Cary North Carolina Living Trust for Husband and Wife with No Children

Description

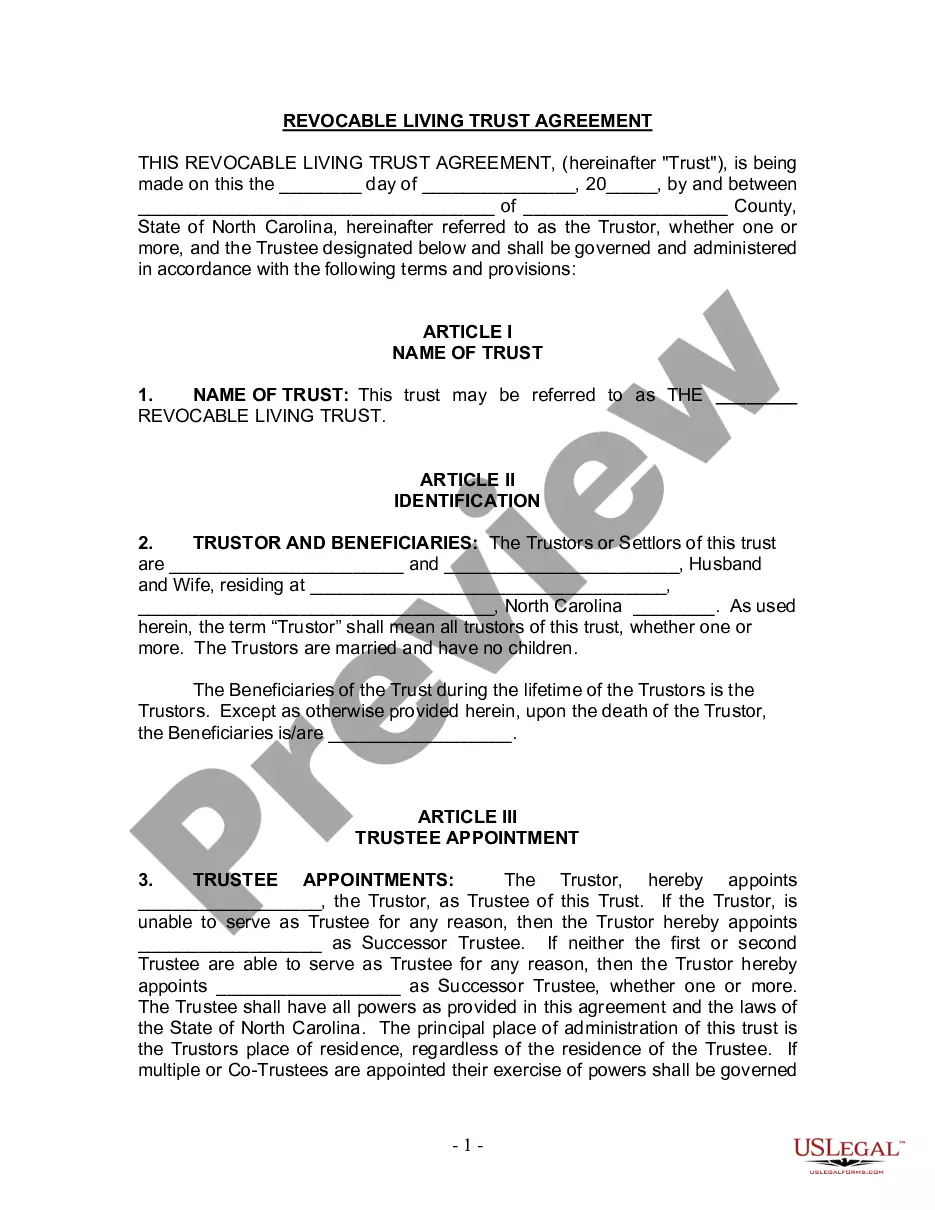

How to fill out North Carolina Living Trust For Husband And Wife With No Children?

If you are in search of an authentic document, it’s exceedingly challenging to select a more user-friendly service than the US Legal Forms website – one of the largest collections available online.

Here you can access a vast array of templates for both business and personal needs organized by type, location, or keywords. With our sophisticated search capabilities, obtaining the latest Cary North Carolina Living Trust for Husband and Wife without Children is as simple as 1-2-3.

Furthermore, the pertinence of each file is confirmed by a panel of proficient attorneys who regularly evaluate the templates on our platform and refresh them in accordance with the latest state and county regulations.

Obtain the document. Choose the file format and save it to your device.

Make adjustments. Fill out, alter, print, and sign the obtained Cary North Carolina Living Trust for Husband and Wife without Children. Each document you store in your user profile does not expire and belongs to you indefinitely. You can access them through the My documents menu, so if you need to acquire an additional copy for editing or printing, you may return and download it anytime. Utilize the US Legal Forms professional library to access the Cary North Carolina Living Trust for Husband and Wife without Children you sought along with a multitude of other professional and state-specific templates on a single platform!

- If you are already familiar with our site and possess an account, all you need to do to obtain the Cary North Carolina Living Trust for Husband and Wife without Children is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, refer to the instructions outlined below.

- Ensure you have accessed the form you desire. Review its description and utilize the Preview feature to inspect its contents. If it doesn’t meet your requirements, use the Search option at the top of the page to find the suitable document.

- Verify your selection. Click the Buy now button. Following that, choose your preferred payment plan and provide details to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Joint trusts can complicate the distribution process after one partner passes away. When using a joint trust, assets may become entangled, leading to confusion during probate. A Cary North Carolina Living Trust for Husband and Wife with No Children may offer a smoother transition since it allows for distinct estate management. Couples might find that separate trusts better align with their individual estate planning needs while still achieving shared goals.

Husbands and wives may opt for separate trusts to maintain individual control over certain assets. This structure can provide clarity in asset management and distribution, especially in cases of differing financial goals or previous commitments. A Cary North Carolina Living Trust for Husband and Wife with No Children can allow couples to combine benefits while protecting personal interests. This arrangement may also help in minimizing tax implications or ensuring specific wishes are honored.

Suze Orman emphasizes the importance of having a living trust, especially for couples. She highlights that a Cary North Carolina Living Trust for Husband and Wife with No Children can help manage assets efficiently. This type of trust can simplify the transition of wealth and reduce potential conflict among beneficiaries. Orman's insights encourage couples to consider trusts as valuable tools for financial security.

When establishing a Cary North Carolina Living Trust for Husband and Wife with No Children, consider leaving out certain kinds of assets. For example, life insurance policies should generally remain outside the trust to ensure smooth beneficiary payouts. Additionally, personal belongings with sentimental value or items that require high maintenance might not be suitable for inclusion in a trust.

Yes, individuals can write their own trust in North Carolina; however, it is generally advisable to seek professional assistance to ensure compliance with state laws. A Cary North Carolina Living Trust for Husband and Wife with No Children must meet specific legal requirements to function properly. Using platforms like uslegalforms can guide you through the process, simplifying the creation of a trust that meets your needs.

While the goal of shielding assets is common, the effectiveness of this strategy varies. A Cary North Carolina Living Trust for Husband and Wife with No Children serves primarily to manage assets and streamline inheritance, but it might not provide the level of privacy or protection some couples desire. Legal tools like spendthrift trusts can offer additional protection against creditors, so consulting a legal expert is important.

Assets like primary residences often cannot be transferred into a trust immediately without tax implications. This is particularly relevant for a Cary North Carolina Living Trust for Husband and Wife with No Children as it may affect property tax benefits. Always consult a tax professional before making these transfers to avoid unexpected financial burdens.

When considering a Cary North Carolina Living Trust for Husband and Wife with No Children, certain assets may be better kept outside the trust. Primarily, retirement accounts such as IRAs and 401(k)s usually have specific beneficiary rules that can complicate trust management. Additionally, vehicles, which can be subject to state registration requirements, are often not advisable for inclusion in a trust.

Yes, you can create your own living trust in North Carolina, including a Cary North Carolina Living Trust for Husband and Wife with No Children. Many online platforms, such as USLegalForms, provide resources and templates to guide you through the process. However, consulting with a legal professional can help ensure that your trust is set up correctly and aligns with your intentions. Taking this step can give you confidence that your estate is well-planned.

While you may not be parents, understanding common mistakes can be helpful when contemplating a Cary North Carolina Living Trust for Husband and Wife with No Children. A significant error often involves not reviewing and updating the trust regularly. Additionally, failing to fund the trust properly can render it ineffective. Carefully managing these aspects ensures your trust meets your needs and goals over time.