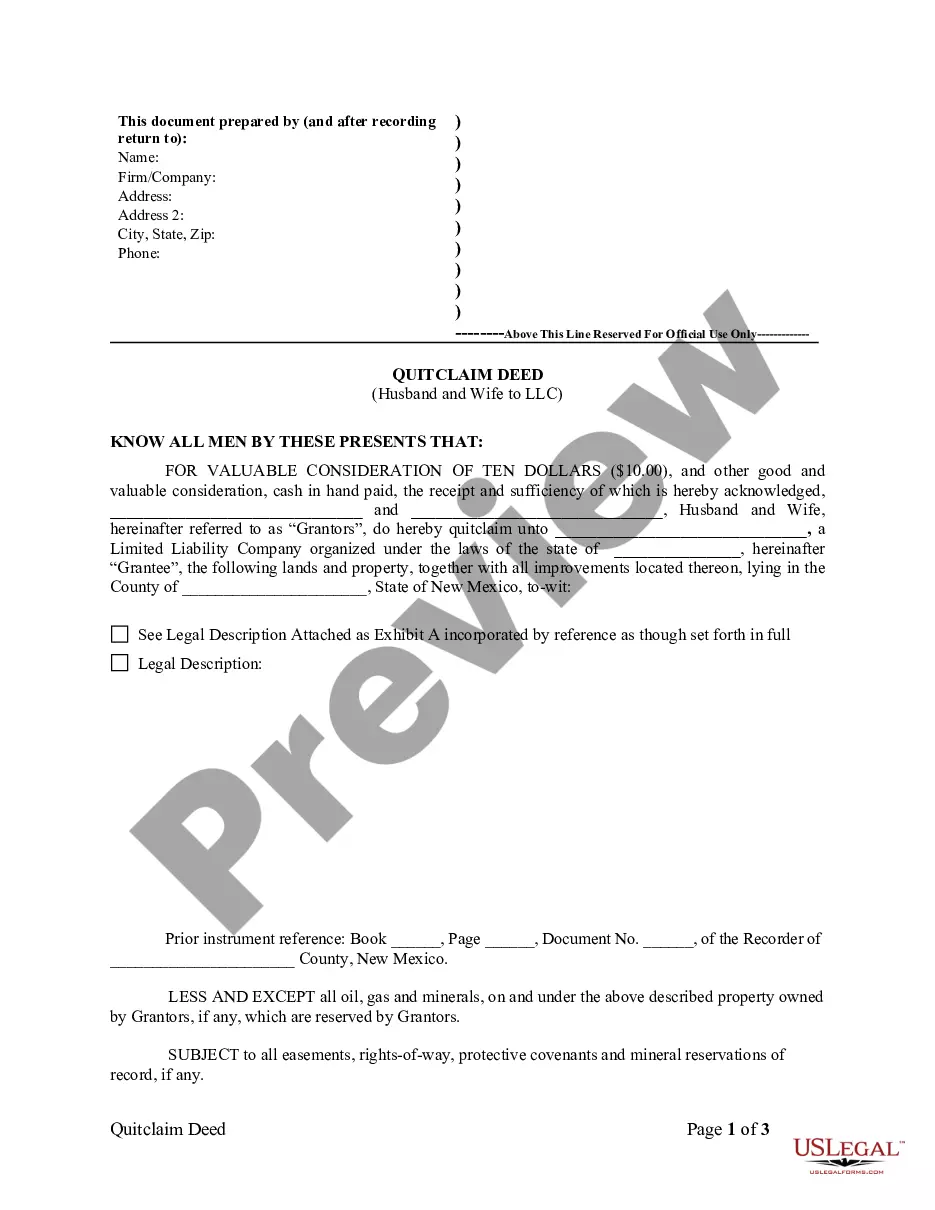

Las Cruces New Mexico Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out New Mexico Quitclaim Deed From Husband And Wife To LLC?

We consistently aim to reduce or avert legal complications when managing intricate legal or financial matters.

To achieve this, we seek attorney services that are typically very costly.

Yet, not every legal issue is as complicated, as many can be handled independently.

US Legal Forms is an online repository of current DIY legal forms covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button beside it. If you've misplaced the document, you can always re-download it in the My documents section. The procedure is equally straightforward if you are not accustomed to the website! You can establish your account in a matter of minutes. Ensure that the Las Cruces New Mexico Quitclaim Deed from Husband and Wife to LLC conforms to the laws and regulations of your state and region. Additionally, it’s vital that you review the form’s description (if provided), and if you notice any inconsistencies with what you initially sought, look for a different template. Once you’ve confirmed that the Las Cruces New Mexico Quitclaim Deed from Husband and Wife to LLC suits your needs, you can select the subscription option and continue to payment. You can then download the document in any compatible format. For over 24 years, we have assisted millions by offering ready-to-customize and up-to-date legal forms. Take full advantage of US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your matters independently without needing to consult legal advisors.

- We offer access to legal document templates that aren't universally available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search.

- Utilize US Legal Forms whenever you require to retrieve and download the Las Cruces New Mexico Quitclaim Deed from Husband and Wife to LLC or any other document promptly and securely.

Form popularity

FAQ

To transfer a deed from personal ownership to an LLC, you will need to execute a quitclaim deed that names the LLC as the new property owner. This requires completing the quitclaim deed form with all relevant details. After properly signing and notarizing the document, file it with the county clerk’s office in Las Cruces, New Mexico. Using U.S. Legal Forms can help streamline this process, ensuring all legal requirements are met.

To fill out a quitclaim deed to add a spouse, begin with the full names of both spouses and the legal description of the property. Clearly indicate that you are transferring your interest to include your spouse. After providing the required signatures, it’s crucial to have the document notarized. Finally, submit the completed quitclaim deed to the county clerk in Las Cruces, New Mexico, to ensure it is officially recorded.

A quitclaim deed primarily benefits the grantor and the grantee in a property transfer. The grantor clears any confusion about ownership, while the grantee receives rights to the property. In the context of Las Cruces, New Mexico, both husband and wife can simplify property ownership transitions to an LLC, which may provide benefits such as asset protection and liability management.

To complete a quitclaim deed in New Mexico, start by obtaining the necessary form from a reliable source. Fill out the form with accurate property details, the names of the parties involved, and the type of transfer. After signing the deed in front of a notary public, you must file it with the local county clerk. This process ensures that the quitclaim deed from husband and wife to LLC is legally binding.

Adding your spouse to a deed may be considered a gift, depending on the circumstances. In Las Cruces, New Mexico, transferring ownership without receiving anything in return typically qualifies as a gift for tax purposes. However, if you still have an interest in the property, this may not apply. It is a good idea to consult a tax professional for clarity on your specific situation.

To add your spouse to your deed without refinancing, you can file a quitclaim deed in Las Cruces, New Mexico. This document transfers your interest in the property to both you and your spouse. It is essential to ensure that the quitclaim deed is properly signed, notarized, and filed with the county clerk's office. This process allows you to include your spouse without the complications of refinancing.

Typically, a quitclaim deed is used to transfer property between family members or in situations where the seller cannot provide a warranty of title. For instance, when a couple moves property ownership into an LLC, they may opt for a Las Cruces New Mexico Quitclaim Deed from Husband and Wife to LLC. This approach is popular for simplifying ownership transitions without complicated legal processes. US Legal Forms offers guidance and templates to make this process smooth and efficient.

In New Mexico, a quitclaim deed allows one party to transfer their ownership interest in a property to another party. This type of deed does not guarantee that the property has a clear title; it merely conveys the interest the grantor may have. Utilizing a Las Cruces New Mexico Quitclaim Deed from Husband and Wife to LLC can simplify the transfer, especially in situations involving family or business arrangements. It's crucial to understand the implications before proceeding, and platforms like US Legal Forms provide helpful resources.

One potential disadvantage of putting property in an LLC is the loss of certain tax benefits available to personal homeowners. For example, you may not be able to deduct mortgage interest as easily when your property is held by an LLC. Additionally, there may be legal and filing fees associated with establishing and maintaining the LLC. It is essential to weigh these drawbacks against the protection an LLC can provide before proceeding with a Las Cruces New Mexico Quitclaim Deed from Husband and Wife to LLC.

Yes, you can use a quitclaim deed to transfer property to an LLC. In this case, the Las Cruces New Mexico Quitclaim Deed from Husband and Wife to LLC allows you to relinquish your personal interest in the property to the LLC. This legal process is straightforward, but you should ensure all necessary forms are correctly completed and filed with your county. Utilizing a service like uslegalforms can help simplify this process for you.