Omaha Nebraska Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals without provision for Alternate Beneficiary

Description

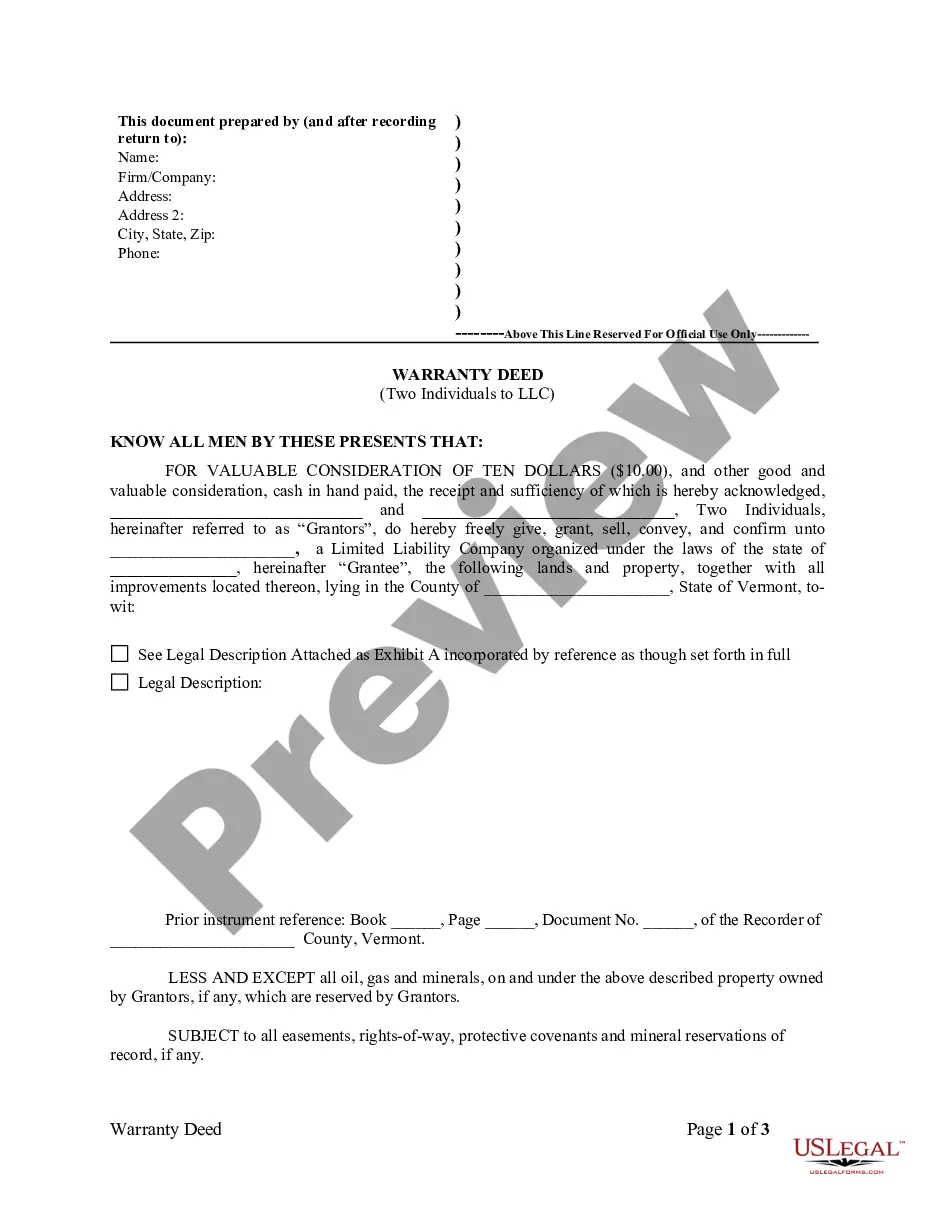

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals Without Provision For Alternate Beneficiary?

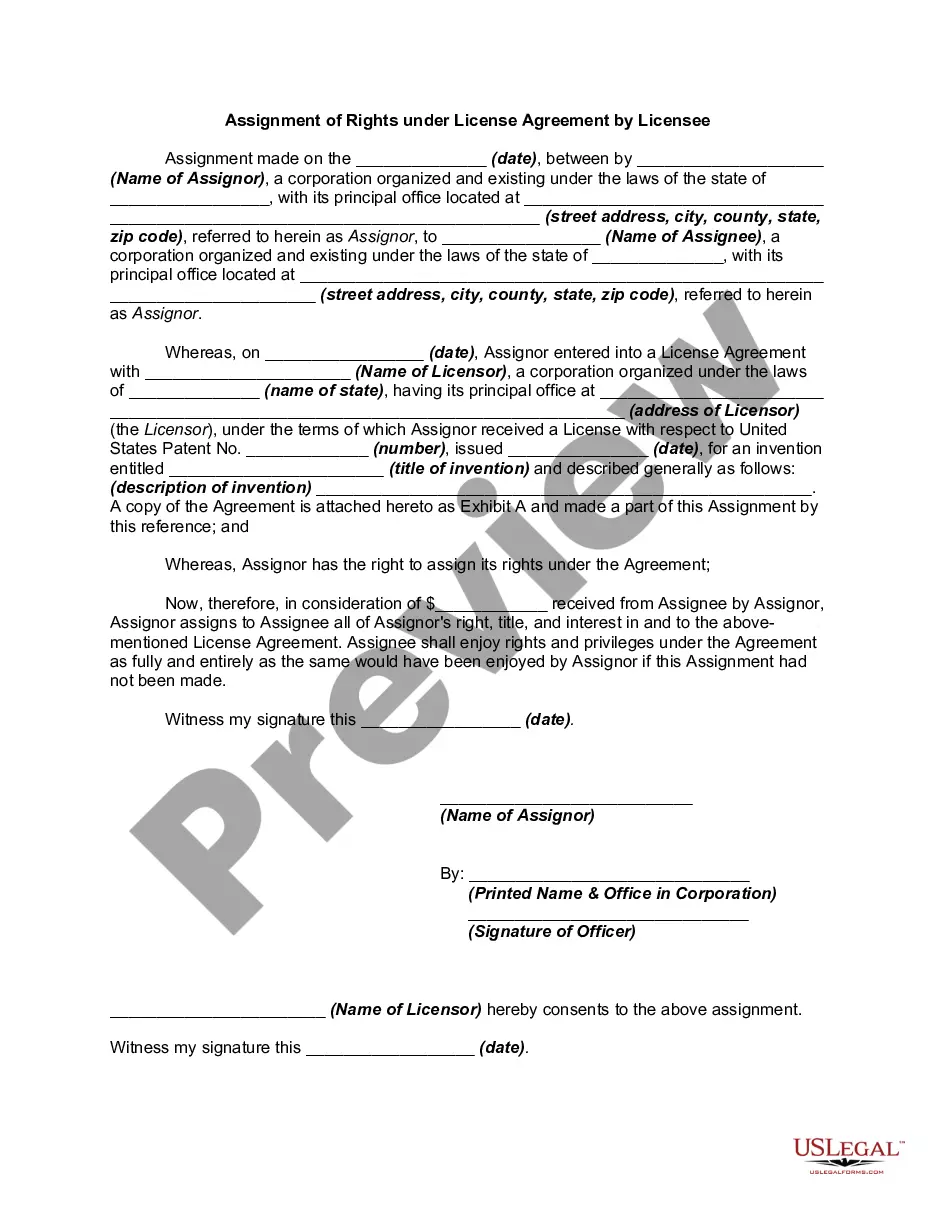

Regardless of social or career rank, completing law-related paperwork is a regrettable requirement in today's working landscape.

More often than not, it’s nearly impossible for someone lacking legal expertise to create such documents from scratch, primarily because of the intricate terminology and legal subtleties they entail.

This is where US Legal Forms proves useful.

Ensure the template you have discovered is tailored to your area since the laws of one state or county do not apply to another.

Examine the document and read a brief summary (if available) of situations the document can be utilized for.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal matter.

- US Legal Forms also acts as a valuable tool for associates or legal advisors looking to conserve time by utilizing our DIY papers.

- If you require the Omaha Nebraska Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals without provision for Alternate Beneficiary, or any other document that is legitimate in your state or county, US Legal Forms has everything readily available.

- Here’s how you can swiftly obtain the Omaha Nebraska Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals without provision for Alternate Beneficiary using our reliable service.

- If you are currently a member, you may proceed to Log In to your account to download the necessary form.

- However, if you are not familiar with our platform, make sure to follow these steps before procuring the Omaha Nebraska Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals without provision for Alternate Beneficiary.

Form popularity

FAQ

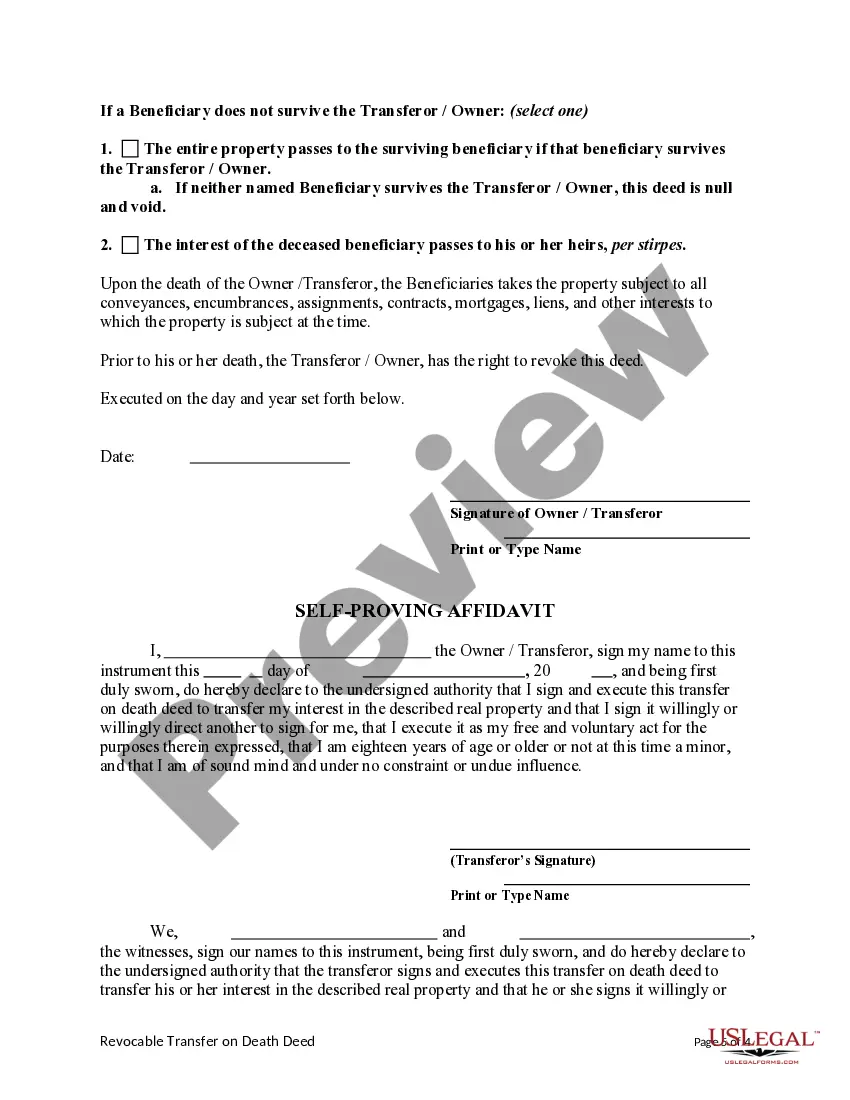

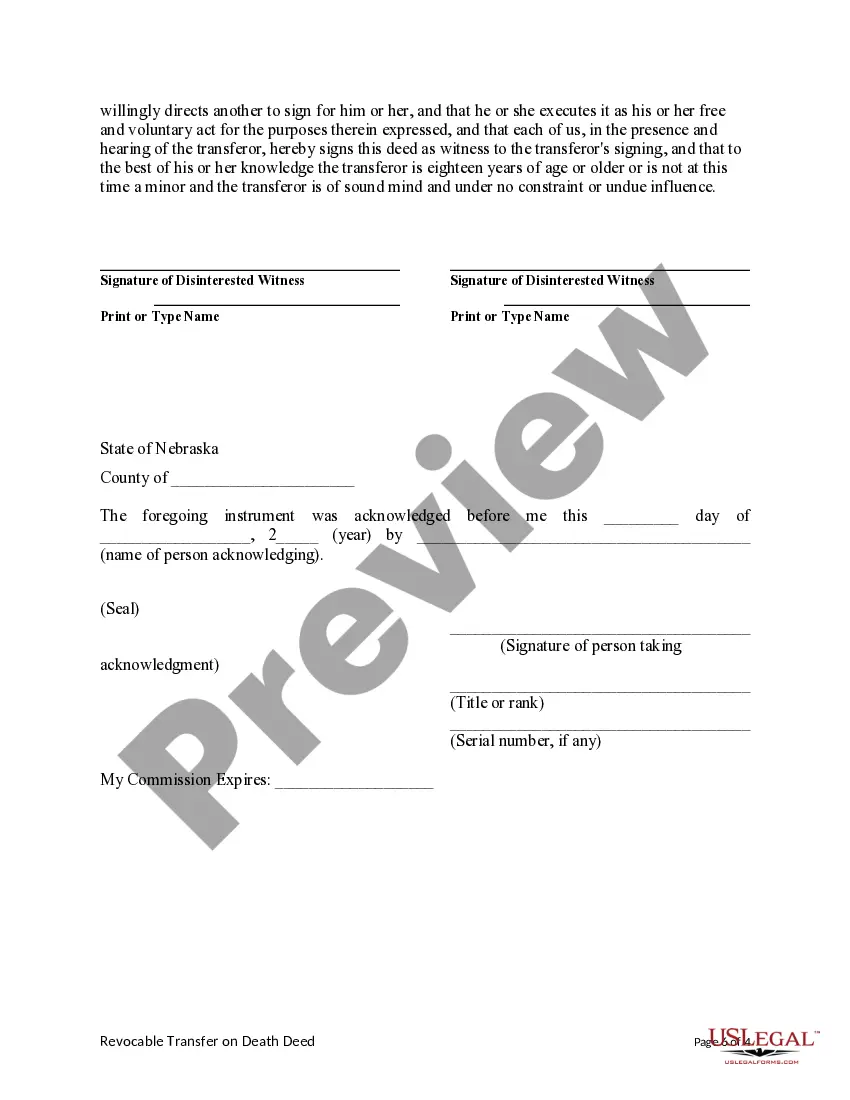

In addition to using the proper form, the TOD deed has certain requirements that must be met: (1) the TOD deed must be signed by two independent witnesses; (2) the independent witnesses and you (the property owner) must all appear before a notary public and have it acknowledged before the notary public or other

Transfer-on-Death Deeds for Real Estate North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

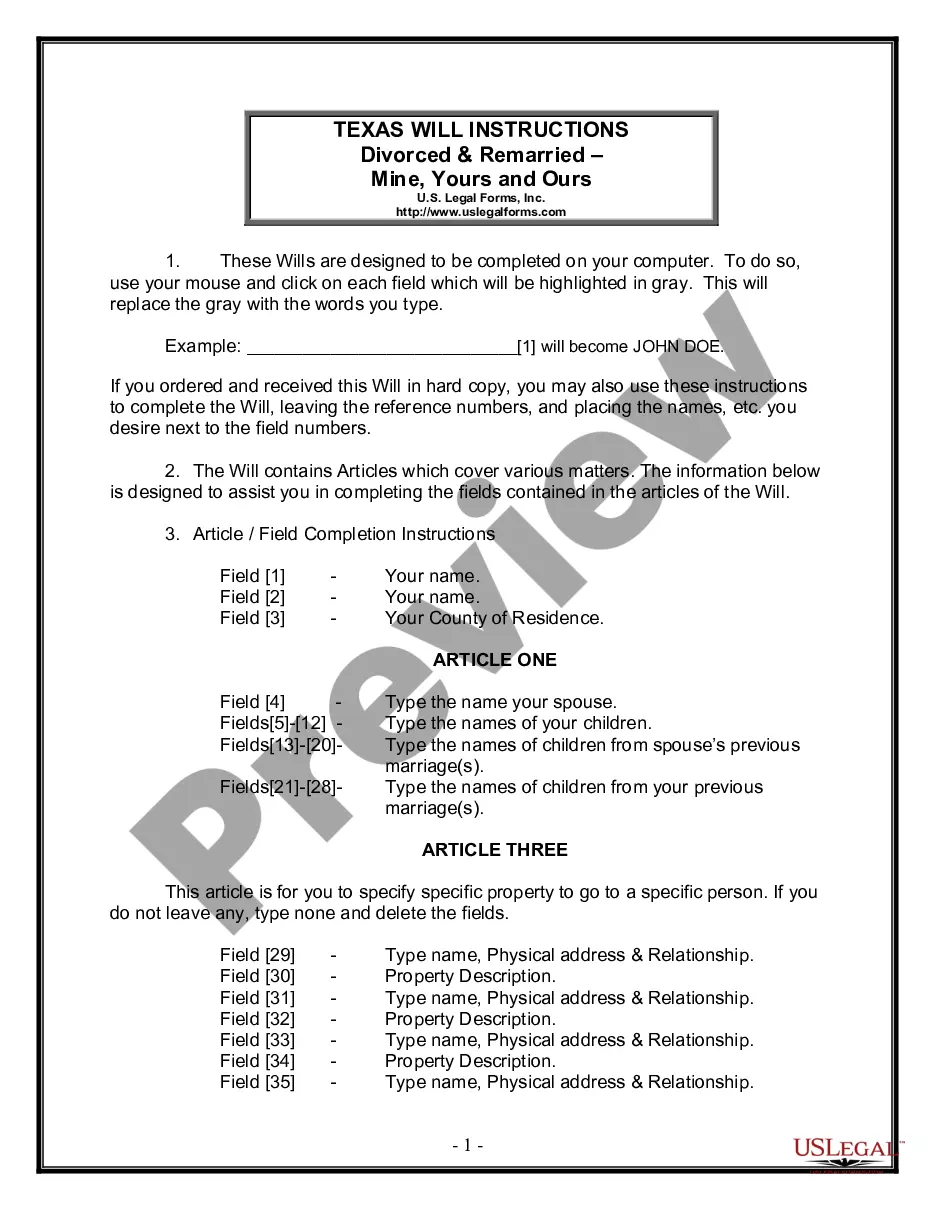

The Act allows an individual to transfer property located in Nebraska to one or more beneficiaries effective at the transferor's death through the use of a special deed referred to as a ?Transfer on Death Deed.?

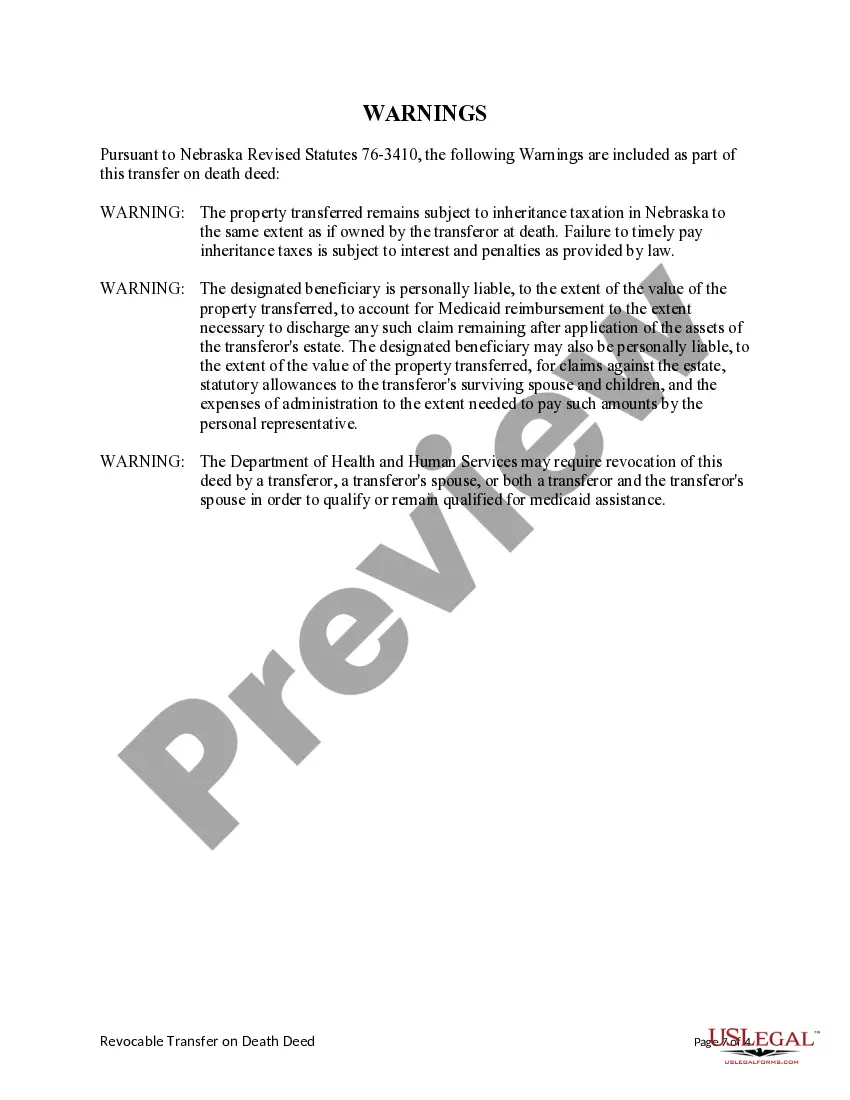

(b)(1) A transfer on death deed shall contain the following warnings: WARNING: The property transferred remains subject to inheritance taxation in Nebraska to the same extent as if owned by the transferor at death. Failure to timely pay inheritance taxes is subject to interest and penalties as provided by law.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

A transfer on death deed, or a TOD Deed, allows for individuals to pass real property to a beneficiary upon their death.

When the owner dies, a Nebraska TOD deed transfers title to the beneficiary named in the deed. The beneficiary formally takes title by recording the owner's death certificate and a cover sheet with the register of deeds.