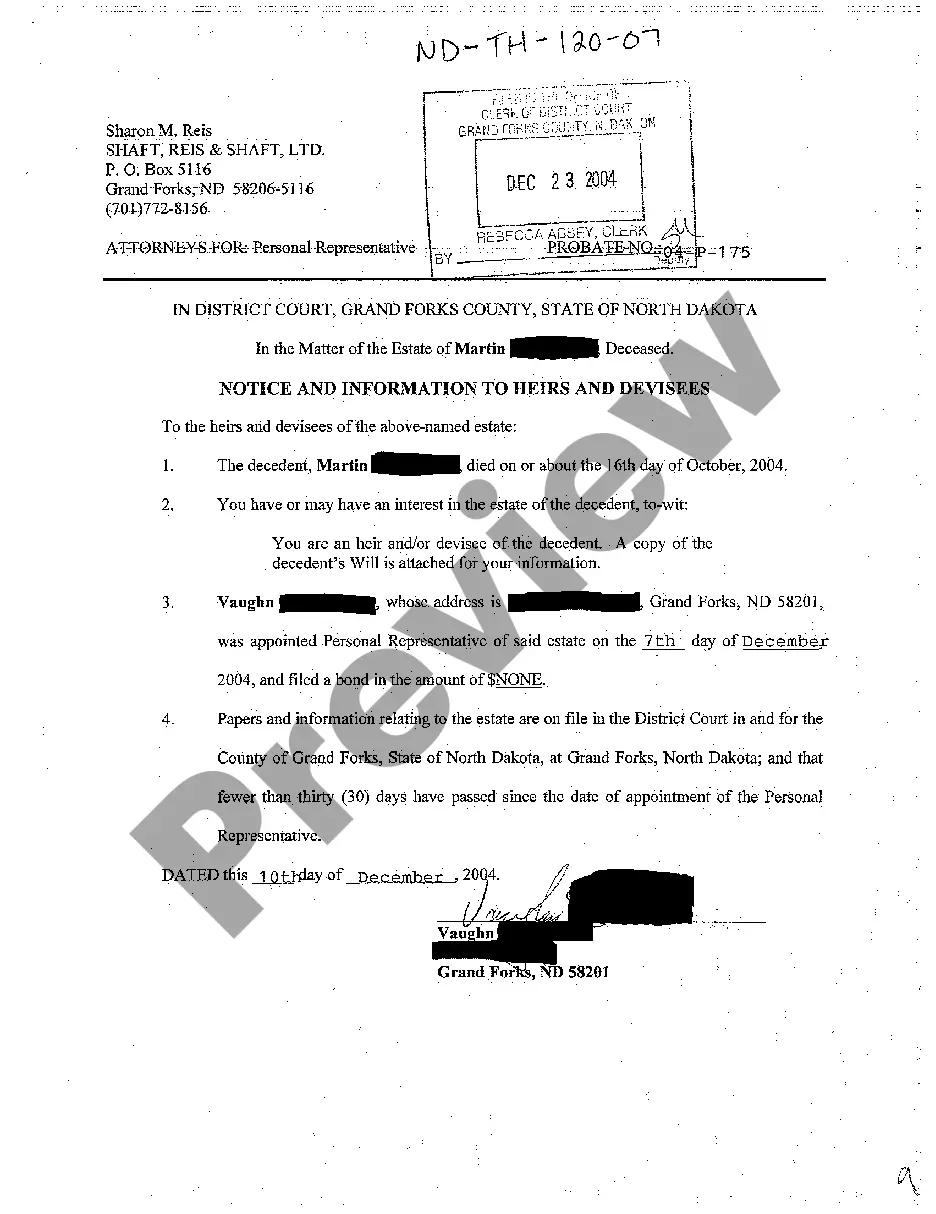

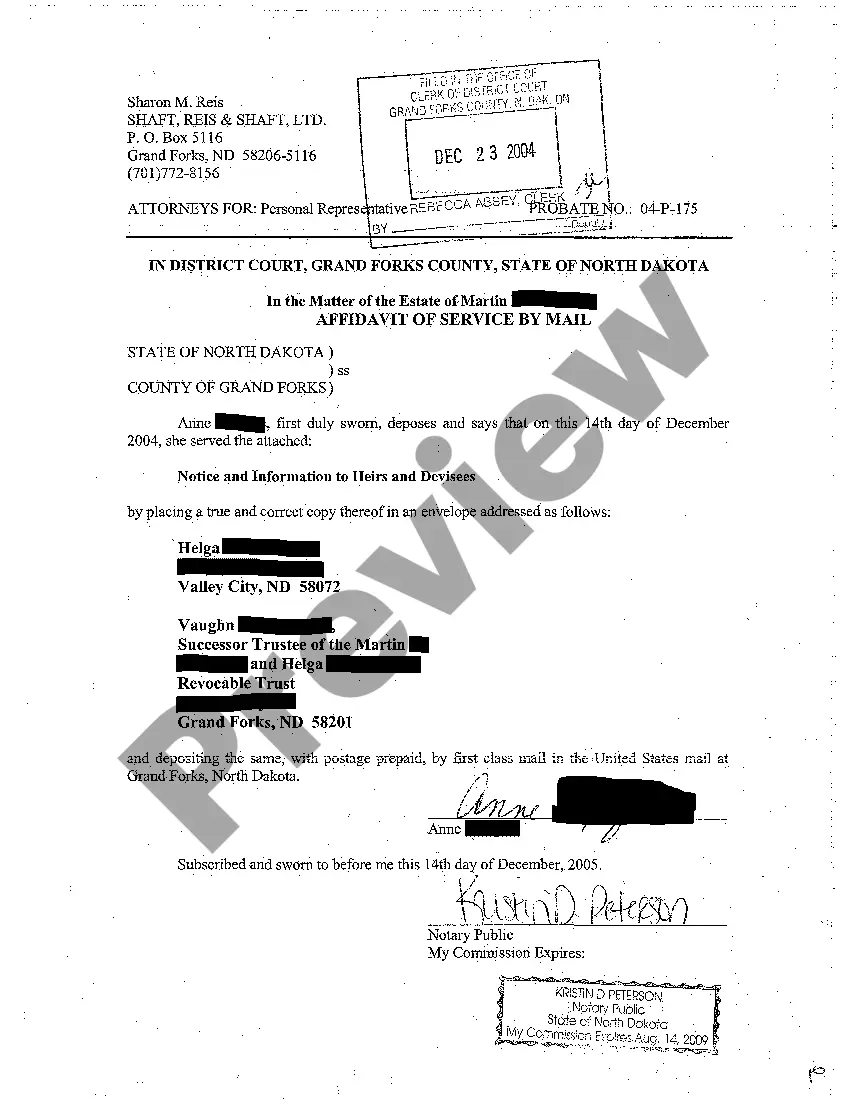

Fargo North Dakota Notice and Information to Heirs and Devisees

Description

How to fill out North Dakota Notice And Information To Heirs And Devisees?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our helpful website, featuring a vast collection of templates, enables you to locate and acquire nearly any document sample you seek.

You can download, complete, and sign the Fargo North Dakota Notice and Information to Heirs and Devisees within minutes instead of spending hours online searching for the ideal template.

Using our library is a fantastic approach to enhance the security of your document submissions.

If you haven't created an account yet, follow the steps below.

Open the page with the template you require. Ensure that it is the template you were expecting: confirm its title and description, and utilize the Preview feature when available. Otherwise, employ the Search field to find the correct one.

- Our qualified attorneys frequently review all documents to ensure that the forms are appropriate for a specific state and adhere to updated statutes and regulations.

- How can you obtain the Fargo North Dakota Notice and Information to Heirs and Devisees.

- If you possess a profile, simply Log In to your account.

- The Download option will be activated on all documents you explore.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

The probate threshold in North Dakota is set at $50,000, which applies to the gross value of the estate. When the estate exceeds this figure, the probate process becomes mandatory, allowing for the proper distribution of assets. This threshold is crucial for heirs and devisees to understand their rights and responsibilities. As part of our commitment to assist, we provide comprehensive resources and the Fargo North Dakota Notice and Information to Heirs and Devisees to simplify your journey through probate.

In Fargo, North Dakota, the minimum value for assets that require probate is typically $50,000. This means that if the total value of the estate is less than this threshold, the process may not be necessary. Understanding this limit is essential for heirs and devisees, ensuring that they navigate the legal landscape effectively. For additional guidance, you can refer to our Fargo North Dakota Notice and Information to Heirs and Devisees.

Inheritance law in North Dakota governs how estates are distributed after someone's passing. It outlines the rights of heirs and devisees, ensuring relevant parties receive their rightful share of the deceased's assets. The Fargo North Dakota Notice and Information to Heirs and Devisees provides crucial details about these legal processes, informing you about your rights and responsibilities. For thorough guidance, consider using platforms like US Legal Forms, which can help navigate these laws effectively.

To order a testamentary letter in Fargo, North Dakota, you should first gather relevant documents, including the original will and any necessary identification. Once you have your documents ready, you can visit the local probate court or use a trusted online platform like USLegalForms to assist you in the process. This platform offers a user-friendly service that simplifies obtaining a Fargo North Dakota Notice and Information to Heirs and Devisees. After submitting the required information and payment, you should receive your testamentary letter efficiently.

Probate in North Dakota is typically triggered when a person passes away leaving behind assets that cannot be transferred without going through court. This can include real estate, bank accounts, and other valuable property. If the deceased left a will, probate is necessary to validate it. For more insights, refer to the Fargo North Dakota Notice and Information to Heirs and Devisees, which provides helpful context.

To fill out the inventory for a decedent's estate in North Dakota, start by listing all assets, such as real estate, bank accounts, and personal property. Next, provide an estimate of the fair market value of each item. Be sure to include liabilities as well, such as debts owed by the estate. Resources like the Fargo North Dakota Notice and Information to Heirs and Devisees can guide you through this process.

In North Dakota, an estate generally must exceed $50,000 in total value to enter probate. If the estate’s value is $50,000 or less, it can often be settled without formal probate proceedings. However, various factors may influence this, including debts and specific asset types. For comprehensive details, consult the Fargo North Dakota Notice and Information to Heirs and Devisees.

You can avoid probate in North Dakota by creating a revocable living trust. This legal arrangement allows you to maintain control of your assets during your lifetime, while designating beneficiaries to receive them directly upon your passing. Furthermore, establishing joint ownership or using beneficiary designations on accounts can also prevent probate delays. For further information, explore the Fargo North Dakota Notice and Information to Heirs and Devisees.

To avoid probate in North Dakota, consider establishing a living trust. By placing your assets in a trust, they can be transferred directly to your beneficiaries without going through the probate process. Additionally, using payable-on-death accounts and joint ownership can also help bypass probate. For more detailed guidance, you can refer to the Fargo North Dakota Notice and Information to Heirs and Devisees.