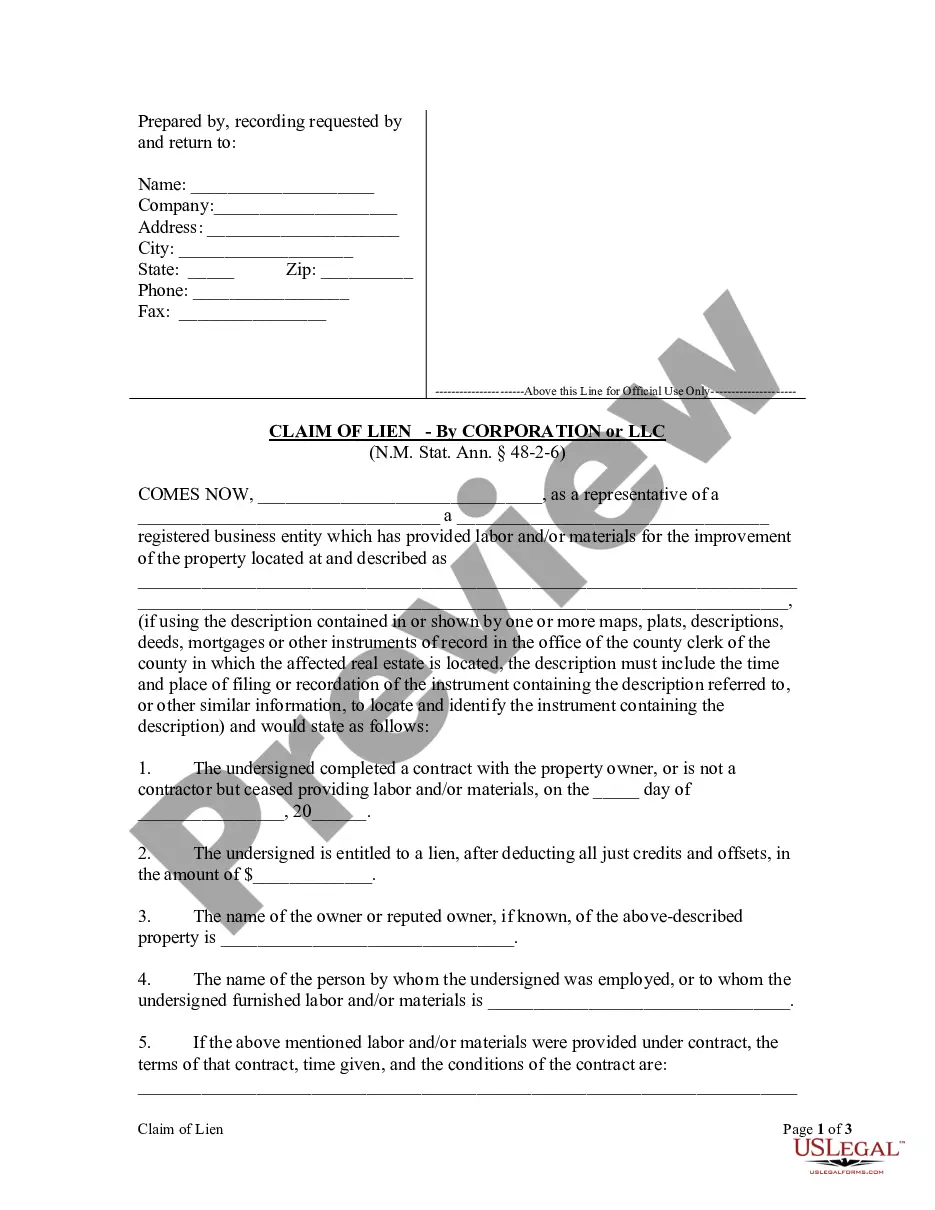

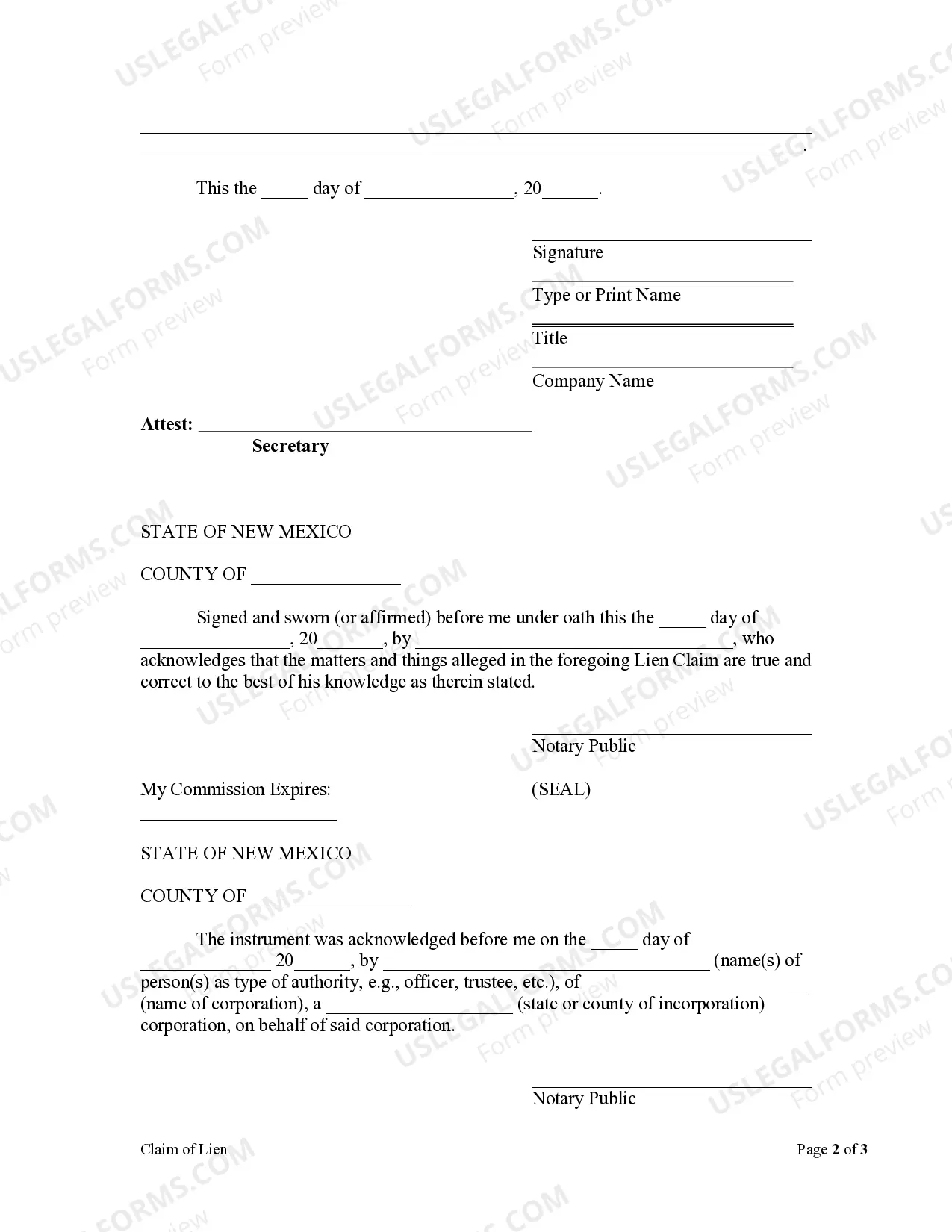

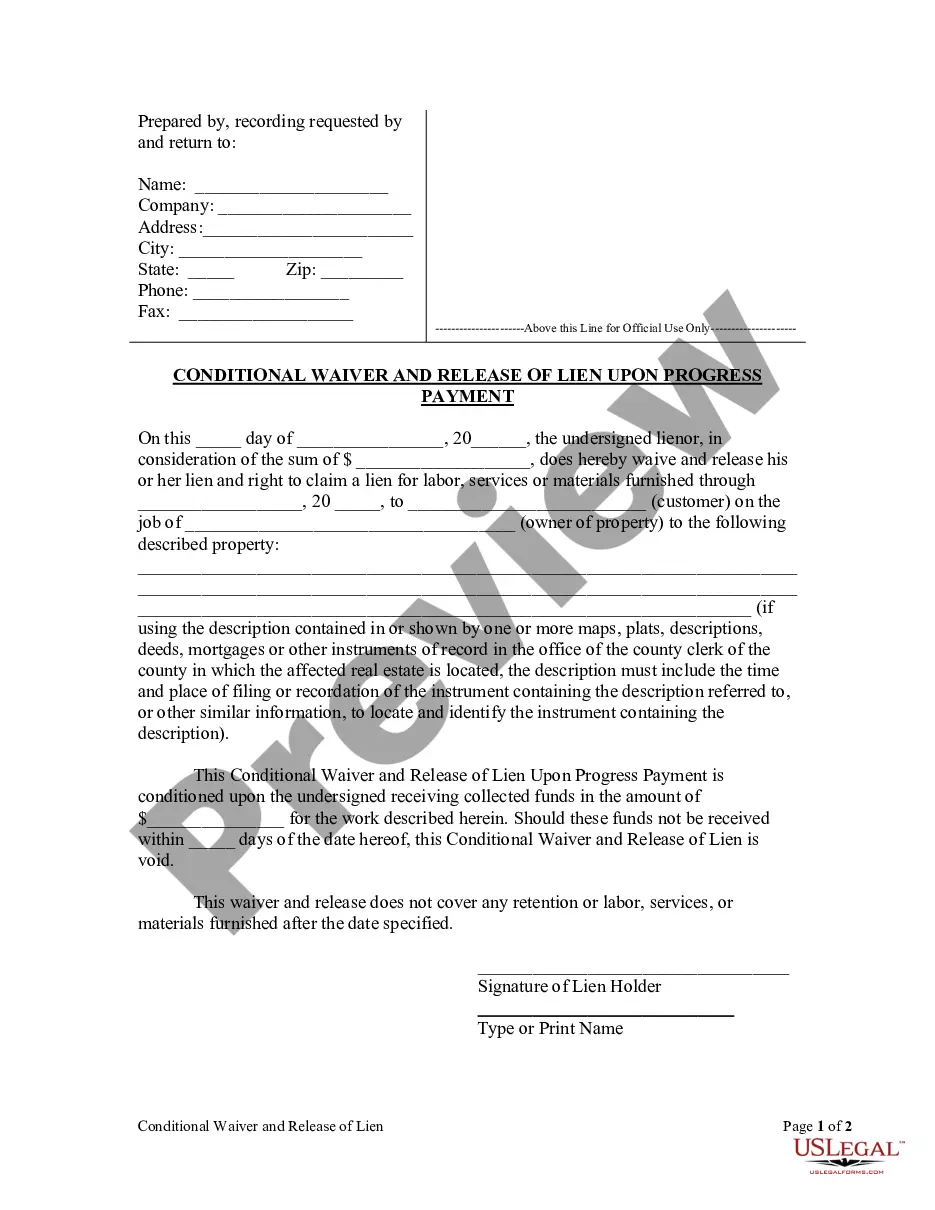

Every original contractor, within one hundred and twenty days after the completion of his contract, and every person, except the original contractor, desiring to claim a lien pursuant to Sections 48-2-1 through 48-2-19 NMSA 1978, must, within ninety days after the completion of any building, improvement or structure, or after the completion of the alteration or repair thereof, or the performance of any labor in a mining claim, file for record with the county clerk of the county in which such property or some part thereof is situated, a claim containing a statement of his demands, after deducting all just credits and offsets. The claim shall state the name of the owner or reputed owner, if known, and also the name of the person by whom he was employed, or to whom he furnished the materials, and shall include a statement of the terms, time given and the conditions of the contract, and also a description of the property to be charged with the lien, sufficient for identification. The claim must be verified by the oath of himself or of some other person.

Las Cruces, New Mexico Claim of Lien by Corporation or LLC: A Comprehensive Guide In Las Cruces, New Mexico, a Claim of Lien by Corporation or LLC refers to a legal document filed by a corporate entity or a limited liability company (LLC) to assert their rights and secure a lien against a property or assets in case of non-payment or breach of contractual obligations. When a corporation or LLC has provided labor, materials, or professional services for a construction project, property improvement, or any other project involving property, and if they have not been duly compensated as per the agreed terms, they have the right to file a Claim of Lien. This legal instrument aims to protect the interests of the entity by providing a means to seek payment for the work done or resources provided. By filing a Claim of Lien, the corporation or LLC establishes its right to seek reimbursement from the proceeds of the sale or refinancing of the property in question. There are various types of Las Cruces, New Mexico Claim of Lien filings specific to corporations and LCS. Some of these include: 1. Mechanic's Lien: This type of lien is filed when a corporation or LLC has supplied labor, materials, or professional services to improve or enhance a property, such as construction, renovation, or remodeling projects. If payment is not received for these services, the claimant can file a Mechanic's Lien. 2. Material Supplier Lien: Filed by material suppliers (corporations or LCS) who have provided resources, such as building materials, fixtures, or equipment, but have not been compensated fully or partially. This type of lien allows the supplier to seek payment for the materials provided. 3. Professional Service Provider Lien: Corporations or LCS engaged in providing professional services, such as architectural, engineering, or consulting services, may file a lien if they have not received the agreed-upon compensation. 4. Subcontractor Lien: This type of lien is filed by a subcontractor hired by a general contractor, corporation, or LLC. It allows them to secure their right to payment for the work performed on a property, especially if the subcontractor has not been paid by the general contractor. 5. Final Lien Affidavit: A Final Lien Affidavit is filed when the corporation or LLC has completed the work or provided the services as per the agreement, but payment has not been received. It is typically filed as a last resort before initiating legal action. To file a Claim of Lien by Corporation or LLC in Las Cruces, New Mexico, the claimant must adhere to specific legal procedures and timelines. It is essential to consult with an attorney familiar with New Mexico's lien laws to ensure compliance and maximize the chances of a successful claim. In conclusion, a Claim of Lien by Corporation or LLC in Las Cruces, New Mexico, is a crucial legal instrument that allows corporations and limited liability companies to assert their right to payment for work done, services rendered, or resources provided. By filing a lien, these entities protect their interests and establish a legal basis to pursue compensation. Understanding the different types of lien filings available can help corporations and LCS choose the appropriate category for filing based on their specific circumstances.Las Cruces, New Mexico Claim of Lien by Corporation or LLC: A Comprehensive Guide In Las Cruces, New Mexico, a Claim of Lien by Corporation or LLC refers to a legal document filed by a corporate entity or a limited liability company (LLC) to assert their rights and secure a lien against a property or assets in case of non-payment or breach of contractual obligations. When a corporation or LLC has provided labor, materials, or professional services for a construction project, property improvement, or any other project involving property, and if they have not been duly compensated as per the agreed terms, they have the right to file a Claim of Lien. This legal instrument aims to protect the interests of the entity by providing a means to seek payment for the work done or resources provided. By filing a Claim of Lien, the corporation or LLC establishes its right to seek reimbursement from the proceeds of the sale or refinancing of the property in question. There are various types of Las Cruces, New Mexico Claim of Lien filings specific to corporations and LCS. Some of these include: 1. Mechanic's Lien: This type of lien is filed when a corporation or LLC has supplied labor, materials, or professional services to improve or enhance a property, such as construction, renovation, or remodeling projects. If payment is not received for these services, the claimant can file a Mechanic's Lien. 2. Material Supplier Lien: Filed by material suppliers (corporations or LCS) who have provided resources, such as building materials, fixtures, or equipment, but have not been compensated fully or partially. This type of lien allows the supplier to seek payment for the materials provided. 3. Professional Service Provider Lien: Corporations or LCS engaged in providing professional services, such as architectural, engineering, or consulting services, may file a lien if they have not received the agreed-upon compensation. 4. Subcontractor Lien: This type of lien is filed by a subcontractor hired by a general contractor, corporation, or LLC. It allows them to secure their right to payment for the work performed on a property, especially if the subcontractor has not been paid by the general contractor. 5. Final Lien Affidavit: A Final Lien Affidavit is filed when the corporation or LLC has completed the work or provided the services as per the agreement, but payment has not been received. It is typically filed as a last resort before initiating legal action. To file a Claim of Lien by Corporation or LLC in Las Cruces, New Mexico, the claimant must adhere to specific legal procedures and timelines. It is essential to consult with an attorney familiar with New Mexico's lien laws to ensure compliance and maximize the chances of a successful claim. In conclusion, a Claim of Lien by Corporation or LLC in Las Cruces, New Mexico, is a crucial legal instrument that allows corporations and limited liability companies to assert their right to payment for work done, services rendered, or resources provided. By filing a lien, these entities protect their interests and establish a legal basis to pursue compensation. Understanding the different types of lien filings available can help corporations and LCS choose the appropriate category for filing based on their specific circumstances.