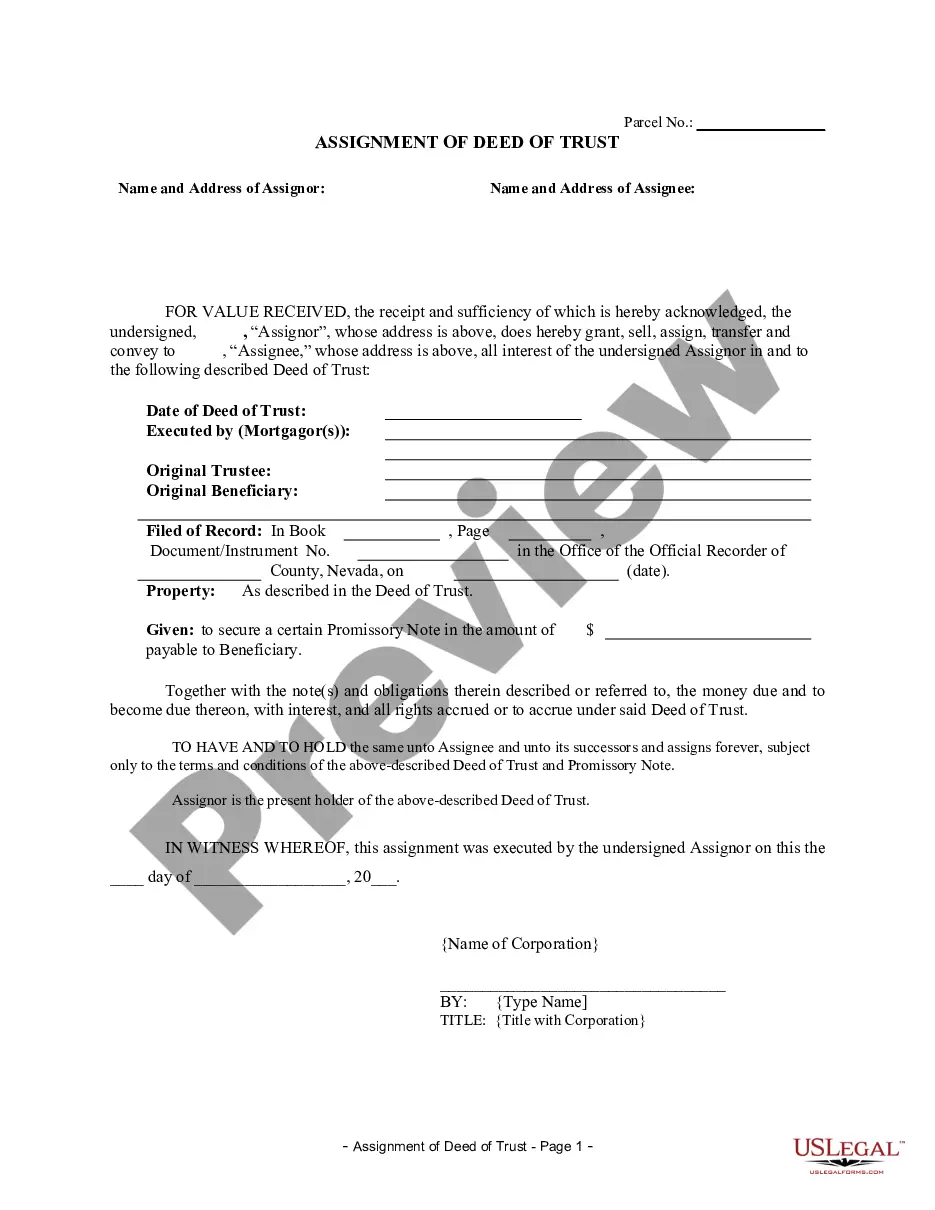

Assignment of Deed of Trust by Corporate Mortgage Holder

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rule

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Nevada Law

Execution of Assignment or Satisfaction:

Assignment must be signed by Trust Beneficiary. Trust Beneficiary must sign certificate

of release and provide to Trustee, who then signs satisfaction.

Assignment:

Recommended that assignment be recorded in order to avoid complications.

Demand to Satisfy:

Within 21 calendar days after receiving written notice that a debt secured by a deed of trust made

on or after October 1, 1991, has been paid or otherwise satisfied or discharged,

the beneficiary shall deliver to the trustee or the trustor the original

note and deed of trust, if he is in possession of those documents, and

a properly executed request to reconvey the estate in real property conveyed

to the trustee by the grantor.

Recording Satisfaction:

A recorded deed of trust may be discharged by an entry on the margin of the record thereof,

signed by the trustee or his personal representative or assignee in the

presence of the recorder or his deputy, acknowledging the satisfaction

of or value received for the deed of trust and the debt secured thereby.

(But see, NRS 107.073, below.)

Marginal Satisfaction:

Allowed, UNLESS deed of trust has been recorded by a microfilm or other photographic process-

if so, an acknowledged reconveyance of the deed of trust must be recorded.

Penalty:

If the beneficiary fails to deliver to the trustee a properly executed request to reconvey, or if the trustee

fails to cause to be recorded a reconveyance of the deed of trust, the

beneficiary or the trustee, as the case may be, is liable in a civil action

to the grantor, his heirs or assigns in the sum of $500, plus a reasonable

attorney's fee. (And see, NRS 107.077(3), below.)

Acknowledgment:

An assignment or satisfaction must contain a proper Nevada acknowledgment, or other acknowledgment approved

by Statute.

Nevada Statutes

NRS 107.073 Marginal entries; reconveyance must be recorded if

deed of trust recorded by photographic process; presentation of certificate

executed by trustee or his personal representative or assignee.

1. Except as otherwise provided in subsection 2, a recorded

deed of trust may be discharged by an entry on the margin of the record

thereof, signed by the trustee or his personal representative or

assignee in the presence of the recorder or his deputy, acknowledging

the satisfaction of or value received for the deed of trust and the debt

secured thereby. The recorder or his deputy shall subscribe the entry as

witness. The entry has the same effect as a reconveyance of the deed of

trust acknowledged and recorded as provided by law. The recorder shall

properly index each marginal discharge.

2. If the deed of trust has been recorded by a microfilm

or other photographic process, a marginal release may not be used and an

acknowledged reconveyance of the deed of trust must be recorded.

3. If the recorder or his deputy is presented with a certificate

executed by the trustee or his personal representative or assignee, specifying

that the deed of trust has been paid or otherwise satisfied or discharged,

the recorder or his deputy shall discharge the deed of trust upon the record.

NRS 107.077 Delivery of documents by beneficiary to trustee;

recording by trustee; liability for failure to deliver or record documents;

requirements for release of deed of trust when reconveyance not recorded;

liability for improperly recording deed of trust; criminal penalty.

1. Within 21 calendar days after receiving written notice

that a debt secured by a deed of trust made on or after October 1, 1991,

has been paid or otherwise satisfied or discharged, the beneficiary shall

deliver to the trustee or the trustor the original note and deed of trust,

if he is in possession of those documents, and a properly executed request

to reconvey the estate in real property conveyed to the trustee by the

grantor. If the beneficiary delivers the original note and deed of trust

to the trustee or the trustee has those documents in his possession, the

trustee shall deliver those documents to the grantor.

2. Within 45 calendar days after a debt secured by a deed

of trust made on or after October 1, 1991, is paid or otherwise satisfied

or discharged, and a properly executed request to reconvey is received

by the trustee, the trustee shall cause to be recorded a reconveyance of

the deed of trust.

3. If the beneficiary fails to deliver to the trustee a

properly executed request to reconvey pursuant to subsection 1, or if the

trustee fails to cause to be recorded a reconveyance of the deed of trust

pursuant to subsection 2, the beneficiary or the trustee, as the case may

be, is liable in a civil action to the grantor, his heirs or assigns in

the sum of $500, plus a reasonable attorney's fee and the costs of bringing

the action, and he is liable in a civil action to any party to the deed

of trust for any actual damages caused by his failure to comply with the

provisions of this section and for a reasonable attorney's fee and the

costs of bringing the action.

4. Except as otherwise provided in this subsection, if a reconveyance

is not recorded pursuant to subsection 2 within:

(a) Seventy-five calendar days after the payment, satisfaction or

discharge of the debt, if the payment, satisfaction or discharge was made

on or after October 1, 1993; or

(b) Ninety calendar days after the payment, satisfaction or discharge

of the debt, if the payment, satisfaction or discharge was made before October

1, 1993, a title insurer may prepare and cause to be recorded a release

of the deed of trust. At least 30 calendar days before the recording of

a release pursuant to this subsection, the title insurer shall mail, by

first-class mail, postage prepaid, notice of the intention to record the

release of the deed of trust to the trustee, trustor and beneficiary of

record, or their successors in interest, at the last known address of each

such person. A release prepared and recorded pursuant to this subsection

shall be deemed a reconveyance of a deed of trust. The title insurer shall

not cause a release to be recorded pursuant to this subsection if the title

insurer receives written instructions to the contrary from the trustee,

the trustor, the owner of the land, the holder of the escrow or the owner

of the debt secured by the deed of trust or his agent.

5. The release prepared pursuant to subsection 4 must set

forth:

(d) A statement that the debt secured

by the deed of trust has been paid in full or otherwise satisfied or discharged;

6. A release prepared and recorded pursuant to subsection

4 does not relieve a beneficiary or trustee of the requirements imposed

by subsections 1 and 2.

7. A trustee may charge a reasonable fee to the trustor or

the owner of the land for services relating to the preparation, execution

or recordation of a reconveyance or release pursuant to this section. A

trustee shall not require the fees to be paid before the opening of an

escrow, or earlier than 60 calendar days before the payment, satisfaction

or discharge of the debt secured by the deed of trust. If a fee charged pursuant to this subsection does not exceed $100, the fee is conclusively

presumed to be reasonable.

8. In addition to any other remedy provided by law, a title

insurer who improperly causes to be recorded a release of a deed of trust

pursuant to this section is liable for actual damages and for a reasonable

attorney's fee and the costs of bringing the action to any person who is

injured because of the improper recordation of the release.

9. Any person who willfully violates this section is guilty

of a misdemeanor.

NRS 111.312 Recording of certain documents relating to real property:

Mailing address of grantee or person requesting recording and assessor's

parcel number required.

1. The county recorder shall not record with respect to real

property, a notice of completion, a declaration of homestead, a lien or

notice of lien, an affidavit of death, a mortgage or deed of trust, or

any conveyance of real property or instrument in writing setting forth

an agreement to convey real property unless the document being recorded

contains:

(a) The mailing address of the grantee or, if there is no grantee,

the mailing address of the person who is requesting the recording of the

document; and

(b) The assessor's parcel number of the property at the top of the

first page of the document, if the county assessor has assigned a parcel

number to the property. The county recorder is not required to verify that

the assessor's parcel number is correct.

2. The assessor's parcel number shall not be deemed to be

a complete legal description of the real property conveyed.