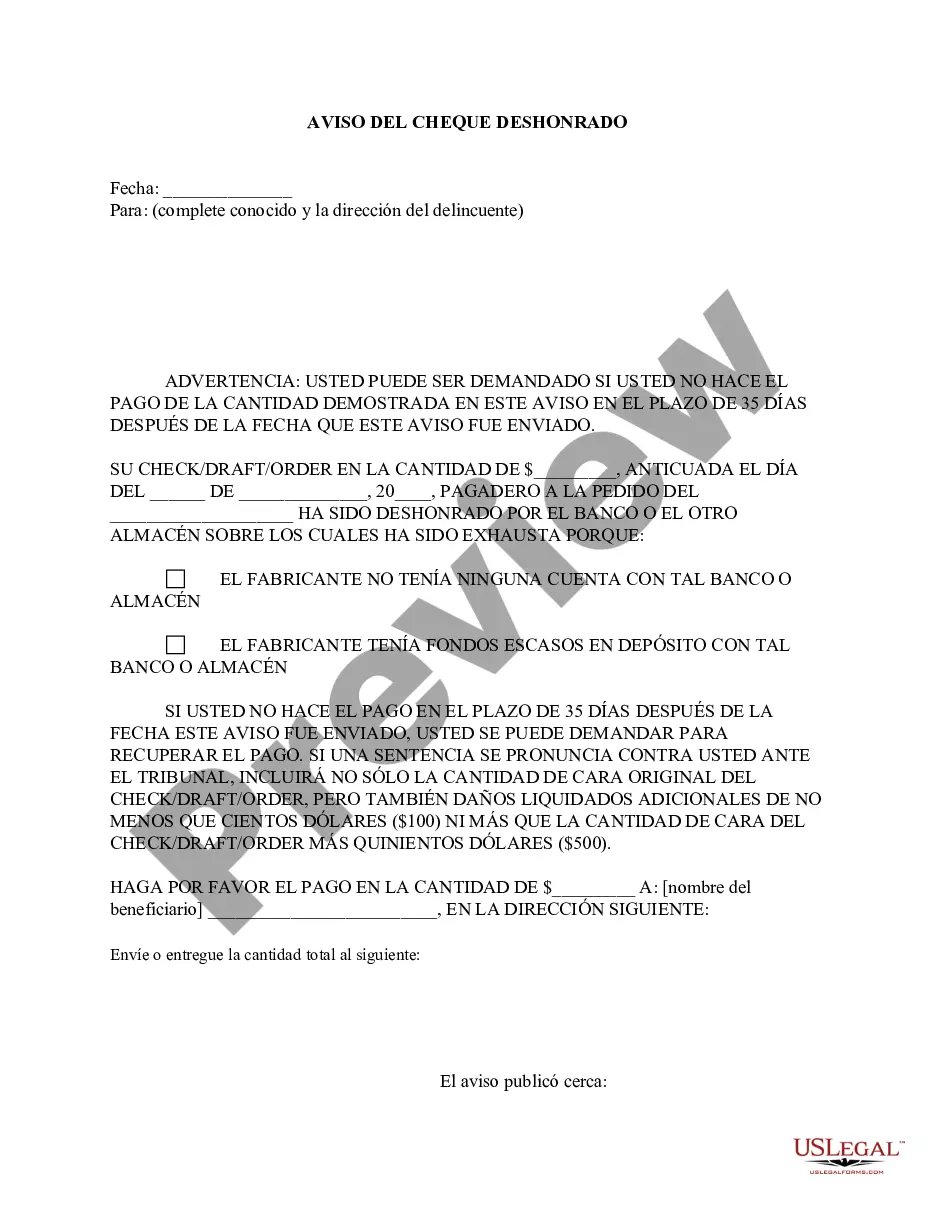

This is a Notice of Dishonored Check (Civil). A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Jersey City New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check - Spanish

Description

How to fill out New Jersey Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check - Spanish?

We consistently seek to reduce or evade legal complications when handling subtle legal or financial issues. To achieve this, we enlist attorney services that are typically very costly. However, not all legal situations are equally intricate. Most of them can be managed by ourselves.

US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to handle your matters independently without requiring legal advice. We offer access to legal form templates that are not always widely available. Our templates are specific to your state and region, which greatly simplifies the search process.

Utilize US Legal Forms whenever you need to locate and download the Jersey City New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check - Spanish or any other form promptly and securely. Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it from the My documents tab.

The process is just as simple if you’re new to the site! You can create your account in a few minutes.

For over 24 years in the industry, we’ve assisted millions by providing ready-to-customize and up-to-date legal documents. Make the most of US Legal Forms today to conserve time and resources!

- Ensure that the Jersey City New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check - Spanish complies with the laws and regulations of your state and area.

- It's important that you review the form’s description (if available), and if you notice any inconsistencies with what you initially needed, look for an alternative template.

- Once you’ve confirmed that the Jersey City New Jersey Notice of Dishonored Check - Civil - Keywords: bad check, bounced check - Spanish is suitable for your situation, you can choose the subscription plan and process the payment.

- You can then download the form in any preferred format.

Form popularity

FAQ

The bad check law in New Jersey mandates legal penalties for writing checks that cannot be honored. If a person issues a check knowing that there are insufficient funds, they may be held liable for damages. Awareness of this law is essential when dealing with a Jersey City New Jersey Notice of Dishonored Check, as it outlines your responsibilities and potential consequences. For further assistance and accessibility to essential legal documents, uslegalforms can help you navigate this complex area.

A bad check refers to a check that cannot be processed due to insufficient funds, a closed account, or other issues. In essence, if the check cannot be cashed or cleared, it falls into this category. Knowing the laws surrounding bad checks, particularly in New Jersey, can aid individuals in handling situations effectively, especially when it pertains to a Jersey City New Jersey Notice of Dishonored Check. Uslegalforms provides legal documents and guidance to assist you in these situations.

The term 'bounced check' stems from the way the check is returned to the payee. When a check is dishonored, it 'bounces' back from the bank, indicating that the payment could not be processed. This phrase has become common parlance, especially in discussions about the Jersey City New Jersey Notice of Dishonored Check, as it captures the essence of the problem. For individuals dealing with such situations, uslegalforms offers solutions to manage and understand the repercussions.

Yes, you may face challenges if someone writes you a bad check. In some cases, you could be reported as a victim, but it’s essential to act quickly to resolve the situation. Understanding your rights and options in such scenarios, particularly regarding notices of dishonored checks in Jersey City, New Jersey, is crucial. Legal platforms like USLegalForms can guide you through the necessary steps.

To report a bounced check in New Jersey, first gather relevant details such as the check number, amount, and the issuer's information. Contact your bank to understand their procedures for reporting dishonored checks. You may also consider filing a complaint with local authorities or seeking advice through legal resources like USLegalForms for assistance with the reporting process.

When writing a bounced check letter, express your acknowledgment of the bad check and provide clear details. Include your contact information, the date of the check, and how you plan to rectify the situation. It's crucial to maintain a professional tone and take responsibility for the oversight, especially when addressing issues involving bad checks in Jersey City, New Jersey. Consider using templates available on platforms like USLegalForms for a straightforward approach.

Writing a bad check over $500 in New Jersey can lead to more serious penalties, including potential felony charges. This could result in greater fines and even jail time. Understanding these potential consequences is essential, especially when dealing with cases of dishonored checks in Jersey City, New Jersey. If you find yourself in this situation, seeking legal assistance via platforms like USLegalForms may help.

Yes, New Jersey imposes a statute of limitations on bad checks. Generally, the timeframe is five years from the date the check was issued. After this period, you may not face legal action for the dishonored check. However, for the most accurate guidance, consulting resources like USLegalForms can be beneficial.

In New Jersey, if you write a bad check, the law classifies this as a criminal offense. The statute specifies that issuing a check without sufficient funds can lead to serious consequences. It is important to understand this law to avoid potential penalties in Jersey City, New Jersey, related to notices of dishonored checks. Individuals can seek information from legal resources or platforms like USLegalForms for guidance.

To retrieve a bounced check, contact the payee directly and discuss the situation. It may require restitution or negotiation for a different form of payment. If informal attempts are unsuccessful, formal actions such as utilizing the Jersey City New Jersey Notice of Dishonored Check services might be necessary to recover the funds. Ensuring clear communication can often lead to a smoother resolution.