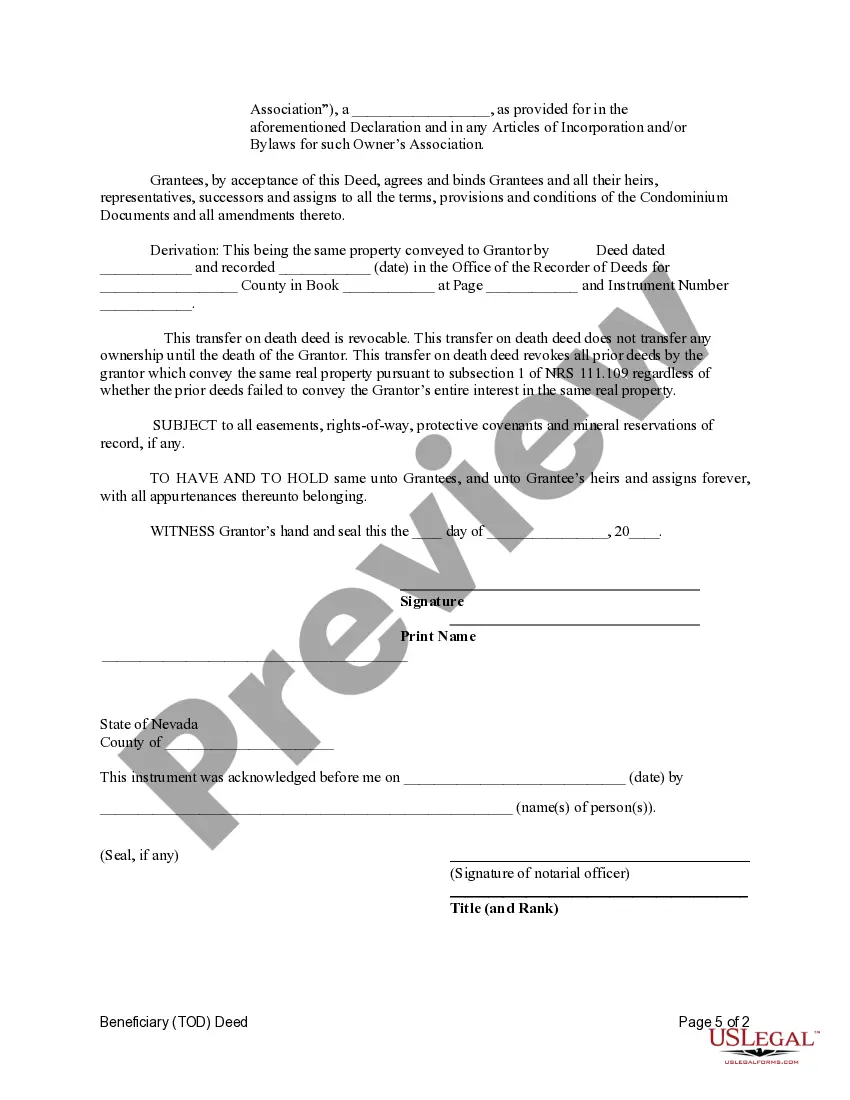

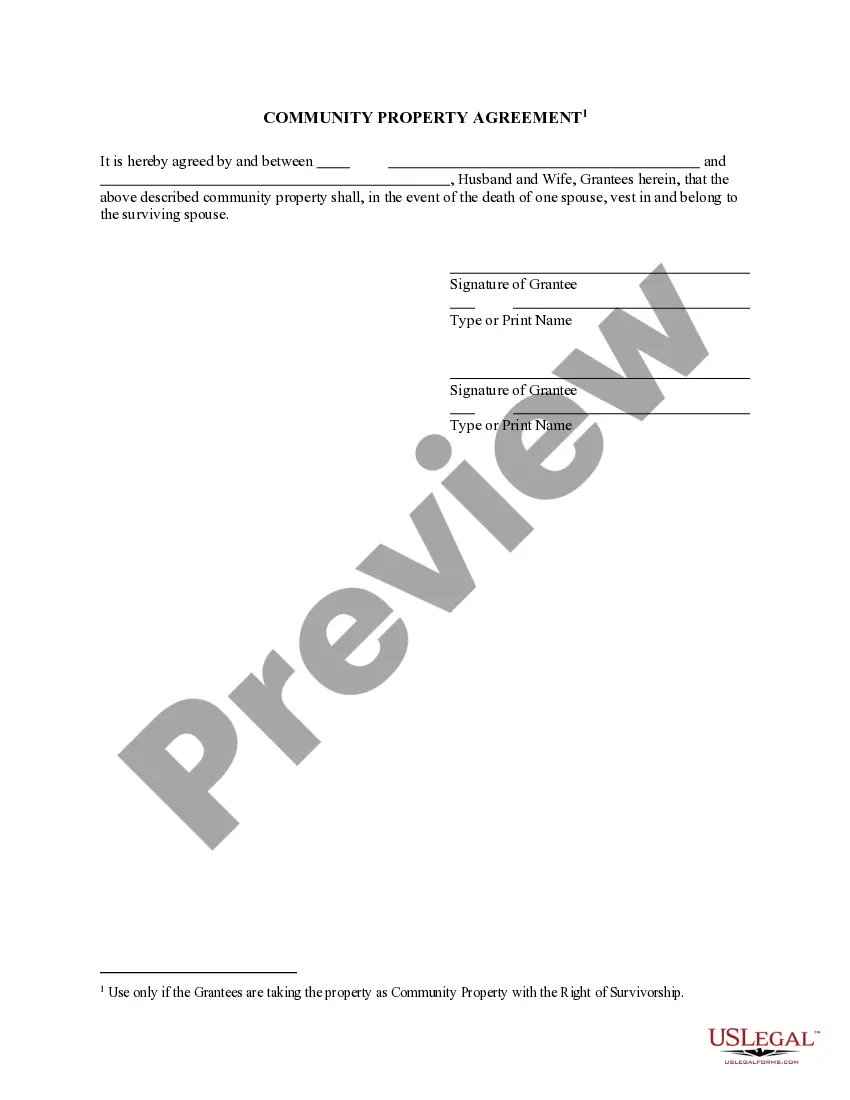

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantees are two individuals or husband and wife. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Las Vegas Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife

Description

How to fill out Nevada Beneficiary Deed (TOD) For A Condominium From An Individual To Two Individuals / Husband And Wife?

If you have previously utilized our service, Log In to your account and retrieve the Las Vegas Nevada Beneficiary Deed (TOD) for a Condominium from one Individual to Two Individuals / Husband and Wife onto your device by clicking the Download button. Ensure that your subscription is active. If it isn't, renew it as per your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Leverage the US Legal Forms service to easily find and store any template for your personal or professional requirements!

- Ensure you've found the correct document. Read the details and utilize the Preview option, if available, to verify if it meets your specifications. If it’s unsuitable, use the Search tab above to discover the right one.

- Purchase the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and process your payment. Input your credit card information or use the PayPal option to finalize the transaction.

- Obtain your Las Vegas Nevada Beneficiary Deed (TOD) for a Condominium from one Individual to Two Individuals / Husband and Wife. Choose the file format for your document and save it onto your device.

- Complete your form. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Transferring ownership of an inherited property During probate the executors of the will need to transfer ownership of the property into the beneficiary's name. In order to do this they need to fill out forms with the Land Registry. You can find the property transfer forms on the Government website.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

There are various components to titling; one is using a transfer on death (TOD), generally used for investment accounts, or payable on death (POD) designation, used for bank accounts, which acts as a beneficiary designation to whom the account assets are to pass when the owner dies.

A TOD account allows the account holder to name a beneficiary on a non-retirement financial account to receive assets at the time of the account holder's death, thereby (generally ? i.e., when used correctly) avoiding probate.

In Nevada, one option for Robert is a Beneficiary Deed or Deed Upon Death. This means that the home would pass outright to the beneficiary at death without probate. Trusts are also another option that avoids probate and can provide protections for beneficiaries.

Yes. A Nevada TOD deed only makes an effective transfer of real estate upon the owner's death if the TOD deed was recorded ?before the death of the owner.?52 A Nevada TOD signed by the owner but left unrecorded is ineffective.

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

Because TOD accounts are still part of the decedent's estate (although not the probate estate that the Last Will establishes), they may be subject to income, estate and/or inheritance tax. TOD accounts are also not out of reach for the decedent's creditors or other relatives.

A Nevada quitclaim deed is a form of deed that functions essentially like a release. It transfers any title, interest, or claim the person signing the deed holds in the real estate with no promises regarding the quality of the transferred interest.

What Is a Transfer on Death (TOD) Account? A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.