Raleigh North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out North Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Are you searching for a trustworthy and affordable legal documents provider to purchase the Raleigh North Carolina Installments Fixed Rate Promissory Note Secured by Residential Property? US Legal Forms is your preferred option.

Whether you require a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the court system, we've got you covered.

Our platform provides over 85,000 current legal document templates for both personal and commercial applications. All templates available are not generic and are structured in compliance with the regulations of specific states and counties.

To download the document, you need to Log In to your account, locate the necessary template, and click the Download button next to it. Please remember that you can access your previously acquired form templates at any time from the My documents section.

Now you can establish your account. Then select the subscription plan and proceed to the payment process. Once your payment is completed, download the Raleigh North Carolina Installments Fixed Rate Promissory Note Secured by Residential Property in any available file format. You can revisit the website whenever necessary and redownload the document without incurring any additional fees.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and put an end to hours wasted learning about legal documents online.

- Is this your first visit to our site? No problem.

- You can create an account in a few minutes, but first ensure to do the following.

- Verify whether the Raleigh North Carolina Installments Fixed Rate Promissory Note Secured by Residential Property complies with the laws of your state and locality.

- Examine the details of the form (if available) to understand who and what the document is meant for.

- Start the search again if the template does not suit your legal needs.

Form popularity

FAQ

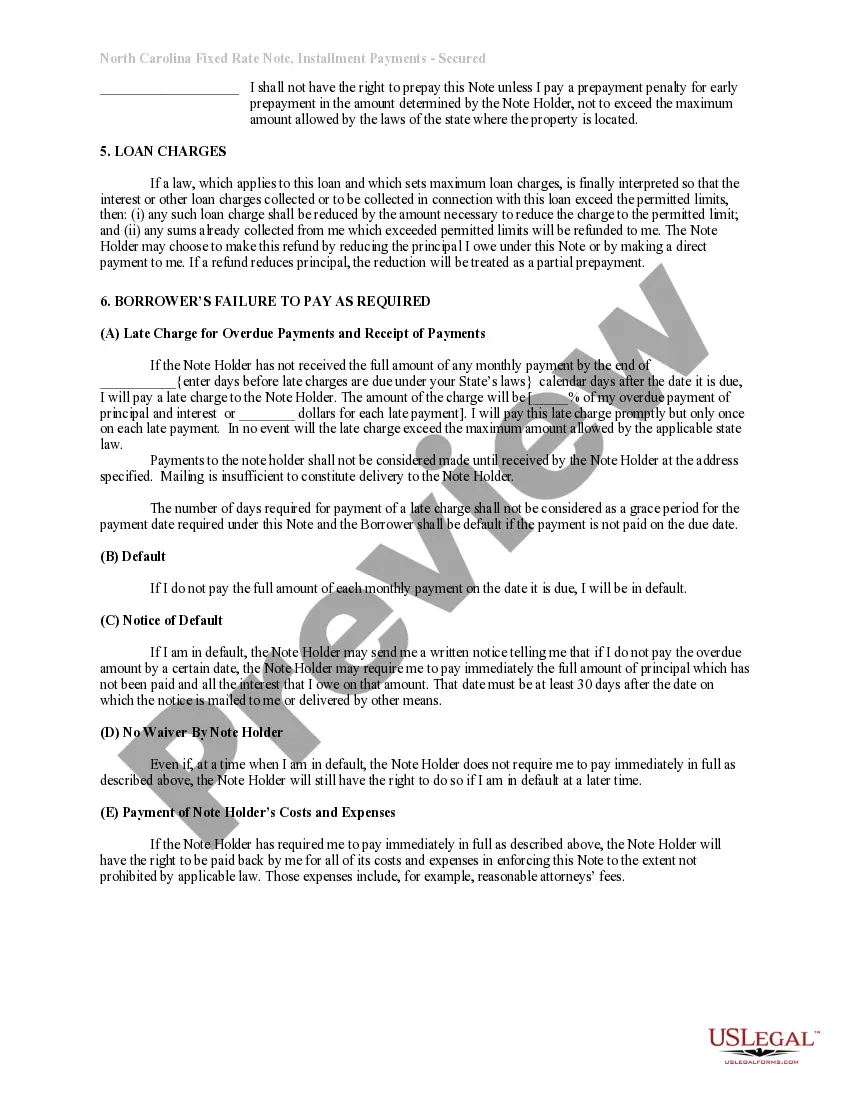

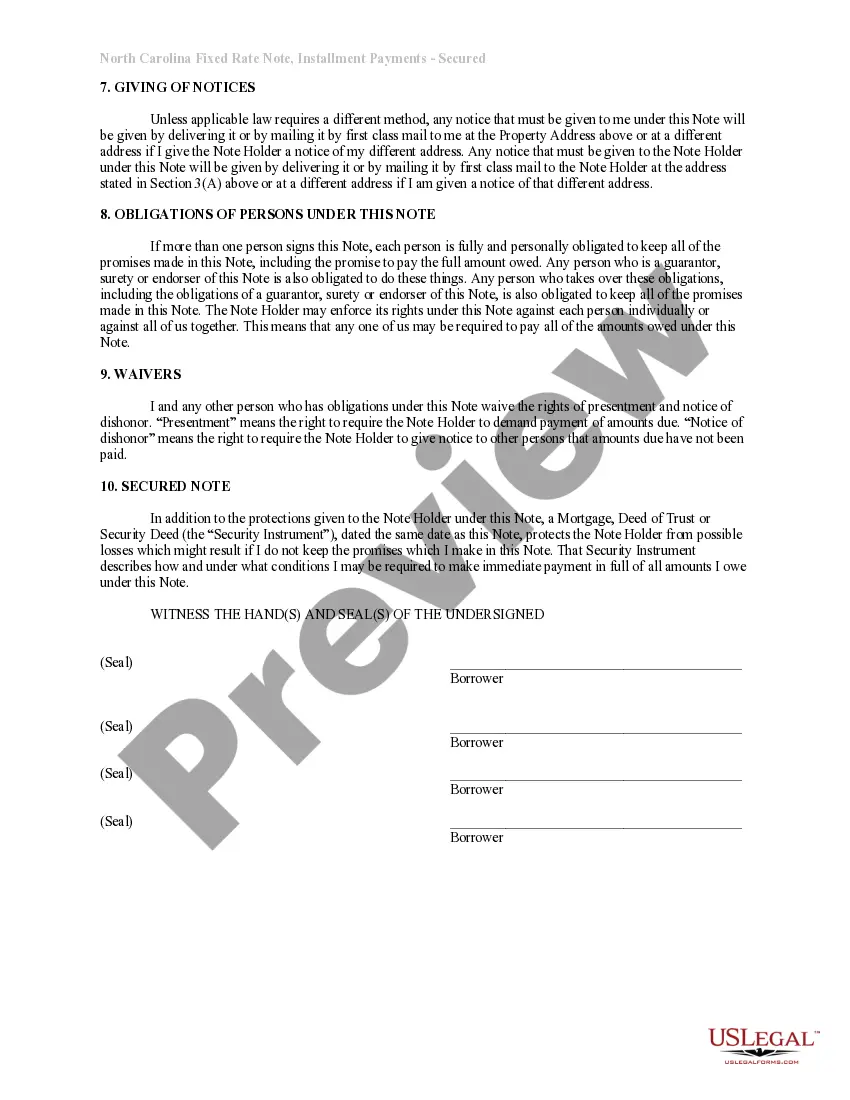

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.

Secured Promissory Notes By assuring that the property attached to the note is of sufficient value to cover the amount of the loan, the payee thus has a guarantee of being repaid. The property that secures a note is called collateral, which can be either real estate or personal property.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.

Dated Signature: In North Carolina, both unsecured and secured promissory notes should be signed and dated by the borrower and any co-signer; the lender need not sign. There is no legal requirement for most promissory notes to be witnessed or notarized in North Carolina.

Promissory notes are legally binding contracts. That means when you don't pay back your loan, you could lose your collateral. If there's no collateral to secure the loan, the lender on the promissory note can take the borrower to court seeking repayment.