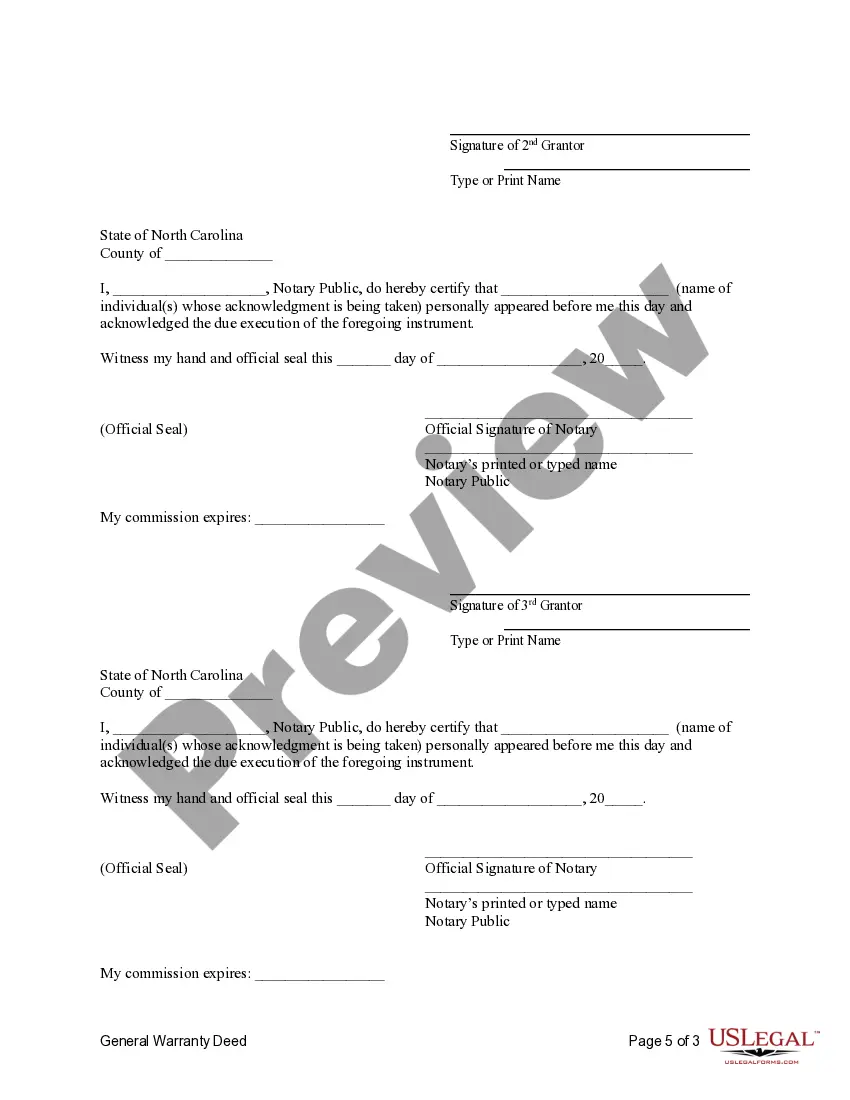

This form is a General Warranty Deed where the Grantors are three (3) individuals and the Grantee is an individual. Grantors convey and generally warrant the described property to the Grantee. This deed complies with all state statutory laws.

Charlotte North Carolina General Warranty Deed from three Individuals to an Individual

Description

How to fill out North Carolina General Warranty Deed From Three Individuals To An Individual?

Finding authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

This is an online repository of over 85,000 legal documents catering to both personal and professional requirements across various real-world situations.

All forms are correctly organized by usage area and jurisdiction, making it easy to access the Charlotte North Carolina General Warranty Deed from three Individuals to an Individual.

Maintaining documentation organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have crucial document templates readily available for any requirements!

- Examine the Preview mode and form description. Confirm that you have selected the correct one that fulfills your requirements and aligns with your local jurisdiction criteria.

- Search for an alternative template if necessary. If you encounter any discrepancies, make use of the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next stage.

- Acquire the document. Hit the Buy Now button and pick the subscription plan that suits you best. You will need to create an account to gain access to the resources in the library.

- Complete your purchase. Provide your credit card information or utilize your PayPal account to pay for the service.

- Download the Charlotte North Carolina General Warranty Deed from three Individuals to an Individual. Save the template on your device to fill it out and access it in the My documents menu of your profile whenever necessary.

Form popularity

FAQ

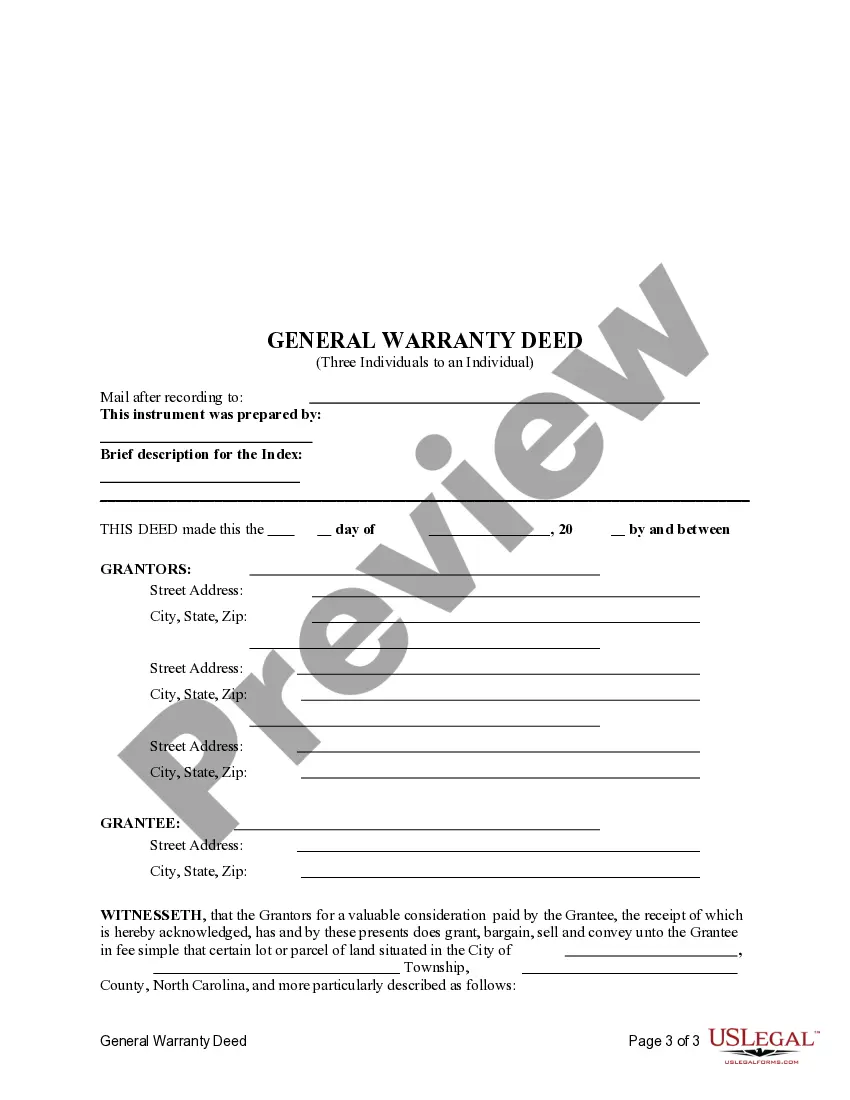

A General Warranty Deed is a deed in which the party conveying the property (the ?Grantor?) warrants and guarantees to the party receiving the conveyance (the ?Grantee?) that the title to the property he is conveying is good and unencumbered as against all persons.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

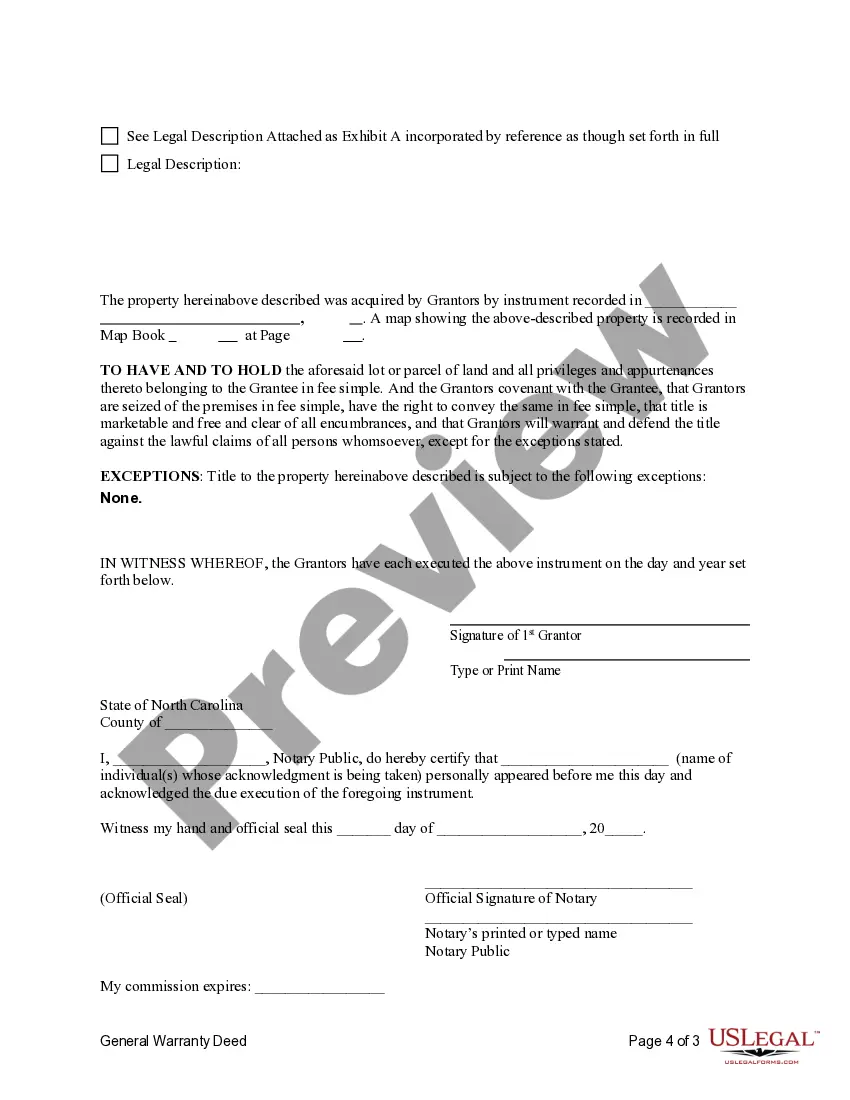

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

A deed is a legal instrument that evidences legal ownership of a parcel of real property, which includes land and any buildings on the land. To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.