Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check

Note: This summary is not intended to be an all

inclusive summary of the law of bad checks, but does contain basic and

other provisions.

Civil Provisions

Chapter 6. Liability for Court Costs.

ARTICLE 3. Civil Actions and Proceedings.

§ 6-21.3. Remedies for returned check.

(a) Notwithstanding any criminal sanctions that may apply, a person, firm, or corporation who knowingly draws, makes, utters, or issues and delivers to another any check or draft drawn on any bank or depository that refuses to honor the same because the maker or drawer does not have sufficient funds on deposit in or credit with the bank or depository with which to pay the check or draft upon presentation or because the check has previously been presented and honored for the payment of money or its equivalent, and who fails to pay the same amount, any service charges imposed on the payee by a bank or depository for processing the dishonored check, and any processing fees imposed by the payee pursuant to G.S. 25-3-506 in cash to the payee within 30 days following written demand therefor, shall be liable to the payee (i) for the amount owing on the check, the service charges, and processing fees and (ii) for additional damages of three times the amount owing on the check, not to exceed five hundred dollars ($500.00) or to be less than one hundred dollars ($100.00). If the amount claimed in the first demand letter is not paid, the claim for the amount of the check, the service charges and processing fees, and the treble damages provided for in this subsection may be made by a subsequent letter of demand prior to filing an action. In an action under this section the court or jury may, however, waive all or part of the additional damages upon a finding that the defendant's failure to satisfy the dishonored check or draft was due to economic hardship.

The initial written demand for the amount of the check, the service charges, and processing fees shall be mailed by certified mail to the defendant at the defendant's last known address and shall be in the form set out in subsection (a1) of this section. The subsequent demand letter demanding the amount of the check, the service charges, the processing fees, and treble damages shall be mailed by certified mail to the defendant at the defendant's last known address and shall be in the form set out in subsection (a2) of this section. If the payee chooses to send the demand letter set out in subsection (a2) of this section, then the payee may not file an action to collect the amount of the check, the service charges, the processing fees, or treble damages until 30 days following the written demand set out in subsection (a2) of this section.

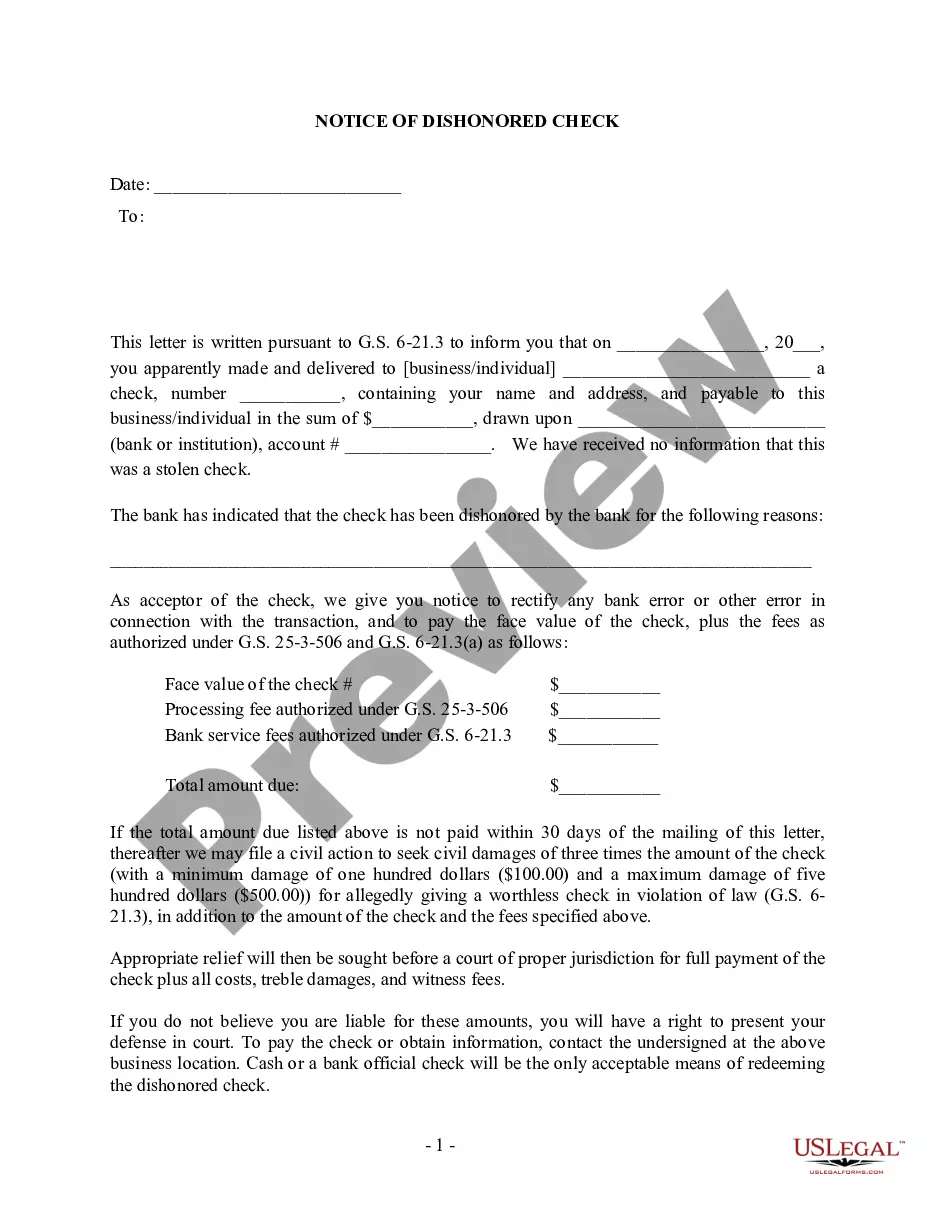

(a1) The first notification letter shall be substantially in the following form:

This letter is written pursuant to G.S. 6-21.3 to inform you that on _______________, you made and delivered to the business listed above a check payable to this business containing your name and address in the sum of $_____, drawn upon __________ (bank or institution), account #_____. [If the check was received in a face-to-face transaction insert this sentence: This check contained a drivers license identification number from a card with your photograph and mailing address, which was used to identify you at the time the check was accepted.] [If the check was delivered by mail insert this sentence: We have compared your name, address, and signature on the check with the name, address, and signature on file in the account previously established by you or on your behalf, and the signature on the check appears to be genuine.] Also, we have received no information that this was a stolen check, if that is the circumstance.

The check has been dishonored by the bank for the following reasons:___________________________________________________________

As acceptor of the check, we give you notice to rectify any bank error or other error in connection with the transaction, and to pay the face value of the check, plus the fees as authorized under G.S. 25-3-506 and G.S. 6-21.3(a) as follows:

Face value of the check # $__________________

Processing fee authorized

under G.S. 25-3-506 $__________________

Bank service fees authorized

under G.S. 6-21.3 $__________________

Total amount due: $__________________

If the total amount due listed above is not paid within 30 days of the mailing of this letter, thereafter we may file a civil action to seek civil damages of three times the amount of the check (with a minimum damage of one hundred dollars ($100.00) and a maximum damage of five hundred dollars ($500.00)) for allegedly giving a worthless check in violation of law (G.S. 6-21.3), in addition to the amount of the check and the fees specified above.

Appropriate relief will then be sought before a court of proper jurisdiction for full payment of the check plus all costs, treble damages, and witness fees.

If you do not believe you are liable for these amounts, you will have a right to present your defense in court. To pay the check or obtain information, contact the undersigned at the above business location. Cash or a bank official check will be the only acceptable means of redeeming the dishonored check.

If you do not believe that you owe the amount claimed in this letter or if you believe you have received this letter in error, please notify the undersigned at the above business location as soon as possible.

(a2) If the total amount due in subsection (a1) has not been paid within 30 days after the mailing of the notification letter, a subsequent demand letter may be sent and shall be substantially in the following form:

On __________, we informed you that we received a check payable to this business containing your name and address in the sum of $_____, drawn upon __________ (bank or institution), account #_______________. This check contained identification information which was used to identify you as the maker of the check. Also, we have received no information that this was a stolen check, if that is the circumstance.

The check has been dishonored by the bank for the following reasons:___________________________________________________________

We notified you that you were responsible for the face value of the check ($_____) plus the fees authorized under G.S. 25-3-506 ($_____) and G.S. 6-21.3(a) ($_____) for a total amount due of $_____. Thirty days have passed since the mailing of that notification letter, and you have not made payment to us for that total amount due.

Under G.S. 6-21.3, we claim you are now liable for the face value of the check, the fees, and treble damages. The damages we claim are three times the amount of the check or one hundred dollars ($100.00), whichever is greater, but cannot exceed five hundred dollars ($500.00). The total amount we claim now due is:

Face value of the check $__________________

Processing fee authorized

under G.S. 25-3-506 $__________________

Bank service fees authorized

under G.S. 6-21.3 $__________________

Three times the face value of the

check, with a minimum of $100.00

and a maximum of $500.00 $__________________<br />

<br />

Total amount due: $__________________<br />

<br />

Payment of the total amount claimed above within 30 days of the mailing of this letter shall satisfy this civil remedy for the returned check.<br />

<br />

If payment has not been received within this 30-day period, we will seek appropriate relief before a court of proper jurisdiction for full payment of the check plus all costs, treble damages, and witness fees.<br />

<br />

If you do not believe you are liable for these amounts, you will have a right to present your defense in court. To pay the check or obtain information, contact the undersigned at the above business location. Cash or a bank official check will be the only acceptable means of redeeming the dishonored check.<br />

<br />

If you do not believe that you owe the amount claimed in this letter or if you believe you have received this letter in error, please notify the undersigned at the above business location as soon as possible.<br />

<br />

(b) In an action under subsection (a) of this section, the presiding judge or magistrate may award the prevailing party, as part of the court costs payable, a reasonable attorney’s fee to the duly licensed attorney representing the prevailing party in such suit.<br />

<br />

(c) It shall be an affirmative defense, in addition to other defenses, to an action under this section if it is found that: (i) full satisfaction of the amount of the check or draft was made prior to the commencement of the action, or (ii) that the bank or depository erred in dishonoring the check or draft, or (iii) that the acceptor of the check knew at the time of acceptance that there were insufficient funds on deposit in the bank or depository with which to cause the check to be honored.<br />

<br />

(d) The remedy provided for herein shall apply only if the check was drawn, made, uttered or issued with knowledge there were insufficient funds in the account, that no credit existed with the bank or depository with which to pay the check or draft upon presentation, or that the check was presented with the knowledge that the check had previously been presented and honored for the payment of money or its equivalent.<br />

<br />

(e) A check or draft refused by a bank or depository, or the image of that check or draft, may be submitted as evidence for the remedy provided by this section if the bank or depository has returned it in the regular course of business stamped, marked, or with an attachment indicating the reason for the dishonor with terms that include, but are not limited to, the following: “insufficient funds,” “no account,” “account closed,” “NSF,” “uncollected,” “unable to locate,” “stale dated,” “postdated,” “endorsement irregular,” “signature irregular,” “nonnegotiable,” “altered,” “unable to process,” “refer to maker,” “duplicate presentment,” “forgery,” “noncompliant,” or “UCD noncompliant.” (1975, c. 129, s. 1; 1981, c. 781, s. 2; 1985, c. 643; 1993, c. 374, s. 1; 1995, c. 356, s. 1; 1995 (Reg. Sess., 1996), c. 742, s. 5; 2013-244, ss. 1-3.)