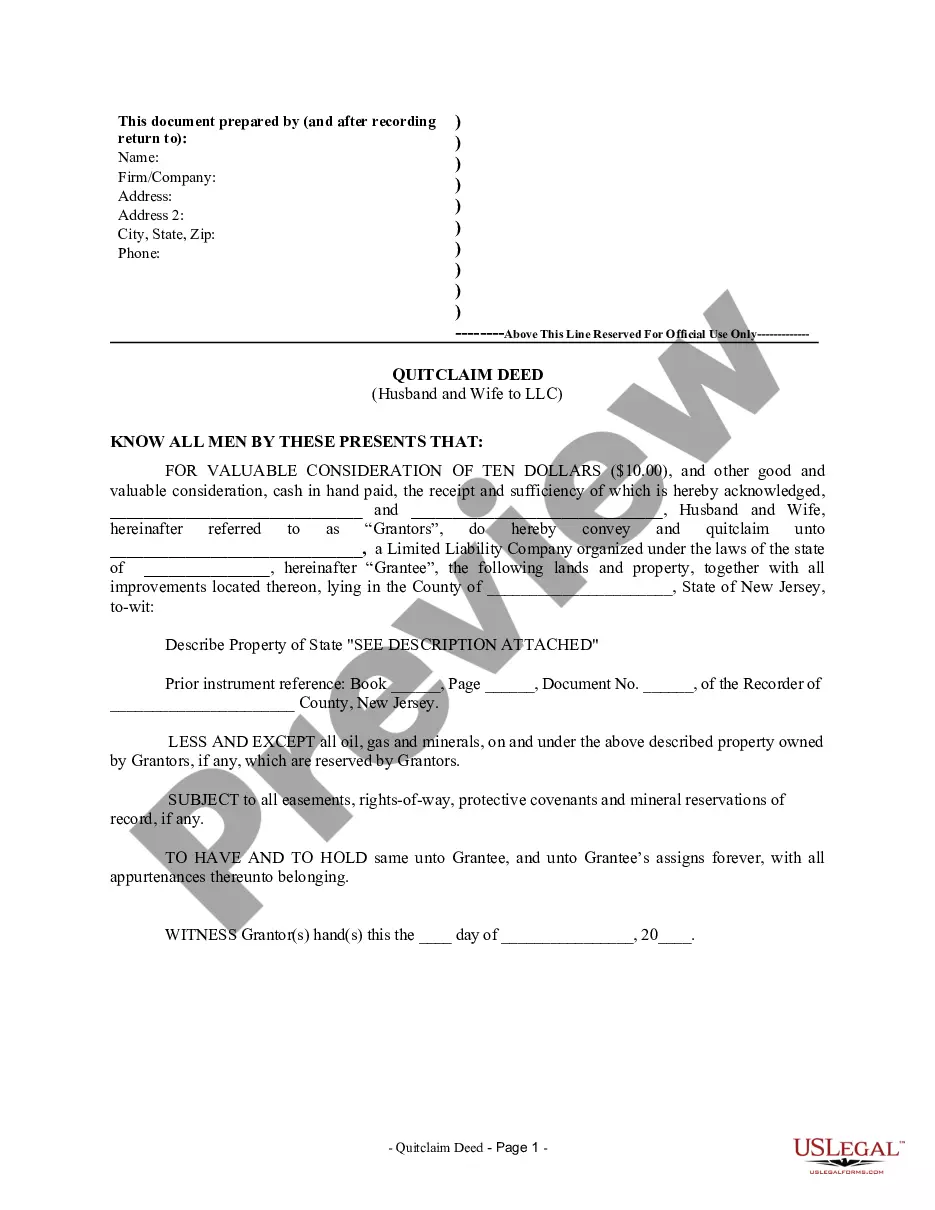

Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out New Jersey Quitclaim Deed From Husband And Wife To LLC?

Utilize the US Legal Forms and gain immediate access to any form example you desire.

Our user-friendly platform with a vast collection of document templates simplifies the process of locating and acquiring practically any document sample you need.

You can download, fill out, and sign the Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC within minutes instead of spending hours online looking for the perfect template.

Using our catalog is an excellent method to enhance the security of your form submissions.

If you haven't created an account yet, follow the steps outlined below.

Locate the form you need. Ensure that it is the correct form you were looking for: verify its title and description, and use the Preview feature if available. Otherwise, utilize the Search box to find the suitable one.

- Our knowledgeable legal experts routinely verify all records to ensure that the forms meet the requirements for specific states and comply with current laws and regulations.

- How can you obtain the Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC.

- If you have a subscription, simply Log In to your account.

- The Download button will be displayed on all the samples you view.

- Additionally, you can access all your previously saved files in the My documents section.

Form popularity

FAQ

The best type of deed for a married couple often depends on their specific situation; however, a quitclaim deed is commonly used for its simplicity and efficiency. An Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC is an excellent choice when couples wish to shift property into a business framework. Understanding the advantages of different deeds can help couples make the right decision.

Many individuals put property into an LLC for asset protection and liability limitations. By creating an Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC, owners can protect personal assets from business liabilities. This structure also facilitates easier management of rental properties or investment real estate.

An Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC allows a married couple to transfer their ownership share of a property to an LLC. This type of deed does not guarantee that the title is clear; it merely conveys whatever interest the couple holds. It is a straightforward way to formalize ownership changes, especially for business or investment purposes.

While it's not legally required to have a lawyer to transfer a deed in New Jersey, having legal assistance can simplify the process and prevent potential issues. A lawyer can ensure that the Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC is completed correctly. Their expertise can be especially valuable in complex transactions.

To transfer a deed to an LLC, you need to execute an Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC, properly naming the LLC as the new owner. Next, you should file this deed with the county clerk or recorder's office where the property is located. Following proper procedures ensures a smooth transfer and protects your interests.

Transferring property ownership to an LLC can have various tax implications. Generally, the IRS treats most transfers as sales, which may lead to capital gains tax if the property has appreciated. It's advisable to consult a tax professional to fully understand the consequences of using an Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC.

While there are advantages to using an LLC, such as liability protection, it may also introduce some drawbacks. For instance, property held in an LLC may face higher taxes and potential legal challenges regarding transfer and ownership. Understanding these factors can clarify whether using an Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC is suitable for you.

People frequently use an Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC when transferring property ownership without clearing up any financial claims on the property. This deed is often used among family members or to simplify property transfers into an LLC. It allows couples to convert personal property into business assets quickly and efficiently.

Spouses often consider using a quit claim deed for several reasons, including estate planning, simplifying asset ownership, or transferring property into a business structure like an LLC. The Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC can help streamline legal affairs and potentially protect assets. Additionally, it can provide clarity in ownership, especially in cases of divorce or asset distribution.

When a spouse signs a quit claim deed in New Jersey, they generally relinquish their rights to that property. In the context of an Elizabeth New Jersey Quitclaim Deed from Husband and Wife to LLC, once the deed is executed, the spouse that signed it usually cannot claim ownership of the property against the LLC. However, it's wise to consult with a legal expert to understand specific circumstances and ensure your rights are protected.