Charlotte North Carolina Amendment to Living Trust

Description

How to fill out North Carolina Amendment To Living Trust?

We consistently endeavor to diminish or evade legal complications when engaging with intricate legal or financial matters.

To achieve this, we seek legal services that are typically very costly. Nevertheless, not every legal matter is equally complicated.

The majority can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it.

- Our repository empowers you to handle your matters without relying on legal advisors.

- We provide access to legal document templates that aren’t always accessible to the public.

- Our templates are specific to states and areas, which greatly streamlines the search process.

- Make use of US Legal Forms whenever you need to obtain and download the Charlotte North Carolina Amendment to Living Trust or any other document swiftly and securely.

Form popularity

FAQ

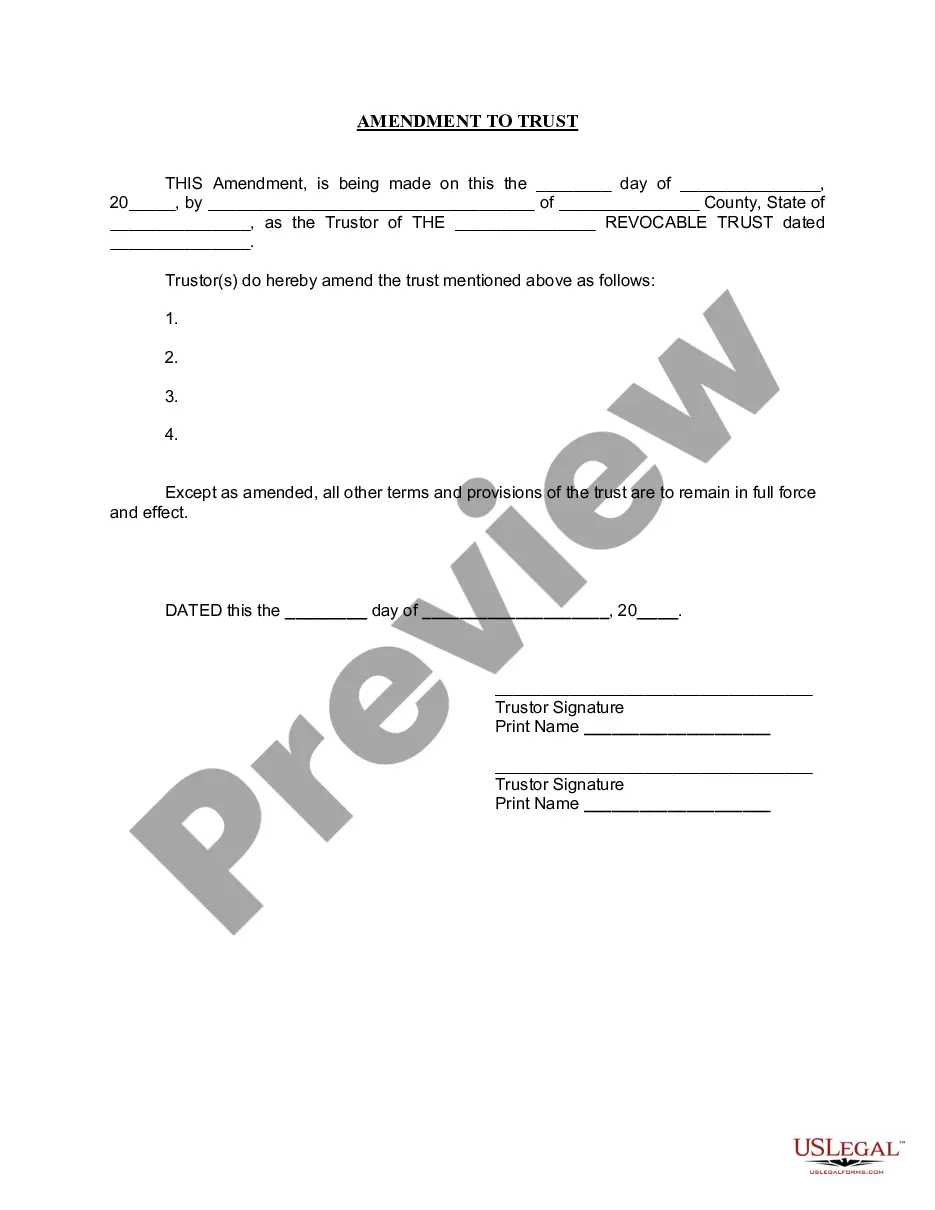

A revocable trust can be modified while the Grantor is alive. Revising the terms of a trust is known as ?amending? the trust. An amendment is generally appropriate when there are only a few minor changes to make, like rewording a certain paragraph, changing the successor trustee, or modifying beneficiaries.

Amending a Living Trust in California Nearly all trust documents can be amended. However, some are easier to amend than others. In the case of a revocable living trust, amendments usually take on the form of additional documents written after the original trust document has been signed and notarized.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

If you use an online program to draw up the trust document yourself, you will pay a few hundred dollars or less. You can also choose to hire an attorney, which could end up costing more than $1,000. The exact amount you'll pay for a lawyer will depend on the fees the lawyer charges.

One advantage for using a trust is that trusts can be used to begin distributing property before death, at death or even sometime afterwards. That isn't helpful or important in all cases, but it provides a level of flexibility that a will simply can't.

Fortunately, California law allows for the amendment, modification or termination of an otherwise irrevocable trust--under the proper circumstances and using the proper procedures.

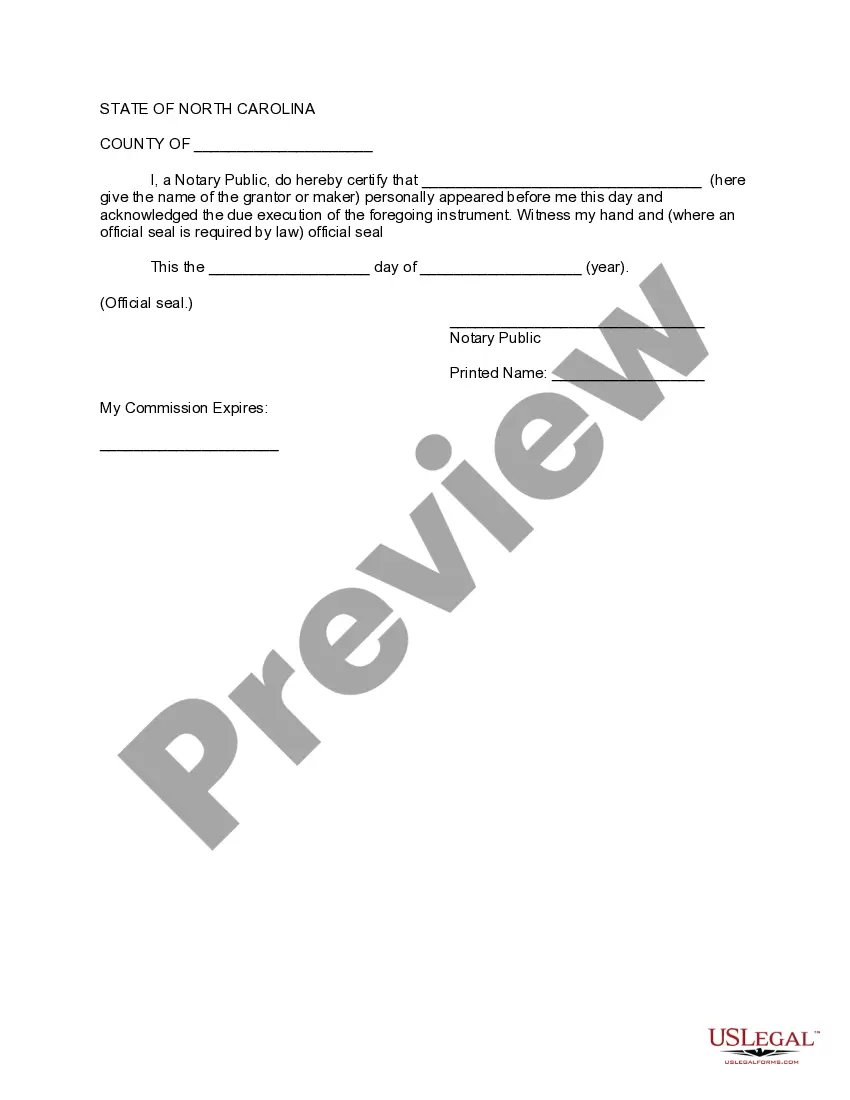

However, most states, including North Carolina, afford privacy to a living trust's creator and beneficiaries by not requiring public registration of trusts.

Likewise, North Carolina law provides that all current trust beneficiaries have a right to receive a copy of the trust document, and a right to financial accountings and trust management records at ?reasonable intervals.? It is a good idea for a trustee to be proactive, and responsive, in providing these items to

STAND-ALONE DOCUMENTS Revocable Living Trust Amendments & Restatements: Cost starts at $350 for a simple amendment or $1,000 for a full restatement. Special Needs Trust: Cost starts at $3,000 for a stand-alone document or $1,500 when created in conjunction with a revocable living trust-based estate plan.

With the adoption of Probate Code Section 15401, that changed, and the law provided two distinct ways in which to revoke a California Trust: (1) revoke using the manner provided in the Trust instrument, or (2) revoke by any writing (other than a Will) signed by the Settlor and delivered to the trustee during the