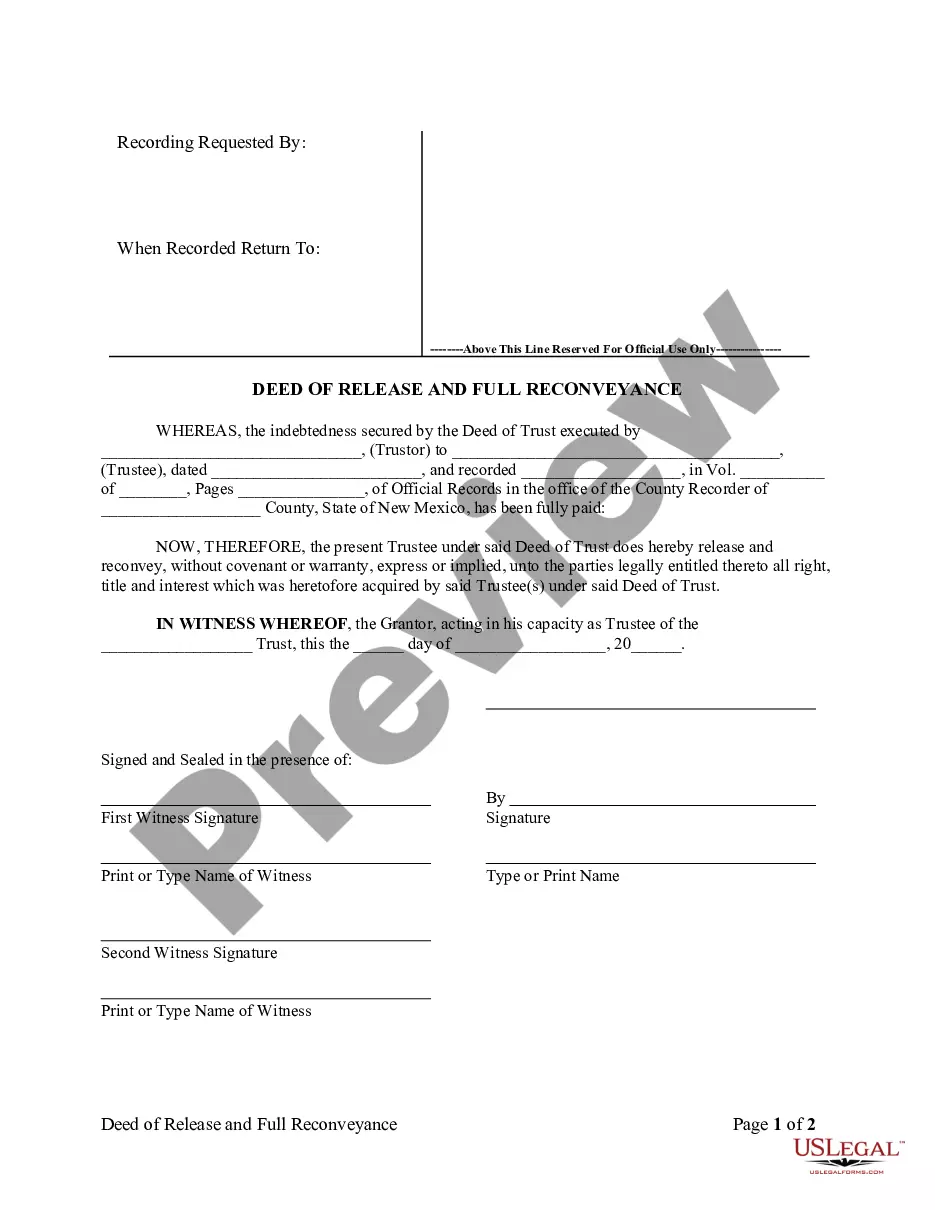

Albuquerque New Mexico Deed of Release and Full Reconveyance - Individual Lender or Holder

Description

How to fill out New Mexico Deed Of Release And Full Reconveyance - Individual Lender Or Holder?

Regardless of social or professional standing, completing law-related documents is an unfortunate obligation in today's workplace.

Frequently, it’s nearly unfeasible for someone without legal training to create such documents from scratch, primarily due to the intricate language and legal details they entail. US Legal Forms is where assistance is provided.

Our platform features an extensive collection of over 85,000 ready-to-use, state-specific forms suited for nearly any legal circumstance. US Legal Forms also acts as an excellent resource for associates or legal advisors looking to enhance their efficiency with our DIY forms.

If the one you selected does not fulfill your needs, you can restart and look for the appropriate document.

Click ‘Buy now’ and select your preferred subscription option. Log In to your account {using your credentials or create a new one from scratch. Choose your payment method and proceed to download the Albuquerque New Mexico Deed of Release and Full Reconveyance - Individual Lender or Holder once the payment has been processed. You’re good to go! Now you can print the form or complete it online. In case you encounter any issues retrieving your purchased forms, you can easily find them in the My documents section. Regardless of the case you’re aiming to resolve, US Legal Forms has you supported. Try it today and discover the difference.

- Whether you require the Albuquerque New Mexico Deed of Release and Full Reconveyance - Individual Lender or Holder or any other documentation that will hold validity in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s how you can quickly obtain the Albuquerque New Mexico Deed of Release and Full Reconveyance - Individual Lender or Holder using our reliable service.

- If you’re a current subscriber, feel free to Log In to access the desired form.

- However, if you are new to our library, make sure you follow these procedures before downloading the Albuquerque New Mexico Deed of Release and Full Reconveyance - Individual Lender or Holder.

- Ensure the template you have selected is suitable for your region, as the laws of one state or county may not be applicable in another.

- Review the form and read a brief description (if provided) of situations the document can be utilized for.

Form popularity

FAQ

A release deed is a deed whereby the signor releases to the other party any interest if any, they had in the property.

An attorney licensed to practice law in Ohio must prepare deeds, powers of attorney, and other instruments that are to be recorded. One exception is that a party to the transaction may prepare an instrument in which they are a party.

The deed of reconveyance is completed and signed by the lender and filed with the local recording office, such as the county courthouse.

To execute a release of Deed of Trust, it is necessary to submit the following to the Public Trustee's Office: Request for Release of Deed of Trust Form signed by all holders of the Evidence of Debt (normally a Promissory Note) or their attorney or agent. Lenders' signatures must be acknowledged by a Notary Public.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

Any legal document can be filed in the Clerk's Office. All documents must be original and signed by all pertinent parties and notarized. Property must be identified with Grantor (seller) and Grantee (buyer). On Deeds, grantor must sign document.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.

This release of mortgage is recorded or filed and gives notice to the world that the lien is no more. On the other hand, when you have a trust deed or deed of trust, the lender files a release deed. With a deed of trust, you temporarily give control of the title to your property to the lender for security purposes.

Once you've met all the mortgage payment terms or fully repaid your loan, your lender's legal team draws up the deed of release form and in it reports that: you've repaid the loan in full under the terms required; and. the lender has removed its charge or 'lien' and has transferred full title to you.

State laws generally require a mortgage lender to submit the deed of reconveyance documentation to the county recorder or borrower within a certain time frame after payoff ? typically 30 or 60 days, Hernandez says.