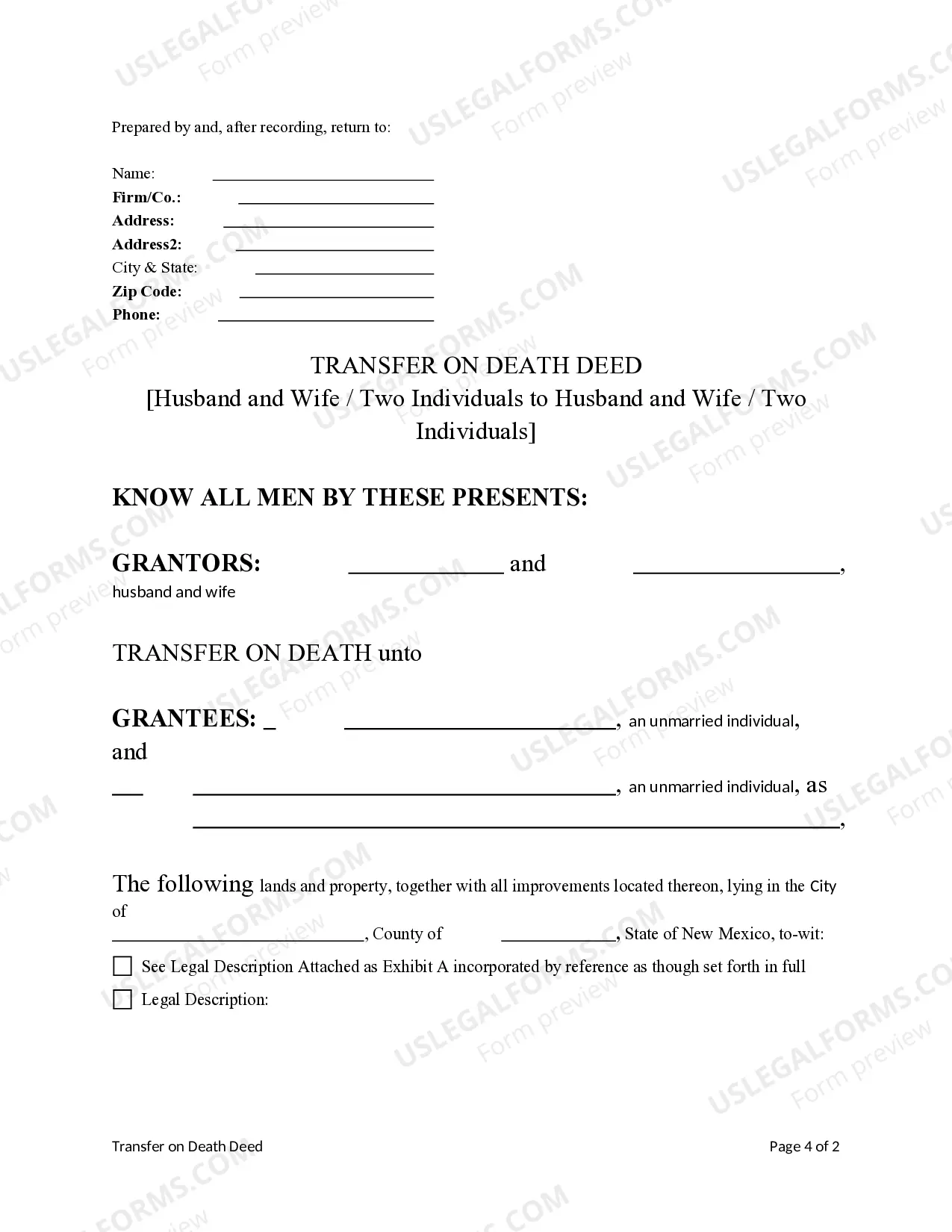

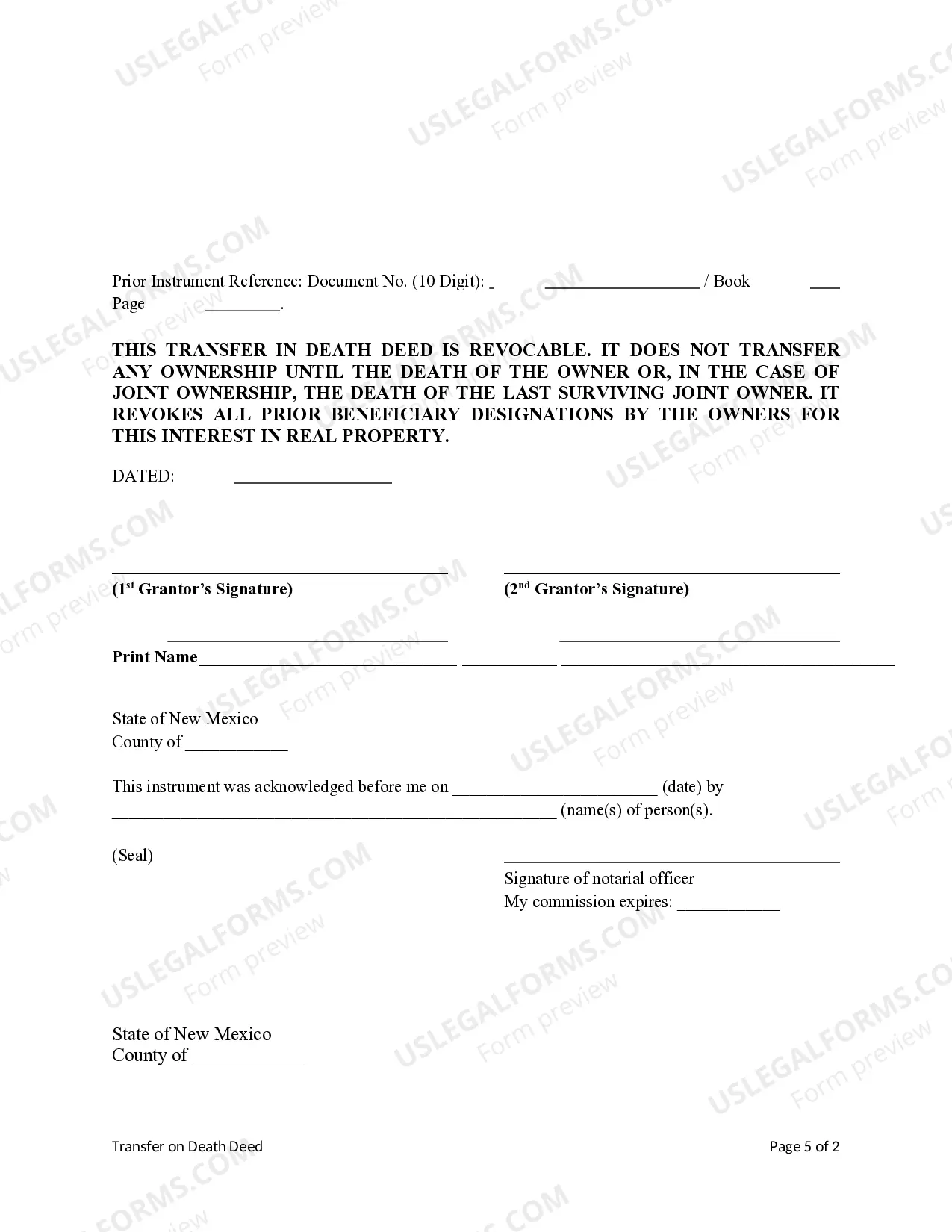

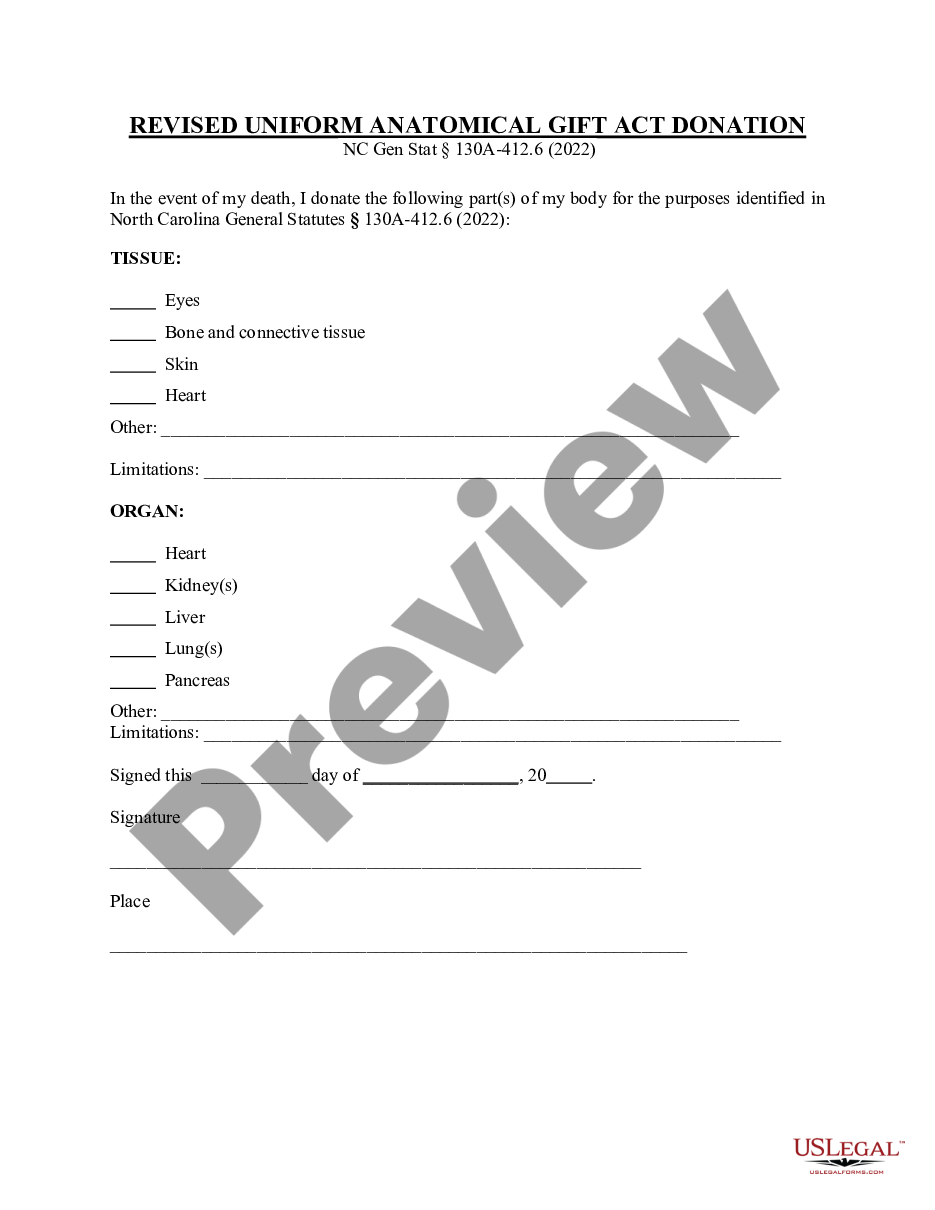

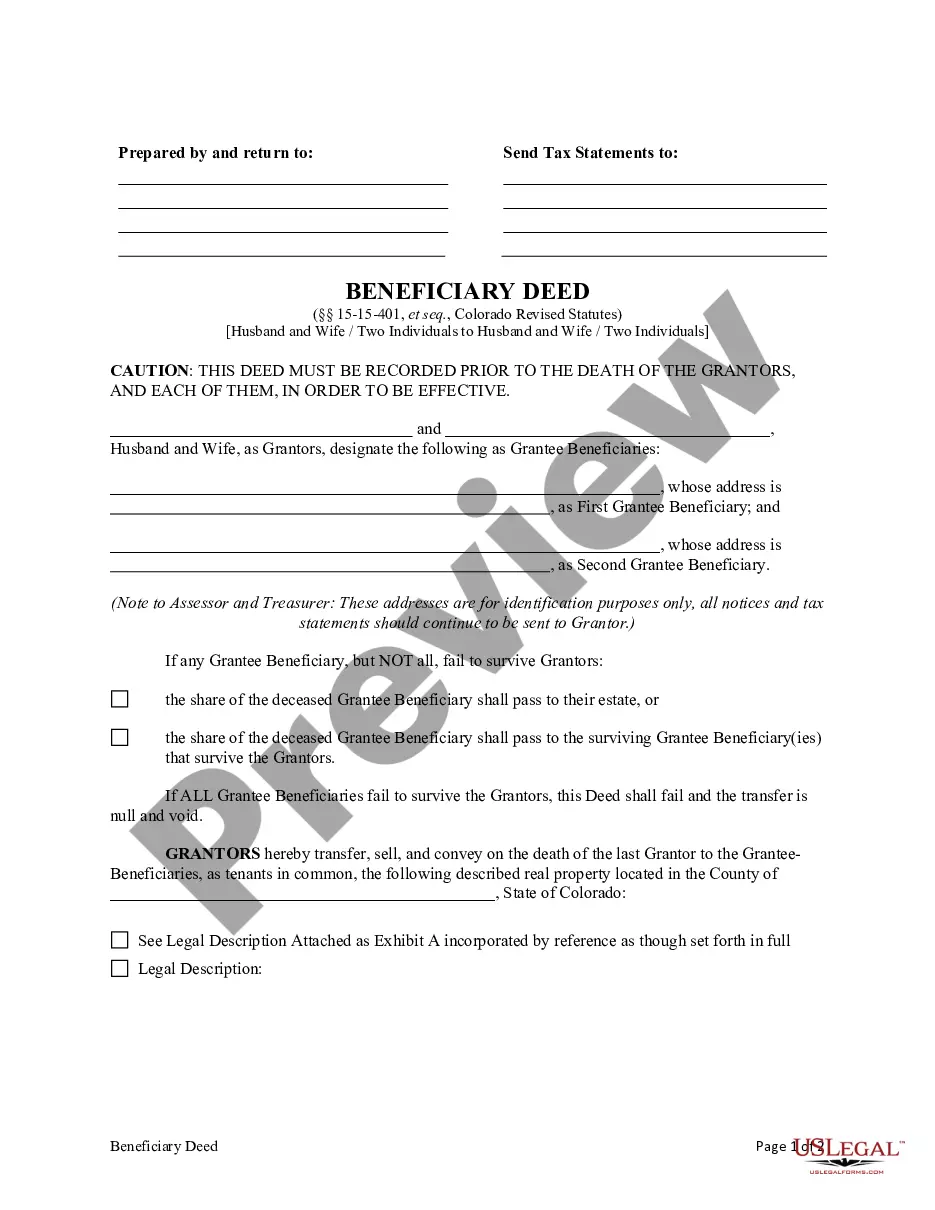

This form is a Transfer on Death Deed where the Grantors are husband and wife, or two individuals, and the Grantees are hudaband and wife, or two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common, joint tenants with the right of survivorship, or community property. This deed complies with all state statutory laws.

Albuquerque New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife

Description

How to fill out New Mexico Transfer On Death Deed From Two Individuals / Husband And Wife To Two Individuals / Husband And Wife?

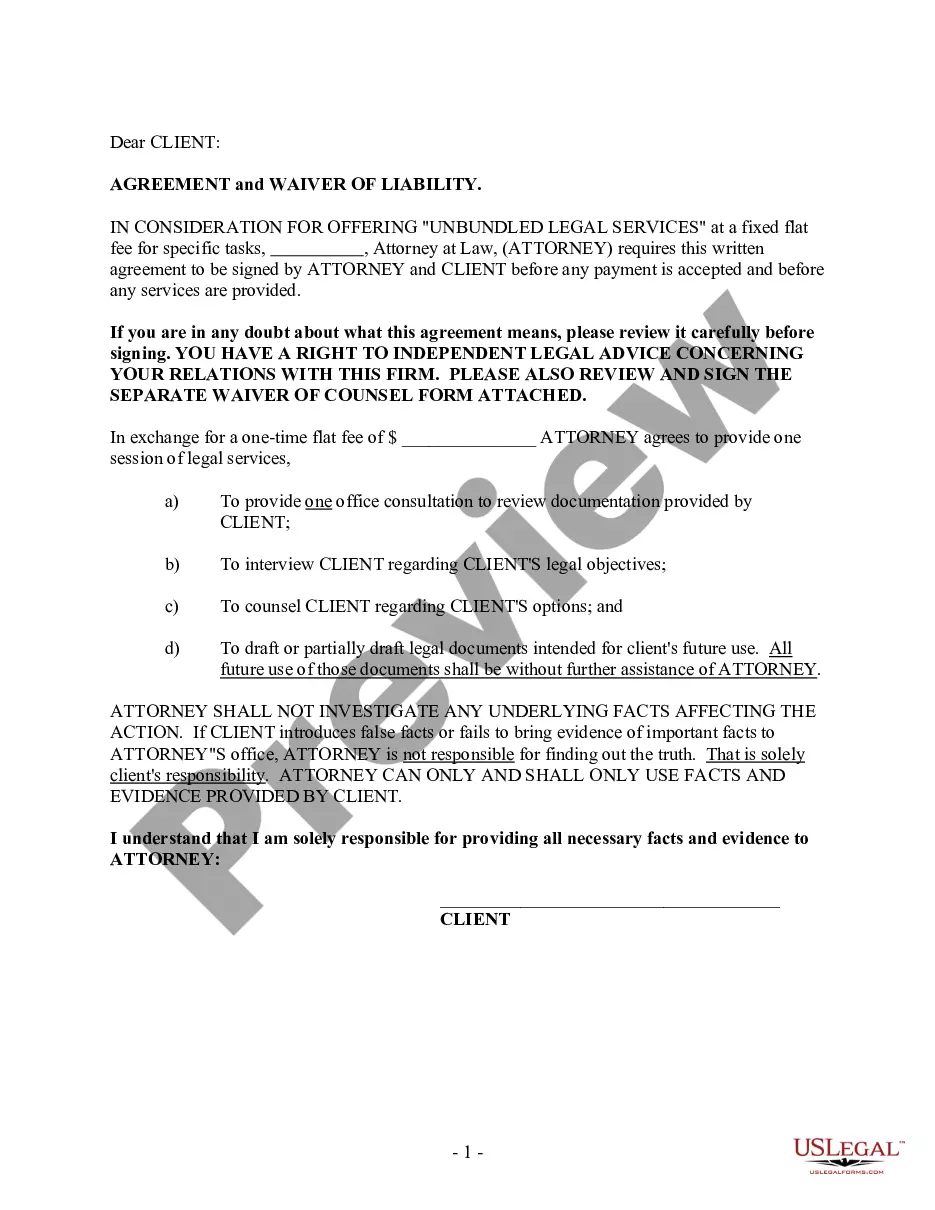

Regardless of social or professional standing, filling out legal documents is an unfortunate yet essential requirement in the current professional landscape.

It is often nearly impossible for individuals without a legal background to create this type of documentation from scratch, primarily because of the complex language and legal nuances involved.

This is where US Legal Forms can be extremely beneficial.

Make certain the template you’ve located is suitable for your jurisdiction, as the laws governing one state or area do not apply to another.

Examine the document and read a brief overview (if available) of scenarios for which the form may be utilized.

- Our service offers an extensive compilation of over 85,000 ready-to-use state-specific forms applicable to nearly any legal situation.

- US Legal Forms also serves as a valuable resource for associates or legal advisors aiming to save time with our DIY forms.

- Whether you need the Albuquerque New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife or any other documentation that will be acknowledged in your state, US Legal Forms has everything readily available.

- Here’s how you can quickly acquire the Albuquerque New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife using our trustworthy service.

- If you are already a member, simply Log In to your account to retrieve the suitable form.

- However, if you are new to our platform, ensure you follow these steps before obtaining the Albuquerque New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife.

Form popularity

FAQ

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

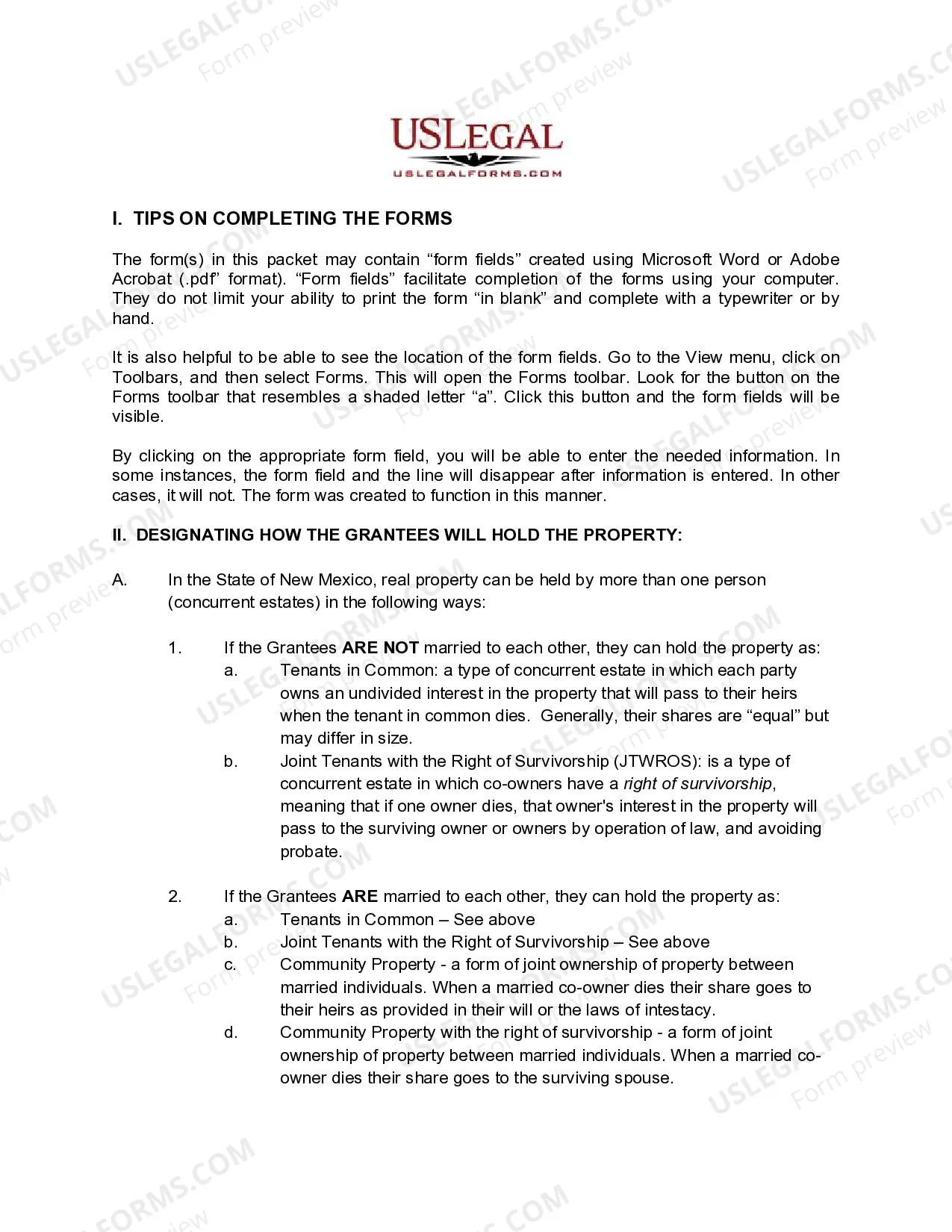

Use this form to leave your New Mexico real estate without probate. You retain ownership, responsibility, and control over the property during your life. After your death, ownership transfers to the beneficiary you name.

1978, § 14-9-1) ? A quit claim deed is required to be filed at the County Clerk's Office where the property is located along with the required recording fee(s). Signing (N. M. S. A. 1978, § 47-1-44) ? In New Mexico, it must be signed with a Notary Public viewing the Grantor(s) signature(s).

TOD account holders can name multiple beneficiaries and divide assets any way they like. If your TOD investment account is set up to be split evenly between your children, each will receive an even part when you die.

Beneficiaries or next-of-kin can then legally act as personal representatives for the deceased, meaning that they have the power and ability to then transfer ownership of the property and change the name on the deed if they so choose. They also have the power to sell the property.

If there isn't a will, the court will appoint someone, usually an adult child or surviving spouse, to be the executor or personal representative. The executor or personal representative takes care of the estate of the decedent.

In New Mexico, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

A will must be filed with the county court in New Mexico where the person resided before their death. Even if there is no estate or the assets don't need to go through probate, the will must be recorded.

A New Mexico deed is used to legally convey real estate between parties in New Mexico. In order to transfer property, with a deed, you will need the names of the seller, or grantor, the names of the buyer, or grantee, the legal description of the property and an acknowledgment by a notary public.

The law in New Mexico allows an owner of real property (land or house) to transfer that property to another person (grantee beneficiary) through the use of a Transfer on Death Deed (TODD).