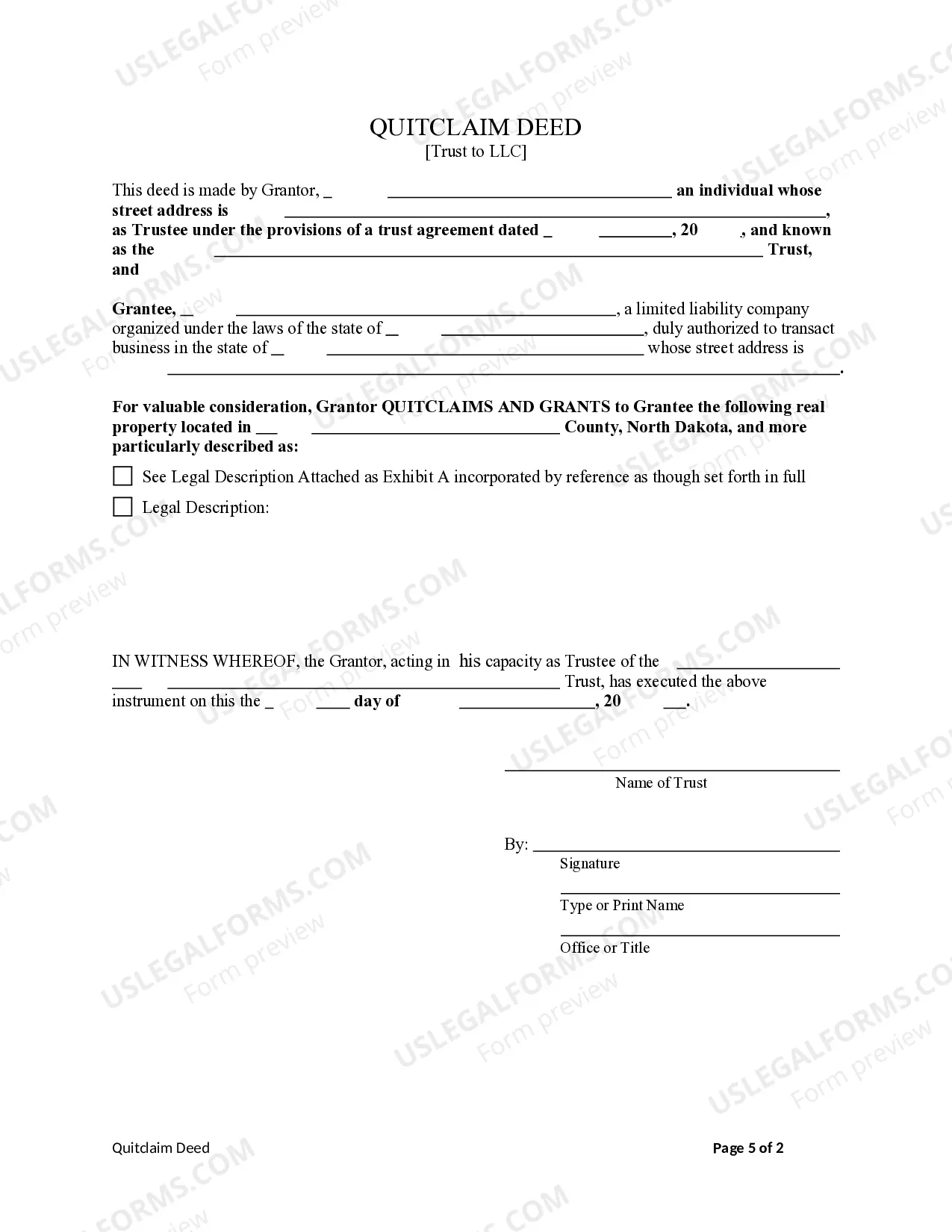

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company.

Description

How to fill out North Dakota Quitclaim Deed From Trust To Limited Liability Company.?

We consistently seek to diminish or avert legal complications when managing intricate legal or financial matters.

To achieve this, we obtain legal services that are typically very expensive. Nevertheless, not every legal problem is equally complicated. Many of them can be resolved independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our database enables you to handle your affairs without needing to consult legal advisors.

We offer access to legal document templates that are not always readily accessible. Our templates are specific to states and regions, which greatly simplifies the search procedure.

The procedure is just as straightforward if you’re not familiar with the website! You can set up your account in just a few minutes.

- Take advantage of US Legal Forms whenever you need to locate and download the Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company.

- or any other document quickly and securely.

- Simply Log In to your account and click the Get button beside it.

- If you misplace the document, you can always re-download it from the My documents section.

Form popularity

FAQ

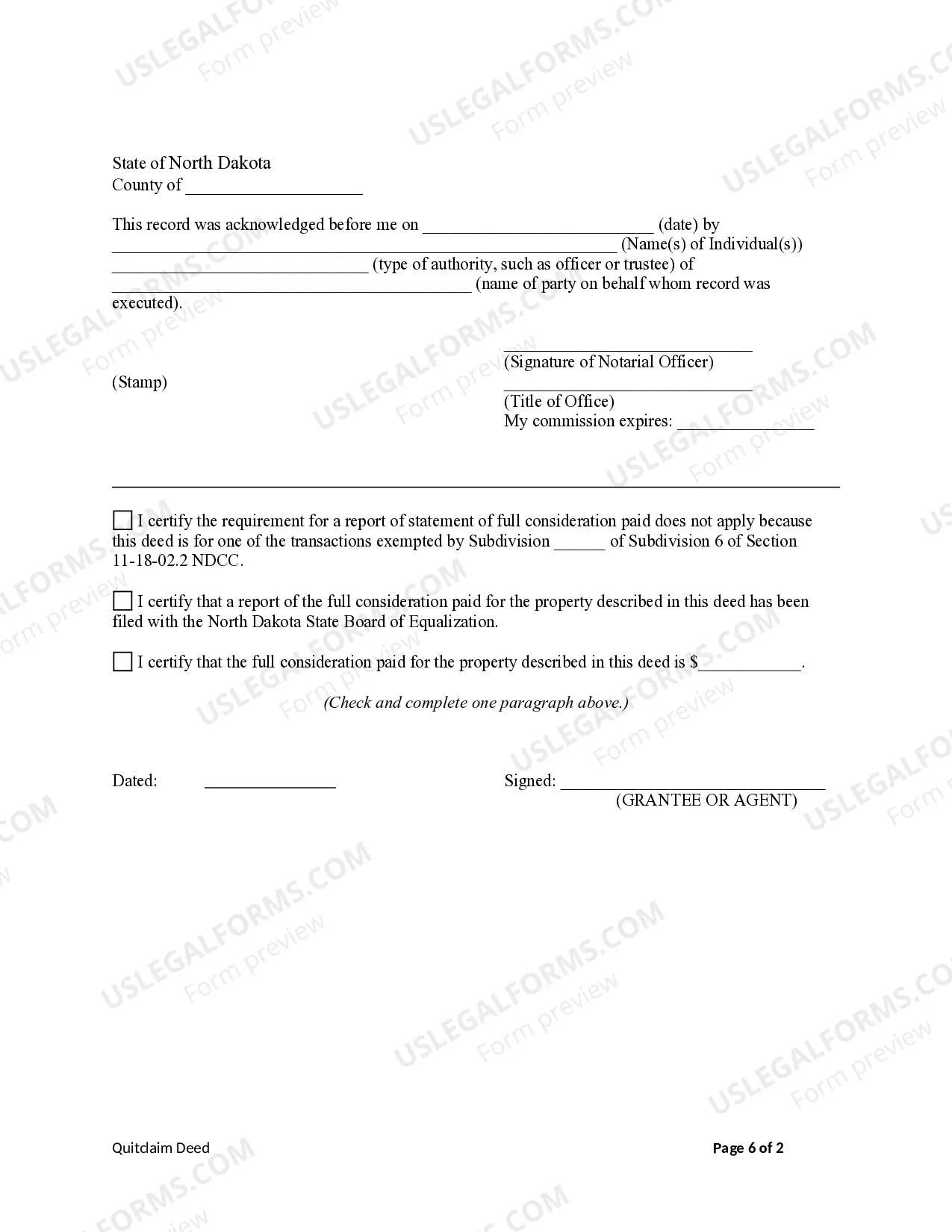

To file a quitclaim deed in North Dakota, you first need to obtain the proper form, ensuring it complies with state requirements for a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company. Next, fill out the deed accurately, including all necessary details about the involved parties and the property. Once completed, the document must be notarized and then submitted to the appropriate county recorder's office, where it will be officially recorded. Using US Legal Forms can make this process easier, providing you with the proper forms and guidance to navigate the filing requirements.

Deciding between a quitclaim deed and a trust requires understanding your objectives. A quitclaim deed facilitates quick transfers, such as a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company, making it simple for property changes. Conversely, a trust is ideal for managing assets over time and may offer additional benefits, like asset protection. Reviewing your specific requirements can help you make the right choice.

Whether a trust is better than a quitclaim deed depends on your specific situation. A trust offers long-term asset management and can help with the estate planning process. In contrast, a quitclaim deed provides a straightforward transfer of property ownership, such as in a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company. Assess your goals carefully to determine which option best suits your needs.

To properly fill out a quitclaim deed for transferring property like a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company, start by clearly identifying the granter and grantee. Include the property description and any relevant legal details, such as the tax identification number. Be sure to sign the deed in front of a notary public to make it legally binding. For detailed guidance, you can explore resources available on US Legal Forms.

Quitclaim deeds are often viewed as risky because they do not guarantee a clear title. This means the buyer may inherit unresolved issues, such as liens or claims against the property. While useful in certain situations, like using a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company, potential buyers should proceed with caution and possibly conduct thorough title checks.

To create a quit claim deed in North Dakota, you need the names of the grantor and grantee, a description of the property, and signatures from the relevant parties. Additionally, you must ensure the deed complies with North Dakota law. Using a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company can simplify this process when transferring properties held in trust.

Yes, a quit claim deed can transfer property from a trust. This process is often straightforward when using a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company. Simply ensure that the trust document allows the trustee to make such a transfer, and follow the local recording requirements to complete the transaction.

To start an LLC in North Dakota, you will need to select a unique name for your business, designate a registered agent, and prepare articles of organization. Additionally, you should have an operating agreement to outline the management structure and member responsibilities. By using US Legal Forms, you can easily navigate these requirements, especially when dealing with a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company, ensuring all legal documentation is in order.

Setting up an LLC in North Dakota typically takes about 1-2 weeks if you file the paperwork online. However, processing times may vary based on state workload and your chosen method of filing. To expedite the process, ensure that all your documents are complete and accurate. If you need assistance, using US Legal Forms can streamline the process, especially when managing a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company.

A corporation is a legal entity owned by shareholders, while a Limited Liability Company (LLC) combines the benefits of a corporation and a partnership. In essence, an LLC offers personal liability protection to its owners, which is similar to a corporation. However, LLCs generally have fewer formalities and more flexible management structures. If you are considering transferring assets using a Fargo North Dakota Quitclaim Deed from Trust to Limited Liability Company, understanding these differences is crucial.