Elizabeth New Jersey Business Registration Package including Nonprofit

Description

How to fill out New Jersey Business Registration Package Including Nonprofit?

Do you require a trustworthy and affordable provider of legal document templates to obtain the Elizabeth New Jersey Business Registration Package that includes Nonprofit.

US Legal Forms is your preferred option.

Whether you need a straightforward contract to establish rules for living with your partner or a collection of documents to progress your divorce through the legal system, we’ve got you covered.

Our website features over 85,000 current legal document templates for both personal and commercial purposes. All templates available for access are tailored and designed according to the stipulations of specific states and regions.

Review the details of the form (if available) to understand who the document is meant for and its intended purpose.

If the template does not suit your legal circumstances, start your search again.

- To acquire the document, you must sign in to your account, locate the desired template, and click the Download button next to it.

- Please note that you can retrieve your previously purchased document templates at any time via the My documents section.

- Is this your initial visit to our site? No need to fret.

- You can create an account in minutes, but before proceeding, make sure to do the following.

- Verify if the Elizabeth New Jersey Business Registration Package, including Nonprofit, complies with your state and local regulations.

Form popularity

FAQ

To register a non-profit in New Jersey, start by choosing a name that complies with state regulations. Next, prepare and file the Certificate of Incorporation with the New Jersey Division of Revenue and Enterprise Services. You can simplify this process by using the Elizabeth New Jersey Business Registration Package including Nonprofit, which guides you through necessary documentation and helps you understand compliance requirements. After filing, apply for federal tax-exempt status to ensure your organization can operate without paying certain taxes.

To open a non-profit in New Jersey, start by drafting your organization's bylaws and a mission statement. Next, you will need to file your Certificate of Incorporation with the New Jersey Division of Revenue and Enterprise Services. Additionally, consider obtaining an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes. To streamline the process and ensure compliance, you might want to utilize the Elizabeth New Jersey Business Registration Package including Nonprofit from uslegalforms, which provides all necessary documents and guidance for successful establishment.

The approval time for a nonprofit can vary, often taking anywhere from two to six months depending on your application and the workload of the IRS. After submitting your application for tax-exempt status, the IRS will review your application for completeness and compliance. By using the Elizabeth New Jersey Business Registration Package including Nonprofit, you can help avoid common pitfalls and reduce potential delays in the approval process.

Starting a nonprofit in New Jersey typically takes a few weeks to a couple of months. First, you must file the necessary paperwork, which includes the Certificate of Incorporation, with the New Jersey Division of Revenue. After that, you may need to wait for approval from the IRS for your tax-exempt status. Utilizing the Elizabeth New Jersey Business Registration Package including Nonprofit can streamline this process, ensuring you complete every step accurately and efficiently.

Yes, nonprofits can be exempt from sales tax in New Jersey under certain conditions. However, to qualify for this exemption, your organization must be registered as a nonprofit and have the appropriate paperwork. The Elizabeth New Jersey Business Registration Package including Nonprofit includes all necessary documentation and guidance to help you understand and obtain your tax-exempt status efficiently. By utilizing our platform, you not only gain access to the correct forms but also to experts who can assist you throughout the process.

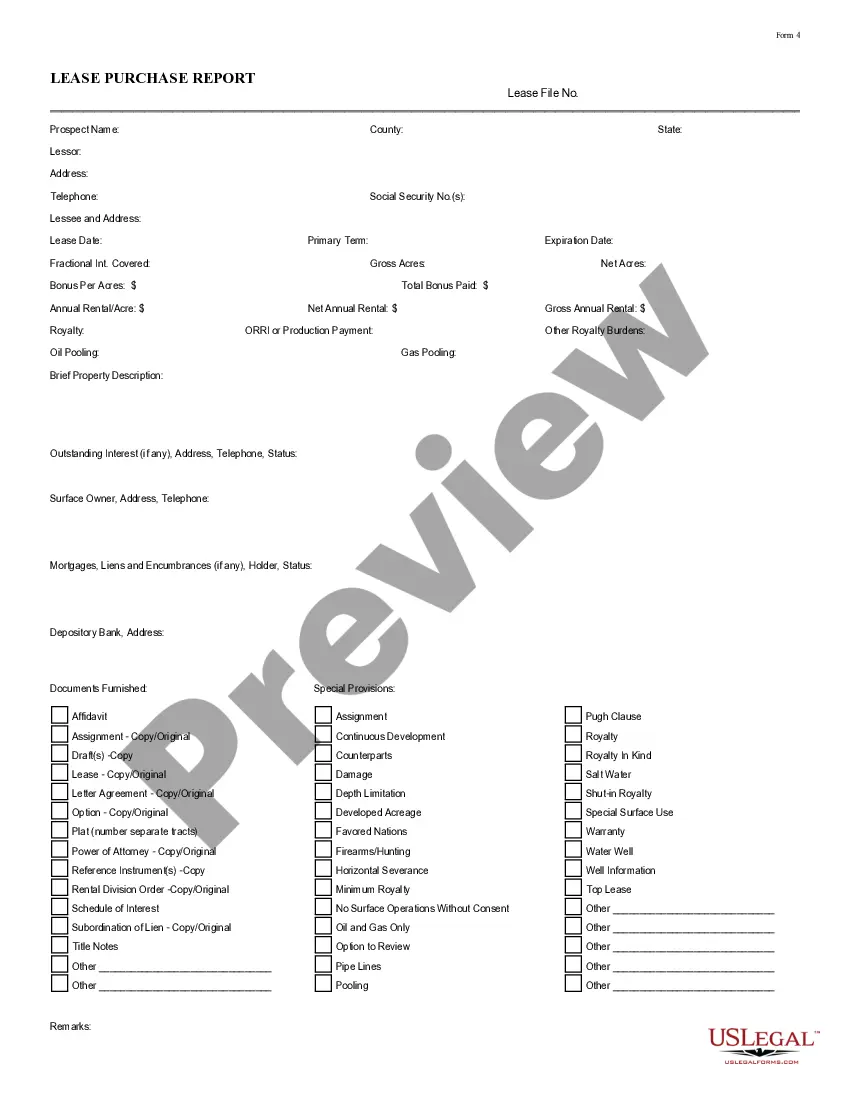

To register a business in New Jersey, you typically need to select a business structure, such as a corporation or LLC, and gather necessary documents. You will need to provide identification, your business name, and a registered agent. The Elizabeth New Jersey Business Registration Package including Nonprofit simplifies this process by offering all essential forms and guidance, ensuring you meet state requirements efficiently. Additionally, using our platform can help streamline your registration, saving you time and reducing stress.

An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Income Tax Return for Estates and Trusts.

File Form NJ-REG (Business Registration Application) to register with the state to collect/remit New Jersey taxes such as sales tax or employee withholdings, and to obtain a New Jersey tax identification number. You can register online or file a paper application.

Submitting Your New Jersey LLC Documents The process to file paperwork typically gets completed online, but there is a business registration packet available; you must complete pages 17 through 19, or Form NJ-REG. The fee is $125 for all for-profit entities and foreign nonprofit entities.

To maintain an LLC in New Jersey you will need to pay an annual fee of $75 along with state income tax at 6.625%, state sales tax and federal taxes. You need to be familiar with the requirements and the process of Foreign LLC registration before you file your application.