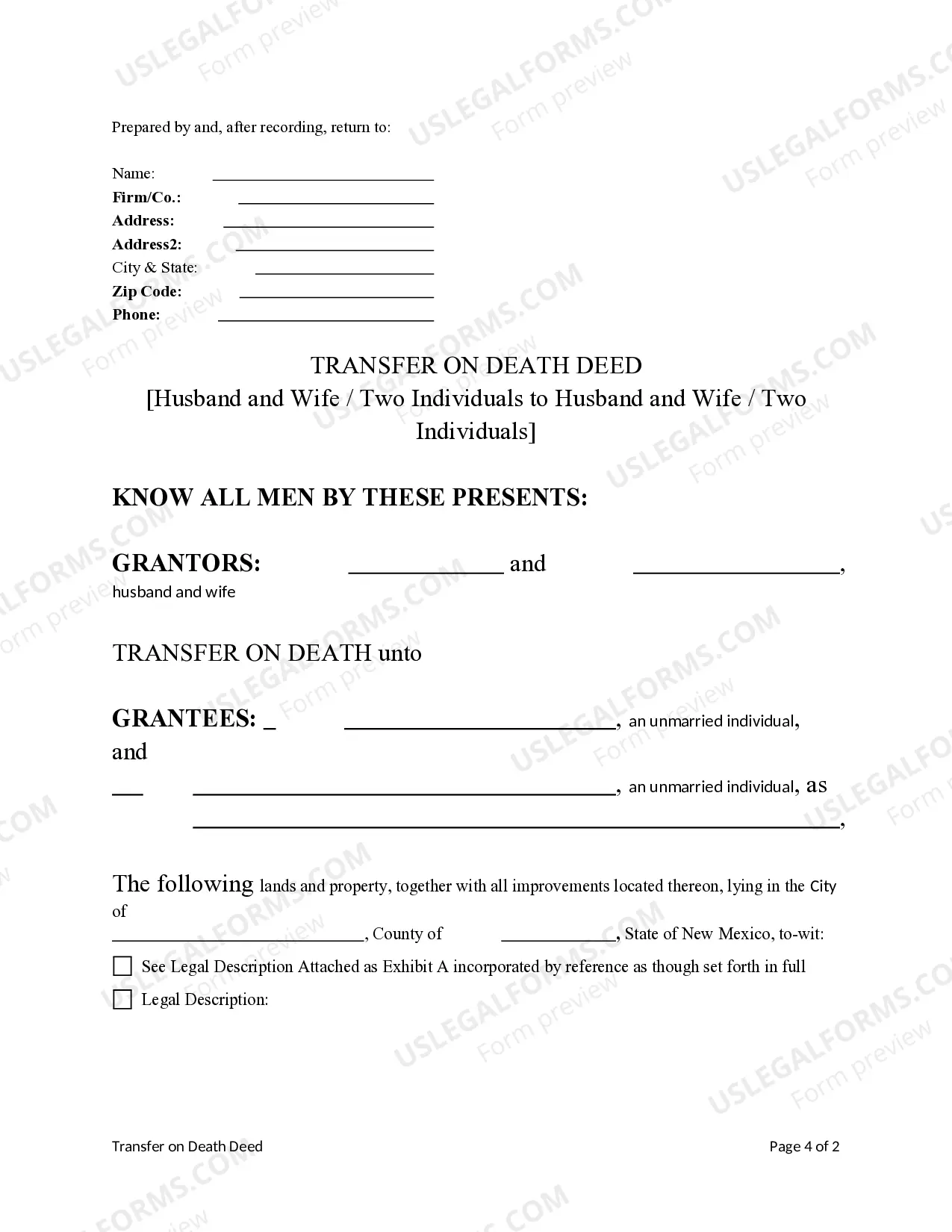

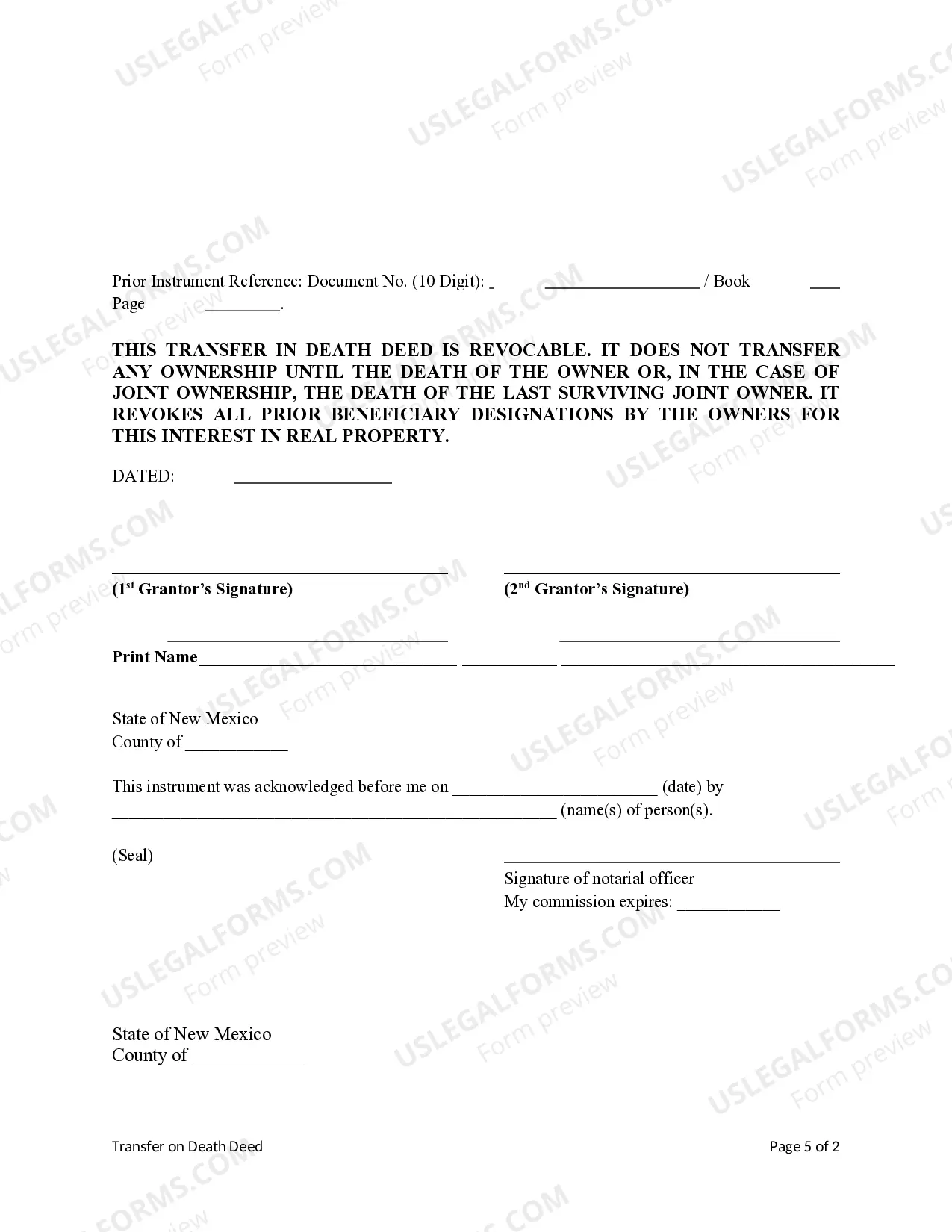

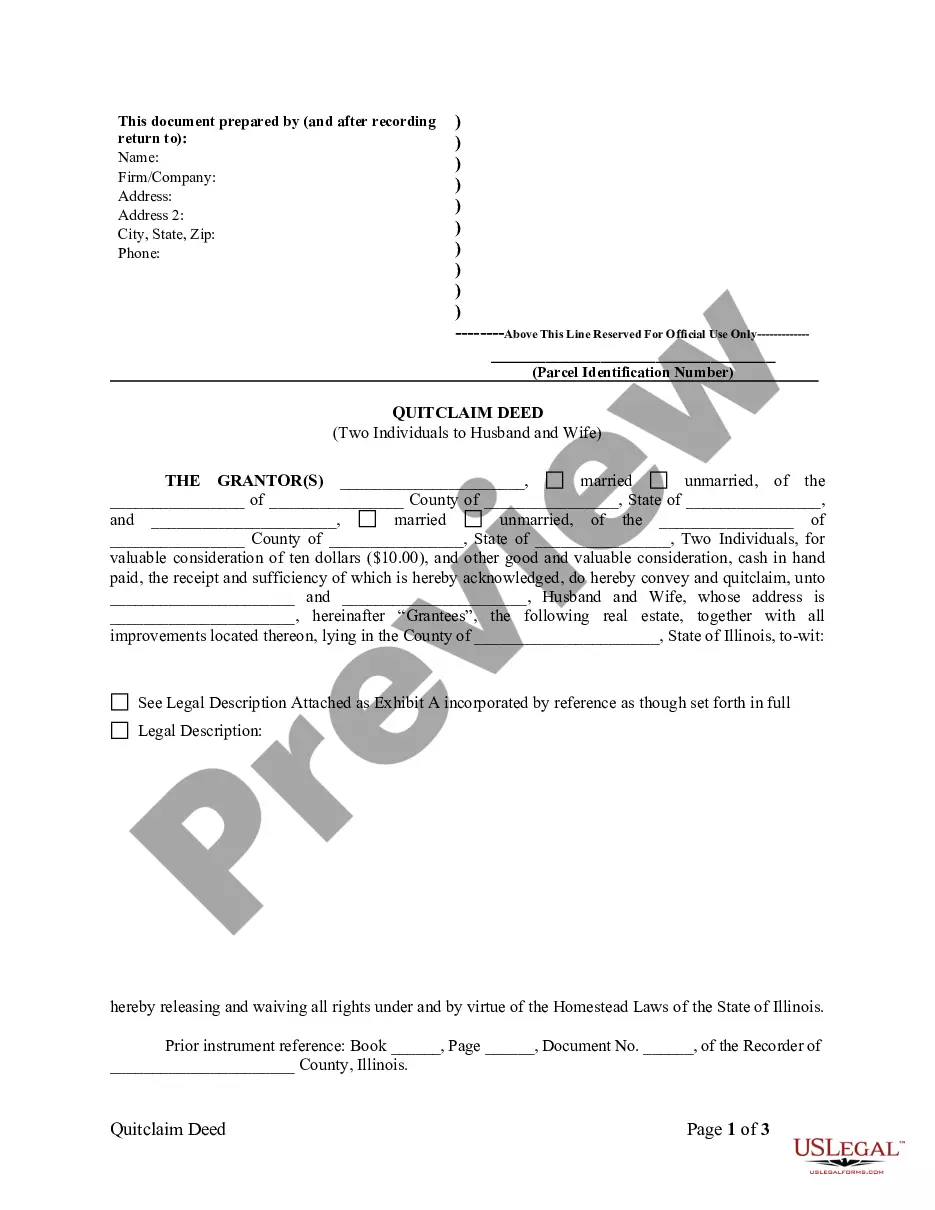

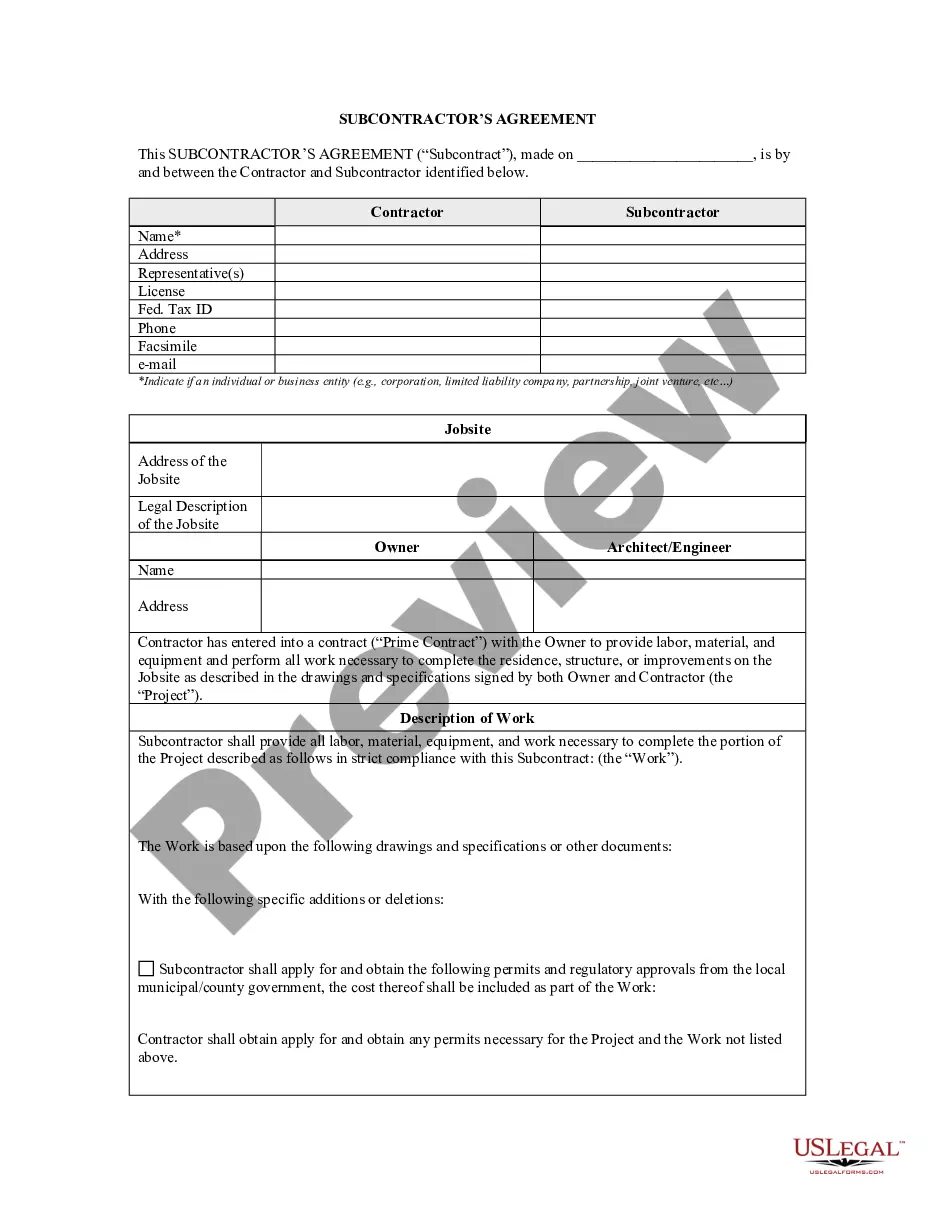

This form is a Transfer on Death Deed where the Grantors are husband and wife, or two individuals, and the Grantees are hudaband and wife, or two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common, joint tenants with the right of survivorship, or community property. This deed complies with all state statutory laws.

Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife

Description

How to fill out New Mexico Transfer On Death Deed From Two Individuals / Husband And Wife To Two Individuals / Husband And Wife?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our helpful website, featuring thousands of templates, simplifies the process of locating and obtaining nearly any document sample you need.

You can download, fill out, and sign the Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife within minutes instead of spending hours searching online for a suitable template.

Using our catalog is an excellent strategy to enhance the security of your document filing.

Initiate the saving process. Click Buy Now and select your preferred pricing plan. Then, register for an account and complete your order using a credit card or PayPal.

Download the document. Select the format to obtain the Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife and adjust and fill it out, or sign it based on your needs. US Legal Forms is one of the most comprehensive and trustworthy template libraries available online. Our company is always ready to assist you with virtually any legal process, even if it involves just downloading the Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife.

- Our skilled attorneys regularly review all documents to confirm that the templates are applicable for a specific state and comply with recent laws and regulations.

- How can you acquire the Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife? If you own a profile, simply Log In to your account.

- The Download option will be available for all the samples you view. Furthermore, you can find all previously saved documents in the My documents section.

- If you haven’t created an account yet, follow the steps outlined below.

- Locate the form you need. Confirm that it is the correct form you seek: check its name and description, and use the Preview feature if available. If not, use the Search box to find the right one.

Form popularity

FAQ

While you can prepare a transfer on death deed on your own, working with a lawyer is often beneficial. A Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife has specific requirements that a legal expert can navigate easily. Consulting with a professional helps ensure the deed is valid and meets all local regulations. The uslegalforms platform also offers resources that can guide you through the process if you choose to take it on independently.

While a transfer on death deed offers many benefits, there are potential downsides to consider. A Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife may not protect the property from creditors, and there can be complications if beneficiaries predecease you. Additionally, if the deed is not executed correctly, it can lead to legal disputes. It’s advisable to review your decision with a legal professional to ensure it fits your needs.

Choosing between a transfer on death deed and naming a beneficiary can depend on your situation. A Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife allows for a smoother transfer of property at death without probate. On the other hand, designating a beneficiary may involve different rules regarding assets that fall outside property transfers. Evaluating what you own and how you wish to pass it on can help clarify which method suits you better.

Many states recognize a transfer on death deed, including New Mexico, which allows a Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife. This legal instrument provides a simple way to transfer real estate upon death without going through probate. However, it’s important to verify the specifics in your state, as laws can vary. You can find resources and guidance on the uslegalforms platform to assist with your state’s requirements.

A Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife can indeed help in avoiding inheritance tax. The transfer on death deed allows property to pass to the designated beneficiaries outside of probate. This means your loved ones can receive the property without facing the burden of inheritance taxes, depending on local laws. It is always best to consult with a tax professional to understand the implications in your specific situation.

To transfer a property title to a family member in New Mexico, you need to complete a deed that transfers ownership to the new owner. Utilizing a Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife can simplify this process for passing the property after your death. It's also important to record the deed with the county clerk to finalize the transfer. This ensures that the new ownership is documented and legally recognized.

The best way to transfer a property title between family members is through a formal deed, such as a warranty deed or quitclaim deed. Additionally, using a Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife provides a way to transfer title after your death without probate. Consulting with a legal professional helps ensure the process is seamless and correct. This method streamlines the transfer process, reducing stress for your family.

Transferring property to a family member in New Mexico typically involves drafting a deed that clearly identifies the property and the new owner. You can also consider using a Las Cruces New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife for a smoother transfer process. Once the deed is executed, it should be recorded in the county clerk's office. This ensures the transfer is official and legally recognized.

To transfer a deed upon death to two beneficiaries, you need to prepare a Las Cruces New Mexico Transfer on Death Deed. Both individuals must be clearly named in the deed. After your passing, the property automatically transfers to these beneficiaries without going through probate. This method offers a straightforward way to ensure your property goes directly to your loved ones.

While a transfer on death deed in Las Cruces, New Mexico offers benefits, it also has disadvantages. For instance, it does not shield the property from creditors after death, which could affect the beneficiaries. Additionally, if the grantors want to sell the property or change the beneficiaries, they must revoke or amend the deed, which can complicate matters. To address these concerns effectively, consider consulting the resources available through US Legal Forms for comprehensive solutions.