Raleigh North Carolina Assignment to Living Trust

Description

How to fill out North Carolina Assignment To Living Trust?

If you have previously taken advantage of our service, Log In to your account and download the Raleigh North Carolina Assignment to Living Trust to your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it based on your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to acquire your file.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents section whenever you wish to reuse it. Make the most of the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

- Confirm you’ve found an appropriate document. Review the description and utilize the Preview feature, if available, to ascertain if it satisfies your needs. If it does not meet your criteria, use the Search option above to find the right one.

- Obtain the template. Click the Buy Now button and choose between a monthly or yearly subscription plan.

- Establish an account and process payment. Enter your credit card information or select the PayPal option to finalize the purchase.

- Receive your Raleigh North Carolina Assignment to Living Trust. Choose the file type for your document and save it to your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

However, most states, including North Carolina, afford privacy to a living trust's creator and beneficiaries by not requiring public registration of trusts.

A trust does not go through the North Carolina probate process and becomes a matter of public record.

The cost of forming a living trust will depend on how you go about setting it up. If you use an online program to draw up the trust document yourself, you will pay a few hundred dollars or less. You can also choose to hire an attorney, which could end up costing more than $1,000.

Likewise, North Carolina law provides that all current trust beneficiaries have a right to receive a copy of the trust document, and a right to financial accountings and trust management records at ?reasonable intervals.? It is a good idea for a trustee to be proactive, and responsive, in providing these items to

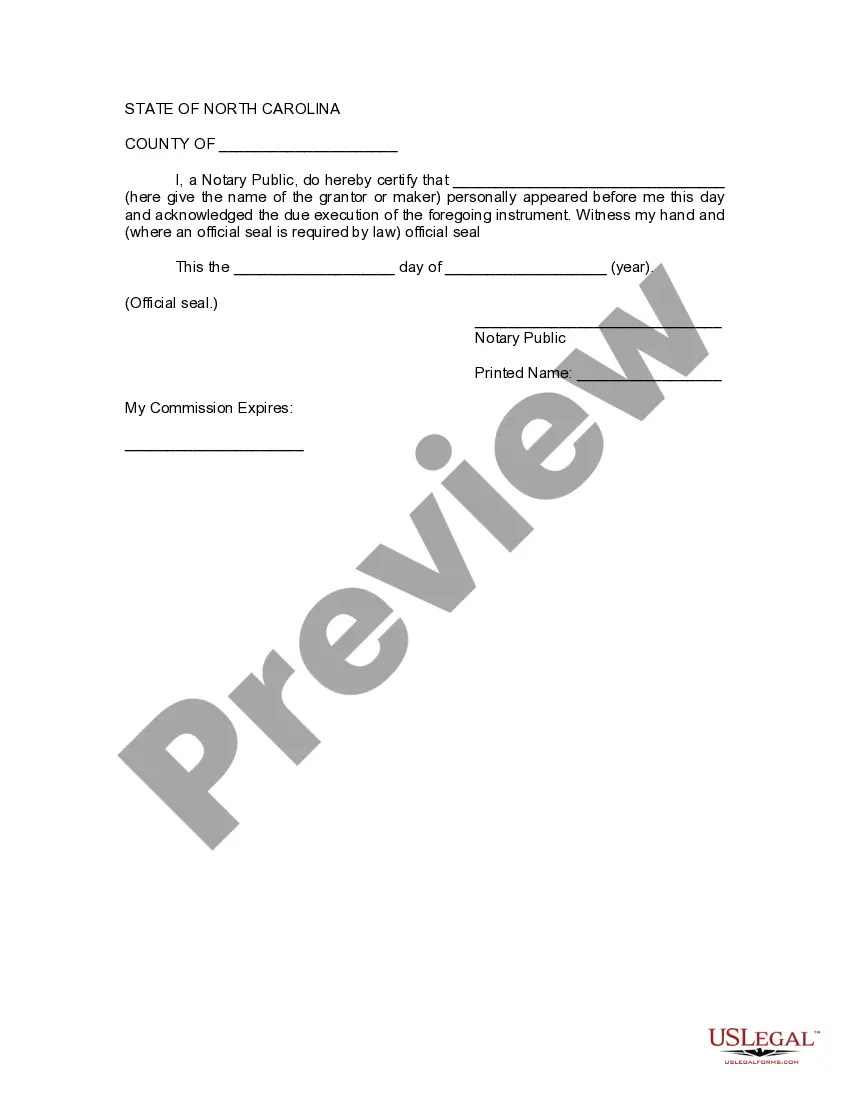

A notary is not required to create a trust (N.C.G.S. § 36C-4-407). However, it is common practice in North Carolina for a trust to be witnessed by a notary.

To make a living trust in North Carolina, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Movable property: A trust in relation to movable property can be declared as in the case of immovable property or by transferring the ownership of the property to the trustee. Hence, registration is not mandatory.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

A living trust in North Carolina (also known as an inter vivos trust) is set up by the grantor, a person placing assets in trust. When you establish a trust like this, your assets will be owned in the name of the trust, but managed for your benefit while you are alive.