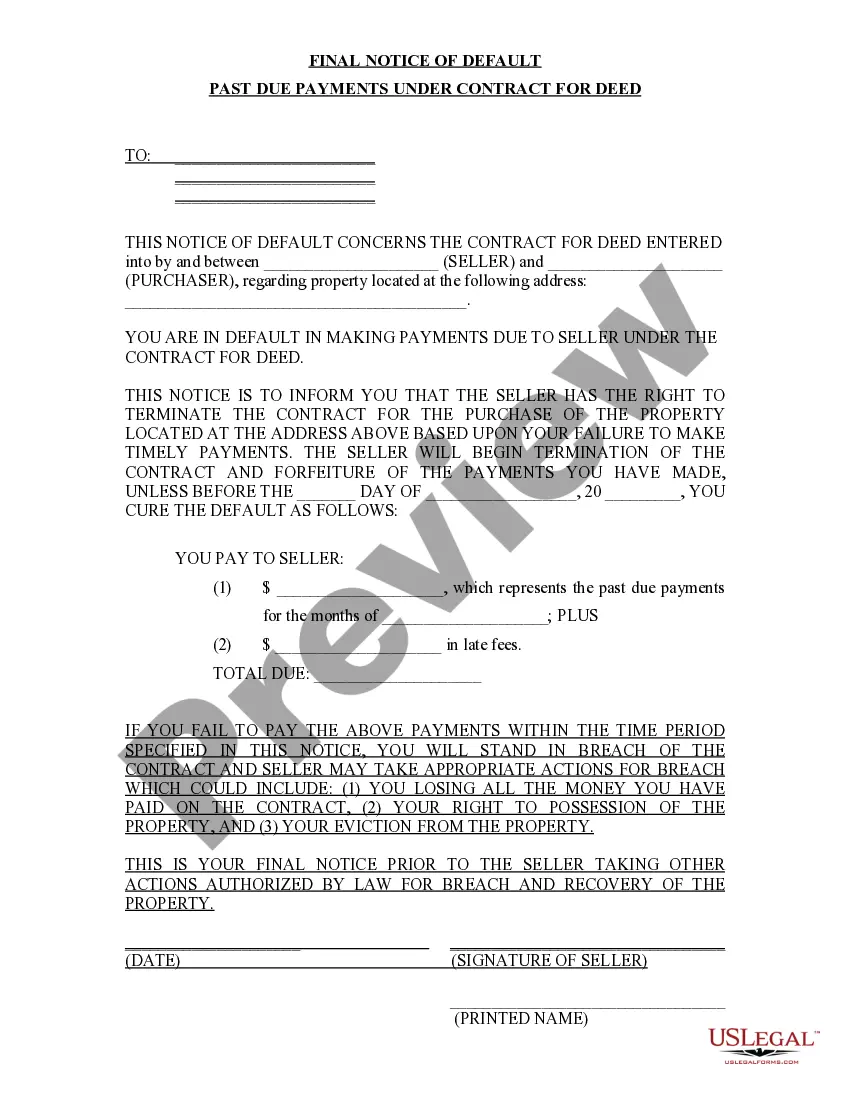

A Nassau New York Final Notice of Default for Past Due Payments typically includes the property address, the amount due, and a deadline for payment. This document usually contains legal language indicating the implications of failing to rectify the default. Understanding its format can help you identify key details about the property's status.

Yes, a notice of default is a public record in real estate. In Nassau, New York, this document becomes part of the official records and is accessible to anyone interested. By reviewing these records, you can find critical information related to properties in default for past due payments tied to a Contract for Deed.

To determine if a property is in default, you can start by contacting the lender or mortgage servicer. They will provide you with the status of any payments related to the Contract for Deed. Additionally, you can check the local county recorder's office for the Nassau New York Final Notice of Default for Past Due Payments, which is often filed when a property is delinquent.

Typically, three consecutive missed payments can initiate the foreclosure process. Lenders often send a Nassau New York Final Notice of Default for Past Due Payments in connection with Contract for Deed after these missed payments. It’s crucial to address the situation promptly, as early intervention can lead to alternative solutions. Keeping an open line of communication with your lender will be beneficial.

The number of missed mortgage payments before foreclosure can vary, but often, just three consecutive missed payments trigger the process. Once this occurs, you may receive a Nassau New York Final Notice of Default for Past Due Payments in connection with Contract for Deed. This notice serves as an important reminder to take action and communicate with your lender. Early intervention may help you avoid foreclosure.

Generally, missing one mortgage payment can begin the process that eventually threatens eviction. In New York, lenders often send a Nassau New York Final Notice of Default for Past Due Payments in connection with Contract for Deed after just one missed payment. If you miss multiple payments, the lender may initiate the foreclosure process. Staying in communication with your lender can help you prevent eviction.

Foreclosure in New York can take several months to over a year, depending on various factors. After the lender files a foreclosure lawsuit, you will receive a Nassau New York Final Notice of Default for Past Due Payments in connection with Contract for Deed. You have the opportunity to respond, which can prolong the process. If the court approves foreclosure, the property will be scheduled for auction.

If you default on a land contract, the seller can issue a Nassau New York Final Notice of Default for Past Due Payments in connection with Contract for Deed. This notice typically gives you a specified period to catch up on missed payments. If you fail to comply, the seller may initiate legal proceedings to terminate the contract and recover the property. Understanding your rights and obligations can help you navigate this challenging situation.

A notice of default on a contract for deed signifies that the buyer has failed to meet the terms of the agreement, typically concerning payments. In the realm of Nassau New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, this notification is the seller's official communication that action may be taken if the situation is not resolved. Understanding what this notice means and how to address it is vital for buyers to maintain their rights and property interests.