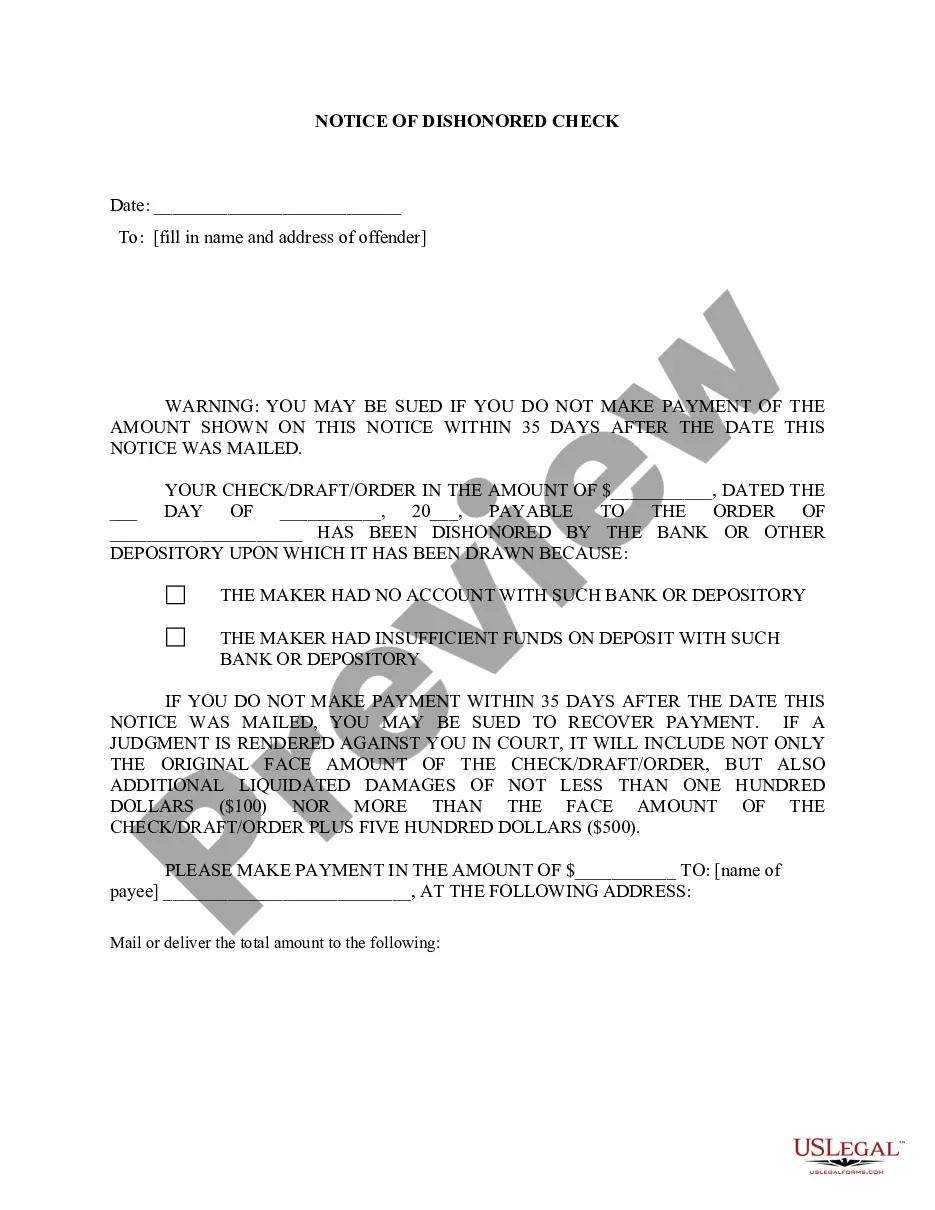

Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out New Jersey Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Take advantage of the US Legal Forms and gain prompt access to any form template you desire.

Our practical platform with a wide variety of templates simplifies the process of finding and obtaining nearly any document example you seek.

You can swiftly download, fill out, and certify the Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in just a few minutes, rather than spending hours searching the web for a suitable template.

Leveraging our catalog is an excellent approach to enhance the security of your document submissions.

If you haven't created an account yet, follow the steps below.

Locate the template you require. Ensure it matches your needs: review its title and description, and utilize the Preview feature if available. Otherwise, utilize the Search option to find the suitable one.

- Our qualified attorneys consistently evaluate all the documents to ensure that the templates are suitable for a specific region and comply with current laws and regulations.

- How can you obtain the Newark New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

- If you have an existing account, simply Log In.

- The Download button will be available for all documents you view.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

A bad check, commonly known as a bounced check, is one that cannot be processed due to insufficient funds or an account closure. Additionally, checks written with a stop payment request or unauthorized signatures also qualify as bad checks. Recognizing what constitutes a bad check is crucial to maintaining financial integrity. If you're facing issues related to a bad check, the Newark New Jersey Notice of Dishonored Check can guide your next steps.

To retrieve a bounced check, first reach out to the person or business that issued it. Often, they may be willing to issue a new check or resolve the issue amicably. If this approach doesn’t work, consider legal options to recover your funds, such as consulting with a legal expert. Utilizing the Newark New Jersey Notice of Dishonored Check may simplify the process of addressing a bounced check.

In New Jersey, a bad check can be classified as a felony if it exceeds $200. If you write a check for this amount or more without sufficient funds, you may face serious penalties. It's crucial to be aware of these limits to avoid unnecessary legal issues. The Newark New Jersey Notice of Dishonored Check process can provide further clarity on handling such situations.

Yes, you can face legal consequences for a bounced check in Newark, New Jersey. If a bounced check is not resolved, it could lead to criminal charges, fines, or even civil action. It is important to communicate with the recipient of the check and seek a resolution. Understanding the process related to a Newark New Jersey Notice of Dishonored Check can help you navigate these potential pitfalls.

The bad check law in New Jersey is primarily governed by N.J.S.A. 2C:21-5. This law establishes that writing a check without sufficient funds can lead to civil and potentially criminal consequences. It provides protections for individuals receiving checks while also outlining the penalties for check writers. Educating yourself about these regulations is essential for anyone involved in financial transactions, including those needing to navigate the Newark New Jersey Notice of Dishonored Check - Civil process.

In New Jersey, the statute of limitations for bad checks is generally six years. This time frame begins from the date the check was issued or from the date the check was dishonored. Knowing this limit is crucial because it affects your rights to seek civil action for a bounced check under the Newark New Jersey Notice of Dishonored Check - Civil laws. Being proactive can help you meet these deadlines.

To dispute a bounced check, first communicate with the check issuer to attempt resolution. If this conversation does not lead to reimbursement, you may need to escalate the situation legally. Filing a claim under the Newark New Jersey Notice of Dishonored Check - Civil statutes becomes necessary in this case. Utilizing services like uslegalforms can streamline this process by providing essential forms tailored for such disputes.

Checks may be returned or dishonored for various reasons, including insufficient funds, a closed account, or a stop payment request made by the check writer. Financial institutions have specific procedures for processing checks, and they typically notify the payee when a check bounces. Understanding these reasons is vital, especially if you have to deal with a Newark New Jersey Notice of Dishonored Check - Civil claim. Being informed empowers you as a check recipient.

If someone writes you a bad check, you have several recourse options available. You can approach the check writer to request payment, allowing them a chance to rectify the situation. Additionally, you may choose to file a complaint through the local courts, which can lead to civil proceedings under the Newark New Jersey Notice of Dishonored Check - Civil guidelines. Using platforms like uslegalforms can provide you with necessary legal documents to support your case.

In New Jersey, the statute concerning bad checks is outlined in N.J.S.A. 2C:21-5. This law specifies that issuing a bad check can be considered a criminal offense, depending on the amount of the check. If someone writes a check with insufficient funds, they may face civil liabilities or even criminal charges for issuing a bounced check. Understanding the Newark New Jersey Notice of Dishonored Check - Civil framework can help you navigate these situations effectively.