Las Cruces New Mexico Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out New Mexico Living Trust For Husband And Wife With Minor And Or Adult Children?

If you are seeking a legitimate form template, it’s remarkably difficult to discover a more user-friendly service than the US Legal Forms website – likely the most extensive collections on the web.

With this collection, you can acquire thousands of templates for business and personal needs by categories and states, or keywords.

With our sophisticated search capability, finding the latest Las Cruces New Mexico Living Trust for Husband and Wife with Minor and/or Adult Children is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and save it on your device. Edit the document. Complete, modify, print, and sign the received Las Cruces New Mexico Living Trust for Husband and Wife with Minor and/or Adult Children. Every template you store in your account has no expiration date and belongs to you indefinitely. You can access them through the My documents menu, so if you need another copy for editing or for creating a hard copy, feel free to come back and download it again at any time. Take advantage of the US Legal Forms extensive catalog to find the Las Cruces New Mexico Living Trust for Husband and Wife with Minor and/or Adult Children you were looking for along with thousands of other professional and state-specific templates on a single platform!

- Additionally, the accuracy of each document is verified by a group of qualified attorneys who consistently review the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our service and possess an account, all you need to do to access the Las Cruces New Mexico Living Trust for Husband and Wife with Minor and/or Adult Children is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

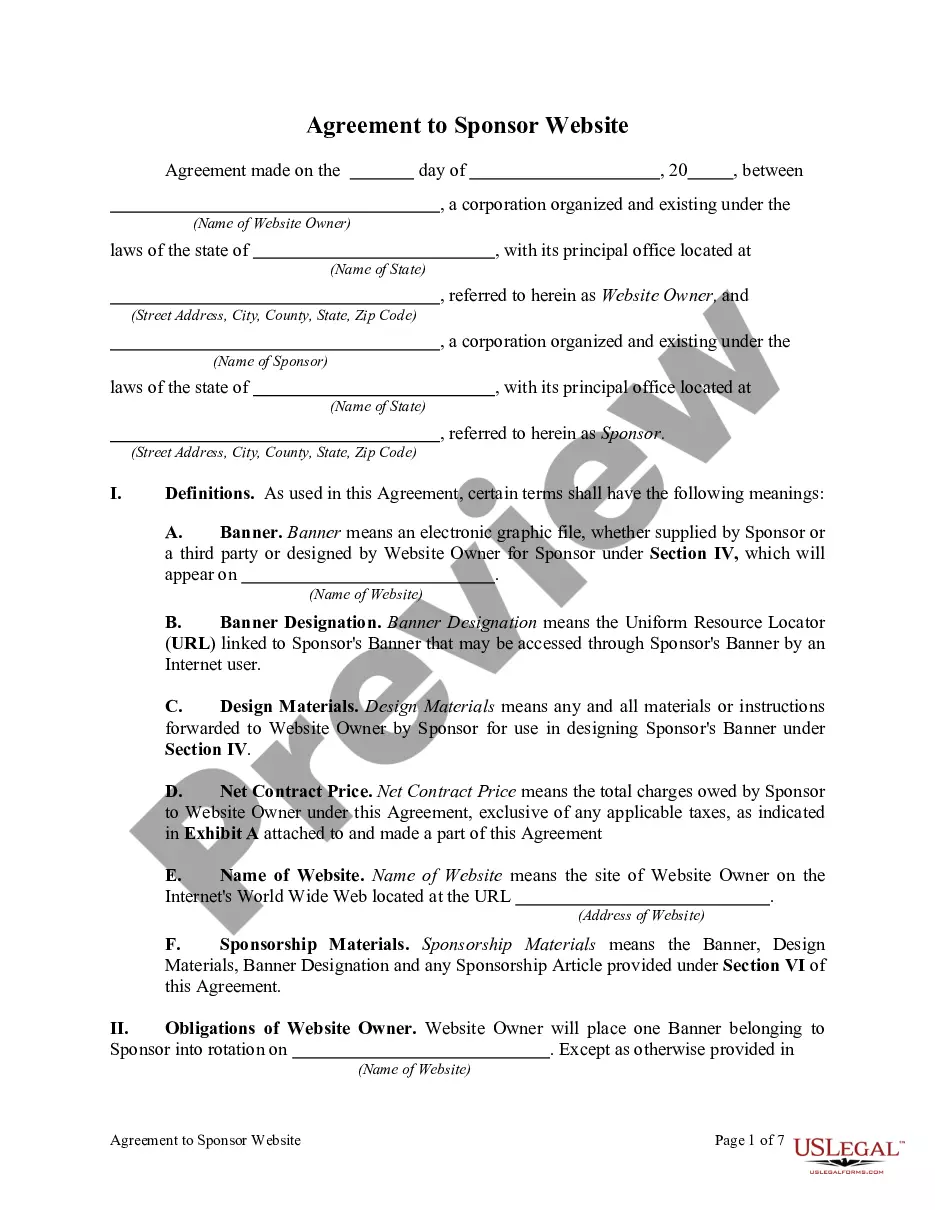

- Ensure you have identified the form you desire. Review its details and utilize the Preview feature to examine its contents. If it doesn’t satisfy your needs, use the Search option at the top of the page to locate the appropriate document.

- Verify your selection. Hit the Buy now button. Next, choose your preferred payment plan and enter your information to register for an account.

Form popularity

FAQ

In many cases, a husband and wife can benefit from having a joint living trust, especially when planning a Las Cruces New Mexico Living Trust for Husband and Wife with Minor and or Adult Children. However, separate trusts might be advantageous for specific financial situations, such as when one spouse has considerable assets or different estate planning needs. Each option has unique advantages, so it is essential to evaluate your family dynamics and financial circumstances. Ultimately, consulting with a legal expert will help you determine the best path forward for your estate planning needs.

To set up a Las Cruces New Mexico Living Trust for Husband and Wife with Minor and or Adult Children, begin by gathering essential information about your assets and heirs. Next, decide how you want to distribute your assets, considering both minor and adult children. You can then use resources like USLegalForms to obtain the necessary documents or consult a qualified attorney who can guide you through the process and ensure everything is legally sound. Finally, remember to fund the trust by transferring ownership of your assets into the trust, securing your family's future.

One of the biggest mistakes parents make when setting up a Las Cruces New Mexico Living Trust for Husband and Wife with Minor and or Adult Children is not clearly defining the terms of the trust. Ambiguous language can create confusion for your beneficiaries. Additionally, parents might overlook the importance of updating the trust as family circumstances change, such as the birth of new children or changes in financial status. To avoid these pitfalls, consider consulting a platform like UsLegalForms, which can guide you through the process of creating and maintaining an effective trust.

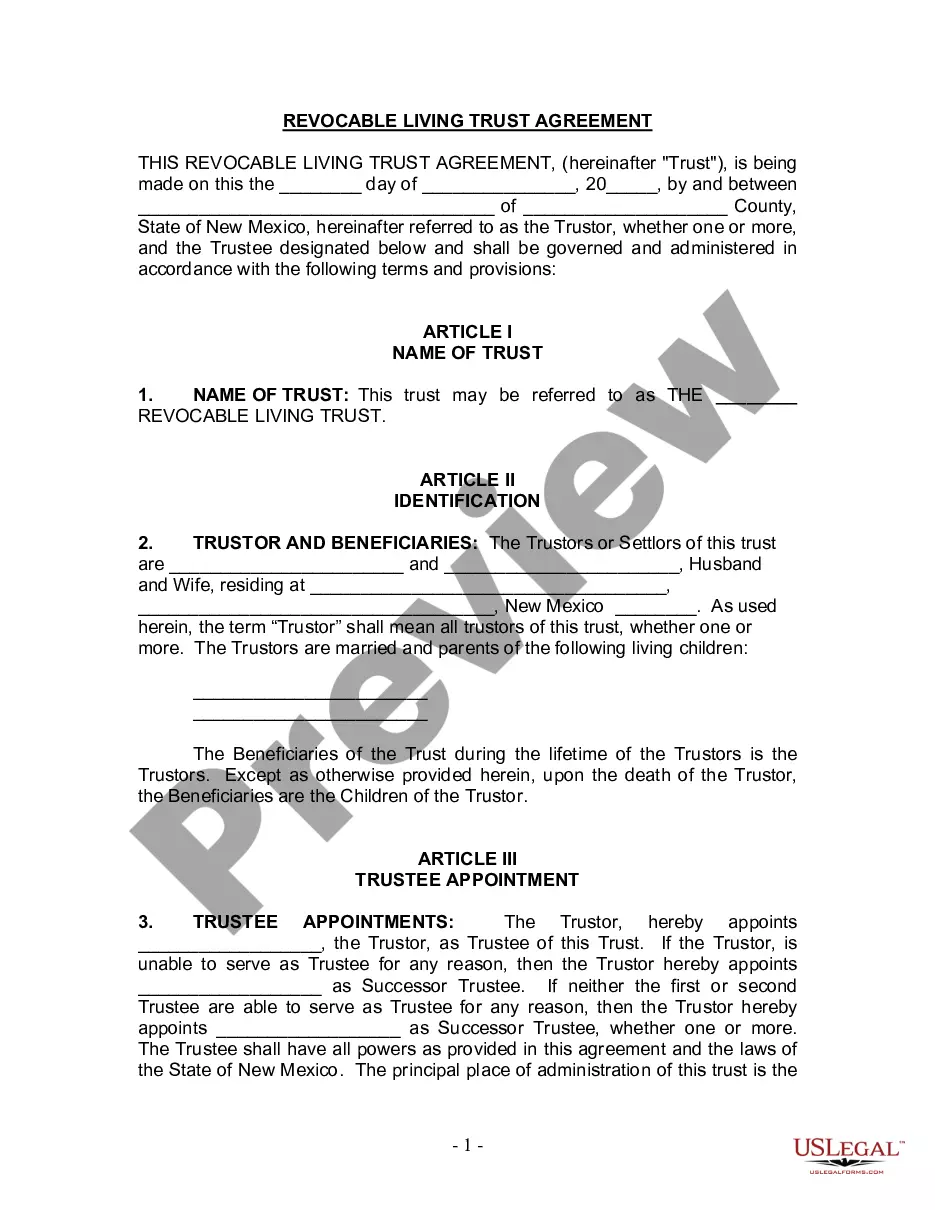

A living trust, sometimes referred to as a revocable trust or inter vivos trust, is established and takes effect during your lifetime by a written document known as a trust agreement. A will is written during your lifetime, but does not take effect until after your death.

In New Mexico, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

How to Create a Living Trust in New Mexico Figure out which type of trust is best for you. If you're single, a single trust is probably what you'll want.Take inventory of your assets.Choose your trustee.Write a trust document.Sign the trust in front of a notary. Fund the trust by moving property into it.

Naming a trust as a beneficiary is a good idea if beneficiaries are minors, have a disability, or can't be trusted with a large sum of money. The major disadvantage of naming a trust as a beneficiary is required minimum distribution payouts.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Which state is best for your trust situs for your trust? According to independent rankings, the top states with the best trust laws are South Dakota trust law and Nevada in the US.