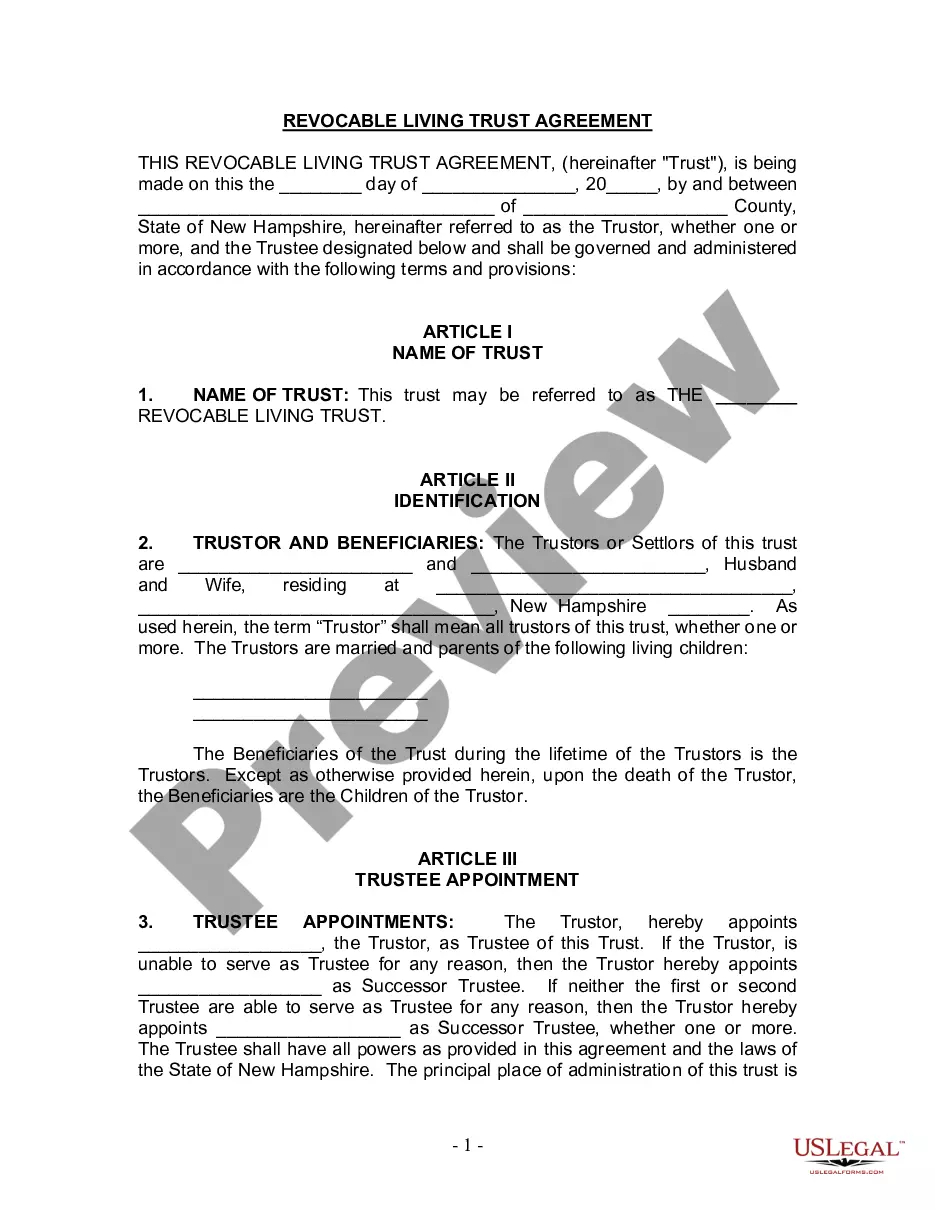

Manchester New Hampshire Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out New Hampshire Living Trust For Husband And Wife With Minor And Or Adult Children?

Locating authenticated templates tailored to your local laws can be challenging unless you utilize the US Legal Forms database.

It’s a digital compilation of over 85,000 legal documents for both personal and professional requirements, covering various real-world scenarios.

All the files are aptly categorized by area of use and jurisdictional sectors, making the search for the Manchester New Hampshire Living Trust for Husband and Wife with Minor and or Adult Children as simple as one, two, three.

Keeping documentation organized and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to have vital document templates readily available for any requirements!

- Examine the Preview mode and form details.

- Ensure you’ve selected the correct one that fulfills your needs and aligns with your local jurisdiction criteria.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one.

- Proceed to the next step if it meets your standards.

Form popularity

FAQ

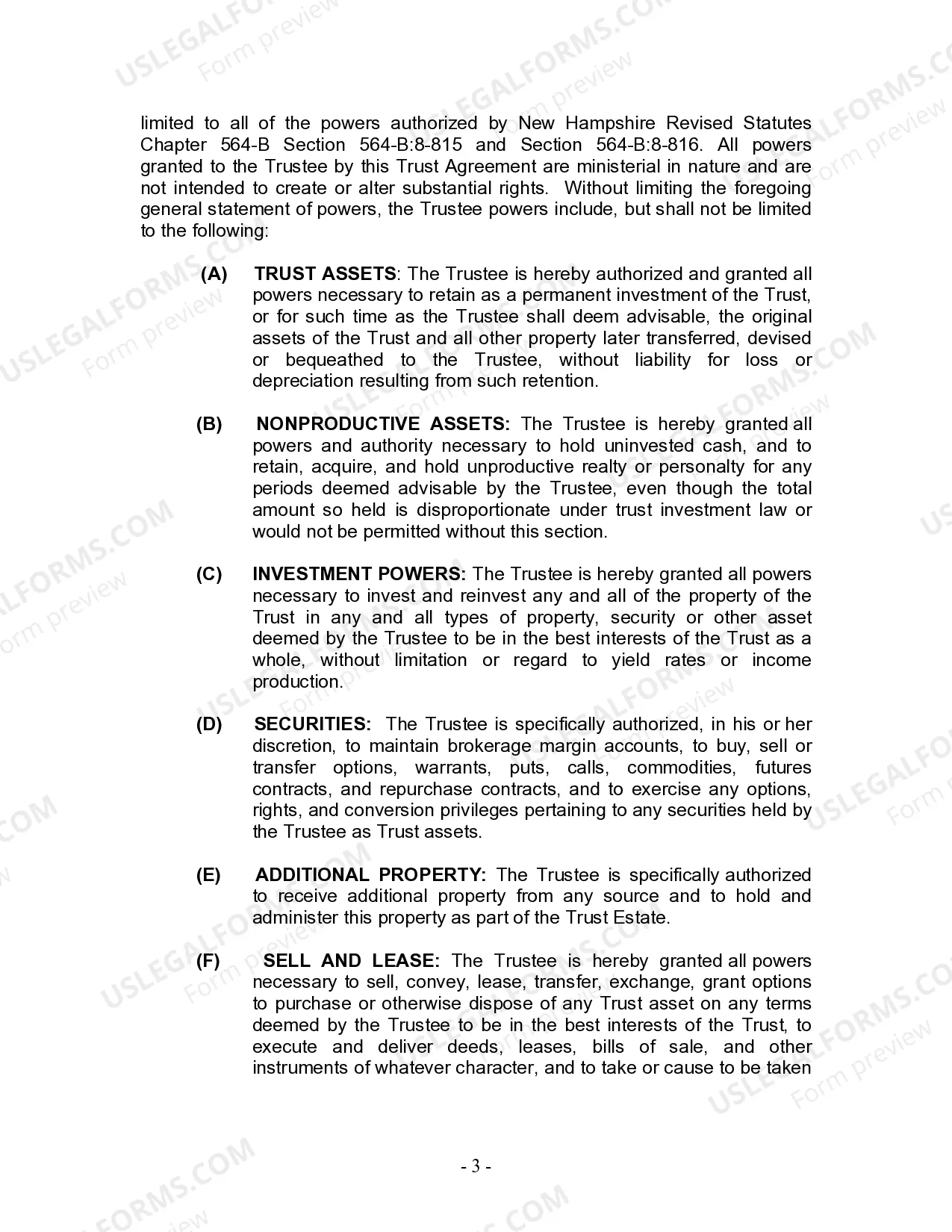

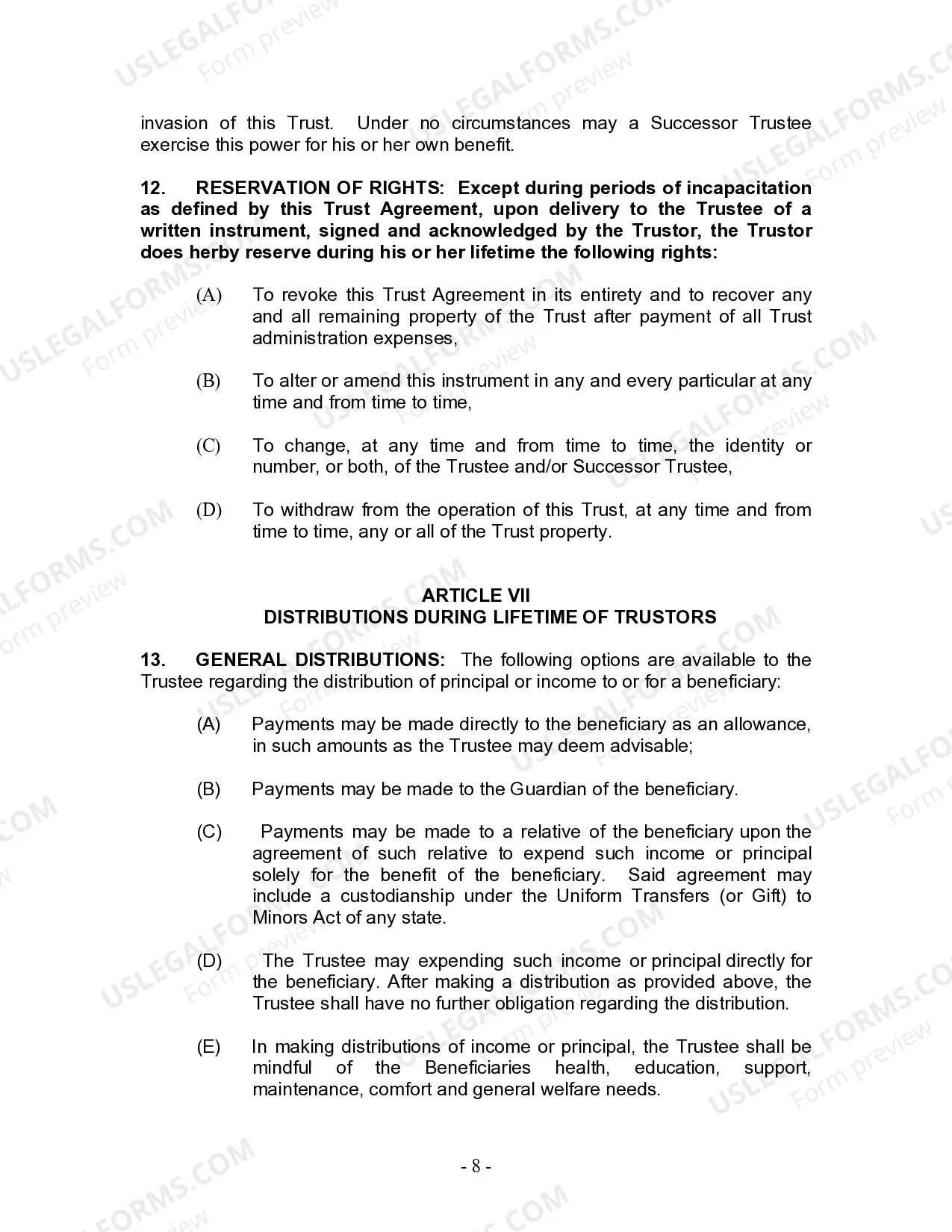

The best living trust for a married couple often depends on their unique situation, especially when considering a Manchester New Hampshire Living Trust for Husband and Wife with Minor and or Adult Children. A revocable living trust allows for flexibility, enabling couples to manage their assets during their lifetime while providing for their children in case of unforeseen events. Moreover, it simplifies the transfer of assets, avoiding probate and ensuring that your wishes are followed. Using resources like USLegalForms can help you create a trust that meets your specific needs and secures your family's future.

Whether a husband and wife should have separate living trusts depends on their individual circumstances and financial goals. For many couples, a joint Manchester New Hampshire Living Trust for Husband and Wife with Minor and or Adult Children offers simplicity and shared benefits. However, separate trusts may be beneficial in certain scenarios, such as when one partner has significant debts or children from a previous relationship. Consulting with an estate planning professional can help clarify the best approach.

Yes, a trust typically needs to be notarized in New Hampshire to ensure its legality and validity. Notarization adds a layer of protection, ensuring that the intentions expressed in your Manchester New Hampshire Living Trust for Husband and Wife with Minor and or Adult Children are honored. By having the trust document notarized, you also help prevent potential disputes among beneficiaries in the future.

To establish a trust in New Hampshire, you need to draft a trust document that details how your assets will be managed and distributed. It is essential to identify the beneficiaries, especially if you are creating a Manchester New Hampshire Living Trust for Husband and Wife with Minor and or Adult Children. Once you've drafted the document, you should sign it in front of a notary public and fund the trust by transferring assets into it.

The biggest mistake parents often make when setting up a trust fund is failing to properly fund the trust after its creation. Without transferring assets into a Manchester New Hampshire Living Trust for Husband and Wife with Minor and or Adult Children, the trust cannot serve its purpose. Another common oversight is not addressing contingency plans for their children’s needs as they grow. To avoid these pitfalls, consider consulting with professionals who can offer guidance throughout the process.

To create a Manchester New Hampshire Living Trust for Husband and Wife with Minor and or Adult Children, start by determining your assets and deciding how you want to distribute them. You can then use online resources, like US Legal Forms, to access templates that guide you through the process. It's advisable to consult with a legal professional to ensure the trust complies with New Hampshire laws and reflects your wishes accurately. Once completed, you will need to transfer your assets into the trust.

One downside of a Manchester New Hampshire Living Trust for Husband and Wife with Minor and or Adult Children is that it requires initial time and effort to create. Unlike a will, a living trust must be funded properly, which means transferring assets into it. Additionally, while a living trust helps avoid probate, it does not protect against estate taxes. Understanding these aspects is essential before establishing your trust.