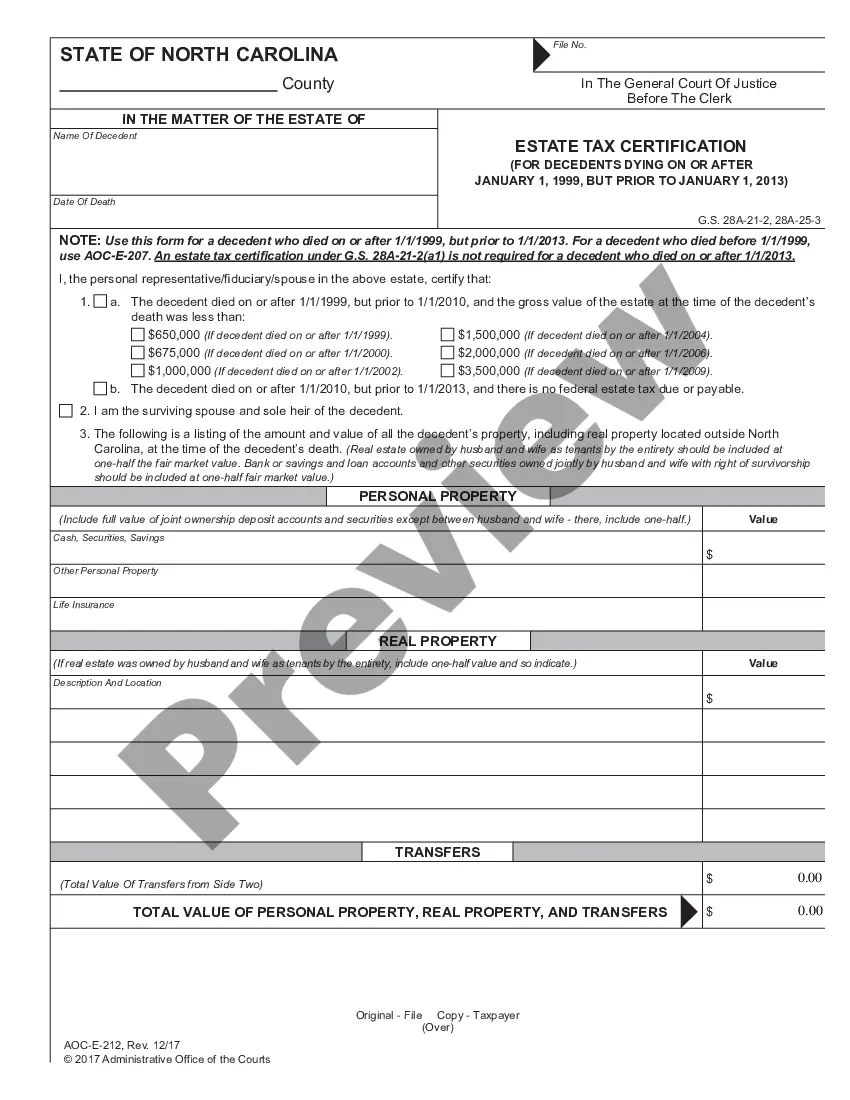

Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99

Description

How to fill out North Carolina Inheritance And Estate Tax Certification - Decedents Prior To 1-1-99?

If you’ve previously made use of our service, Log In to your account and save the Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99 onto your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it following your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have ongoing access to all documents you have purchased: they can be found in your profile under the My documents section whenever you wish to reuse them. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!

- Ensure you’ve identified a suitable document. Review the description and use the Preview feature, if available, to verify if it fulfills your needs. If it doesn’t suit you, utilize the Search option above to find the correct one.

- Purchase the form. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Obtain your Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99. Choose the file format for your document and store it on your device.

- Complete your document. Print it out or utilize professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

Yes, there is a clear difference between inheritance tax and estate tax. Inheritance tax is imposed on the beneficiaries receiving assets from a deceased person's estate, while estate tax is charged on the total value of the deceased's assets before distribution. For Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99, understanding these distinctions is crucial for compliance and financial planning. Utilizing uslegalforms can help you navigate the complexities of these taxes.

In North Carolina, the order of inheritance typically starts with the deceased's spouse and children. If no spouse or children exist, parents and siblings have priority. Understanding Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99 can help you further comprehend how to effectively manage and distribute an estate according to these laws.

North Carolina law mandates that assets are distributed according to the state's intestacy laws if no will exists. These laws prioritize spouses, children, and parents in the distribution process. If you need detailed information regarding Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99, consider using our platform, US Legal Forms, for thorough legal resources.

No, North Carolina does not impose an inheritance tax. Therefore, there is no requirement for an inheritance tax waiver in the state. However, understanding Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99 can clarify any obligations you might have related to estate taxes or certifications needed for the estate settlement process.

To avoid inheritance tax in North Carolina, it is important to plan your estate carefully. Strategies include giving away assets while you are still alive, establishing trusts, and ensuring your beneficiaries are set up correctly. Additionally, staying informed about Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99 can help you navigate any potential tax liabilities effectively.

In North Carolina, there is no inheritance tax on property received after January 1, 1987. While there are federal estate tax considerations, generally, you can inherit without paying state taxes if the estate value falls below the exemption limit. To ensure you understand your specific situation, look into Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99.

An estate tax return can be prepared by the executor of the estate, an attorney, or a tax professional. The key is that the person preparing the return must understand the tax laws and the specific details of the estate. Choosing a service like uslegalforms can also facilitate this process by providing forms and guidance related to Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99.

Whether you need to file an estate tax return in North Carolina depends on the total value of the decedent's estate. If the estate's value exceeds the exemption limit, you will need to file a return within nine months following death. To navigate this process, we recommend using uslegalforms, which provides tailored resources for Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99.

In North Carolina, there is no inheritance tax for assets inherited after January 1, 1987. However, the threshold for estate taxes depends on the taxable estate's value. For estates of decedents prior to January 1, 1999, it is vital to understand the specific regulations in place. To ensure compliance, obtaining Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99 can help clarify any uncertainties.

In North Carolina, you can file inheritance taxes by completing the appropriate tax return forms, which detail the value of the estate and the inheritance received by each beneficiary. It is crucial to gather all necessary documentation, as the filing must be completed within nine months of the decedent's death. If you need assistance with this process, platforms like uslegalforms can provide the necessary forms and guidance tailored to Wilmington North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99.