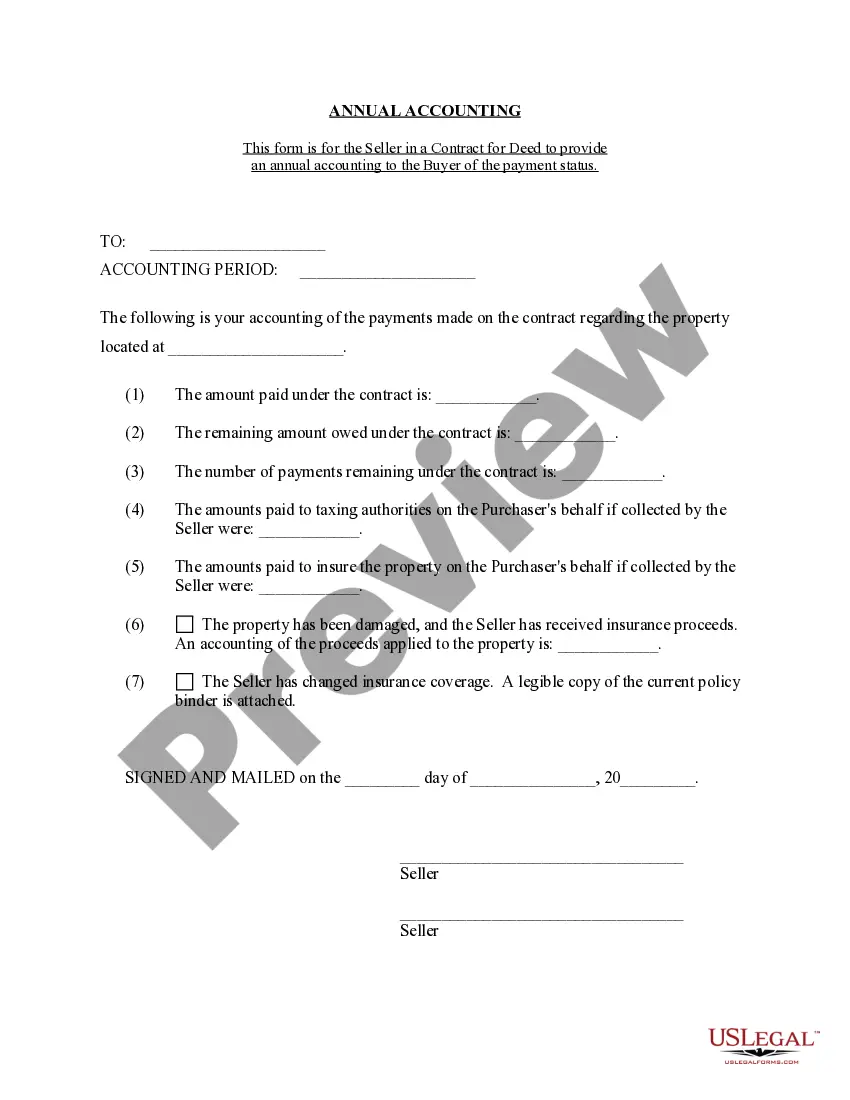

Clark Nevada Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Nevada Contract For Deed Seller's Annual Accounting Statement?

Utilize the US Legal Forms and gain immediate access to any form sample you desire.

Our beneficial website with a vast array of document templates enables you to locate and acquire nearly any document sample you require.

You can download, complete, and sign the Clark Nevada Contract for Deed Seller's Annual Accounting Statement in just a few minutes rather than spending hours online searching for a suitable template.

Using our catalog is an excellent method to enhance the security of your document filing.

If you haven't created a profile yet, follow the instructions outlined below.

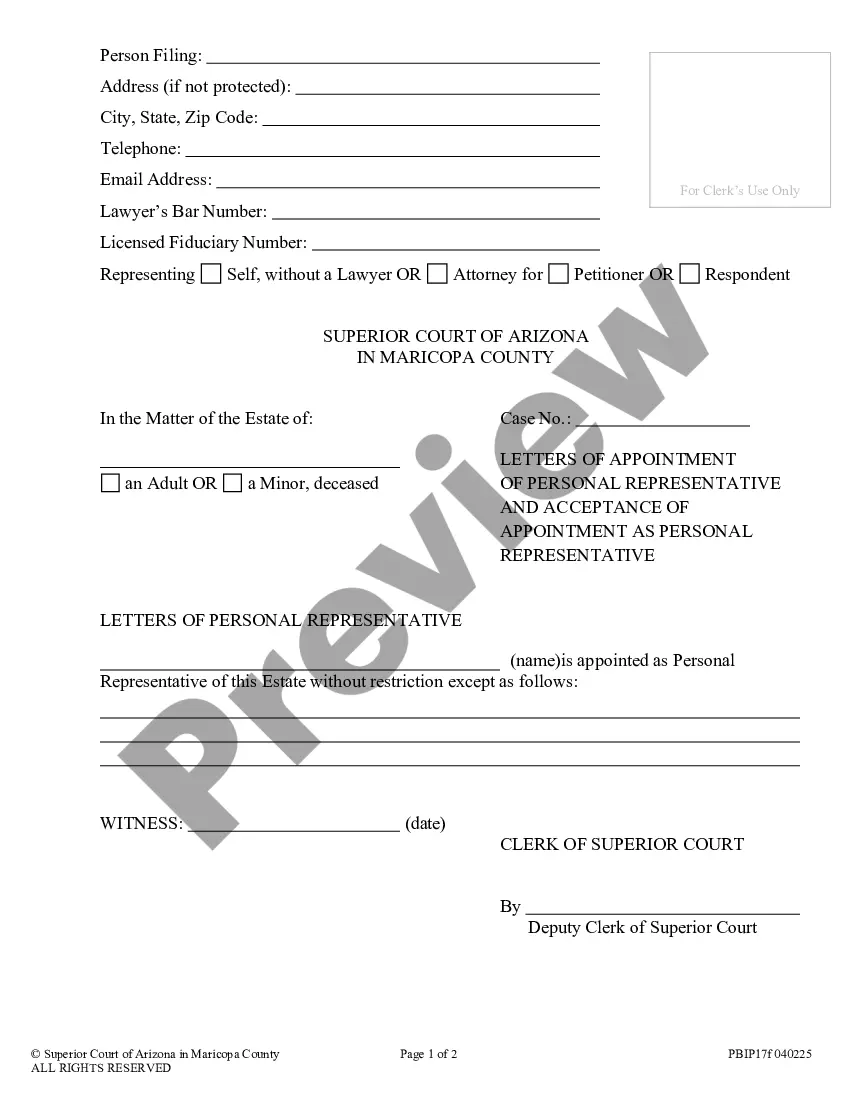

Visit the page with the form you need. Confirm that it is the template you were looking for: check its title and description, and use the Preview option if available. Otherwise, use the Search bar to locate the needed one.

- Our experienced attorneys frequently review all documentation to ensure that the forms are suitable for a specific area and adhere to current laws and regulations.

- How can you obtain the Clark Nevada Contract for Deed Seller's Annual Accounting Statement.

- If you possess a subscription, simply Log In to your account.

- The Download button will be activated on all the samples you access.

- Moreover, you can retrieve all previously saved documents in the My documents section.

Form popularity

FAQ

Recorder Offices Clark County Recorder's Office. Government Center - 500 S Grand Central Pkwy, 2nd Floor / PO Box 551510, Las Vegas, Nevada 89106-1510. Monday through Friday AM to PM.Northwest Branch Office. 3211 N Tenaya Way, Suite 118, Las Vegas, Nevada 89129.Henderson Branch. 240 S.

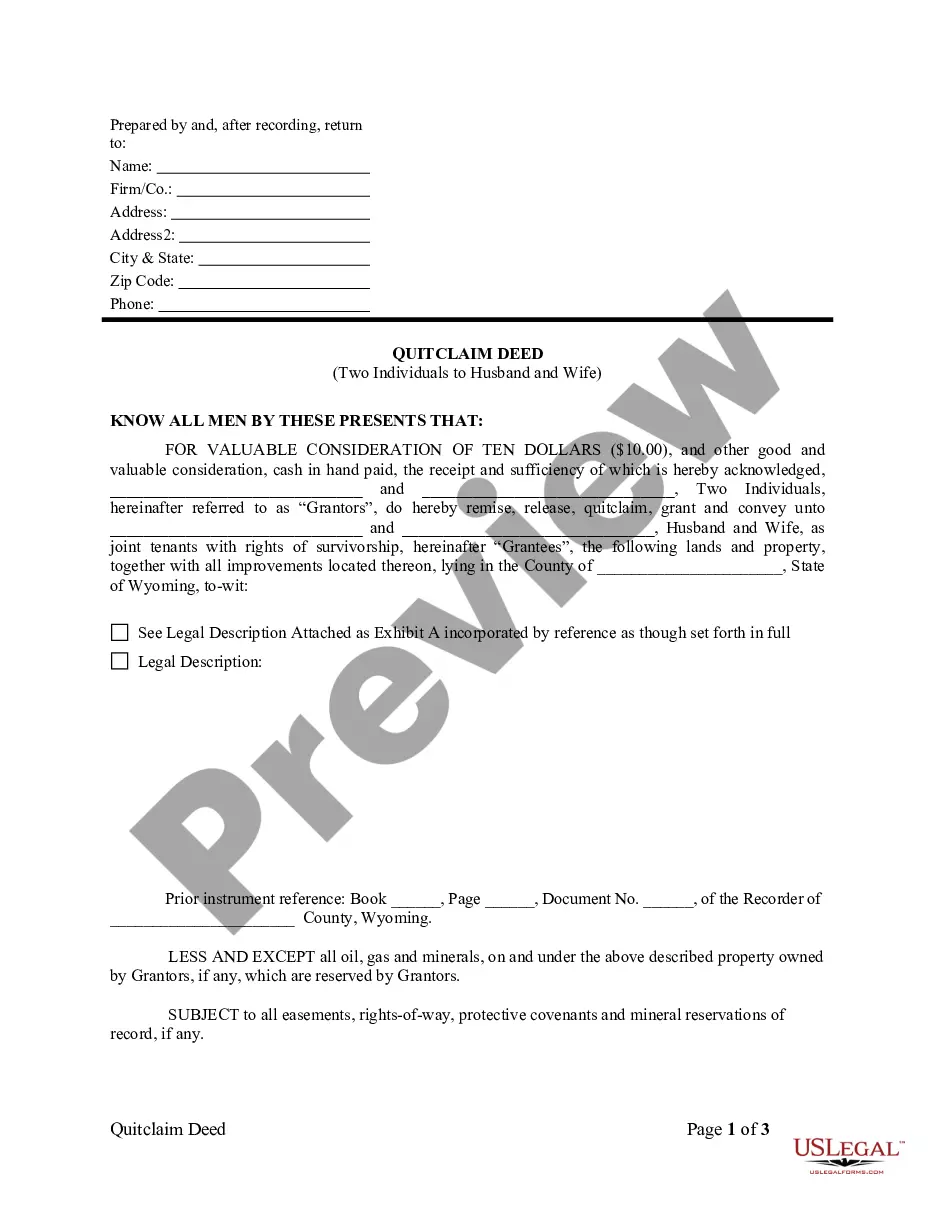

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

The Grantee and Grantor are jointly and severally liable for the payment of the tax. When all taxes and recording fees required are paid, the deed is recorded. Each County Recorder's Office: 1.

You would need to record a new Deed document in the Washoe County Recorder's Office to change how title is held to your property. You can obtain document forms from local office supply stores, or legal counsel can draw them up.

Prepare and Pay Real Property Transfer Tax - The transfer tax is calculated at the rate of $2.55 per $500 of value or a fraction thereof. The transfer tax is based on the full purchase price or the estimated fair market value.

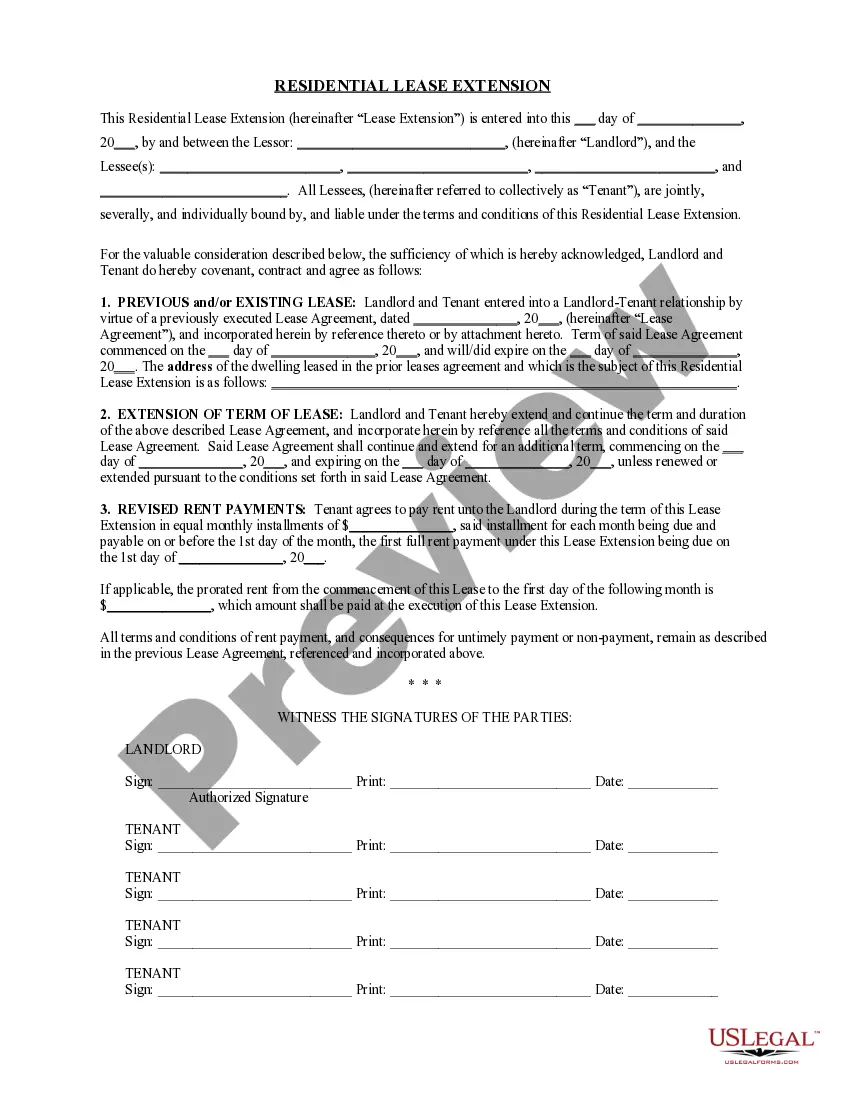

Related Pages Standard Recordings (Not subjected to Real Property Transfer Tax)$42.00 per documentHomestead Filing$42.00 per documentNotice of Default/Breach and Election to Sell Under a Deed of Trust$250.00 + recording fee

Related Pages Standard Recordings (Not subjected to Real Property Transfer Tax)$42.00 per documentHomestead Filing$42.00 per documentNotice of Default/Breach and Election to Sell Under a Deed of Trust$250.00 + recording fee

This process takes approximately 1 - 3 days, depending on the current workload.