Newark New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out New Jersey Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

We continually endeavor to minimize or evade legal complications when engaging with intricate legal or financial matters.

To achieve this, we seek legal remedies that are typically quite costly.

Nevertheless, not every legal complication is similarly convoluted.

The majority of them can be managed by ourselves.

Take advantage of US Legal Forms whenever you require to find and download the Newark New Jersey Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries or any other document smoothly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository assists you in taking control of your affairs without relying on legal counsel.

- We grant access to legal document templates that are not always readily accessible.

- Our templates are specific to state and area, which greatly simplifies the search process.

Form popularity

FAQ

The five key fiduciary duties include the duty of care, duty of loyalty, duty of good faith, duty to disclose, and duty to account. Each of these duties plays a vital role in ensuring that fiduciaries act responsibly and transparently. Utilizing a Newark New Jersey Fiduciary Deed can help ensure these duties are upheld during estate management. By understanding these responsibilities, fiduciaries can build stronger relationships with beneficiaries while maintaining compliance.

In New Jersey, fiduciary duty encompasses responsibilities to act honestly, prudently, and in the best interest of the beneficiaries. This obligation applies to roles such as executors, trustees, and administrators, ensuring that they manage assets with integrity and transparency. When engaging with a Newark New Jersey Fiduciary Deed, being aware of this duty is crucial for fiduciaries. This knowledge promotes effective management and solid relationships with beneficiaries.

The three common breaches of fiduciary duty include self-dealing, failure to act with due care, and the misuse of fiduciary funds. Self-dealing occurs when a fiduciary benefits personally from their position, while failure to act with due care involves neglecting to manage the assets responsibly. For those handling a Newark New Jersey Fiduciary Deed, it is essential to avoid these breaches to maintain credibility and legal standing. Recognizing these breaches early on can safeguard beneficiaries' interests.

Executors do indeed have a fiduciary duty to the estate and its beneficiaries. This duty requires them to manage the estate's assets responsibly, act in good faith, and prioritize the beneficiaries' interests above their own. Proper use of a Newark New Jersey Fiduciary Deed is crucial for executors to fulfill these obligations effectively. By doing so, they also help to build trust with beneficiaries.

The current fiduciary rule outlines that fiduciaries must act with a level of care, loyalty, and honesty toward beneficiaries and clients. This rule emphasizes transparency and requires fiduciaries to avoid conflicts of interest. When using a Newark New Jersey Fiduciary Deed, ensuring adherence to these rules is essential for the protection of all parties involved. By following these guidelines, fiduciaries can effectively fulfill their obligations.

Yes, an executor has a legal obligation to provide an accounting to beneficiaries in New Jersey. This accounting outlines the financial transactions related to the estate, ensuring transparency. When executors prepare a Newark New Jersey Fiduciary Deed, they should include details on how assets have been managed or distributed. This practice helps maintain trust among beneficiaries and supports the executor's fiduciary duty.

The fiduciary rule in New Jersey establishes the responsibilities of individuals like executors, trustees, and other fiduciaries who manage assets on behalf of others. This rule ensures that fiduciaries act in the best interests of those they represent, maintaining loyalty and accountability. When dealing with a Newark New Jersey Fiduciary Deed, it's vital to understand these roles clearly. This understanding not only protects the parties involved but also ensures compliance with state laws.

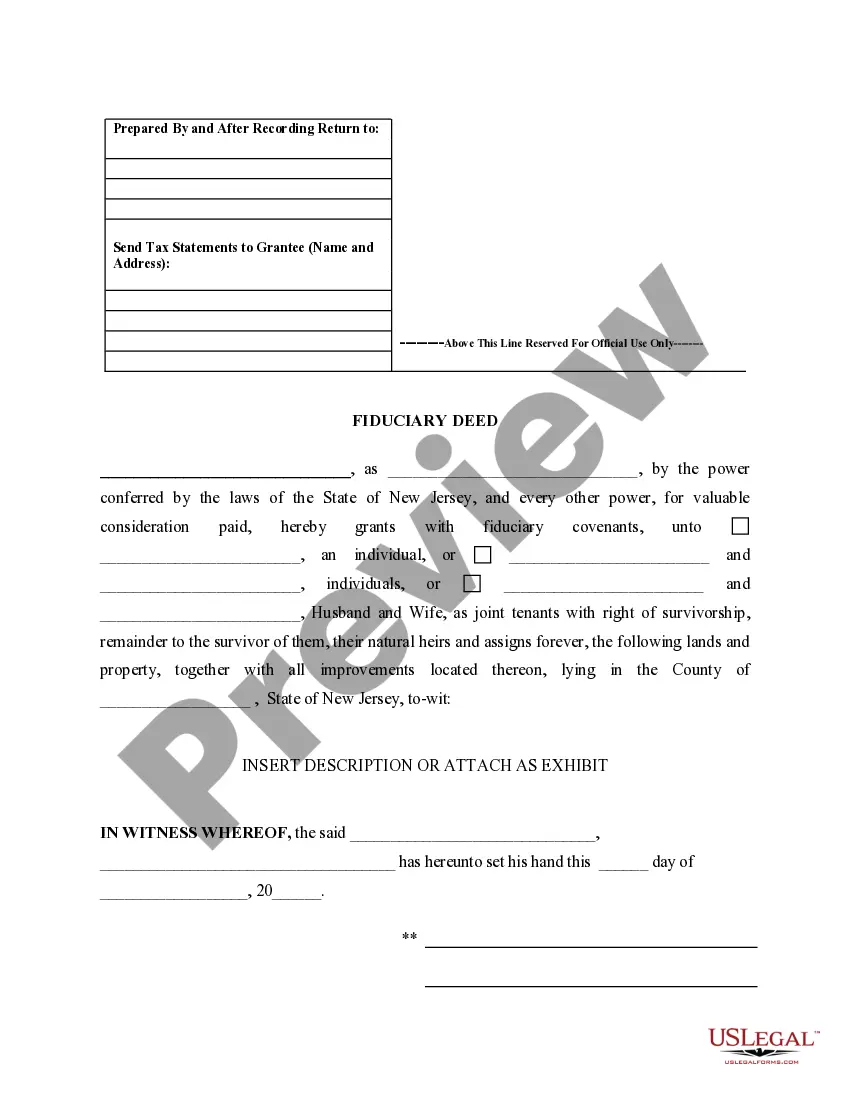

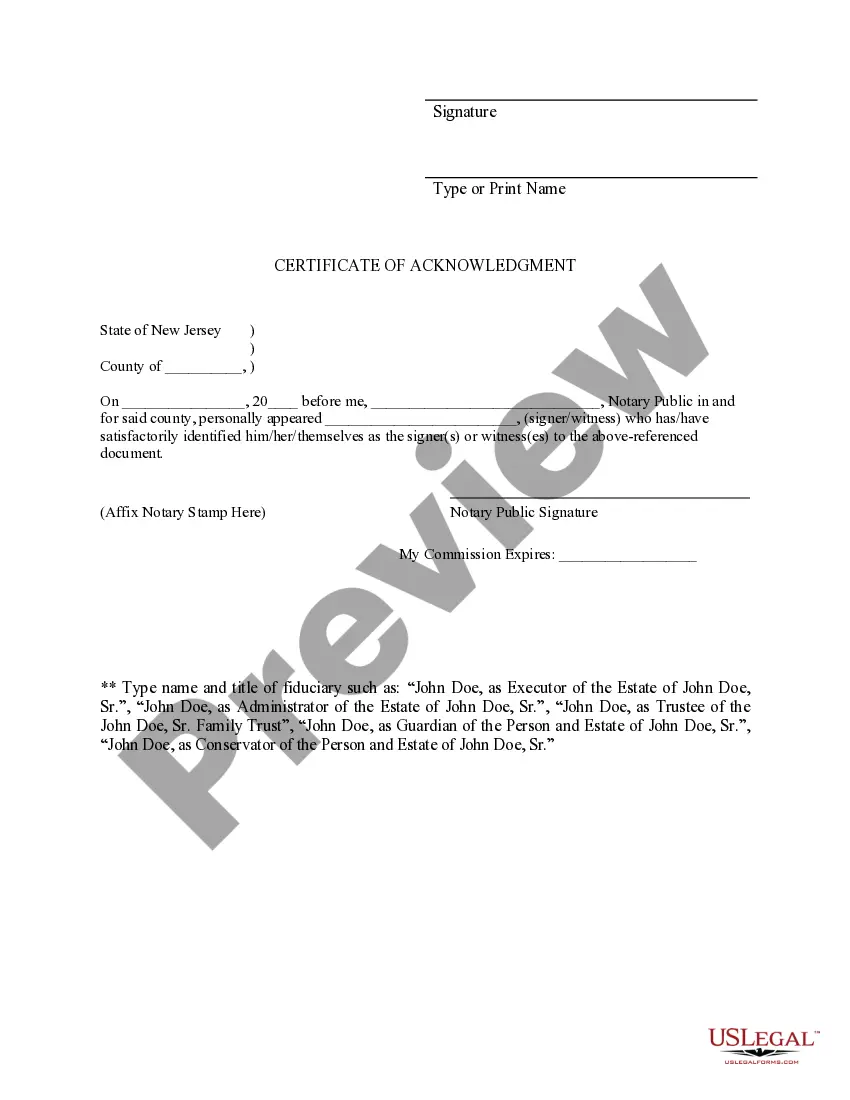

A fiduciary deed is used to transfer property ownership from an estate or trust to another party. It provides Executors, Trustees, Trustors, Administrators, and other Fiduciaries the ability to facilitate property transactions when settling estates or managing trusts. In Newark, New Jersey, understanding fiduciary deeds is essential for ensuring smooth transitions of property and compliance with legal standards.

The NJ 1041 extension form is a specific form that fiduciaries in New Jersey must submit to request an extension for filing their fiduciary income tax return. This form grants Executors, Trustees, Trustors, Administrators, and other Fiduciaries additional time to address their tax obligations efficiently. It’s crucial for maintaining compliance while effectively managing estate or trust affairs.

The extension for the 1041 allows fiduciaries additional time to file their tax returns without incurring penalties. Generally, this grants an automatic six-month extension, giving Executors, Trustees, and other Fiduciaries more breathing room to gather necessary financial documents and prepare accurate submissions. Utilizing this extension can prevent rush-related errors and ensure compliant filings.