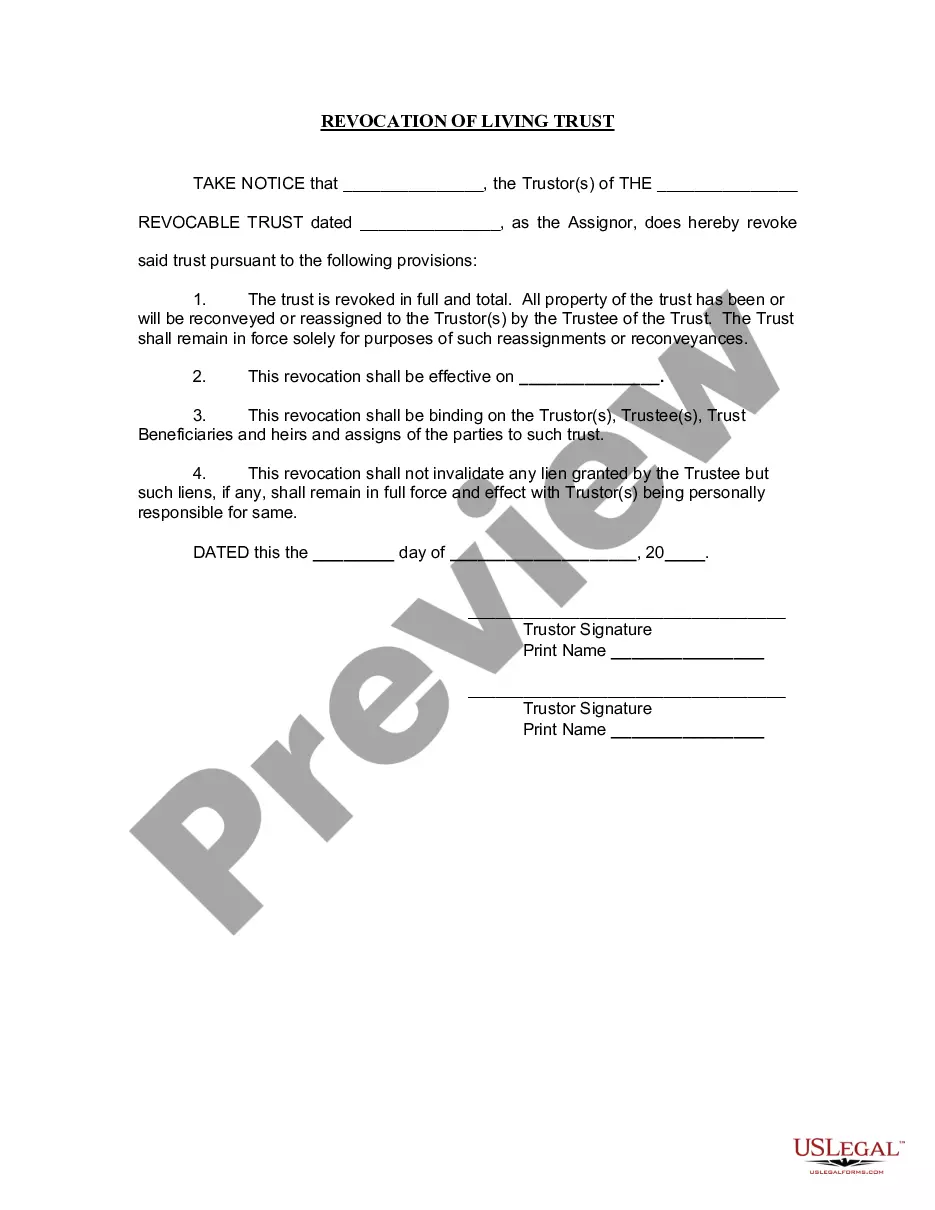

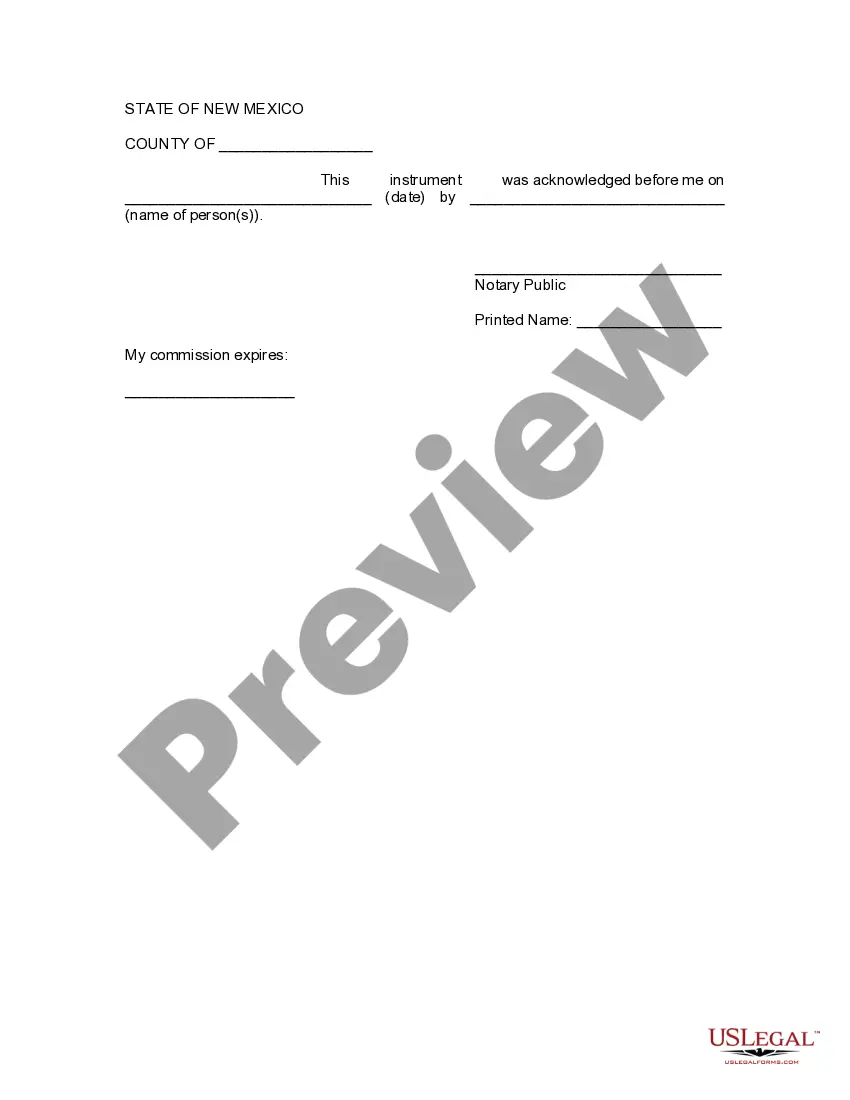

Albuquerque New Mexico Revocation of Living Trust

Description

How to fill out New Mexico Revocation Of Living Trust?

Irrespective of societal or professional standing, completing legal-related documents is a regrettable requirement in today’s society.

Frequently, it’s nearly impossible for someone without legal education to create these types of papers from scratch, primarily due to the intricate terminology and legal nuances they encompass.

This is where US Legal Forms can come to the rescue.

Make sure the template you have discovered is tailored to your location since the regulations of one state or region do not apply to another.

You’re good to go! Now you can either print out the document or fill it in online. If you experience any issues retrieving your purchased documents, they can be easily found in the My documents section.

- Our service features an extensive repository of over 85,000 ready-to-utilize state-specific documents suitable for virtually any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors who wish to enhance their time efficiency using our DIY templates.

- Regardless of whether you need the Albuquerque New Mexico Revocation of Living Trust or any other documentation that will hold validity in your region, with US Legal Forms, everything is readily accessible.

- Here’s how to swiftly obtain the Albuquerque New Mexico Revocation of Living Trust using our reliable service.

- If you are currently an existing customer, you can go ahead to Log In to your account to retrieve the desired form.

- However, if you are new to our platform, ensure to follow these instructions before acquiring the Albuquerque New Mexico Revocation of Living Trust.

Form popularity

FAQ

(a) A noncharitable irrevocable trust may be terminated upon consent of all of the beneficiaries if the court concludes that continuance of the trust is not necessary to achieve any material purpose of the trust.

A trustee has the responsibility of handling, managing, and distributing assets within the trust even while the grantor is alive. A revocable trust can be changed or canceled only when the grantor is alive but becomes irrevocable after their death.

You can completely undo the trust if you decide the arrangement isn't working for you after all. But all a revocable trust can do for you is avoid probate of the property it holds when you die. You can name a successor trustee to take over management of the trust for you if you should become incompetent.

A New Mexico living trust protects and maintains your assets for your exclusive use during your life and passes them to your beneficiaries after your death. A revocable living trust (inter vivos trust) can be an important part of your estate planning process.

An irrevocable trust cannot be revoked or changed. But the difference goes far beyond that fact. Revocable trusts and irrevocable trusts serve very different purposes in estate planning.

Trust agreements usually allow the trustor to remove a trustee, including a successor trustee. This may be done at any time, without the trustee giving reason for the removal. To do so, the trustor executes an amendment to the trust agreement.

The trust is fully valid. It only comes to an end when the settlor fully revokes it.

Trustees generally do not have the power to change the beneficiary of a trust. The right to add and remove beneficiaries is a power reserved for the grantor of the trust; when the grantor dies, their trust will usually become irrevocable. In other words, their trust will not be able to be modified in any way.

Amending a Living Trust in California Nearly all trust documents can be amended. However, some are easier to amend than others. In the case of a revocable living trust, amendments usually take on the form of additional documents written after the original trust document has been signed and notarized.

With the adoption of Probate Code Section 15401, that changed, and the law provided two distinct ways in which to revoke a California Trust: (1) revoke using the manner provided in the Trust instrument, or (2) revoke by any writing (other than a Will) signed by the Settlor and delivered to the trustee during the