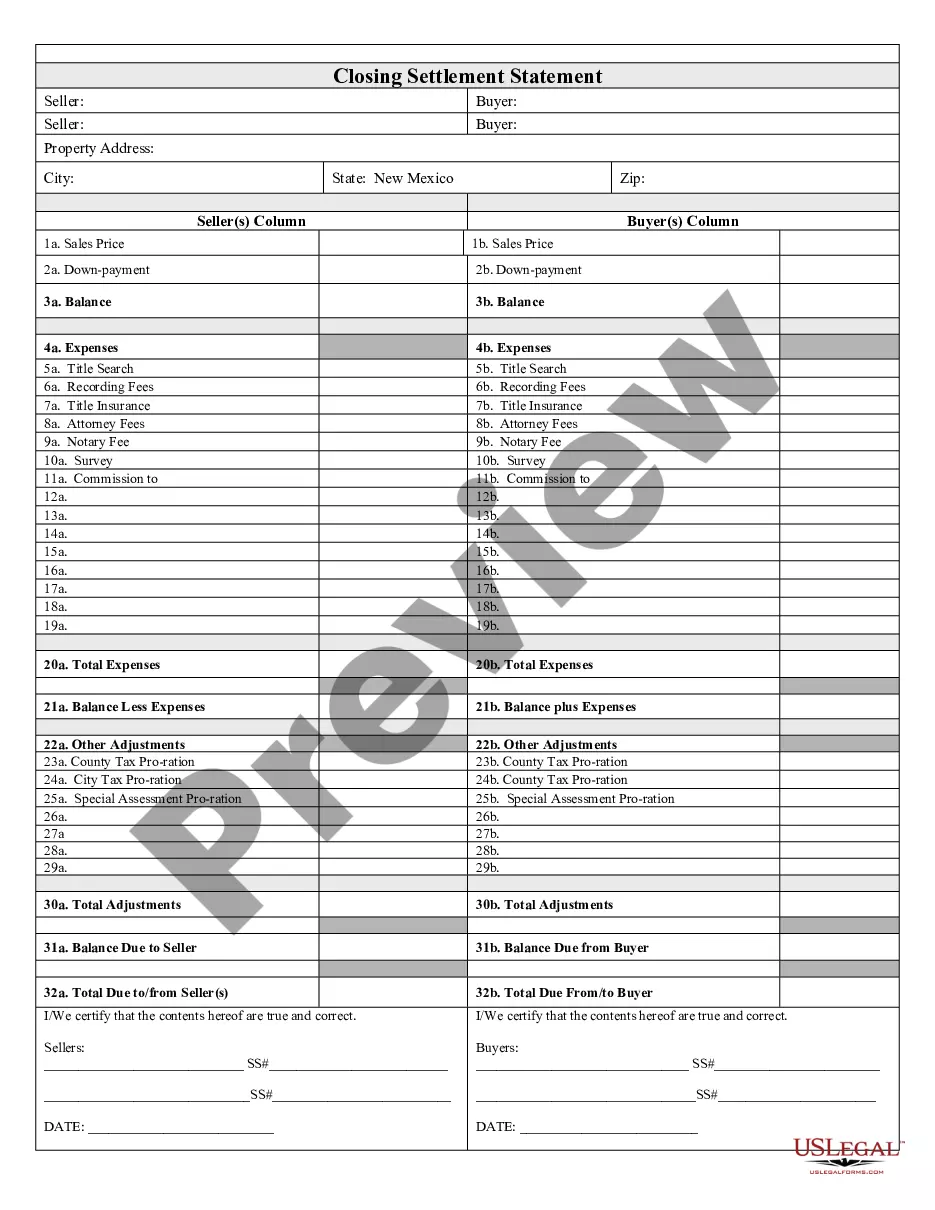

Albuquerque New Mexico Closing Statement

Description

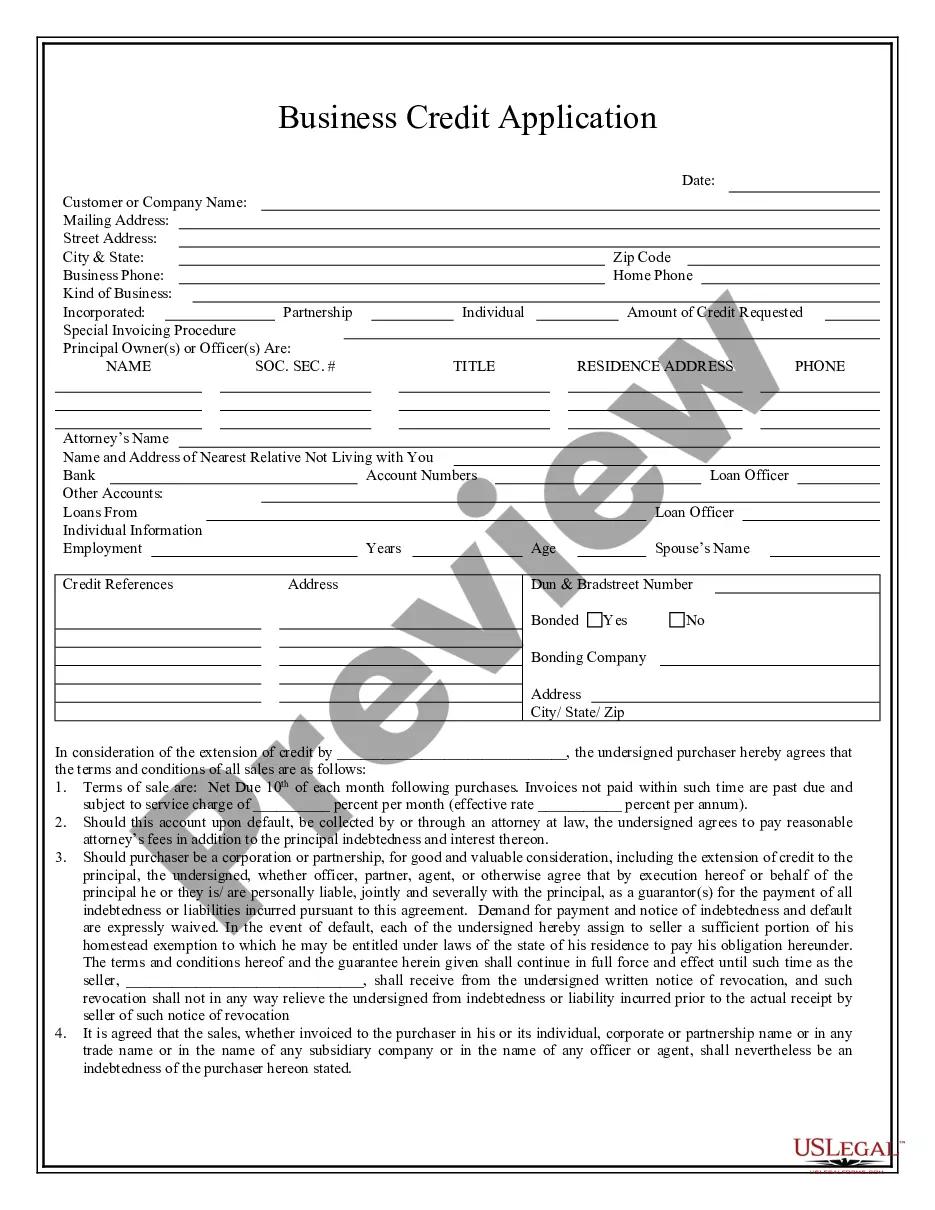

How to fill out New Mexico Closing Statement?

Are you looking for a reliable and affordable provider of legal forms to obtain the Albuquerque New Mexico Closing Statement? US Legal Forms is the ideal choice.

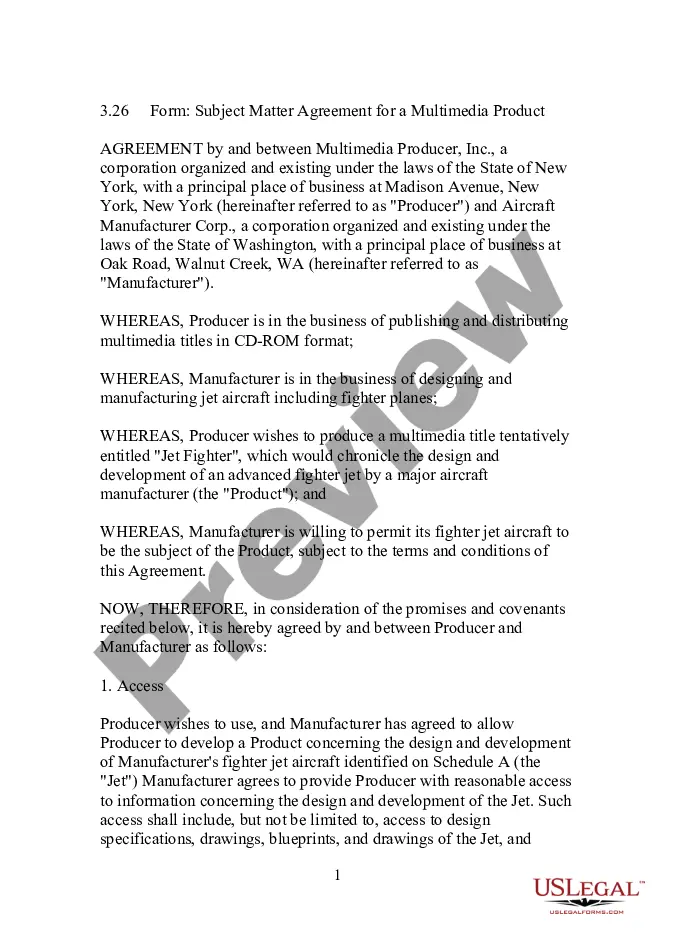

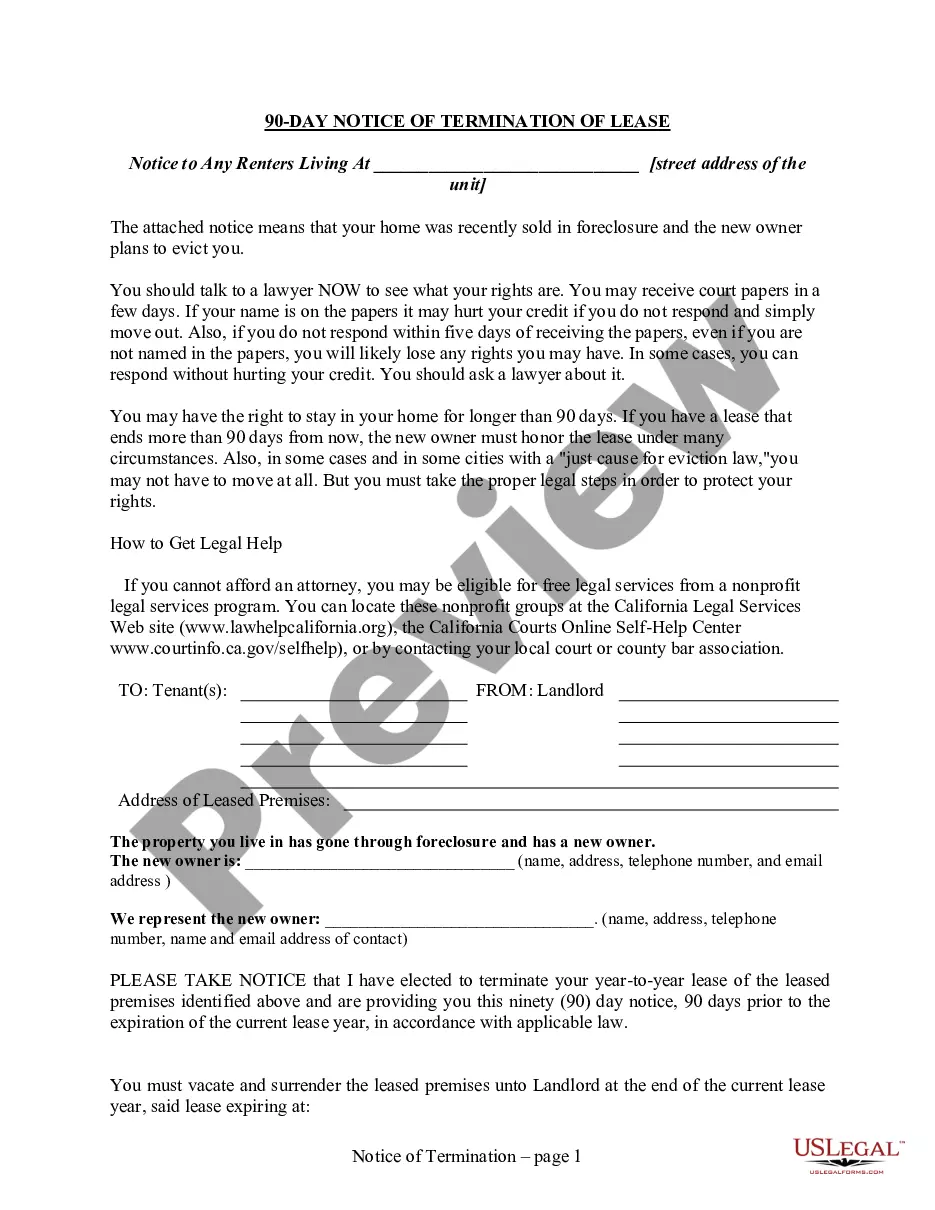

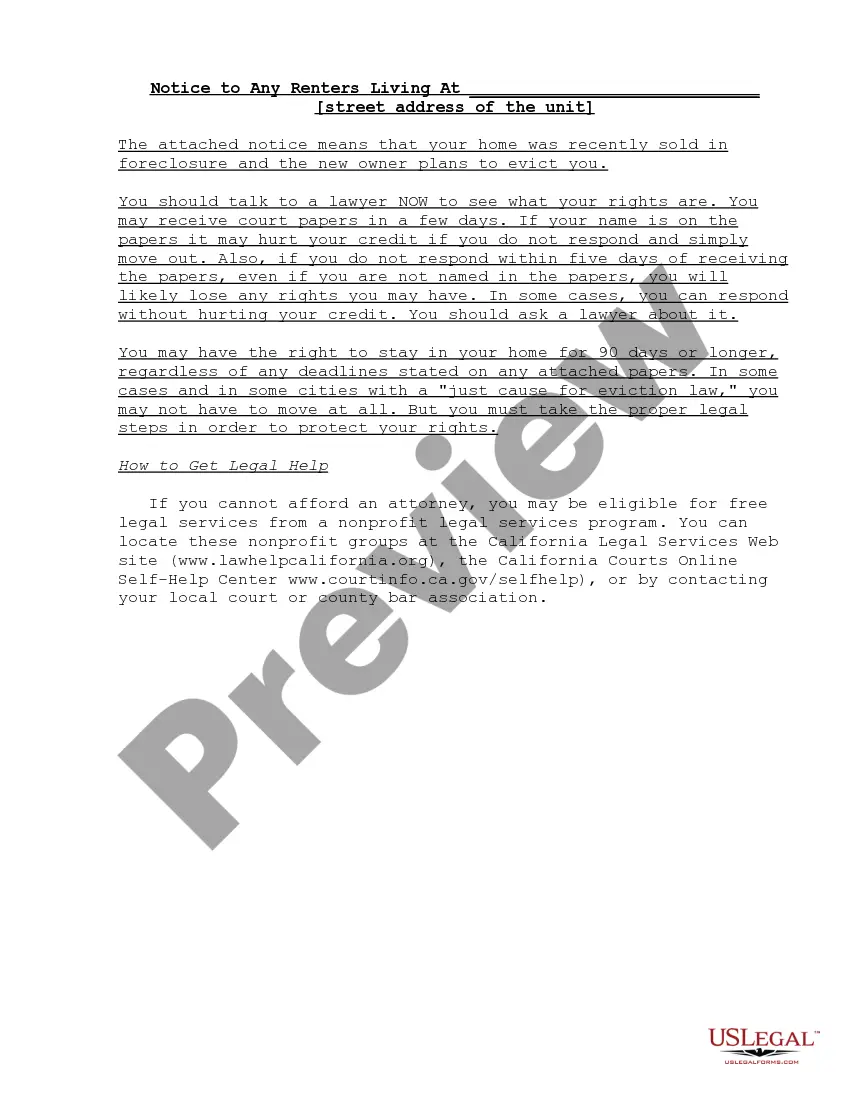

Whether you need a basic agreement to establish rules for living together with your partner or a collection of documents to facilitate your divorce process in court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business use. All the templates we provide are not generic and are tailored to meet the requirements of specific states and regions.

To obtain the document, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please remember that you can download your previously purchased document templates at any time from the My documents section.

Are you unfamiliar with our site? No problem. You can set up an account in moments, but beforehand, ensure to do the following.

Now you can create your account. Then choose the subscription plan and move on to the payment process. After the payment is complete, download the Albuquerque New Mexico Closing Statement in any available format. You can return to the site whenever needed and redownload the document without any cost.

Locating current legal documents has never been more straightforward. Try US Legal Forms today and eliminate the need to spend hours scouring the internet for legal paperwork.

- Verify that the Albuquerque New Mexico Closing Statement aligns with the regulations of your state and locality.

- Review the form’s specifics (if accessible) to understand its intended use and recipients.

- Reinitiate the search if the template does not suit your legal circumstances.

Form popularity

FAQ

Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704.

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return. Depending upon your residency status and your own personal situation, you may need other forms and schedules.

Sales tax return forms can be downloaded from Federal Board of Revenue (FBR)'s official website i.e. . The next step is to login with your company's user ID and password. A window will appear showing your company's profile and previously submitted return files.

New Mexico State Income Taxes for Tax Year 2021 (January 1 - Dec. 31, 2021) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a NM state return). Attention: The New Mexico tax filing and tax payment deadline is April 18, 2022.

New Mexico's law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New Mexico. You must also file a New Mexico return if you want to claim: a refund of New Mexico state income tax withheld from your pay, or.

How to get a sales tax permit in New Mexico. You can register online or mail in form ACD-31015 (opens in PDF). Many local tax offices or town halls also allow taxpayers to apply for their permit. Check with your local government authorities if you prefer to register for a gross receipts tax permit in person.

You may pay by mail sending a check or money order to the Taxation and Revenue Department with a payment voucher. Please refer to the Contact Us page to determine the correct mailing address for each type of tax. Make your check or money order payable to New Mexico Taxation and Revenue Department.

If you are dissolving or withdrawing a corporation from the State of New Mexico, you must request a Corporate Certificate of No Tax Due from the New Mexico Taxation and Revenue Department. You may also contact the Secretary of State (SOS) for information regarding any further requirements administered by that agency.

Because Form RPD-41071, and the required attachments cannot be submitted electronically, you must promptly submit those paper forms and attachments separately. Mail Form RPD-41071 and other required attachments to New Mexico Taxation and Revenue Department, P.O. Box 630, Santa Fe, New Mexico 87504-0630.

Taxpayer Access Point (TAP) Electronic services are safe, secure, fast, and free. You can file your return, pay your tax liability, or check the status of your previously filed returns. It is easy to sign up for an account just visit and click on Create a Logon.