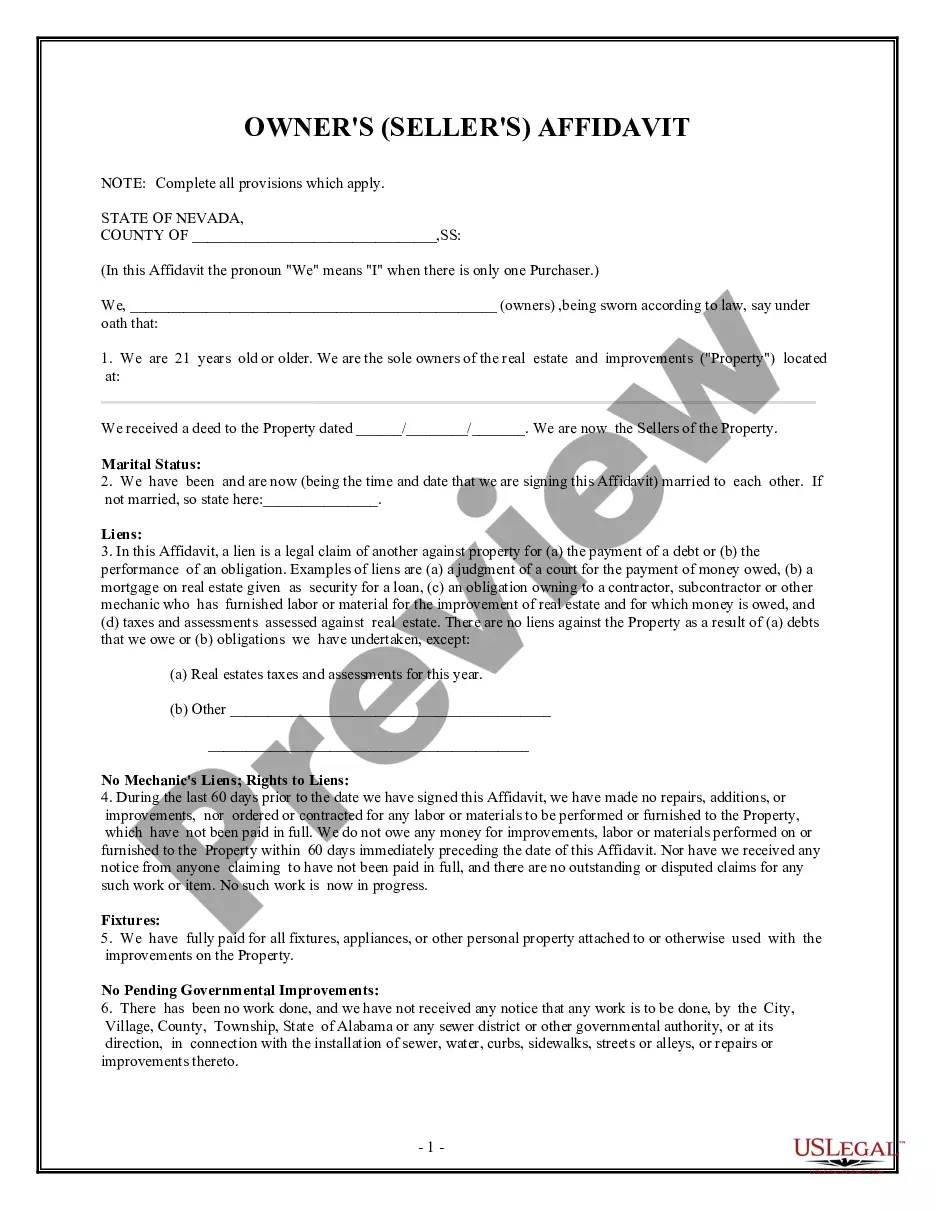

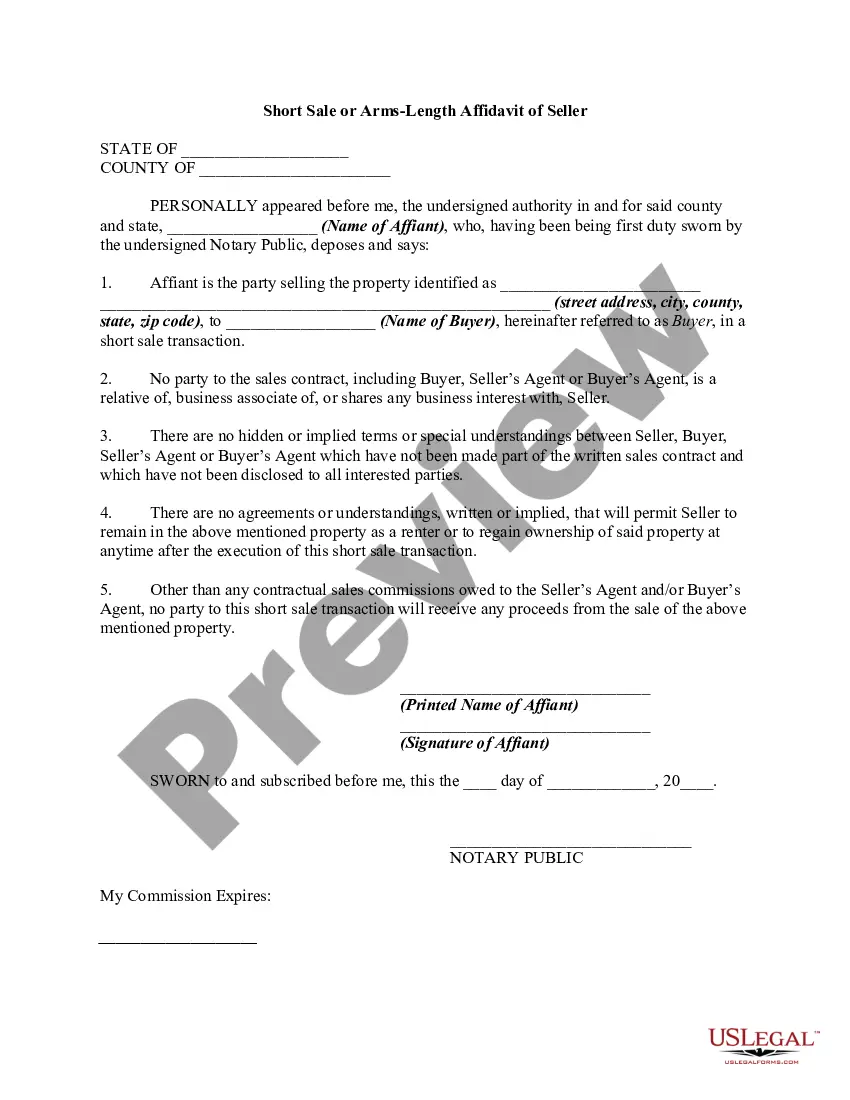

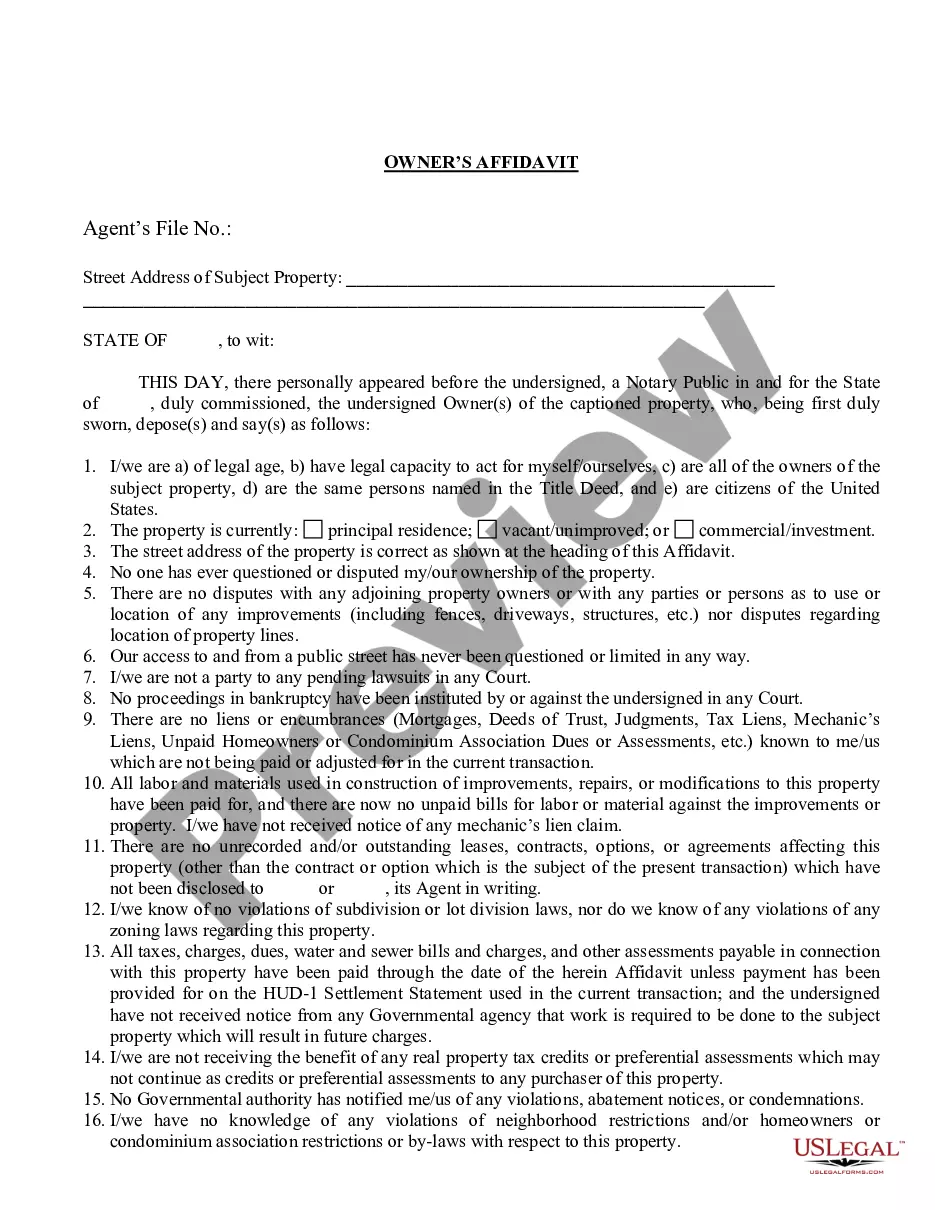

Clark Nevada Owner's or Seller's Affidavit of No Liens

Description

How to fill out Nevada Owner's Or Seller's Affidavit Of No Liens?

Finding authentic templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements as well as various real-life situations.

All the documents are appropriately categorized by usage area and jurisdictional zones, making it as simple as A-B-C to search for the Clark Nevada Owner's or Seller's Affidavit of No Liens.

Complete your purchase. Enter your credit card information or use your PayPal account to pay for the service.

- For those already acquainted with our catalog and who have used it in the past, acquiring the Clark Nevada Owner's or Seller's Affidavit of No Liens requires just a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- The process will take just a couple more steps for new users.

- Review the Preview mode and form description. Ensure you’ve selected the correct one that aligns with your needs and fully adheres to your local jurisdictional requirements.

- Search for another template, if necessary. If you notice any discrepancies, utilize the Search tab above to find the right one. If it meets your criteria, proceed to the next step.

Form popularity

FAQ

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

If you require a Certificate of Ownership, you may request a new one by e-mail us at titles@housing.nv.gov. The new homeowner should submit their request for a new title to the Division within 30 days.

Upon the transfer of any real property in the State of Nevada, a special tax called the Real Property Transfer Tax is imposed. The County Recorder in the county where the property is located is the agency responsible for the imposition and collection of the tax at the time the transfer is recorded.

This process takes approximately 1 - 3 days, depending on the current workload.

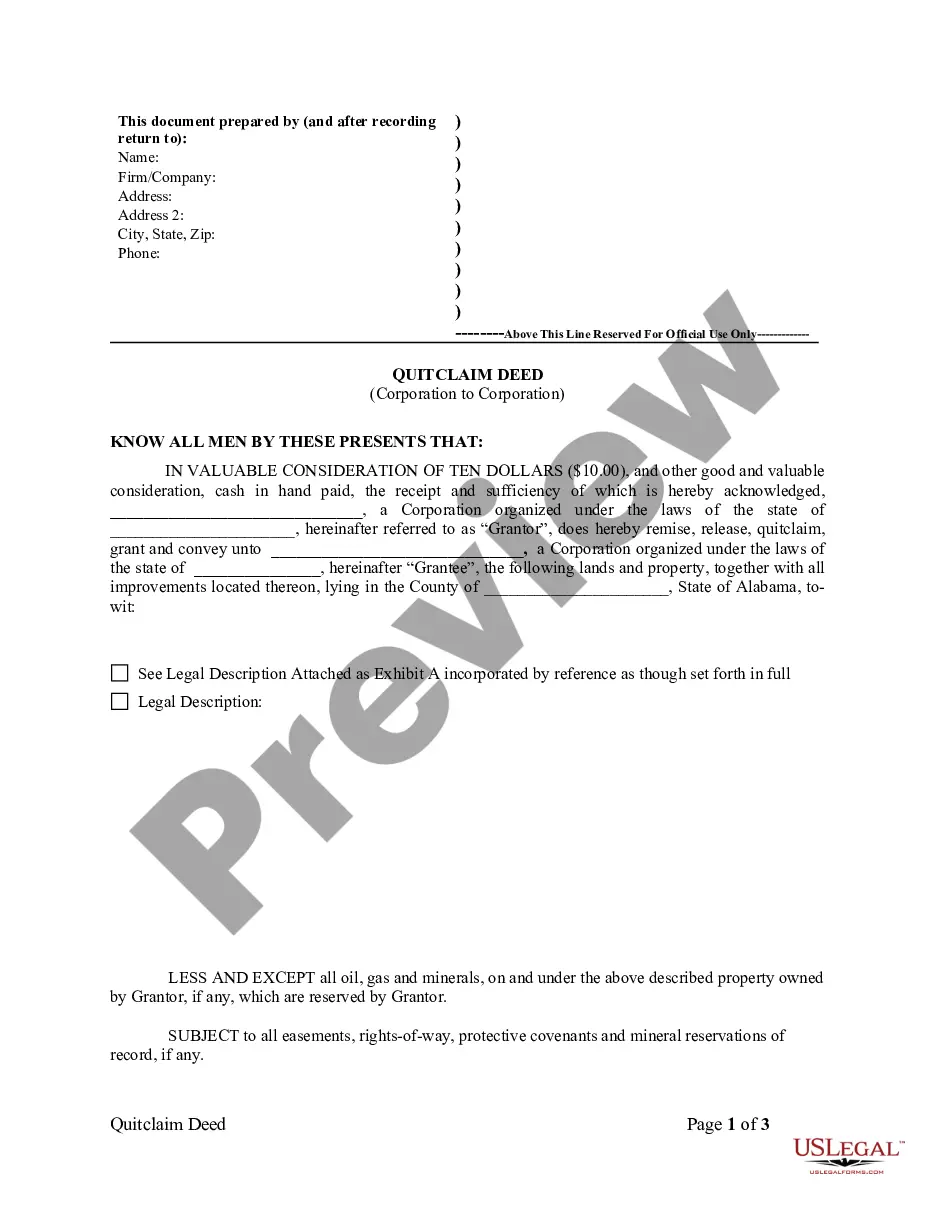

Nevada law recognizes three general types of deeds for transferring real estate: a general warranty deed form; a grant, bargain, and sale deed form; and a quitclaim deed form. These three forms vary according to the guaranty the current owner provides?if any?regarding the quality of the property's title.

The Grantee and Grantor are jointly and severally liable for the payment of the tax. When all taxes and recording fees required are paid, the deed is recorded. Each County Recorder's Office: 1.

Step 1. Determine and prepare the needed requirements for a title transfer. Deed of Conveyance.Photocopies of valid IDs of all signatories in the deed.The Notary Public's official receipt for the deed's notarization. Certified True Copy of the Title (3 copies)Certified True Copy of the latest Tax Declaration.

Both buyer and seller must sign the TL-100 form in front of a notary in the state. The local country assessor must also sign this form at the bottom. Title (must have), Bill of sale (Optional ? Click for Nevada Bill of Sale). Notary is needed on title and Bill of sale.

Related Pages Standard Recordings (Not subjected to Real Property Transfer Tax)$42.00 per documentHomestead Filing$42.00 per documentNotice of Default/Breach and Election to Sell Under a Deed of Trust$250.00 + recording fee

How Much Are Transfer Taxes in Nevada? Nevada's statewide real property transfer tax is $1.95 per $500 of value over $100. Some counties in Nevada, such as Washoe and Churchill, add $0.10 to the rate.