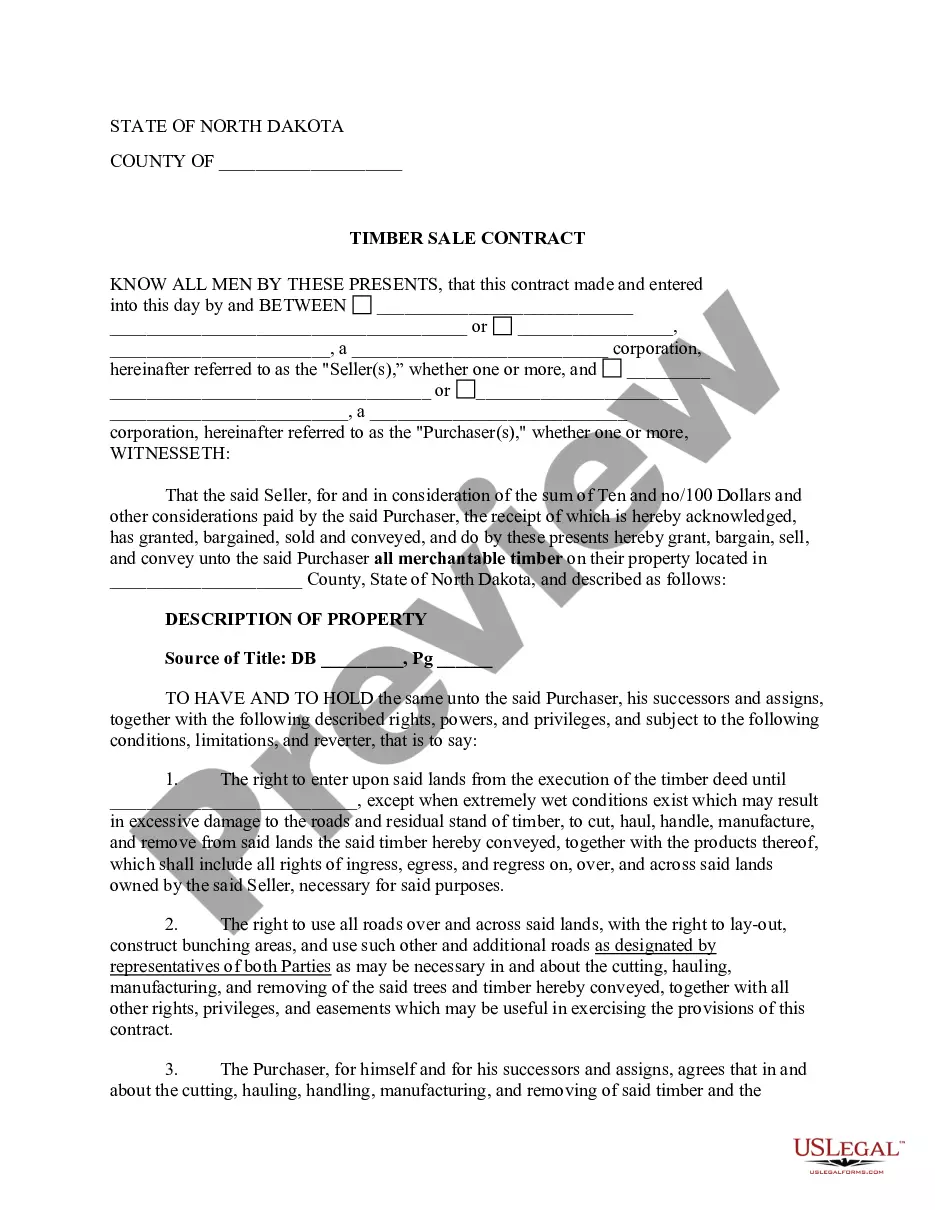

Fargo North Dakota Timber Sale Contract

Description

How to fill out North Dakota Timber Sale Contract?

Regardless of social or professional rank, completing legal documents is unfortunately a vital requirement in today’s workplace.

Frequently, it’s nearly impossible for an individual without any legal expertise to draft this kind of paperwork from scratch, primarily due to the intricate language and legal nuances they contain.

This is where US Legal Forms can be a savior. Our service offers an extensive assortment of over 85,000 ready-to-use state-specific documents suitable for almost any legal matter.

If the document you selected doesn’t fulfill your requirements, you can restart the search for the correct form.

Click 'Buy now' and select the subscription plan that suits you best. Log In using your account credentials or create a new account. Choose the payment method and proceed to download the Fargo North Dakota Timber Sale Contract once your payment is confirmed. You’re set! Now you can either print the document or fill it out online.

If you encounter any issues retrieving your purchased documents, you can easily locate them in the My documents section.

No matter what issue you are attempting to address, US Legal Forms is here to assist you. Try it out now and experience the benefits for yourself.

- Whether you require the Fargo North Dakota Timber Sale Contract or any other document relevant to your state or county, US Legal Forms has everything readily available.

- Here’s how you can swiftly obtain the Fargo North Dakota Timber Sale Contract using our reliable service.

- If you are a returning customer, feel free to Log In to your account to download the required form.

- However, if you are not acquainted with our platform, make sure to follow these steps before acquiring the Fargo North Dakota Timber Sale Contract.

- Verify that the template you have located is appropriate for your locality since the laws of one state or county may not apply to another.

- Examine the document and read through a brief description (if available) of the situations the paper can be used for.

Form popularity

FAQ

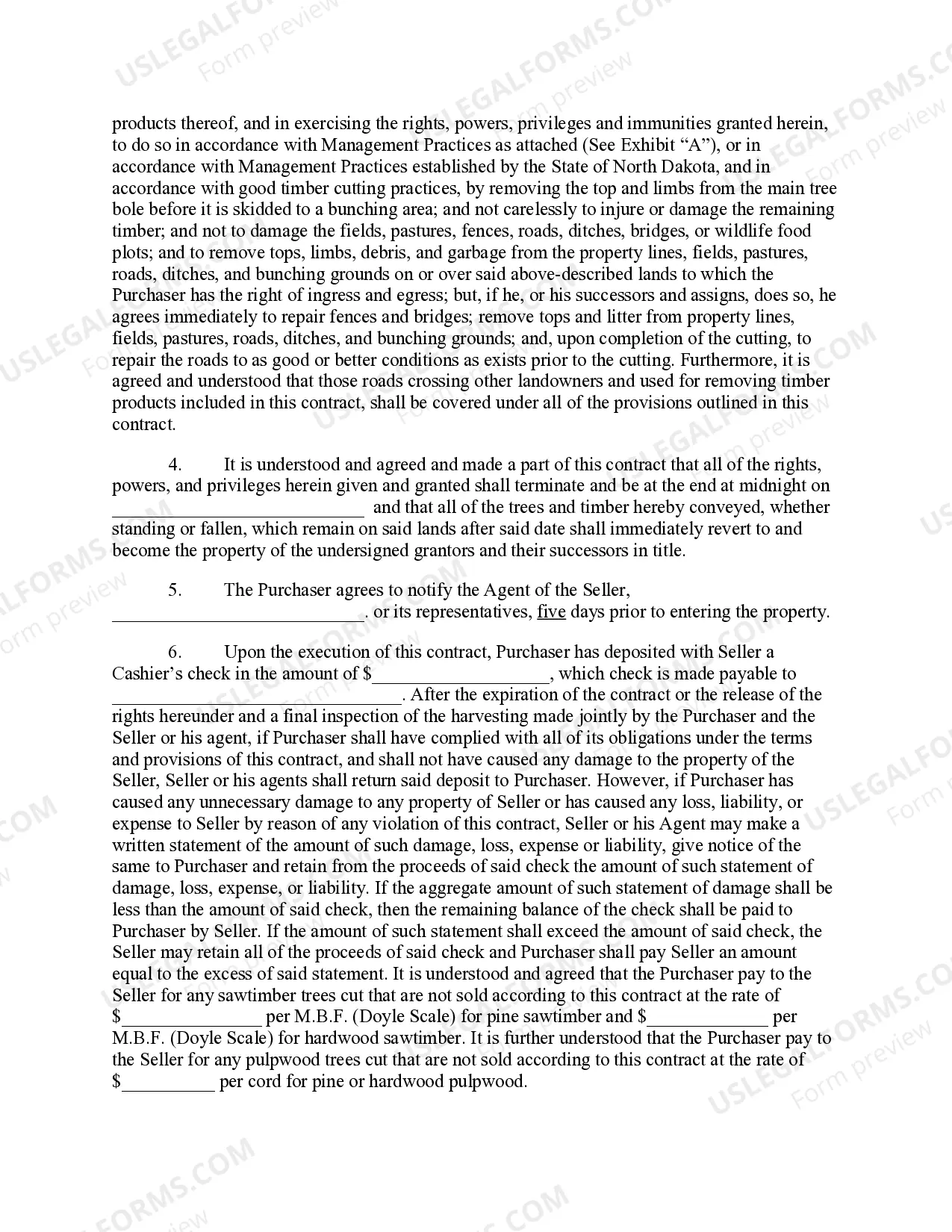

A logging contract outlines the terms between the landowner and the logging company concerning timber harvesting. This contract typically includes payment structures, timelines, and responsibilities of each party. When using a Fargo North Dakota Timber Sale Contract, it's essential to understand these terms to protect your interests. Uslegalforms offers comprehensive contracts that cover all aspects of logging agreements, making the process straightforward.

The minimum acreage needed to sell timber varies by state and the specific contract terms. Generally, a forested area of at least 5 acres is suggested for a more profitable sale. When entering into a Fargo North Dakota Timber Sale Contract, you may want to check local regulations to ensure compliance. Uslegalforms can assist you in understanding these regulations, helping you make informed decisions.

To report timber sales to the IRS, you will typically complete IRS Form 4797, which is used for reporting the sale of business property. In the case of a Fargo North Dakota Timber Sale Contract, you will detail the amount received from the sale and any related expenses. Keeping accurate records of the sale and any commissions or costs can assist you in this process.

Yes, income from timber sales is generally taxable, and this includes revenue from contracts like the Fargo North Dakota Timber Sale Contract. You should report this income on your tax return, as it is classified as ordinary income. Understanding your tax obligations can help you navigate your financial strategy effectively.

Typically, if you sell land and it qualifies under specific criteria, you may receive a Form 1099-S. This includes sales under arrangements like the Fargo North Dakota Timber Sale Contract. Receiving a 1099-S helps document the income from the sale, making it easier for you to report it on your tax return.

To report timber sales on your tax return, you will use IRS Form 4797 for sales of business property. If the timber sale is part of a proper Fargo North Dakota Timber Sale Contract, you will detail the income received and any expenses related to that sale. Keep thorough records of your timber harvest and related costs for accurate reporting.

Yes, you must report the sale of land to the IRS, including transactions involving timber sales. If you sell land outlined in a Fargo North Dakota Timber Sale Contract, any gain from that sale is considered taxable income. Reporting it correctly ensures you meet tax obligations and potentially avoid penalties.

Timber contracts involve an agreement between a landowner and a buyer for the selling of timber on a specific property. Generally, the buyer pays the landowner for the timber based on its volume and species, outlined clearly in the Fargo North Dakota Timber Sale Contract. This contract specifies the rights and obligations of both parties, including harvesting methods and payment terms, ensuring a smooth transaction.