This form is a Quitclaim Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust. This deed complies with all state statutory laws.

Las Vegas Nevada Quitclaim Deed Individual to Trust

Description

How to fill out Nevada Quitclaim Deed Individual To Trust?

Utilize the US Legal Forms and gain instant access to any form you desire.

Our efficient platform featuring a vast array of documents streamlines the process of locating and acquiring nearly any document template you need.

You can save, complete, and sign the Las Vegas Nevada Quitclaim Deed Individual to Trust in just minutes instead of spending hours browsing the internet for an appropriate template.

Using our collection is an excellent approach to enhance the security of your document submissions. Our experienced legal experts regularly review all files to ensure that the forms are suitable for specific regions and comply with new laws and regulations.

If you do not have an account yet, follow the steps below.

- How can you acquire the Las Vegas Nevada Quitclaim Deed Individual to Trust.

- If you possess a subscription, simply Log In to your account. The Download button will be activated on all the samples you view.

- Additionally, all previously saved documents can be found in the My documents section.

Form popularity

FAQ

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

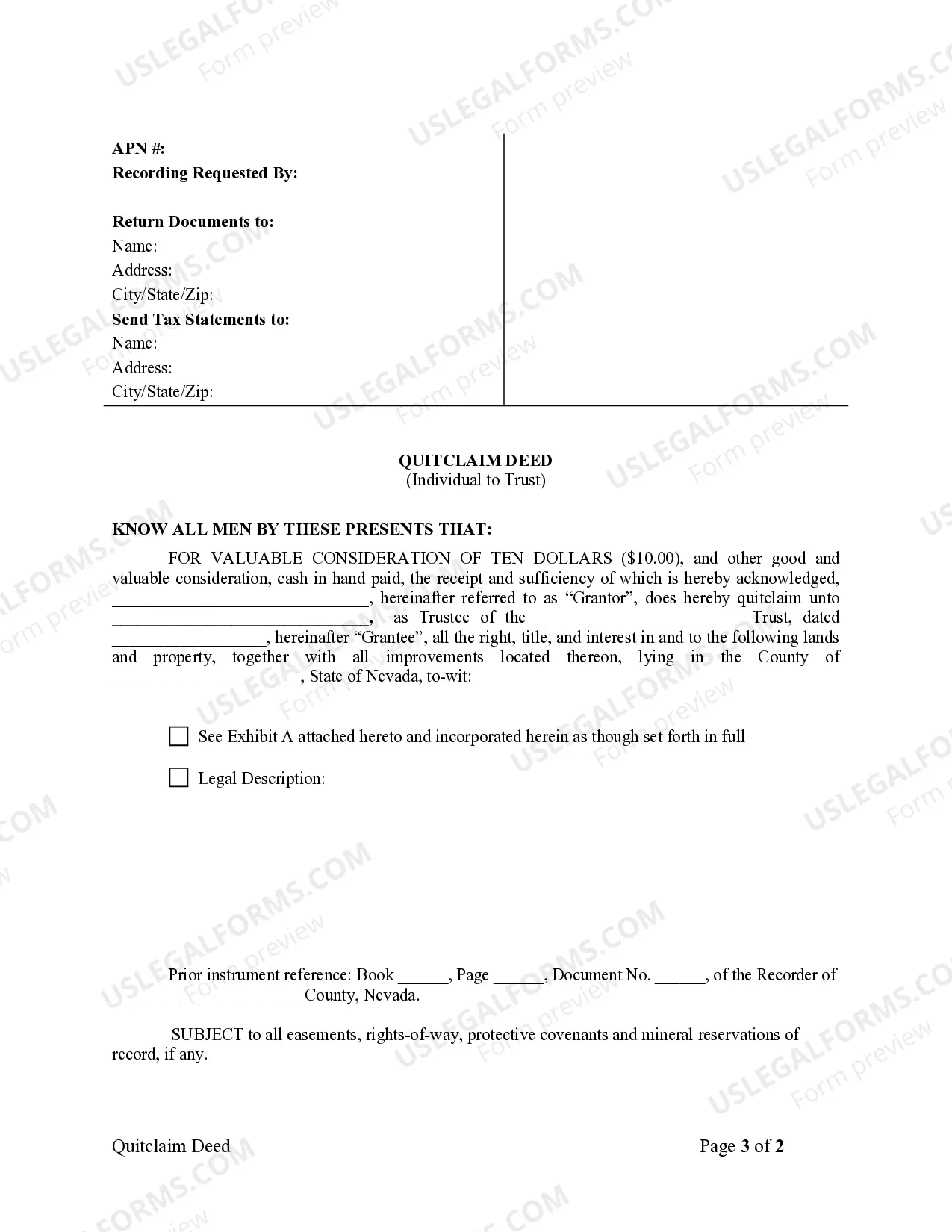

Nevada law recognizes three general types of deeds for transferring real estate: a general warranty deed form; a grant, bargain, and sale deed form; and a quitclaim deed form. These three forms vary according to the guaranty the current owner provides?if any?regarding the quality of the property's title.

You must pay a fee to file a deed with the county recorder. The fee should be $14.00 to record the first page of a quitclaim deed and $1.00 for each additional page. However, you should call ahead of time to check about the amount and acceptable methods of payment.

Nevada law requires that deeds include certain information to be recordable and validly transfer ownership of real estate. Names and addresses, a legal description and parcel number for the property, and the current owner's notarized signature all must appear within a quitclaim deed or other Nevada deed.

Related Pages Standard Recordings (Not subjected to Real Property Transfer Tax)$42.00 per documentHomestead Filing$42.00 per documentNotice of Default/Breach and Election to Sell Under a Deed of Trust$250.00 + recording fee

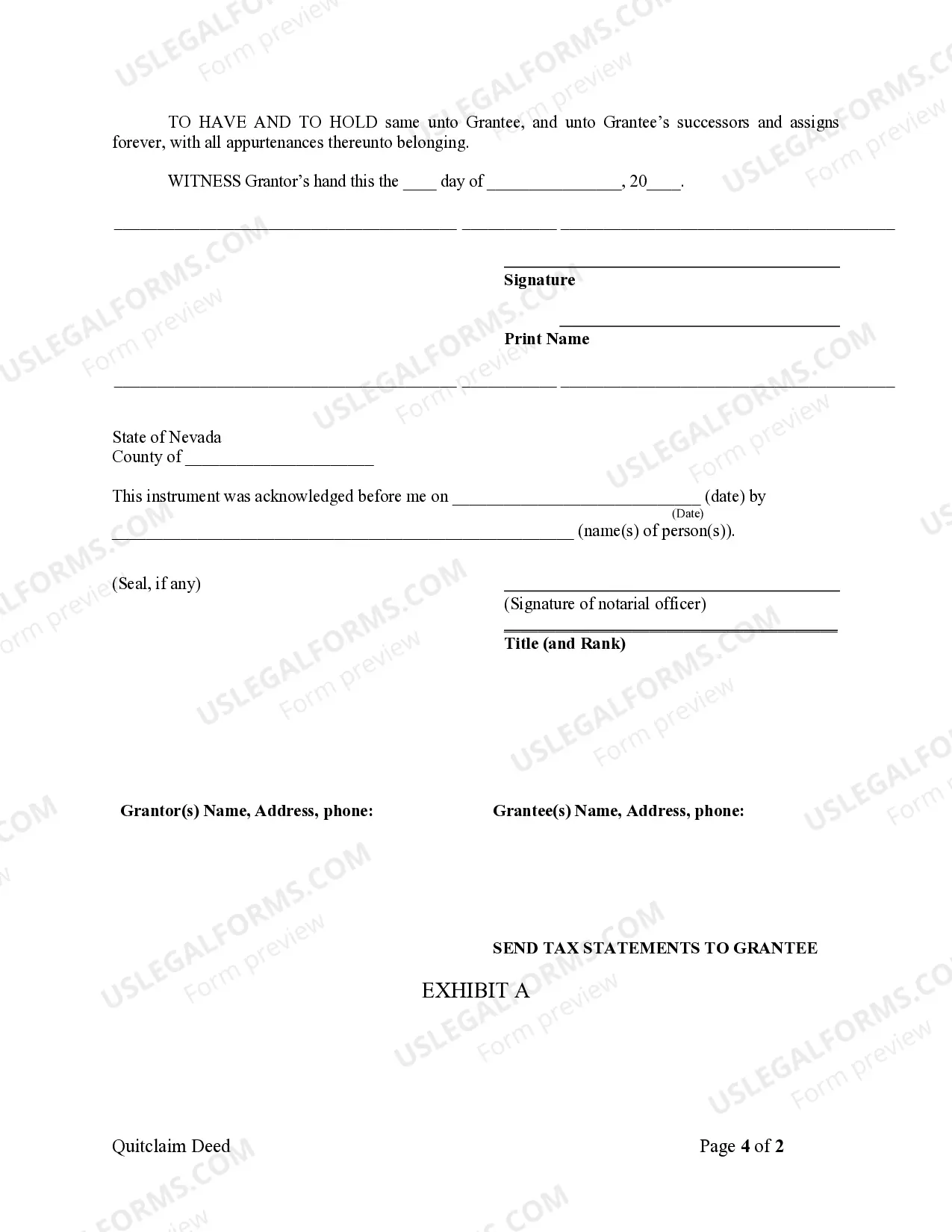

How to File a Quitclaim Deed Obtain a quitclaim deed form. Your very first step is obtaining your quitclaim deed.Fill out the quitclaim deed form.Get the quitclaim deed notarized.Take the quitclaim deed to the County Recorder's Office.File the appropriate paperwork.

Step 1. Determine and prepare the needed requirements for a title transfer. Deed of Conveyance.Photocopies of valid IDs of all signatories in the deed.The Notary Public's official receipt for the deed's notarization. Certified True Copy of the Title (3 copies)Certified True Copy of the latest Tax Declaration.

The Grantee and Grantor are jointly and severally liable for the payment of the tax. When all taxes and recording fees required are paid, the deed is recorded. Each County Recorder's Office: 1.

Upon the transfer of any real property in the State of Nevada, a special tax called the Real Property Transfer Tax is imposed. The County Recorder in the county where the property is located is the agency responsible for the imposition and collection of the tax at the time the transfer is recorded.