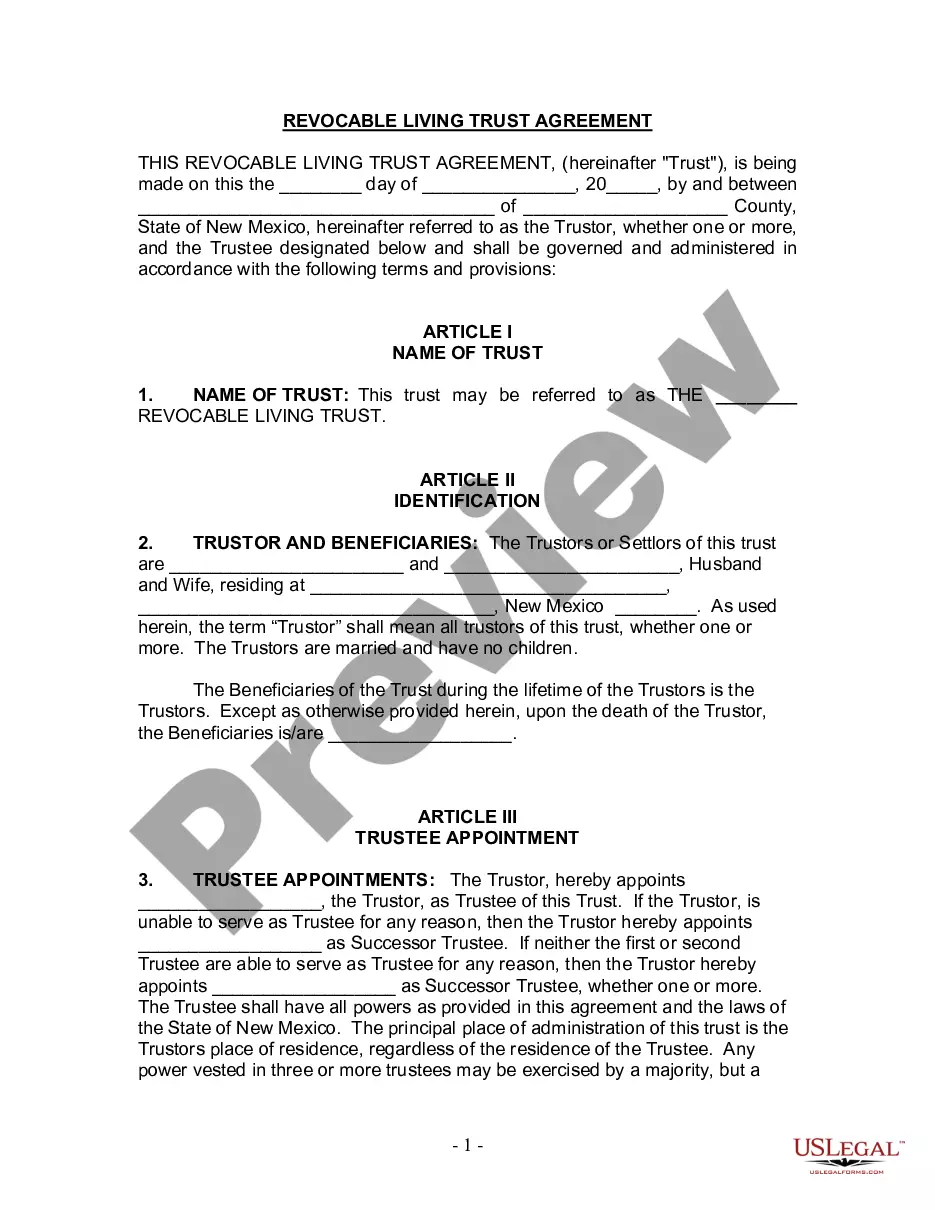

Las Cruces New Mexico Living Trust for Husband and Wife with No Children

Description

How to fill out New Mexico Living Trust For Husband And Wife With No Children?

Finding authenticated templates pertinent to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal forms for both personal and professional purposes and various real-life situations.

All the documents are appropriately organized by category of usage and jurisdictional areas, making the search for the Las Cruces New Mexico Living Trust for Husband and Wife without Children as straightforward as 1-2-3.

Utilize the US Legal Forms library to maintain your paperwork organized and in accordance with legal stipulations, ensuring you have crucial document templates conveniently available for any requirements!

- Ensure to check the Preview mode and document description.

- Be certain you’ve selected the correct one that satisfies your requirements and fully complies with your local jurisdiction rules.

- Look for another template, if necessary.

- If you notice any discrepancies, make use of the Search tab above to find the right one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

Yes, married couples often benefit from placing their house in a trust. By doing so, they can simplify the transfer of ownership and avoid the complexities of probate. A Las Cruces, New Mexico living trust for husband and wife with no children can specifically address how the home is handled, providing peace of mind for both partners. Using a service like US Legal Forms can simplify the creation of such trusts, ensuring you have the right documentation.

Deciding whether to have separate living trusts largely depends on personal circumstances. For couples with complex financial situations or wanting to protect individual assets, separate living trusts may be beneficial. However, if both partners share most of their assets, a joint living trust might streamline the process. Consulting resources like US Legal Forms can help you determine the best path for your Las Cruces, New Mexico living trust for husband and wife with no children.

Husbands and wives may choose to have separate trusts for several reasons, such as managing individual assets or addressing specific tax situations. By establishing a separate trust, each partner retains control over their respective assets, which can be crucial if one spouse has children from a previous marriage. The Las Cruces, New Mexico living trust for husband and wife with no children can be tailored to meet individual needs while providing clarity and security.

The best living trust for a married couple, particularly in Las Cruces, New Mexico, is often a joint living trust. A joint living trust for husband and wife with no children allows both partners to manage their assets together, simplifying estate planning and ensuring smooth transfer of property. This type of trust can offer privacy and avoid the probate process upon death, making it a practical choice for many couples. You might find that using platforms like US Legal Forms makes setting up this trust straightforward.

Setting up a living trust in New Mexico involves several key steps. First, choose the right type of trust, such as a Las Cruces New Mexico Living Trust for Husband and Wife with No Children, based on your needs. Next, draft the trust document, detailing how assets will be managed and distributed. Finally, transfer your assets into the trust to ensure they are protected. Platforms like UsLegalForms can simplify this process with templates and guidance tailored to your needs.

A living trust may require more effort upfront compared to a will. For example, transferring assets into a Las Cruces New Mexico Living Trust for Husband and Wife with No Children can be time-consuming. Additionally, living trusts do not provide tax benefits during your life. Yet, they can help avoid probate, which is a significant advantage for many families.

One major mistake parents make when establishing a trust fund is failing to clearly define their intentions. When creating a Las Cruces New Mexico Living Trust for Husband and Wife with No Children, it's crucial to specify how and when the trust will benefit your loved ones. Without clarity, your wishes may not be honored, which can lead to confusion and conflict. Ensure you communicate your desires effectively to avoid these pitfalls.