This form is a Grant Deed where the Grantors are husband and wife, or two individuals, and the Grantee is an LLC. Grantors convey the described property to the Grantee. This grant deed simply transfers the title of the property to the grantee. Included in the deed are statements verifying the property is not sold to other parties and all encumbrances on the property are known to the grantee. This deed complies with all state statutory laws.

Charlotte North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company

Description

How to fill out North Carolina Grant Deed From Husband And Wife, Or Two Individuals, To A Limited Liability Company?

If you have previously utilized our service, sign in to your account and download the Charlotte North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company onto your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have ongoing access to each document you have purchased: you can find it in your profile under the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to swiftly locate and download any template for your personal or business requirements!

- Ensure you’ve located the correct document. Browse the description and utilize the Preview option, if available, to determine if it fulfills your requirements. If it’s not suitable, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and make a payment. Utilize your credit card information or the PayPal option to finalize the purchase.

- Obtain your Charlotte North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it or employ professional online editors to complete and sign it electronically.

Form popularity

FAQ

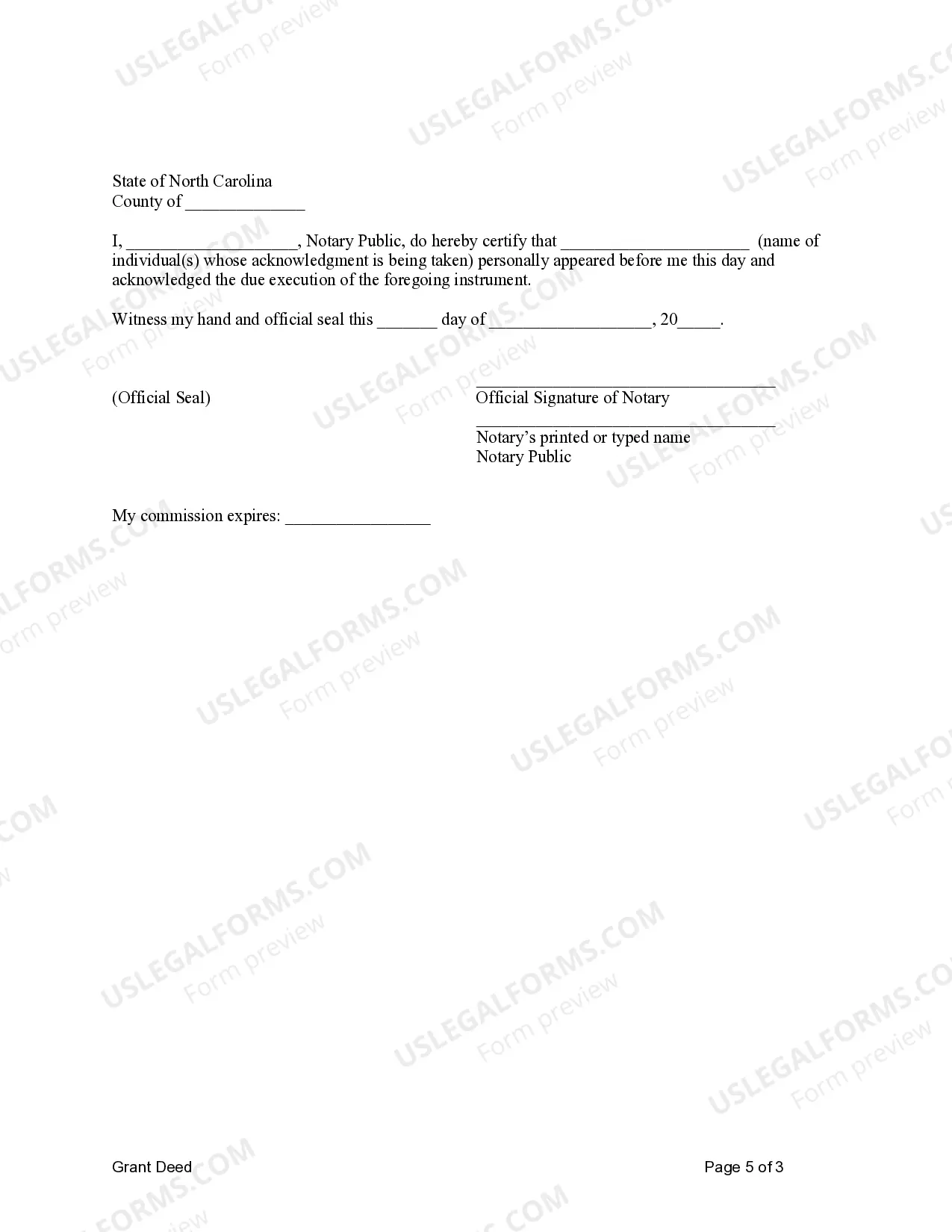

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

The key legal requirements for a document to be a formal deed are: The document must be in writing. The document must make clear that it is intended to be a deed ? known as the face value requirement.The document must be properly executed as a deed.The document must be delivered.

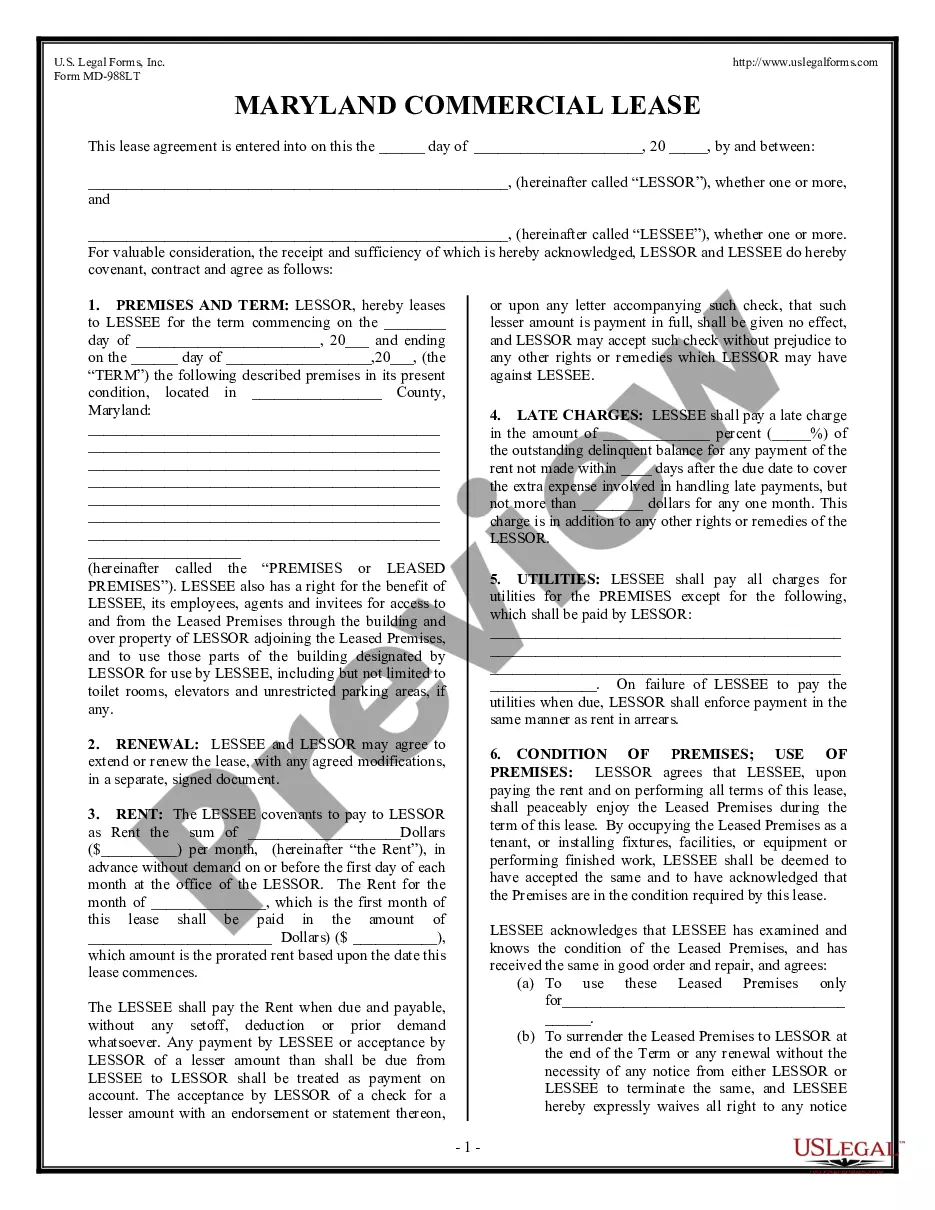

Recording and Document Fees Document TypeFee DetailsDeeds of Trust and Mortgages$64 first 35 pages $4 each additional pageAmendment to Deed of Trust$26 first 15 pages $4 each additional pageAll other Documents / Instruments / Assumed Name (DBA)$26 first 15 pages $4 each additional page3 more rows

The basic requirements of a valid deed are (1) written instrument, (2) competent grantor, (3) identity of the grantee, (4) words of conveyance, (5) adequate description of the land, (6) consideration, (7) signature of grantor, (8) witnesses, and (9) delivery of the completed deed to the grantee. 8.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

A grant deed is a transaction between two people or entities without securing the property as collateral. A deed of trust is used by mortgage companies when a homeowner takes out a loan against the property.