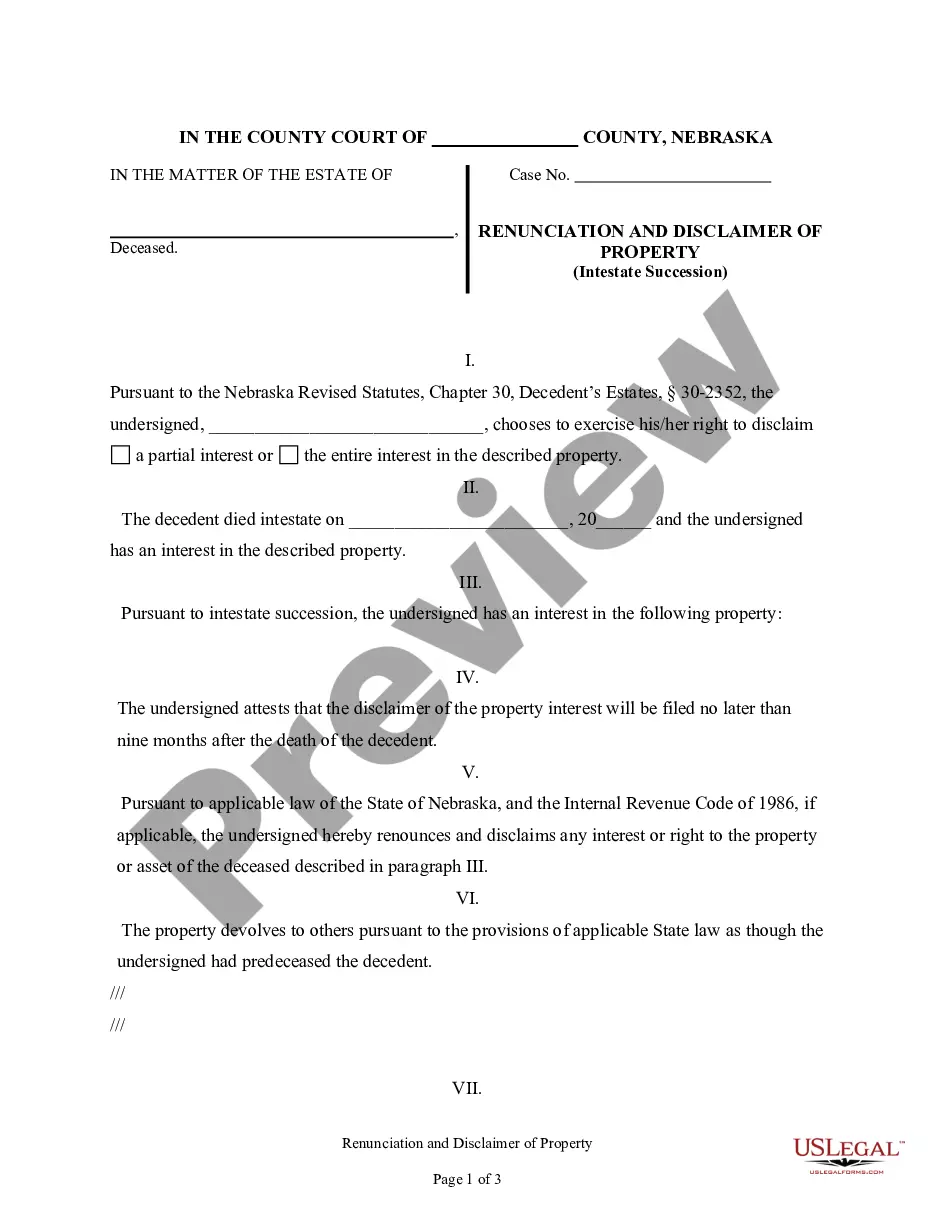

Renunciation And Disclaimer of Property received by Intestate Succession

Disclaimer of Property Interest-Nebraska

Nebraska Revised Statutes

Chapter 30. Decedents' Estates

Renunciation of succession.

(a)

(1) A person (or the representative of a deceased, incapacitated,

or protected person) who is an heir, devisee, person succeeding to a renounced

interest, donee, beneficiary under a testamentary or nontestamentary instrument,

donee of a power of appointment, grantee, surviving joint owner or surviving

joint tenant, beneficiary, or owner of an insurance contract or any incident

of ownership therein, beneficiary or person designated to take pursuant

to a power of appointment exercised by a testamentary or nontestamentary

instrument, person who has a statutory entitlement to or election with

respect to property pursuant to the Nebraska Probate Code, or recipient

of any beneficial interest under any testamentary or nontestamentary instrument,

may renounce in whole or in part, or with reference to specific parts,

fractional shares, undivided portions or assets thereof, by filing a written

instrument of renunciation within the time and at the place hereinafter

provided.

(2) The instrument shall (i) describe the property or part thereof

or the interest therein renounced, (ii) be signed and acknowledged by the

person renouncing in the manner provided for in the execution of deeds

of real estate, (iii) declare the renunciation and the extent thereof,

and (iv) declare that the renunciation is an irrevocable and unqualified

refusal to accept the renounced interest.

(3) The appropriate court in a proceeding under section 30-2806,

may direct or permit a trustee under a testamentary or nontestamentary

instrument to renounce, modify, amend, or otherwise deviate from any restriction

on or power of administration, management or allocation of benefit upon

finding that such restrictions on the exercise of such power may defeat

or impair the accomplishment of the purposes of the trust whether by the

imposition of tax or the allocation of beneficial interest inconsistent

with such purposes or by other reason. Such authority shall be exercised

after hearing and upon notice to all known persons beneficially interested

in such trust, in the manner directed by said court.

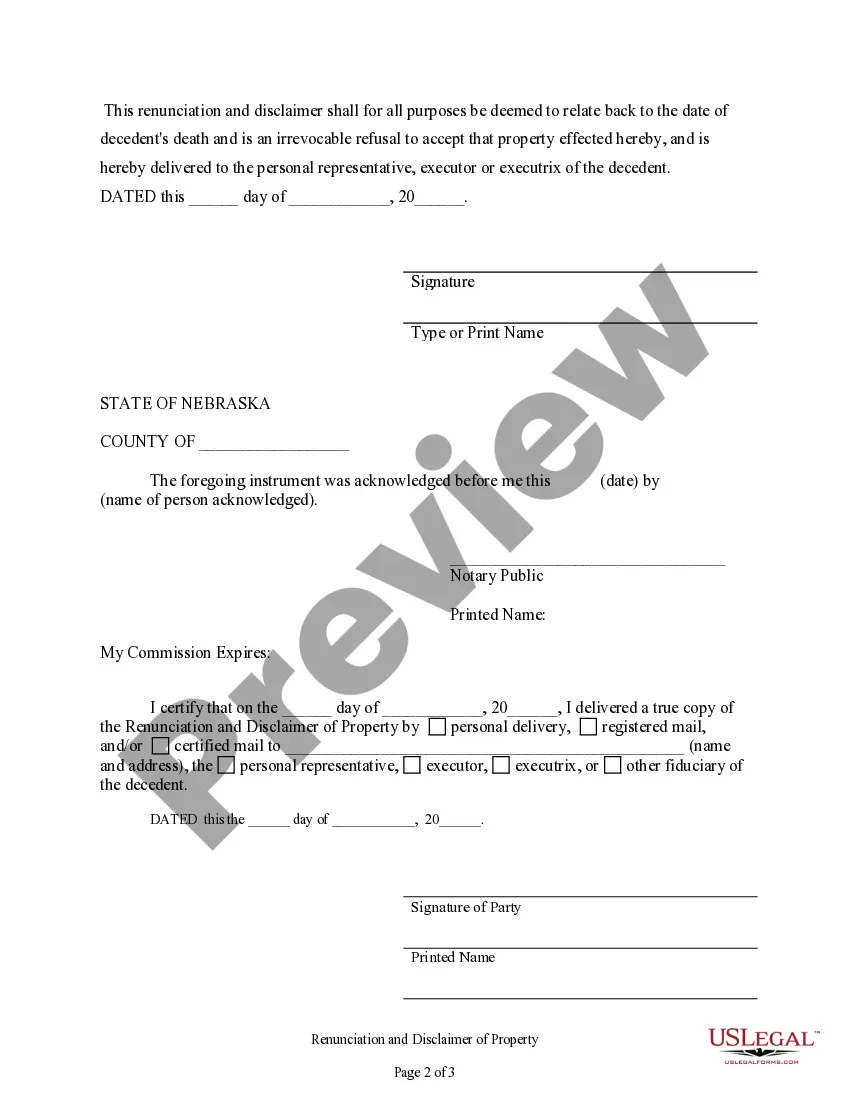

(b) The instrument specified in (a)(1) and (a)(2) must be received

by the transferor of the interest, his or her legal representative, the

personal representative of a deceased transferor, the trustee of any trust

in which the interest being renounced exists, or the holder of the legal

title to the property to which the interest relates. To be effective for

purposes of determining inheritance and estate taxes under articles 20

and 21 of Chapter 77, the instrument must be received not later than the

date which is nine months after the later of (i) the date on which the

transfer creating the interest in such person is made, or (ii) the date

on which such person attains age twenty-one. If the circumstances which

establish the right of a person to renounce an interest arise as a result

of the death of an individual, the instrument shall also be filed in the

court of the county where proceedings concerning the decedent's estate

are pending, or where they would be pending if commenced. If an interest

in real estate is renounced, a copy of the instrument shall also be recorded

in the office of the register of deeds in the county in which said real

estate lies. No person entitled to a copy of the instrument shall be liable

for any proper distribution or disposition made without actual notice of

the renunciation and no such person making a proper distribution or disposition

in reliance upon the renunciation shall be liable for any such distribution

or disposition in the absence of actual notice that an action has been

instituted contesting the validity of the renunciation.

(c) Unless the transferor of the interest has otherwise indicated

in the instrument creating the interest, the interest renounced, and any

future interest which is to take effect in possession or enjoyment at or

after the termination of the interest renounced, passes as if the person

renouncing had predeceased the decedent or had died prior to the date on

which the transfer creating the interest in such person is made, as the

case may be, if the renunciation is within the time periods set forth in

subsection (b) and if not within such time periods the interest renounced,

and any future interest which is to take effect in possession or enjoyment

at or after the termination of the interest renounced, passes as if the

person renouncing had died on the date the interest was renounced. The

person renouncing shall have no power to direct how the interest being

renounced shall pass, except that the renunciation of an interest for which

the right to renounce was established by the death of an individual shall,

in the case of the spouse of the decedent, relate only to that statutory

provision or that provision of the instrument creating the interest being

renounced and shall not preclude the spouse from receiving the benefits

of the renounced interest which may be derived as a result of the renounced

interest passing pursuant to other statutory provisions or pursuant to

other provisions of the instrument creating the interest unless such further

benefits are also renounced. In every case when the renunciation is within

the time periods set forth in subsection (b) the renunciation relates back

for all purposes to the date of death of the decedent or the date on which

the transfer creating the interest in such person is made, as the case

may be.

(d) Any (1) assignment, conveyance, encumbrance, pledge or transfer

of property therein or any contract therefor, (2) written waiver of the

right to renounce or any acceptance of property or benefits therefrom or

an interest therein by an heir, devisee, person succeeding to a renounced

interest, donee, beneficiary under a testamentary or nontestamentary instrument,

donee of a power of appointment, grantee, surviving joint owner or surviving

joint tenant, beneficiary or owner of an insurance contract or any incident

of ownership therein, beneficiary or person designated to take pursuant

to a power of appointment exercised by a testamentary or nontestamentary

instrument, person who has a statutory entitlement to or election with

respect to property pursuant to the Nebraska Probate Code, or recipient

of any beneficial interest under any testamentary or nontestamentary instrument,

or (3) sale or other disposition of property pursuant to judicial process,

made within the time periods set forth in subsection (b) shall not bar

the right to renounce, but shall make a subsequent renunciation within

the time period set forth in subsection (b) of this section ineffective

for purposes of determination of inheritance and estate taxes under articles

20 and 21 of Chapter 77.

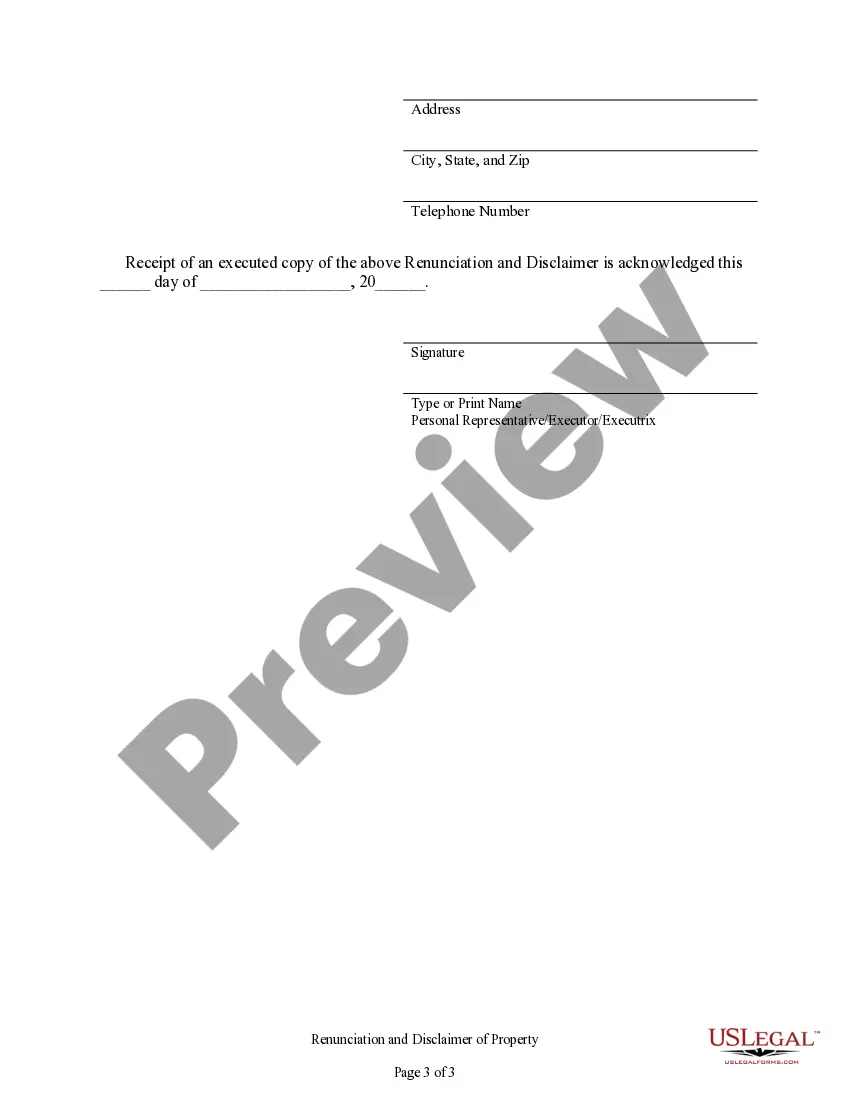

(e) Within thirty days of receipt of a written instrument of renunciation

by the transferor of the interest, his or her legal representative, the

personal representative of the decedent, the trustee of any trust in which

the interest being renounced exists, or the holder of the legal title to

the property to which the interest relates, as the case may be, such person

shall attempt to notify in writing those persons who are known or ascertainable

with reasonable diligence who shall be recipients or potential recipients

of the renounced interest of the renunciation and the interest or potential

interest such recipient shall receive as a result of the renunciation.

(f) The right to renounce granted by this section exists irrespective

of any limitation on the interest of the person renouncing in the nature

of a spendthrift provision or similar restriction. A trust beneficiary

whose interest is subject to any limitation in the nature of a spendthrift

provision or similar restriction may assign, sell, or otherwise convey

such interest or any part thereof upon a finding by a court in a proceeding

under section 30-2806, that the rights of other beneficiaries would not

be impaired and that such assignment, sale, or other conveyance would not

result in any substantial benefit to nonbeneficiaries of the trust at the

expense of the trust or trust beneficiaries. Such finding may be made after

hearing and upon notice to all known persons beneficially interested in

such trust, in the manner directed by the court.

(g) This section does not abridge the right of any person to assign,

convey, release, or renounce any property arising under any other section

of this code or other statute.

(h) Any interest in property which exists on July 19, 1980, may

be renounced after July 19, 1980, as provided herein. An interest which

has arisen prior to July 19, 1980, in any person other than the person

renouncing is not destroyed or diminished by any action of the person renouncing

taken under this section.

Source: Laws 1974, LB 354, § 74, UPC § 2-801; Laws 1978,

LB 650, § 35; Laws 1980, LB 694, § 9.

An exception to the general rule that a renunciation

relates back "for all purposes" exists for individuals depriving themselves

of any property whatsoever for purposes of qualifying for public assistance.

Hoesly v. State, 243 Neb. 304, 498 N.W.2d 571 (1993).

There is nothing inconsistent in making claim

to the whole of an estate and at the same time accepting something less

than the whole under the will since property comprising a bequest of only

a part of an estate would be included within a claim to the entire estate.

Consequently, the claimant had no reason to renounce the will under the

terms of this section. In re Estate of Nicholson, 211 Neb. 805, 320 N.W.2d

739 (1982).

Chap. 30, §30-2352.