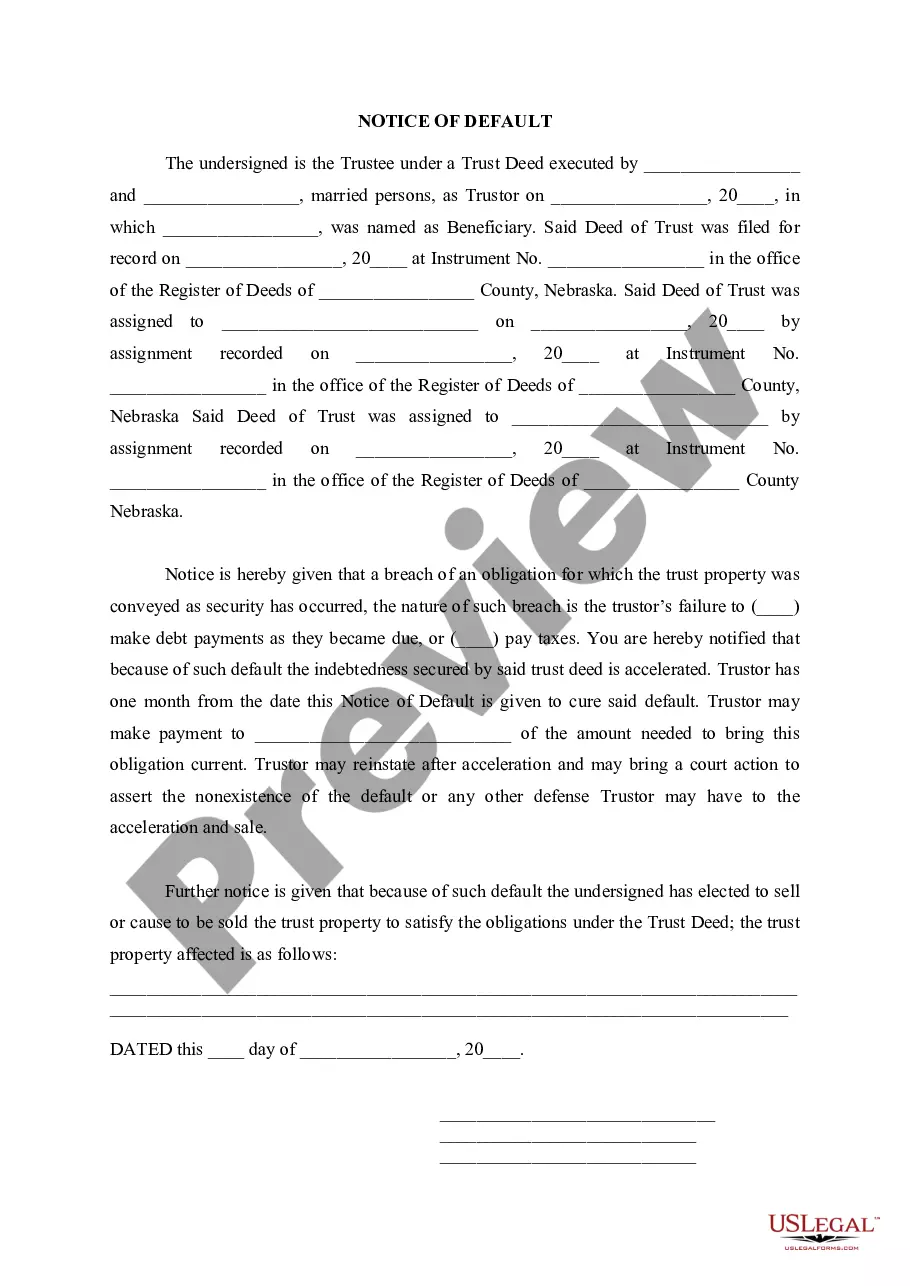

Omaha Nebraska Notice of Default

Description

How to fill out Nebraska Notice Of Default?

Do you require a reliable and economical legal forms provider to acquire the Omaha Nebraska Notice of Default? US Legal Forms is your ideal answer.

Whether you need a fundamental arrangement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the court, we've got you supported.

Our site offers over 85,000 current legal document templates for personal and business purposes. All templates that we provide are not generic and are customized based on the specifications of individual state and locality.

To obtain the document, you must Log In to your account, find the necessary form, and click the Download button beside it. Please remember that you can download your previously acquired document templates at any time from the My documents tab.

Now you can set up your account. Then choose the subscription plan and move forward to payment. After the payment is completed, download the Omaha Nebraska Notice of Default in any provided format. You can return to the website at any moment and redownload the document at no cost.

Finding current legal documents has never been simpler. Try US Legal Forms today and stop spending hours deciphering legal forms online for good.

- Is this your first visit to our website? Don't worry.

- You can create an account with ease, but before that, ensure to do the following.

- Check if the Omaha Nebraska Notice of Default adheres to the statutes of your state and locality.

- Review the form’s specifics (if available) to understand who and what the document is meant for.

- Reinitiate the search if the form isn’t suitable for your legal situation.

Form popularity

FAQ

3 benefits of foreclosure that you may not realize You can negotiate the terms of your loan. While you may think a foreclosure automatically means you'll lose your home, that's not always the case.Foreclosures help you save money.Foreclosures give you a fresh start.

Most Nebraska foreclosures are non-judicial under power of sale in trust or deed, so the civil courts are not involved in the process. Instead, the mortgage holder has to give borrowers notice before any sale of the property can take place.

How Can I Stop a Foreclosure in Nebraska? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

How Long Does a Nebraska Foreclosure Take? It will take between 90 ? 120 days for the completion of an uncontested non-judicial foreclosure. A judicial foreclosure can take between three and nine months, depending on whether the borrower delays the sale.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. Foreclosure and COVD-19 Relief. The Bottom Line.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

The Most Commonly Used Foreclosure Procedure In the State A foreclosure can be either: judicial (the foreclosing party files a lawsuit, and the case goes through the court system) or. nonjudicial (the foreclosing party follows a set of state-specific, out-of-court procedural steps to foreclose).

Foreclosed properties are often in poor condition and may require extensive and expensive renovations. It's important to thoroughly research the property as well. Are there any outstanding liens on the property you'd be responsible for paying for?

6 Ways To Stop A Foreclosure Work It Out With Your Lender.Request A Forbearance.Apply For A Loan Modification.Consult A HUD-Approved Counseling Agency.Conduct A Short Sale.Sign A Deed In Lieu Of Foreclosure.

How Long Does a Nebraska Foreclosure Take? It will take between 90 ? 120 days for the completion of an uncontested non-judicial foreclosure. A judicial foreclosure can take between three and nine months, depending on whether the borrower delays the sale.