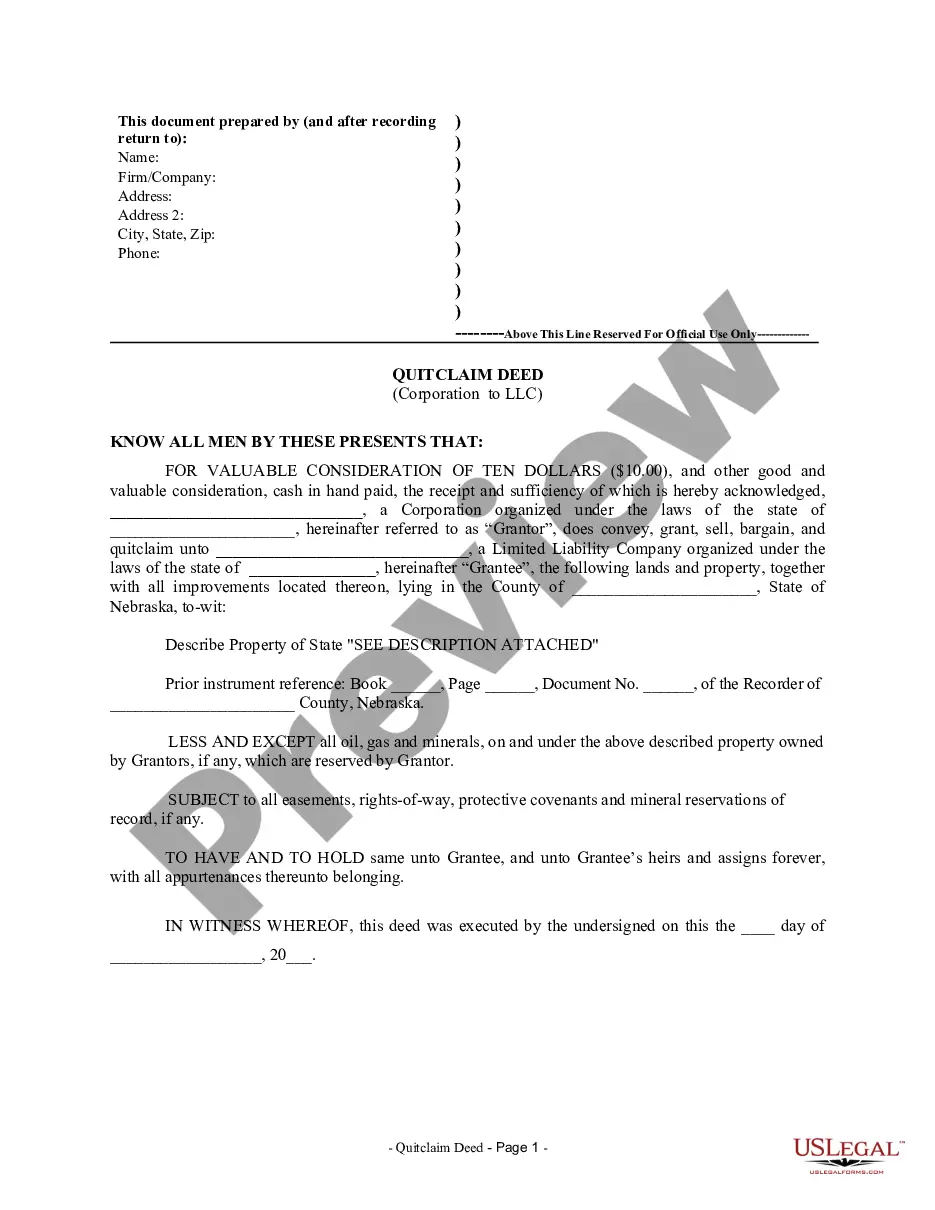

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Omaha Nebraska Quitclaim Deed from Corporation to LLC

Description

How to fill out Nebraska Quitclaim Deed From Corporation To LLC?

Take advantage of US Legal Forms and gain instant access to any form template you desire.

Our advantageous platform featuring a vast array of templates simplifies the process of finding and obtaining nearly any document sample you may require.

You can export, complete, and sign the Omaha Nebraska Quitclaim Deed from Corporation to LLC in just a few minutes rather than spending hours searching online for a suitable template.

Utilizing our library is an excellent method to enhance the security of your document submissions.

Moreover, you can access all previously saved documents in the My documents section.

If you haven’t created an account yet, follow the steps below.

- Our knowledgeable legal experts routinely review all records to ensure that the templates are suitable for a specific state and adhere to current laws and regulations.

- How can you obtain the Omaha Nebraska Quitclaim Deed from Corporation to LLC.

- If you possess a subscription, simply Log In to your account.

- The Download button will be activated on all the templates you examine.

Form popularity

FAQ

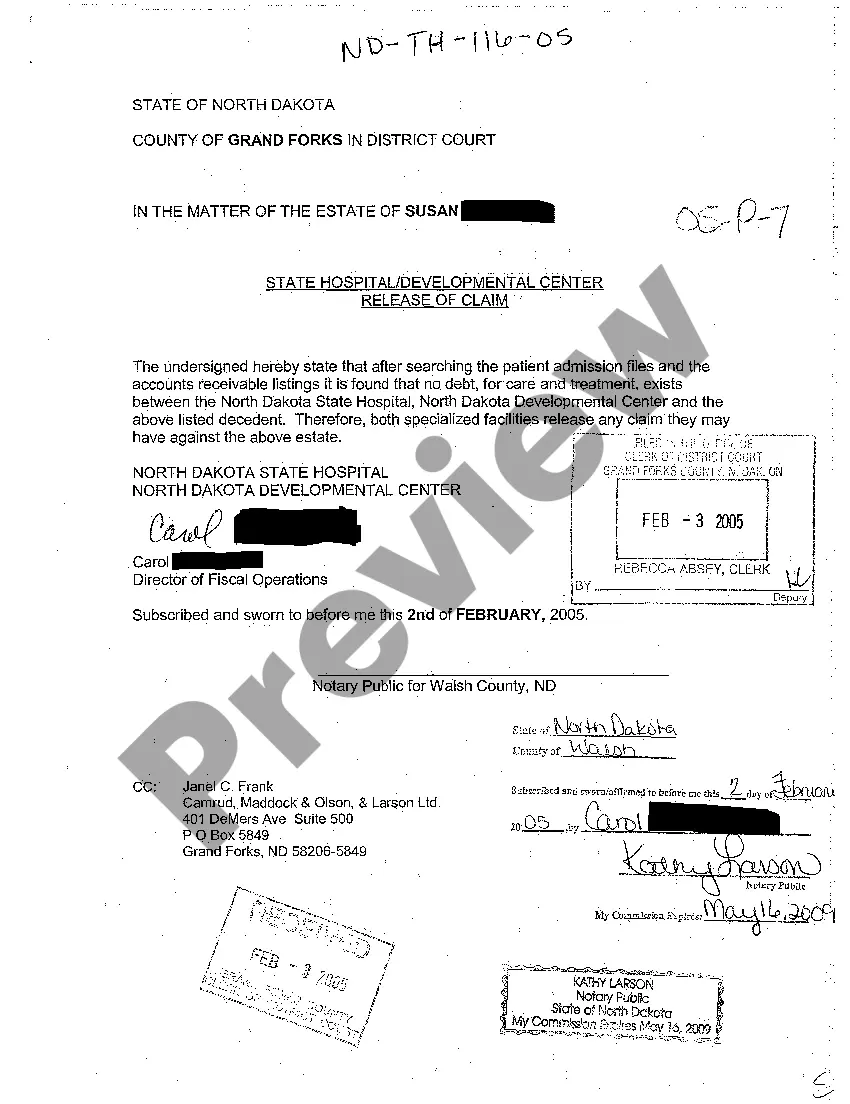

Stat. §§ 76-3401-76-3423 (the ?Act?). The Act allows an individual to transfer property located in Nebraska to one or more beneficiaries effective at the transferor's death through the use of a special deed referred to as a ?Transfer on Death Deed.?

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed require a completed Form 521, which are not subject to the documentary stamp tax until the deed is presented for recording.

There are three basic types of recording statutes: race, notice, and race- notice. See IV AMERICAN LAw OF PROPERTY § 17.5, at 545 (A.J. Casner ed. 1952). Nebraska has a race-notice statute.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

To complete the transfer, the deed must be recorded in the office of the Register of Deeds of the county where the property is located. All deeds also require a Form 521 - Real Estate Transfer Statement.

How to Write a Nebraska Quitclaim Deed Preparer's name and address. Name and mailing address of the party to whom the recorded deed should be sent. County where the real property is located. The consideration paid to the grantor (dollar amount should be written in words and numbers) Grantor's name and address.

Nebraska Quitclaim Deed Laws Signing - All quitclaim deeds written in the state must be signed by the individual(s) selling the property in the presence of a Notary Public (NRS 76-211) Recording - All quitclaim deeds must be filed in the County Recorder's Office in the city or county where the property is located.