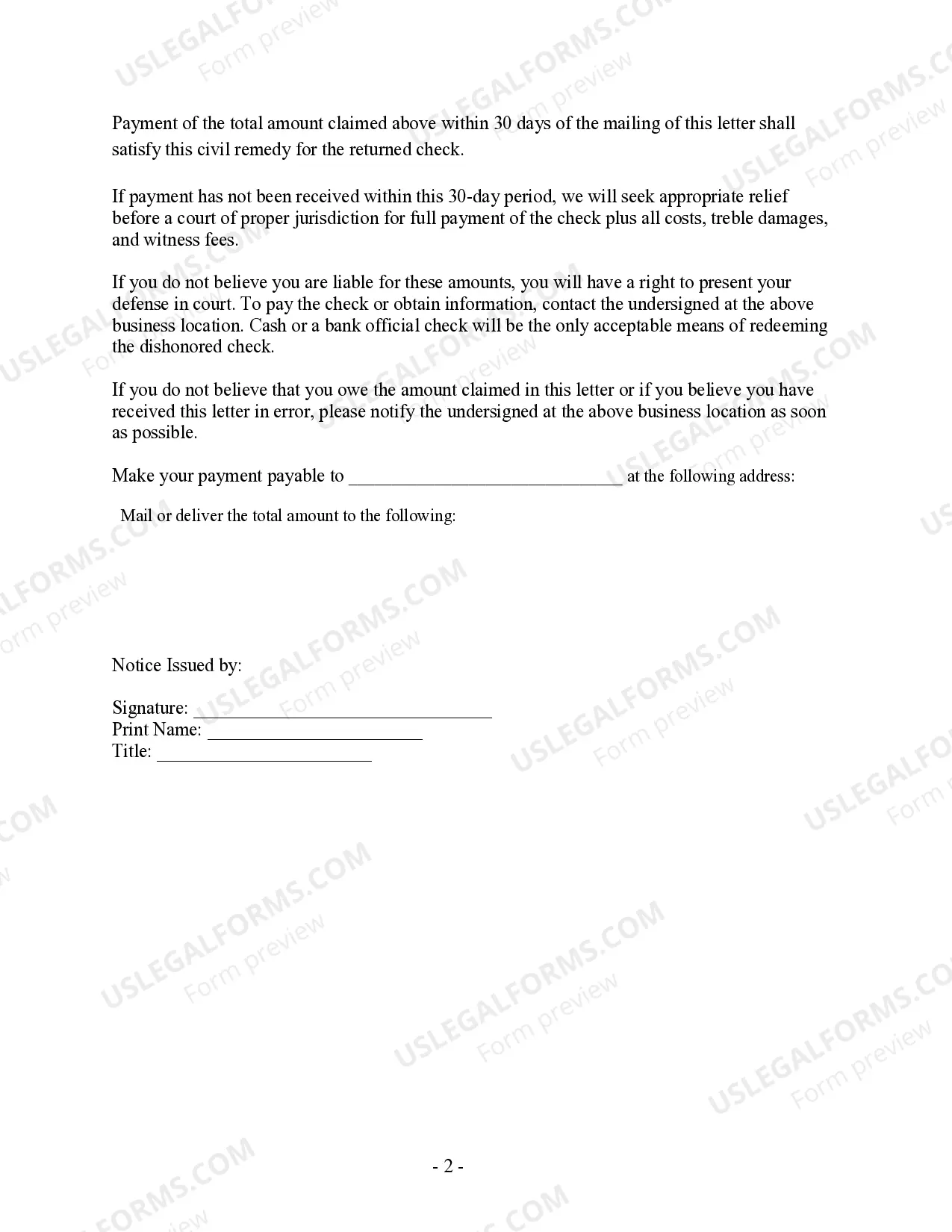

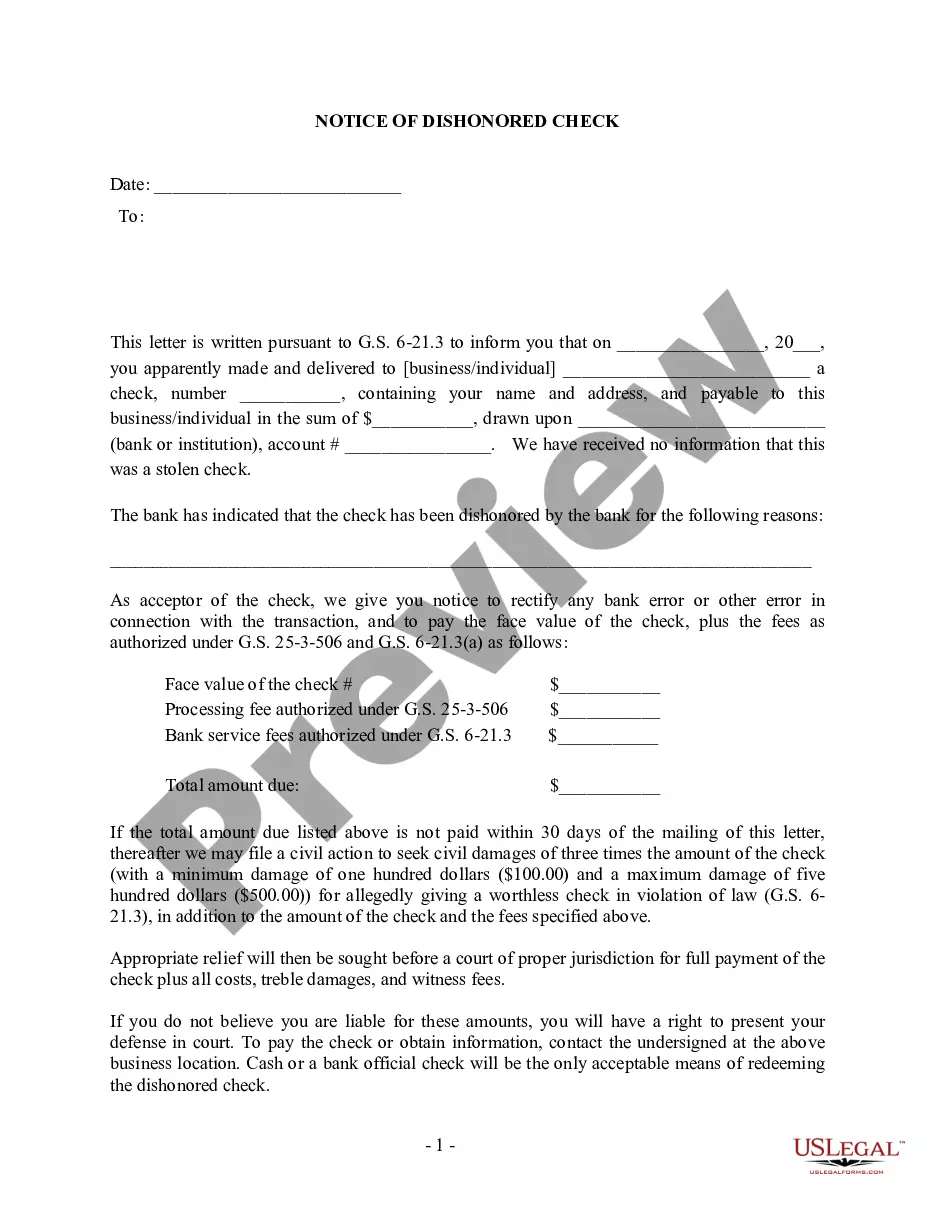

Charlotte North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check

Description

How to fill out North Carolina Notice Of Dishonored Check - Civil - 2nd Notice - Keywords: Bad Check, Bounced Check?

We consistently aim to reduce or evade legal complications when engaging with intricate law-related or financial issues.

To achieve this, we seek attorney solutions that are typically quite expensive.

Nevertheless, not all legal complications are equally intricate.

Many can be managed independently.

Leverage US Legal Forms whenever you need to obtain and download the Charlotte North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check or any other form effortlessly and securely.

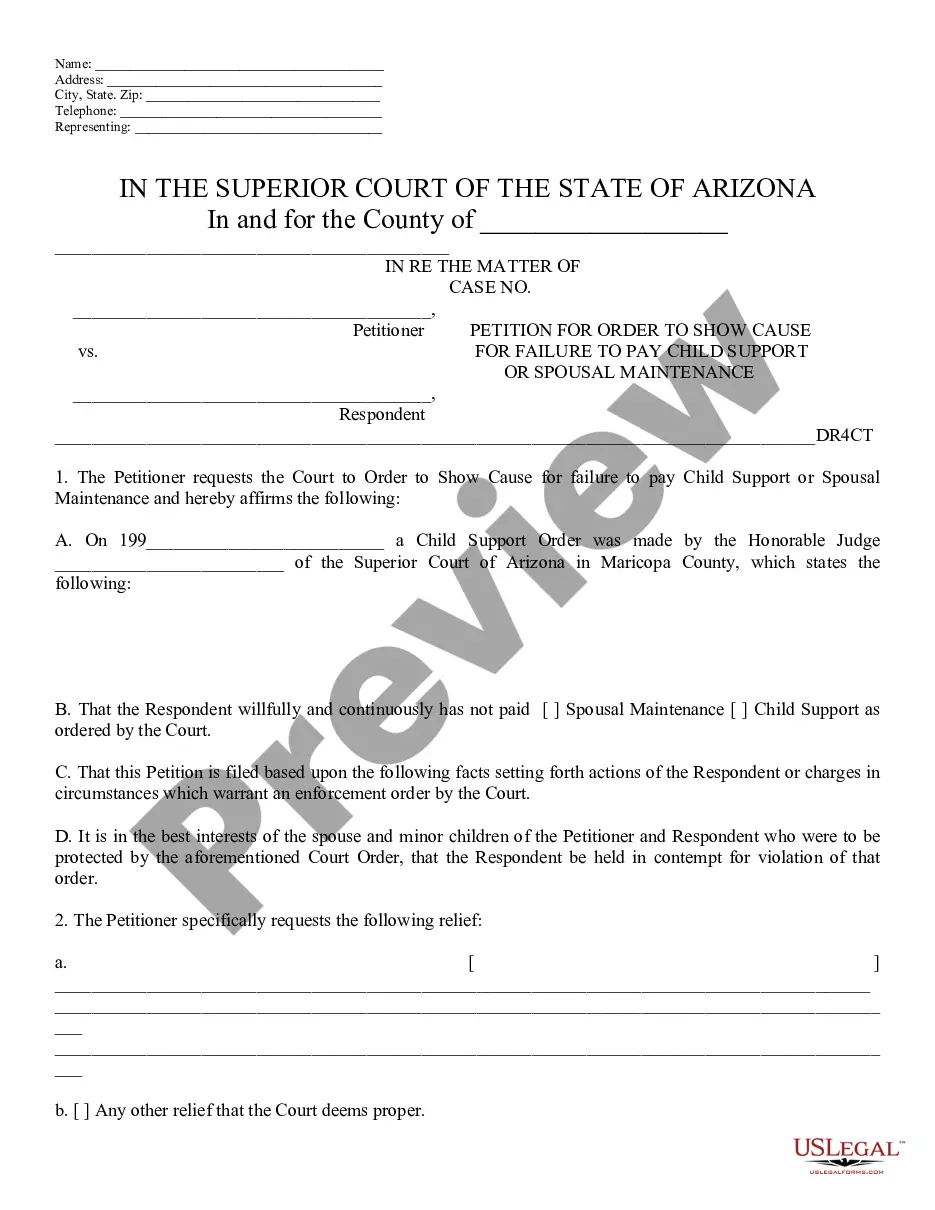

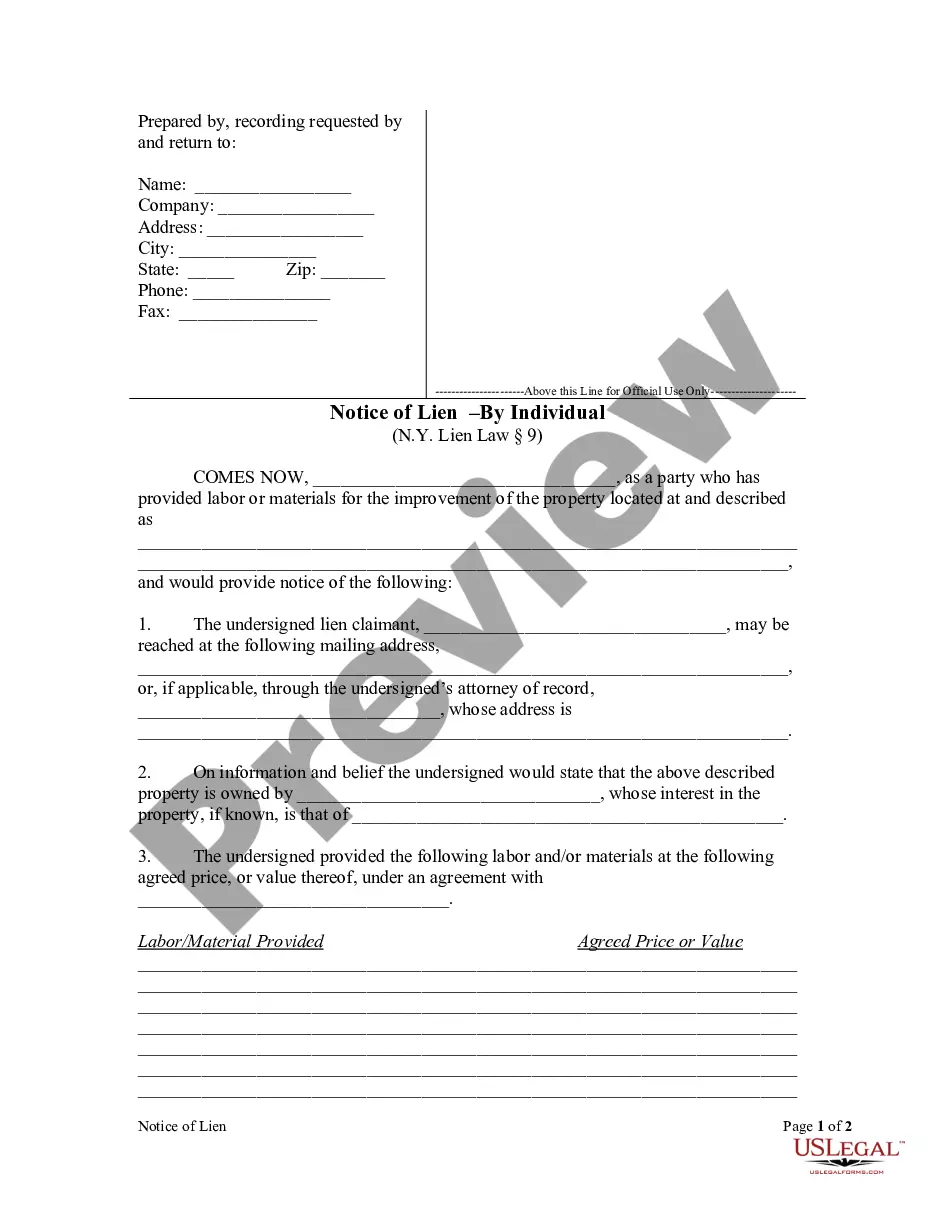

- US Legal Forms is an online repository of current DIY legal templates covering everything from wills and power of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to take control of your affairs without needing to consult an attorney.

- We provide access to legal form templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

(d) A violation of this section is a Class I felony if the amount of the check or draft is more than two thousand dollars ($2,000).

What happens if you deposit a bad check? If you deposit a check that never clears because it was fraudulent or bounces, then the funds will be removed from your account. If you spent the funds, you will be responsible for repaying them. Some banks may charge an additional fee for depositing a bad check.

Passing bad checks can be illegal, and the crime can range from a misdemeanor to a felony, depending on the amount and whether the activity involved crossing state lines.A bounced check may result in fees, restrictions on writing additional checks, and negative impacts to your credit score.

The reports also show whether your negative balances have been paid. The Fair Credit Reporting Act allows checking-account reporting agencies like ChexSystems to report certain negative information for up to seven years.

Generally, a bank may attempt to deposit the check two or three times when there are insufficient funds in your account. However, there are no laws that determine how many times a check may be resubmitted, and there is no guarantee that the check will be resubmitted at all.

If you wrote a check that bounced, your bank may charge you a nonsufficient funds fee or overdraft fee. In addition, the company you were trying to pay may charge you a late fee if the bounced check means your payment is now overdue. Failure to pay outstanding fees can result in your account being sent to collections.

N. C. G. S. §14.107(d) states that writing a bad check ?is a Class I Felony if the amount of the check or draft is more than two thousand dollars ($2,000).? A Class I Felony in North Carolina can result in up to twelve (12) months of incarceration.

If your check bounces, you may be charged a returned check fee. This fee will be charged by the recipient of the check as a penalty for trying to distribute money that you don't have.

If you are given a bad check, you can sue for the amount of the check plus bank fees. You can also add damages to your claim....Bring evidence to prove your claim, including: The bad check; A copy of the demand letter; The certified mail receipt; and. Proof that a good faith dispute does not exist.

You have several options. Contact the district attorney. Some states have a bad-check restitution program where the DA's office has someone contact the check writer and urge them to pay up.Work through a collection agency.Use a check recovery service.Take your customer to court if they refuse to resolve things.