Newark New Jersey Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out New Jersey Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Capitalize on the US Legal Forms and gain instant entry to any form template you desire.

Our advantageous website featuring thousands of templates enables you to discover and acquire nearly any document sample you require.

You can export, complete, and sign the Newark New Jersey Assumption Agreement of Mortgage and Release of Original Mortgagors in just a few minutes rather than spending hours online searching for the perfect template.

Using our collection is an excellent method to enhance the security of your form submission. Our expert attorneys routinely review all documents to ensure that the forms are applicable for a specific state and adhere to current laws and regulations.

If you don’t have an account yet, follow the steps outlined below.

Locate the template you need. Verify that it is the correct template you are looking for: review its title and summary, and use the Preview feature if it is available. Alternatively, utilize the Search box to find the necessary one.

- How can you obtain the Newark New Jersey Assumption Agreement of Mortgage and Release of Original Mortgagors.

- If you have an account, simply Log In to your profile. The Download option will be activated on all the documents you review.

- Furthermore, you can access all previously saved files in the My documents section.

Form popularity

FAQ

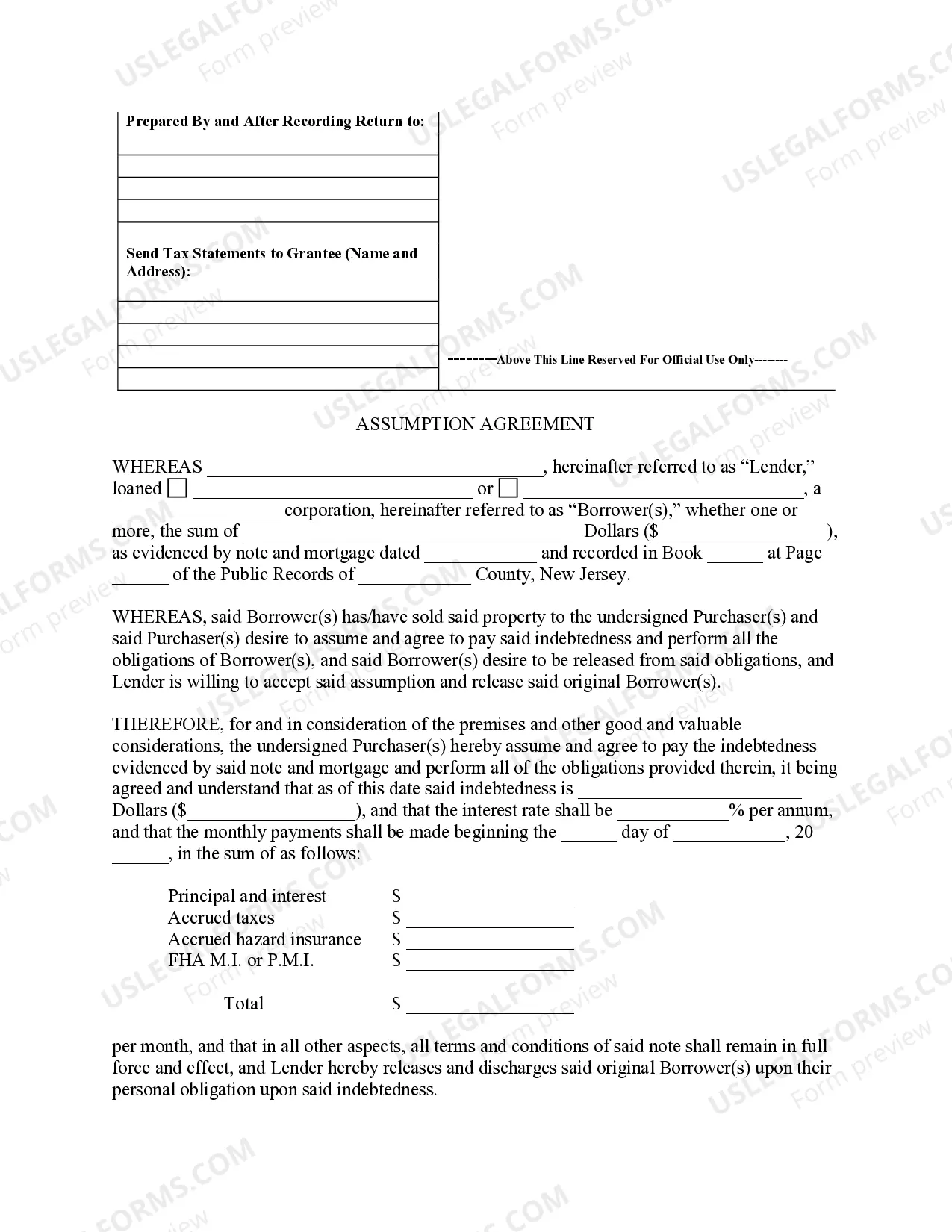

In the context of a Newark New Jersey Assumption Agreement of Mortgage and Release of Original Mortgagors, both the new borrower and the lender must sign the assumption agreement. The original mortgagor may also need to sign, depending on the specific terms of the agreement. By signing, all parties formally agree to the transfer of mortgage responsibilities. This process protects the interests of the lender while allowing the new borrower to take over the existing mortgage.

An assumption and release agreement is a formal document that outlines the terms under which one party assumes an existing mortgage while releasing the original mortgagor from liability. This type of agreement is crucial in the Newark New Jersey Assumption Agreement of Mortgage and Release of Original Mortgagors, ensuring that all parties are aware of their roles and responsibilities. It not only facilitates a smooth transfer of mortgage rights but also provides legal protection to everyone involved.

An assumption and release refers to the process where one borrower assumes a mortgage and the original borrower is released from all future obligations. In the Newark New Jersey Assumption Agreement of Mortgage and Release of Original Mortgagors, this means that once the new borrower accepts the mortgage terms, the original borrower is no longer liable. This transaction simplifies the mortgage transfer, making it a beneficial option for both parties.

The Newark New Jersey Assumption Agreement of Mortgage and Release of Original Mortgagors is designed to transfer the responsibility of a mortgage from one party to another. This process allows the new borrower to take over the payments and obligations of the existing mortgage. Ultimately, the assumption agreement protects the interests of both parties by ensuring clarity in the mortgage obligations.

In New Jersey, the statute of limitations for mortgage foreclosure is typically 20 years from the date of the default. However, various factors can affect the timeline, so it's wise to consult legal expertise to understand your specific situation. Knowing this helps homeowners and lenders navigate possible foreclosures effectively. For further assistance, you may explore the Newark New Jersey Assumption Agreement of Mortgage and Release of Original Mortgagors as part of your strategy.

Assuming a mortgage makes sense if you are selling your home without buying another. As well, if your current mortgage rate is low, and rates are on the rise, giving your buyer the opportunity to assume your mortgage might make your property that much more attractive.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.