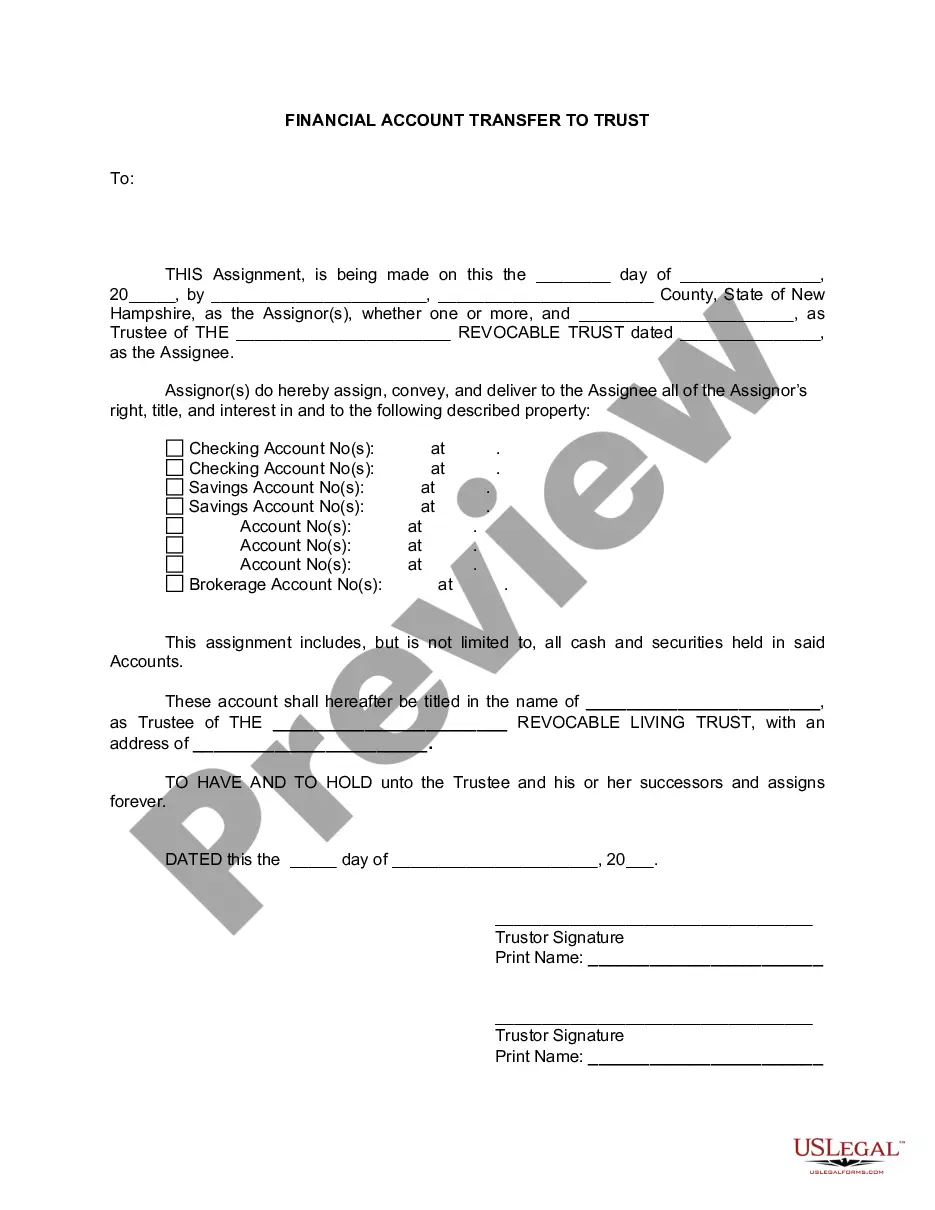

Manchester New Hampshire Financial Account Transfer to Living Trust

Description

How to fill out New Hampshire Financial Account Transfer To Living Trust?

Do you require a reliable and affordable legal document provider to purchase the Manchester New Hampshire Financial Account Transfer to Living Trust? US Legal Forms is your premier resource.

Whether you want a simple agreement to establish rules for living together with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business use. All templates we provide are customized according to the regulations of individual states and regions.

To acquire the document, you must Log In to your account, find the required template, and click the Download button adjacent to it. Please remember that you can download your previously purchased document templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can set up an account in just a few minutes, but first, ensure to do the following.

Now you can establish your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Manchester New Hampshire Financial Account Transfer to Living Trust in any offered file format. You can revisit the website at any time and re-download the document at no cost.

Obtaining updated legal documents has never been simpler. Give US Legal Forms a try now, and stop wasting your valuable time researching legal papers online for good.

- Verify if the Manchester New Hampshire Financial Account Transfer to Living Trust meets the laws of your state and locality.

- Review the form's specifics (if available) to understand for whom and what the document is designed.

- Reinitiate the search if the template is not applicable to your legal situation.

Form popularity

FAQ

To transfer your bank account to a living trust, start by contacting your bank and asking for the required documentation. This process will usually involve completing a form to assign the account to your trust. If you face challenges or require further guidance, US Legal Forms can assist you with the Manchester New Hampshire Financial Account Transfer to Living Trust.

The downside of putting assets in a trust includes the potential loss of control over those assets. Once assets are transferred, they are subject to the terms of the trust, which may restrict how you use them. Understanding these implications is vital when considering the Manchester New Hampshire Financial Account Transfer to Living Trust.

Transferring your brokerage account to a living trust typically involves contacting your brokerage firm and requesting the necessary forms. You'll need to provide information regarding the trust and its beneficiaries while ensuring all documentation is complete. If you are unsure about the process, utilizing resources from US Legal Forms can simplify your Manchester New Hampshire Financial Account Transfer to Living Trust.

One of the biggest mistakes parents make when setting up a trust fund is failing to transfer assets into the trust after its creation. This step is crucial because without transferring assets, the trust cannot function as intended. Properly handling your Manchester New Hampshire Financial Account Transfer to Living Trust is essential to ensure seamless execution of your estate plans.

A significant downfall of having a trust can be the ongoing management responsibilities it entails. Grantors must keep the trust up to date and comply with legal requirements, which might be overwhelming for some. Moreover, without proper guidance, such as offered by US Legal Forms, misunderstandings can lead to issues in Manchester New Hampshire Financial Account Transfer to Living Trust.

It's often beneficial for parents to consider putting their assets in a trust to manage wealth transfer efficiently. A trust can help avoid probate and protect assets from creditors, ensuring smooth transition for family members. However, it is vital to evaluate their specific needs and consult with an expert in Manchester New Hampshire Financial Account Transfer to Living Trust to make an informed decision.

One major disadvantage of a family trust is the complexity involved in setting it up. You need to carefully manage the trust to ensure it operates correctly, which may require ongoing legal assistance. Additionally, the initial costs can be significant, and there could be tax implications that complicate Manchester New Hampshire Financial Account Transfer to Living Trust.

To transfer your house into a trust in New Hampshire, first, you need to create a trust document that specifies the terms of the trust. Next, prepare a new deed that transfers ownership of your property to the trust. It's essential to record this deed with your local registry of deeds to make the transfer legally binding. For assistance with the Manchester New Hampshire Financial Account Transfer to Living Trust process, consider using UsLegalForms, which provides step-by-step guidance and necessary templates to simplify your experience.

When you consider a Manchester New Hampshire Financial Account Transfer to Living Trust, it's essential to recognize some disadvantages. First, transferring your house into a trust might involve upfront costs, including legal fees and potential tax implications. Additionally, you may lose some control over the property, as it now falls under the trust’s terms. Lastly, lenders can sometimes see property in a trust as a higher risk, which may impact your ability to refinance your mortgage.

Putting a brokerage account in a trust offers several benefits, including managing your assets more effectively and ensuring a smooth transfer of wealth. By designating a trust, you streamline the inheritance process, making it easier for your beneficiaries to access their assets after your passing. Additionally, utilizing a trust as part of your estate planning can provide privacy and possibly reduce estate taxes. Consider using services like uslegalforms to facilitate the Manchester New Hampshire Financial Account Transfer to Living Trust efficiently.