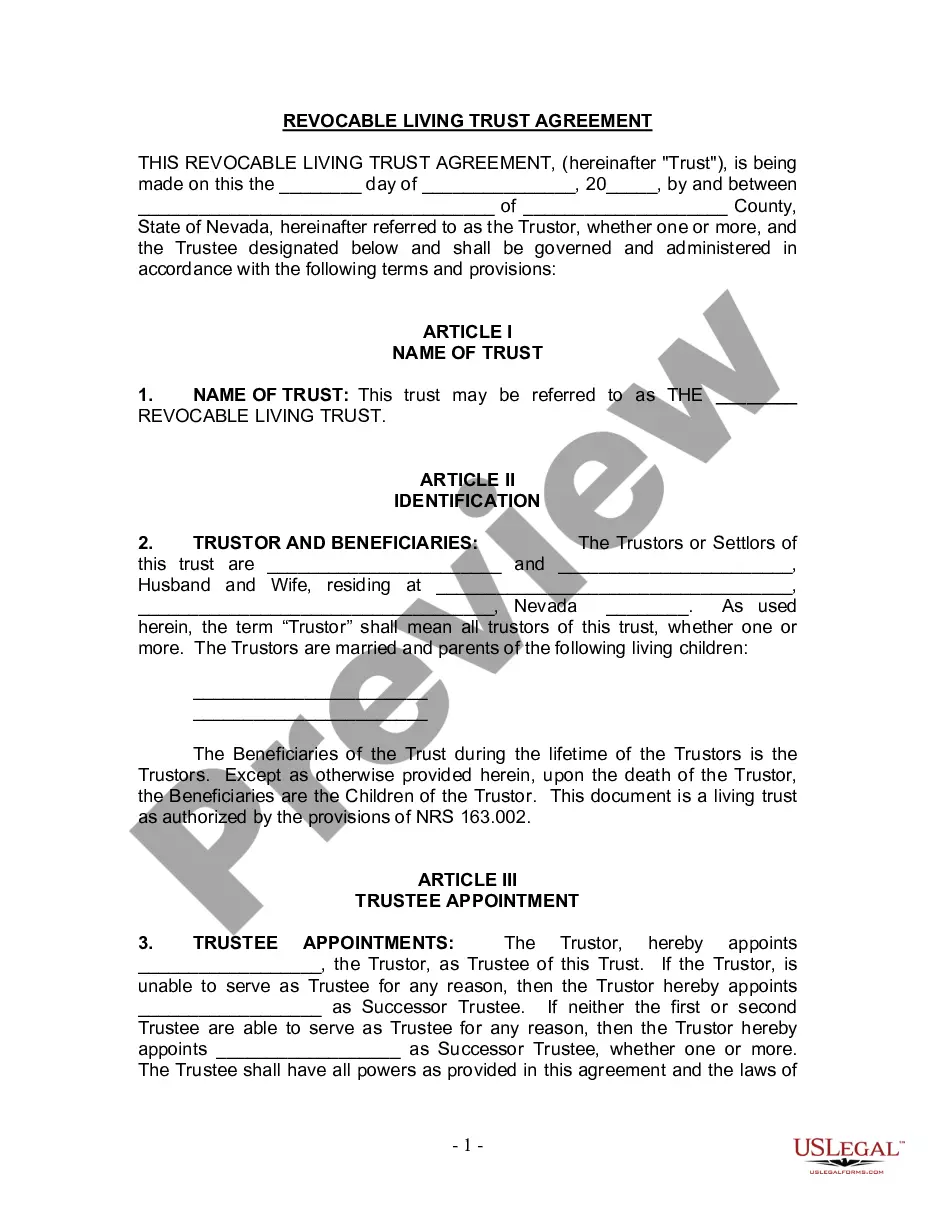

Clark Nevada Living Trust for Husband and Wife with Minor and Adult Children is a legal instrument that allows married couples residing in Clark County, Nevada, to protect and distribute their assets while providing for the care and well-being of their children. The trust is established during the lifetime of the couple and can be modified or revoked as per their discretion. The Clark Nevada Living Trust for Husband and Wife with Minor and Adult Children ensures that the couple's assets are properly managed and preserved for the benefit of their children. It enables the appointed trustees to oversee the distribution of assets to the beneficiaries according to the terms specified in the trust document. The trust can provide for the well-being, education, and financial security of both minor and adult children. This type of living trust offers various benefits for families in Clark County, Nevada. Firstly, it helps avoid probate, saving time and costs associated with the court processes. Additionally, it offers privacy as trusts are not public documents and do not require court involvement. The trust also allows greater flexibility for the couple to customize their estate plan, such as providing specific instructions for the care and upbringing of minor children. There are different variations of Clark Nevada Living Trust for Husband and Wife with Minor and Adult Children to accommodate specific family situations and objectives. Some of these variations include: 1. Revocable Living Trust: This type of trust allows the couple to retain full control and access to their assets during their lifetime, with the flexibility to modify or revoke the trust as desired. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable trust cannot be modified or revoked once established. This type of trust offers additional asset protection and tax planning benefits but limits the control the couple has over the assets. 3. Testamentary Trust: A testamentary trust is established through a will and only takes effect upon the death of one or both parents. It allows the parents to provide for the care and distribution of assets to their children after their passing. 4. Special Needs Trust: This type of trust is designed to provide for the specific needs of a child with disabilities, ensuring they can receive essential government benefits while also benefitting from the assets placed in the trust. Ultimately, the specific type of Clark Nevada Living Trust for Husband and Wife with Minor and Adult Children chosen will depend on the couple's unique circumstances, goals, and preferences. Consulting with an experienced attorney specializing in estate planning is highly recommended ensuring the trust is tailored to meet the family's specific needs.

Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Clark Nevada Living Trust For Husband And Wife With Minor And Or Adult Children?

Take advantage of the US Legal Forms and gain immediate access to any document you desire.

Our advantageous site featuring a vast array of document templates enables you to discover and acquire almost any document sample you require.

You can download, fill out, and sign the Clark Nevada Living Trust for Spouses with Minor and/or Adult Children within a few minutes, rather than spending hours searching the internet for an appropriate template.

Utilizing our collection is an outstanding method to enhance the security of your document submissions.

Furthermore, you can locate all previously saved documents in the My documents section.

If you do not have an account yet, follow the instructions below.

- Our expert attorneys routinely examine all records to guarantee that the forms are suitable for a specific region and adhere to new laws and regulations.

- How do you access the Clark Nevada Living Trust for Spouses with Minor and/or Adult Children.

- If you have a subscription, simply Log In to your account. The Download option will appear on all templates you view.

Form popularity

FAQ

There are several reasons why a husband and wife might choose to establish separate trusts. Separate trusts can provide tailored estate planning that addresses individual financial situations and goals. Additionally, a Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children can ensure that each spouse's assets are managed according to their wishes, particularly in blended families or when distinct asset protection strategies are necessary. Understanding these options can help couples make informed decisions.

In Nevada, a living trust does not need to be recorded with the state. However, it is important to have the trust document readily available for the trustee and beneficiaries. Maintaining clear communication about the trust's contents and terms can facilitate its administration. A well-prepared Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children will ensure your wishes are executed smoothly.

Yes, a married couple should strongly consider having a living trust. A Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children can provide significant benefits, such as avoiding probate and offering a streamlined asset management process. This type of trust also allows couples to maintain control over their assets while ensuring their children are cared for after their passing. Exploring this option can lead to peace of mind for families.

Filing a living trust in Nevada involves several straightforward steps. First, create the trust document with all necessary details about your assets and beneficiaries. After drafting, it's essential to fund the trust by transferring your assets into it. You may consult resources like US Legal Forms for templates and guidance when establishing your Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children.

The decision for a husband and wife to have separate living trusts depends on individual circumstances. In many cases, a shared Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children is suitable, as it simplifies asset management. However, separate trusts may offer more personalized estate planning, especially if couples have significant individual assets or children from previous relationships. Ultimately, consider your unique situation and consult with a legal professional.

One of the biggest mistakes parents make is not being specific about their intentions in their trust. A Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children should include clear directives to avoid confusion among heirs. Additionally, some fail to review the trust regularly, which can lead to outdated provisions. Engaging with services like uslegalforms can help you avoid common pitfalls and keep your trust current.

You can create your own living trust in Nevada without a lawyer. Crafting a Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children on your own allows you to tailor it to your family's needs. Remember to consider specific legal provisions that may be complicated to navigate alone. Resources from uslegalforms can simplify this process and ensure your document is valid.

Yes, you can write your own trust in Nevada. However, it's important to ensure that your Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children meets all legal requirements. Mistakes in the drafting process can lead to complications later on. Using a platform like uslegalforms can guide you in creating a trust that accurately reflects your wishes.

The best living trust for a married couple is typically the Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children. This trust addresses the unique needs of families, ensuring that both partners can maintain control of their assets while setting provisions for minor or adult children. It effectively reduces the complexity of the estate planning process and provides peace of mind for families. Consulting resources, such as uslegalforms, can help you create a trust that aligns with your family goals.

Whether married couples should have separate living trusts depends on their individual circumstances. In many cases, using the Clark Nevada Living Trust for Husband and Wife with Minor and or Adult Children can simplify estate management. However, there may be situations where separate trusts provide distinct benefits, such as separating individual assets or managing different family dynamics. It's wise to discuss your specific needs with a professional to determine the best approach.

Interesting Questions

More info

A written Will is necessary to create and register the Trust. A Will includes information about the beneficiaries, their estate and the property to pass to them upon a death. Additionally, a Will should be signed or witnessed by a Notary Public or Guardian Ad Item. An Executor or Administrator appoints one or more Executors or Administrators to oversee the administration of the estate according to the instructions contained in the Will. A Will can be signed in the presence of an Executor. An Executor can be anybody in the same or a different family group. A Will can be made in the presence of two witnesses, or in a single presence, with each witness testifying under oath, or under threat of perjury. Additionally, in New York, New Jersey, and Florida, a Will may be witnessed by two or more notaries public, or guardians or executors, or notaries public, or two or more guardians with their oaths sworn in or under threat of perjury within 10 days before the execution.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.