Wilmington North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Regardless of the social or occupational ranking, completing legal documents is a regrettable requirement in the current professional landscape.

Frequently, it’s virtually unattainable for someone lacking a legal background to compose such documents from scratch, largely due to the intricate language and legal nuances they involve.

This is where US Legal Forms steps in to assist.

Verify that the form you have selected is appropriate for your locality, as the regulations of one state or county may not be applicable to another.

If the form you selected does not satisfy your needs, you can restart the process and search for the suitable document.

- Our platform offers a vast assortment of over 85,000 ready-to-use, state-specific forms suitable for nearly any legal situation.

- US Legal Forms is also a valuable asset for associates or legal advisers aiming to increase their efficiency using our DIY forms.

- Whether you need the Wilmington North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors or any other document applicable in your jurisdiction, US Legal Forms has everything you need at your fingertips.

- Here’s how to acquire the Wilmington North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors in moments using our reliable platform.

- If you are an existing customer, proceed to Log In to your account to retrieve the necessary form.

- If you are new to our platform, ensure to follow these instructions before downloading the Wilmington North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Form popularity

FAQ

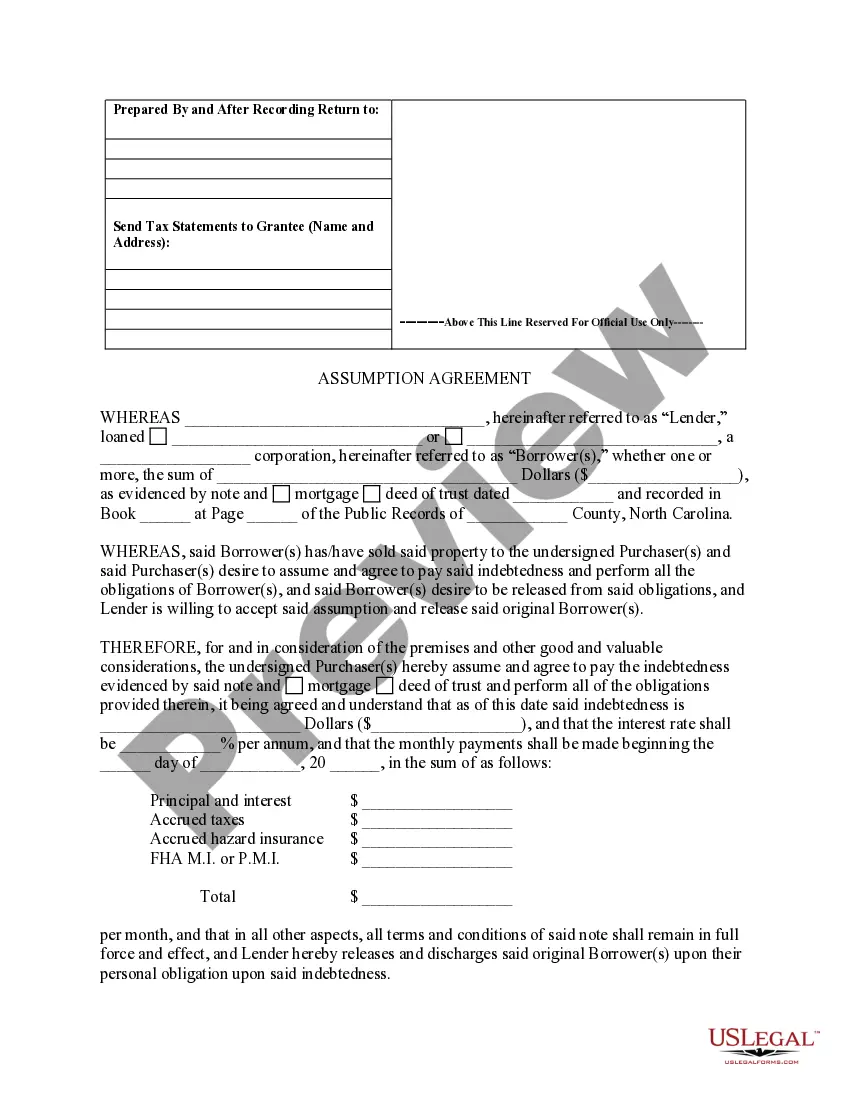

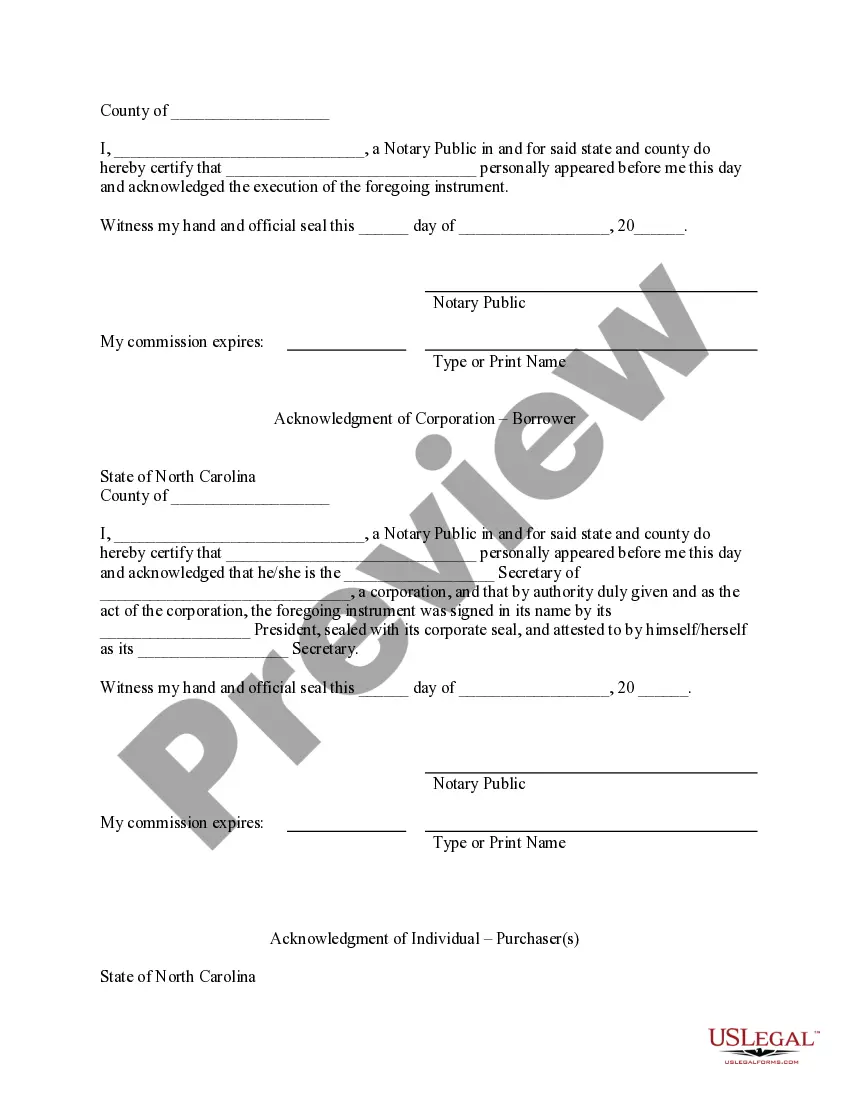

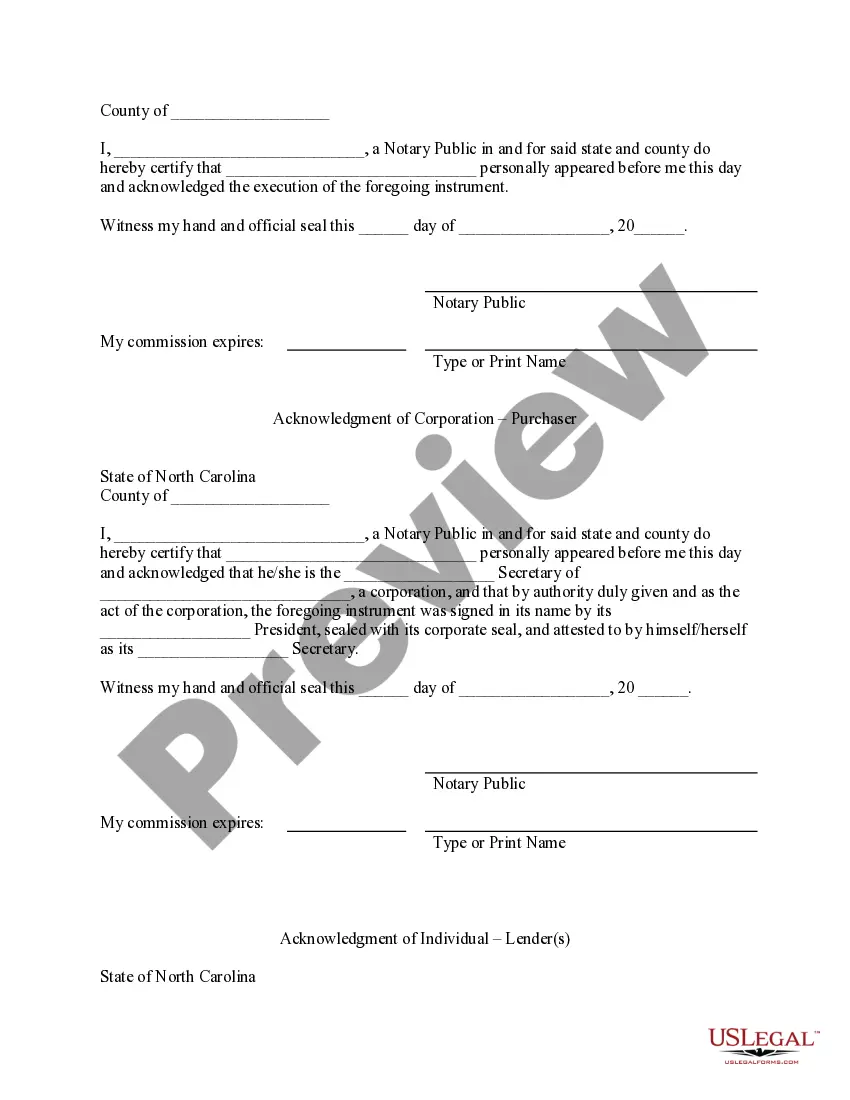

The assumption of the deed of trust occurs when a new borrower takes over an existing mortgage from the original borrower. This arrangement can benefit all parties by maintaining consistent financing terms and avoiding the need for a new mortgage. In Wilmington North Carolina, the Assumption Agreement of Deed of Trust and Release of Original Mortgagors facilitates these transactions, ensuring that all legal aspects are clearly covered.

One disadvantage of a deed of trust is the potential for rapid foreclosure without a court's oversight. This can be daunting for homeowners, as it places significant pressure on borrowers during financial hardship. Understanding the implications of the Wilmington North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors can help mitigate these risks.

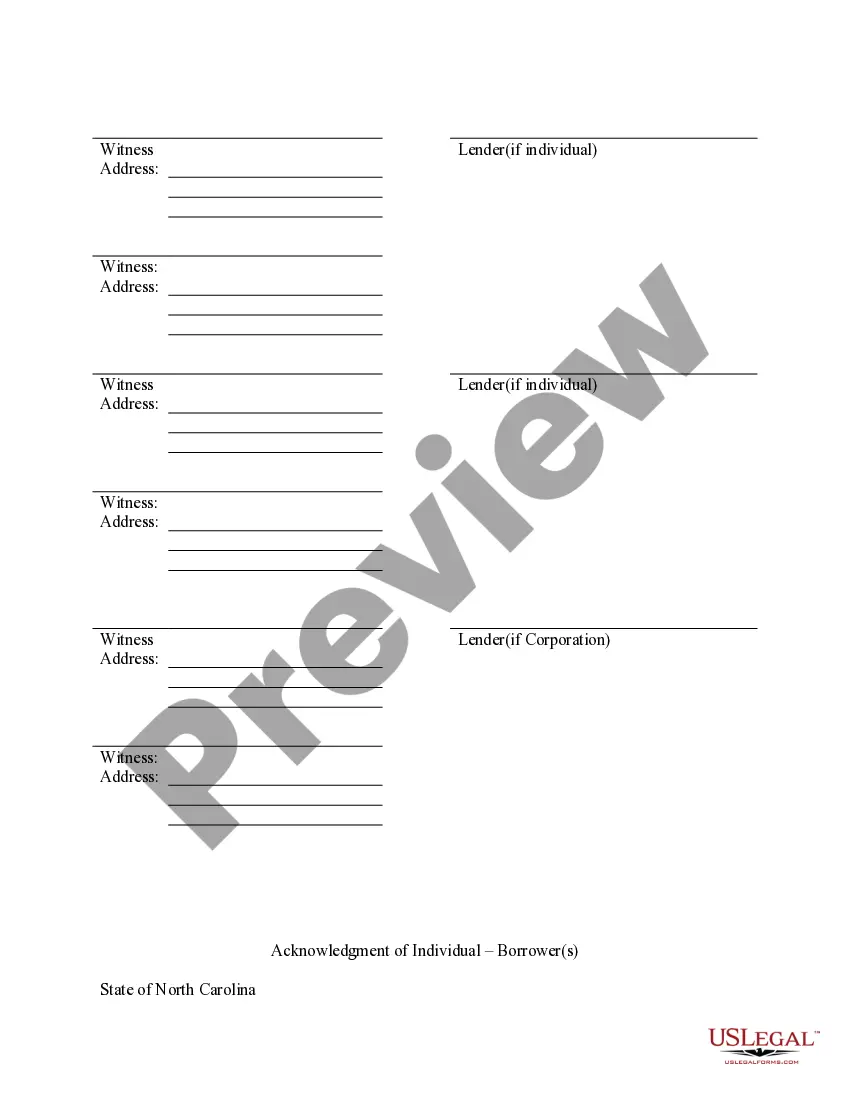

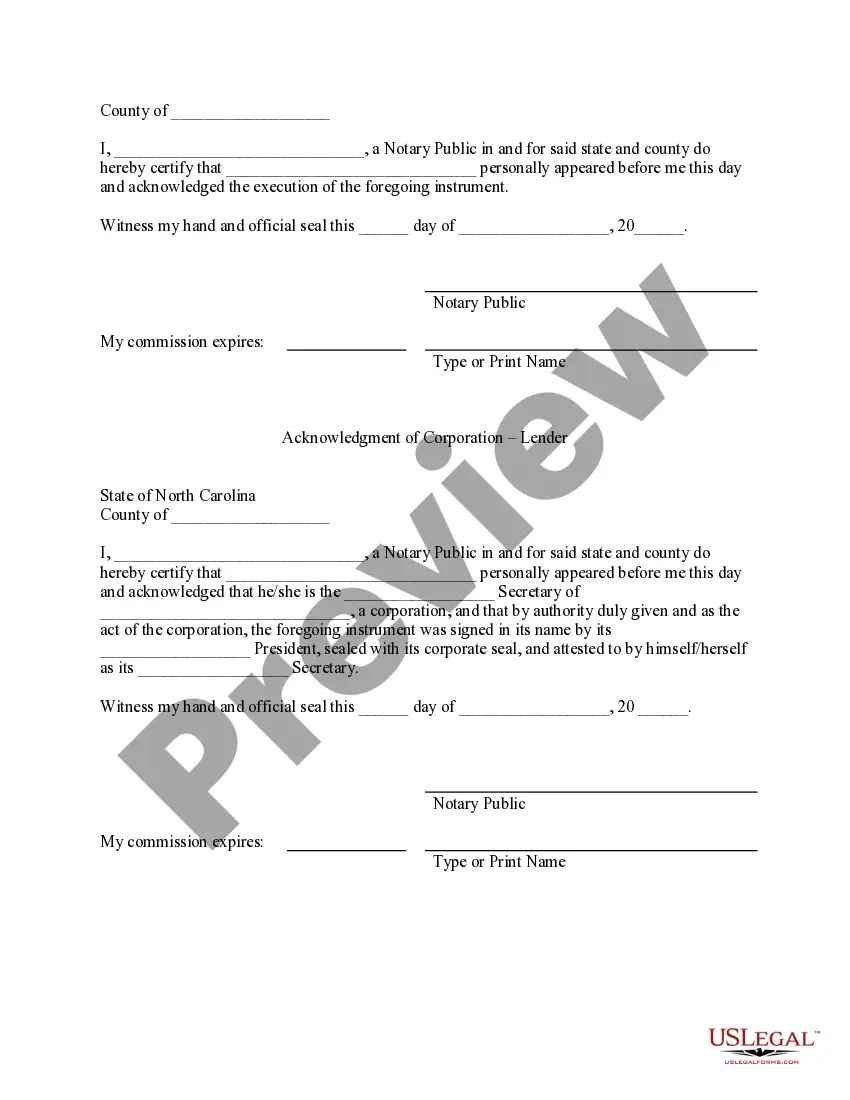

A valid deed in North Carolina must include specific elements such as clear identification of the property, the names of the parties involved, and a legal description of the property. Additionally, it typically needs to be notarized and recorded with the local register of deeds. The Wilmington North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors may also require certain formalities to be valid.

North Carolina primarily uses deeds of trust rather than traditional mortgages. This practice provides an effective way for lenders to secure their investments while also streamlining the foreclosure process. If you're navigating these documents, consider resources related to the Wilmington North Carolina Assumption Agreement of Deed of Trust for clarity and support.

Lenders often favor a deed of trust because it simplifies the foreclosure process. Unlike mortgages, which can require lengthy court involvement, deeds of trust allow lenders to proceed more quickly if a borrower defaults. This efficiency can create a more secure lending environment in Wilmington, North Carolina.

Using a deed of trust provides several advantages, including a quicker foreclosure process. In Wilmington, North Carolina, this method allows lenders to bypass costly court procedures, streamlining the process for both borrowers and lenders. This can lead to more favorable terms for homeowners in an Assumption Agreement of Deed of Trust.

In North Carolina, the statute of limitations for enforcing a deed of trust is typically ten years. This timeframe can affect the rights of the original mortgagors in cases of default or foreclosure. If you have concerns about legal action related to a deed of trust, considering the Wilmington North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors may be beneficial.

In North Carolina, the statute of limitations for property claims generally ranges from three to ten years, depending on the type of claim. This timeline determines how long you have to make a legal claim or defense regarding property disputes. For specific scenarios, including those involving Wilmington North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, consulting a professional can provide clarity.

A deed can be considered invalid in North Carolina for several reasons. Common issues include lack of proper signatures, failure to meet legal requirements for notarization, and not being delivered correctly to the grantee. Additionally, if the deed contains incorrect information or violates established laws, it may also be ruled invalid. If you need help understanding the implications of these issues, consider consulting an expert on Wilmington North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

To release a deed of trust in Wilmington, North Carolina, start by verifying that you have completed all necessary payments to your lender. Once confirmed, you can request a deed of release that serves as proof that the lender relinquishes their claim. Filing this document with the local authority is vital to update the public records and clear your property title.