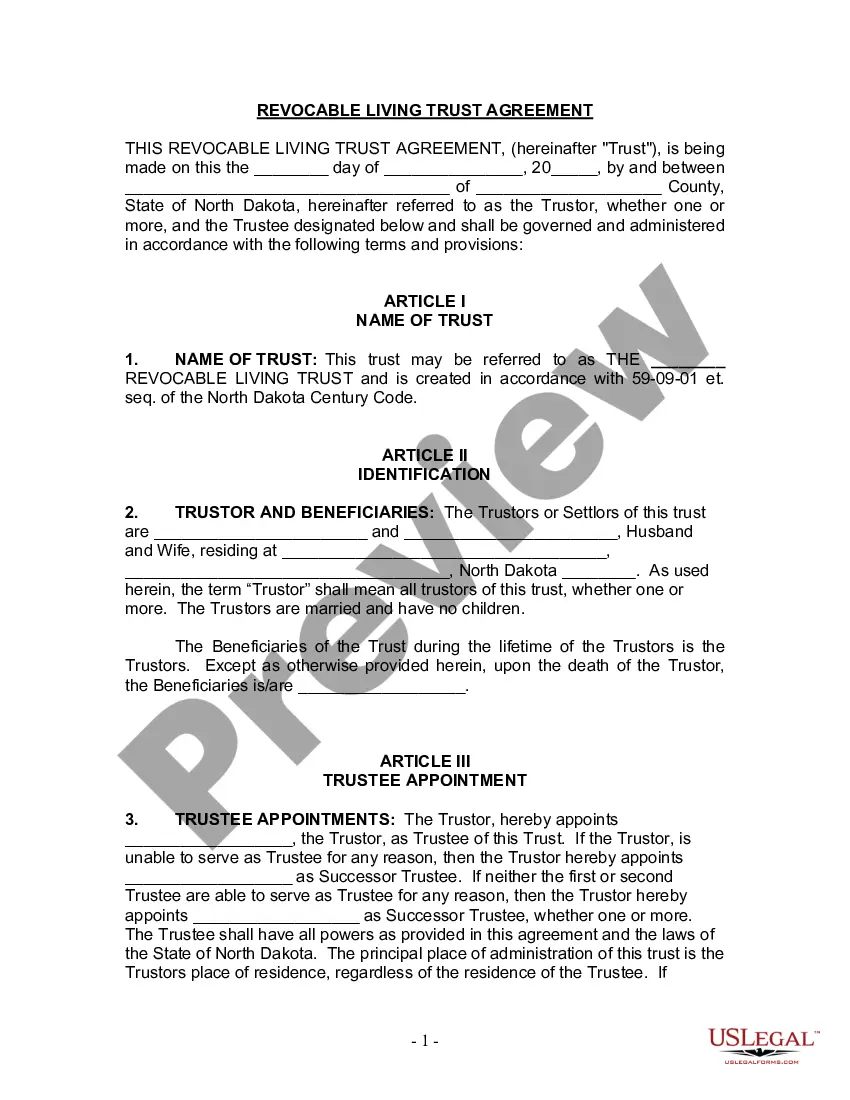

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Fargo North Dakota Living Trust for Husband and Wife with No Children

Description

How to fill out North Dakota Living Trust For Husband And Wife With No Children?

We consistently endeavor to minimize or circumvent legal repercussions while addressing intricate legal or financial issues.

To achieve this, we seek out attorney services that are typically quite expensive.

Nevertheless, not every legal situation is that convoluted; many can be managed independently.

US Legal Forms is an online repository of current DIY legal templates encompassing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Just Log In to your account and click the Get button corresponding to it. If you happen to misplace the document, you can always re-download it from the My documents section. The procedure is just as simple for newcomers to the platform! You can establish your account in mere minutes.

- Our platform empowers you to handle your matters autonomously without needing legal representation.

- We offer access to legal document formats that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Take advantage of US Legal Forms whenever you require the Fargo North Dakota Living Trust for Husband and Wife with No Children or any other document quickly and securely.

Form popularity

FAQ

A key drawback of having a trust is the complexity involved in its management. For instance, a Fargo North Dakota Living Trust for Husband and Wife with No Children requires regular monitoring and possibly even ongoing administrative tasks. If the trust does not align with your financial goals or family situations, it may inadvertently complicate matters instead of simplifying them.

It's often beneficial for parents to consider a Fargo North Dakota Living Trust for Husband and Wife with No Children, especially if they want to simplify the transfer of assets and avoid probate. Trusts can offer protection against potential legal challenges and make asset management smoother. Encouraging parents to consult with a legal professional can provide tailored advice based on their unique situation.

One of the most common mistakes parents make when establishing a trust fund is failing to update the trust as their circumstances change. For instance, parents may overlook adjusting their Fargo North Dakota Living Trust for Husband and Wife with No Children if they acquire new assets or if family dynamics shift. Regularly reviewing the trust ensures it meets current needs and intentions.

To establish a valid Fargo North Dakota Living Trust for Husband and Wife with No Children, you must meet several requirements. First, the grantor, or creator of the trust, must be of legal age and mentally competent. The trust also needs a specific purpose and must include identifiable assets. Finally, proper documentation must be completed and signed to ensure the trust's legal standing, which is why platforms like uslegalforms can be an invaluable resource for guidance through this process.

In many cases, a joint Fargo North Dakota Living Trust for Husband and Wife with No Children works best for couples without children. However, separate trusts may provide distinct advantages, such as protecting individual assets and ensuring specific beneficiaries receive certain items. Couples should consider their unique financial situations and long-term goals in deciding whether to establish joint or separate trusts. Consulting professionals can help clarify the best approach for your specific needs.

Even if you are married without children, a Fargo North Dakota Living Trust for Husband and Wife with No Children can provide significant advantages. A trust helps you manage and distribute your assets according to your wishes, avoiding the lengthy probate process. It also offers privacy, as a trust does not usually become part of the public record, allowing you greater control over your legacy. Therefore, many couples find that establishing a trust is a smart decision, regardless of their parental status.

The prerequisites for creating a trust include having a clear intention to create the trust, defining the trust's purpose, and identifying the beneficiaries. For a Fargo North Dakota Living Trust for Husband and Wife with No Children, it is essential to determine how you want your assets to be managed and distributed. Furthermore, you should appoint a trustee who will oversee the trust according to your wishes. Resources available on uslegalforms can guide you through these steps for a smooth setup.

To set up a trust in North Dakota, you should start by deciding on the type of trust that best fits your needs, such as a Fargo North Dakota Living Trust for Husband and Wife with No Children. You will need to draft a trust document outlining the terms, appoint a trustee, and fund the trust with your assets. It is advisable to consult with an attorney or utilize resources from platforms like uslegalforms to ensure compliance with state laws. Once established, you'll have a reliable framework for managing your estate.

The best trust for a married couple, especially in the context of a Fargo North Dakota Living Trust for Husband and Wife with No Children, is often a revocable living trust. This type of trust allows you to retain control over your assets while providing a clear plan for asset distribution. It also helps avoid probate, which can simplify the process for your loved ones. Additionally, it offers privacy and peace of mind regarding estate planning.

While many assets can be included in a Fargo North Dakota Living Trust for Husband and Wife with No Children, some are typically left out. Assets such as personal belongings, certain retirement accounts, and vehicles often require specific handling. It is crucial to review these exclusions to ensure your estate plan remains efficient. Uslegalforms can provide clarification on which assets should be kept out of a trust for optimal management.