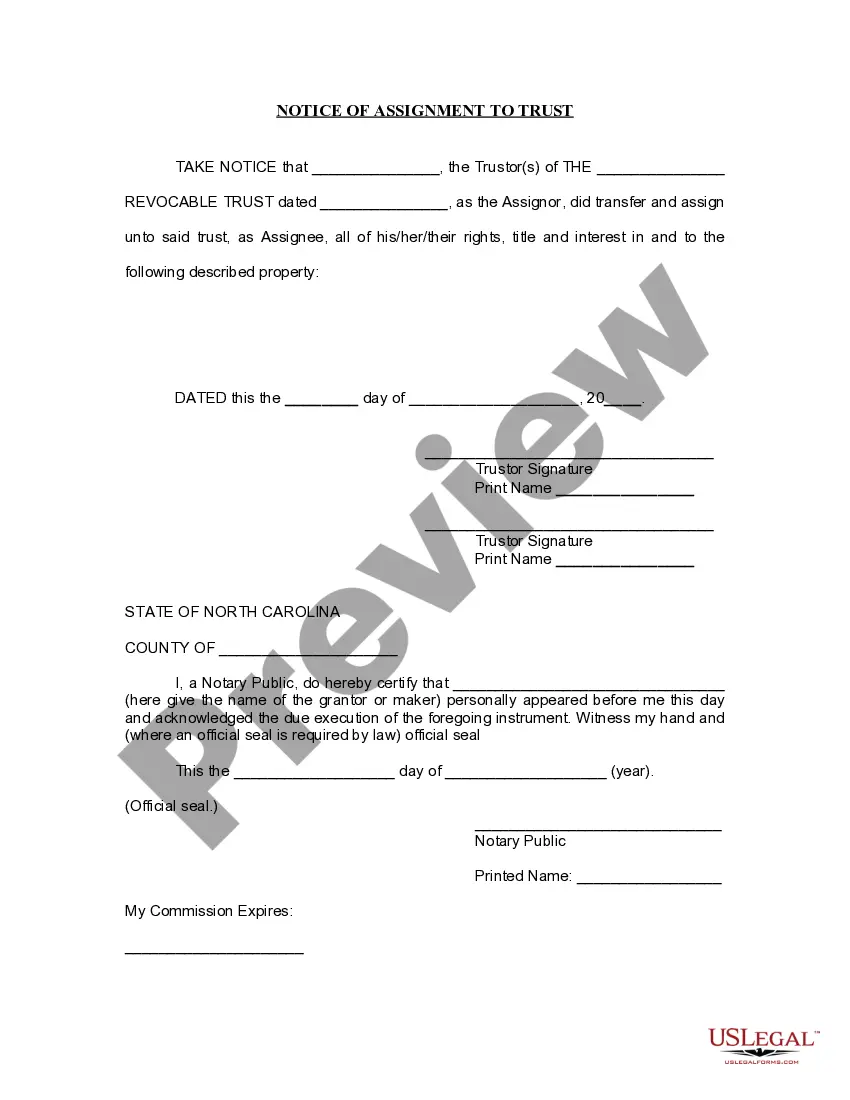

Raleigh North Carolina Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

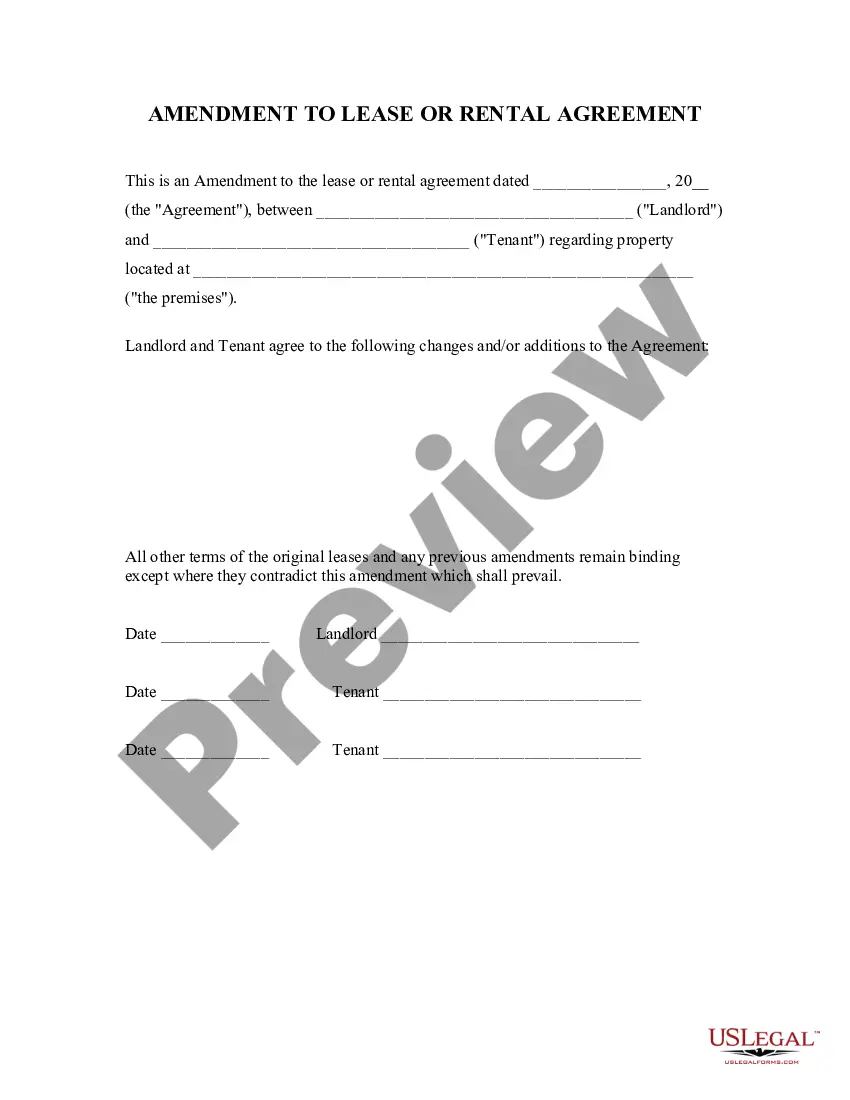

How to fill out North Carolina Notice Of Assignment To Living Trust?

Take advantage of the US Legal Forms and gain immediate access to any form template you require.

Our advantageous platform with a vast selection of templates enables you to discover and acquire nearly any document sample you need.

You can download, fill out, and endorse the Raleigh North Carolina Notice of Assignment to Living Trust in just a few minutes rather than spending hours on the internet searching for the correct template.

Utilizing our collection is an excellent approach to enhance the security of your document submissions. Our skilled attorneys frequently examine all the documents to guarantee that the templates are pertinent to a specific state and in accordance with current laws and regulations.

Initiate the saving process. Click Buy Now and select your preferred pricing plan. After that, create an account and pay for your order with a credit card or PayPal.

Download the file. Specify the format to obtain the Raleigh North Carolina Notice of Assignment to Living Trust and modify and complete, or sign it according to your needs. US Legal Forms is among the most extensive and reliable form repositories online. We are always prepared to support you in nearly any legal situation, even if it is merely downloading the Raleigh North Carolina Notice of Assignment to Living Trust.

- How can you access the Raleigh North Carolina Notice of Assignment to Living Trust.

- If you're a subscriber, simply Log In to your account. The Download option will be accessible for all the documents you view.

- Moreover, you can retrieve all previously saved documents in the My documents section.

- If you haven't created an account yet, follow the steps below.

- Locate the template you need. Ensure that it is the form you were looking for: check its title and description, and utilize the Preview feature if available. Otherwise, use the Search box to find the suitable one.

Form popularity

FAQ

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Movable property: A trust in relation to movable property can be declared as in the case of immovable property or by transferring the ownership of the property to the trustee. Hence, registration is not mandatory.

The cost of forming a living trust will depend on how you go about setting it up. If you use an online program to draw up the trust document yourself, you will pay a few hundred dollars or less. You can also choose to hire an attorney, which could end up costing more than $1,000.

A living trust in North Carolina (also known as an inter vivos trust) is set up by the grantor, a person placing assets in trust. When you establish a trust like this, your assets will be owned in the name of the trust, but managed for your benefit while you are alive.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

To make a living trust in North Carolina, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

A trust does not go through the North Carolina probate process and becomes a matter of public record.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

A trust does not go through the North Carolina probate process and becomes a matter of public record.