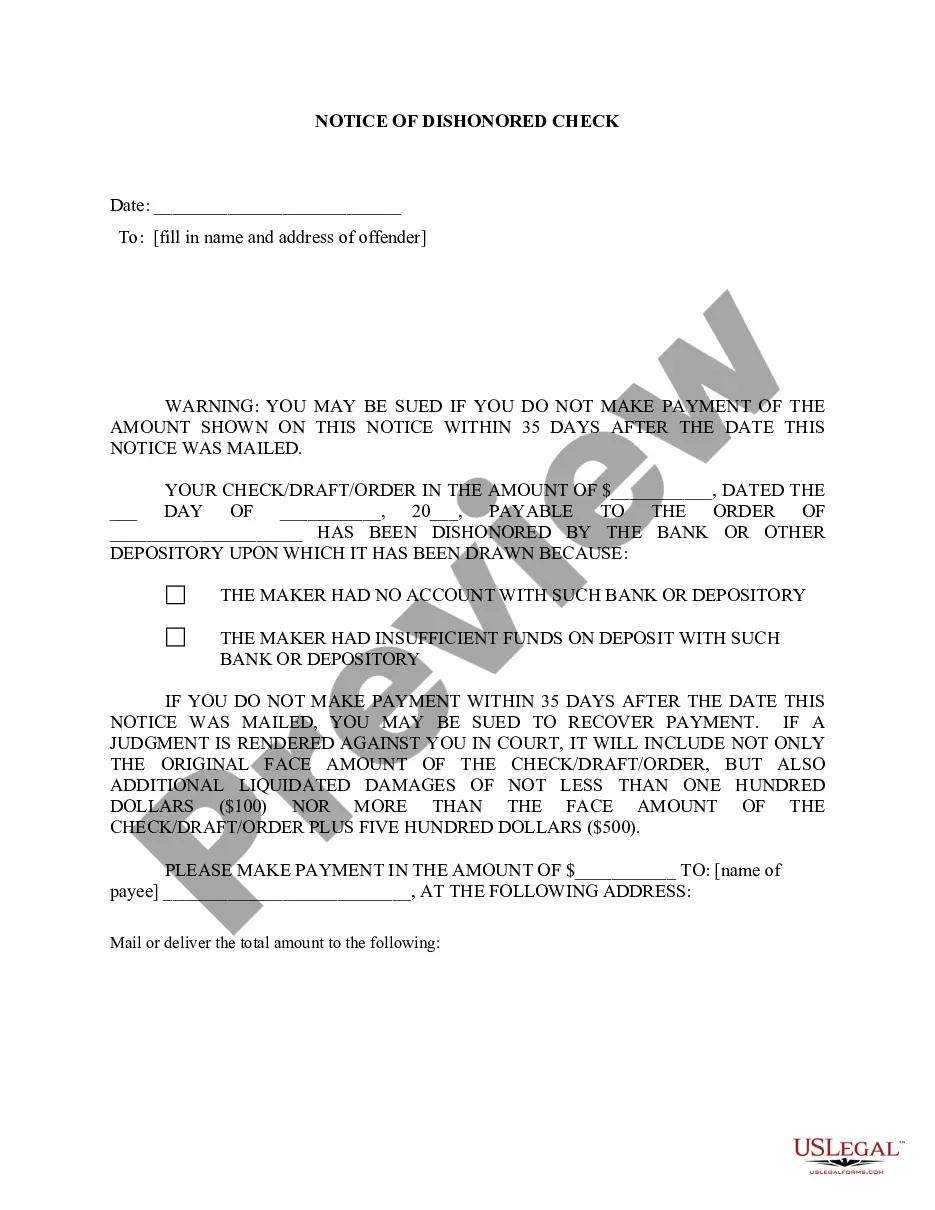

Elizabeth New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out New Jersey Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Are you in search of a reliable and budget-friendly provider of legal documents to acquire the Elizabeth New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? US Legal Forms is your ultimate choice.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce process in court, we have you covered. Our site provides over 85,000 current legal document templates for personal and business needs. All templates we offer are not generic and are structured according to the stipulations of particular states and regions.

To obtain the form, you must Log In to your account, locate the necessary form, and click the Download button beside it. Please keep in mind that you can retrieve your previously purchased form templates at any time in the My documents section.

Is this your first time visiting our site? No problem. You can easily create an account, but prior to that, ensure you do the following.

Now you can establish your account. Next, select a subscription plan and proceed with the payment. Once the payment is completed, you can download the Elizabeth New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in any available format. You can return to the website at any moment and download the form again at no cost.

Discovering current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time navigating legal documentation online once and for all.

- Confirm that the Elizabeth New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check aligns with the laws of your state and local area.

- Review the form’s specifics (if available) to understand who and what the form is applicable for.

- Restart the search if the form is not appropriate for your unique situation.

Form popularity

FAQ

If someone writes you a bad check, you have several options for recourse under New Jersey law. You can contact the check writer directly, write a demand letter, or file a claim in small claims court. Using resources like US Legal Forms can simplify the process and ensure you take the right steps to recover your funds. Being proactive can greatly improve your chances of resolution.

To properly write a demand letter, keep it formal and professional while outlining your case. Include essential information such as the check amount, date, and the reason for the demand. Make your expectations clear and set a deadline for payment. A well-prepared demand letter can serve as the foundation for legal action if necessary.

Consequences of writing a bad check can include civil penalties, criminal charges, and damage to your credit score. In Elizabeth, New Jersey, you may face fines or even jail time if the check is deemed fraudulent. Additionally, the recipient has the right to sue for the amount of the check plus any applicable fees. Understanding these repercussions can motivate timely resolution.

A strong demand payment letter should be concise and clear, outlining the details of the transaction, including the amount and date of the bad check. Make your request for payment unambiguous and set a deadline. Document your willingness to pursue further action if payment is not received. Utilizing the legal tools available on US Legal Forms can help formalize this process.

To write a demand letter for a bad check, start by clearly stating the situation and include pertinent details such as the check number and amount. Request payment within a specific timeframe, and specify the consequences of failing to respond. A well-crafted demand letter can encourage the check writer to settle the issue and prevent further legal action.

Writing a bad check over $500 can lead to serious consequences in New Jersey. It may be classified as a felony, resulting in potential jail time and fines. If you end up facing allegations, seeking legal advice is wise. Preventing such issues can save you from significant legal trouble.

In New Jersey, the statute regarding bad checks is primarily governed by N.J.S.A. 2C:21-5. This law outlines what constitutes a criminal offense related to writing bad checks. Write a bad check, and you risk criminal charges, depending on the amount. Familiarizing yourself with these laws can help you understand your rights and responsibilities.

Yes, there is a statute of limitations for bad checks in New Jersey. Generally, you have up to six years from the date the check was issued to take legal action. This means it's essential to act in a timely manner if you wish to recover funds from a bounced check. Knowing this timeframe can help protect your rights.

To report a bounced check in Elizabeth, New Jersey, you should first attempt to contact the check writer. If that fails, you can report the incident to local law enforcement or the district attorney's office. Keeping a record of the bounced check, along with any correspondence, is crucial for filing a formal complaint. Using platforms like US Legal Forms can help you with the necessary documentation.

A bad check is one that cannot be processed due to insufficient funds or an account closure. In Elizabeth, New Jersey, if a check you received bounces, it is classified as a bad check. This can lead to legal action and consequences for the individual who issued it. Understanding what constitutes a bad check can help you navigate your options.